2020 Cyprus Country Report

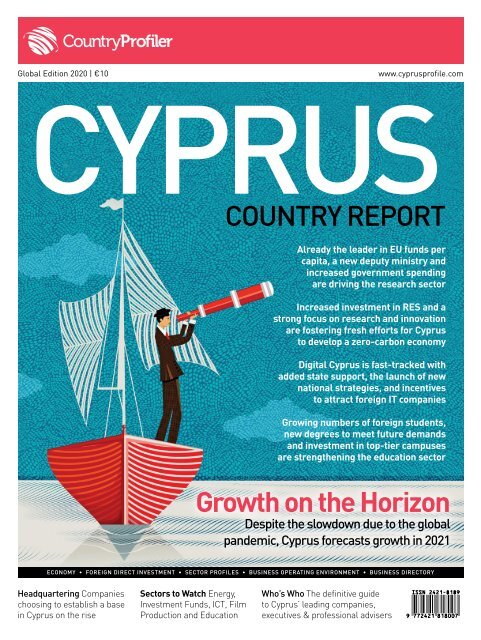

The 2020 Cyprus Country Report features in-depth articles on the economy, foreign direct investment, international trade and headquartering as well as detailed sector profiles and insights from Cyprus’ 100 most influential political, economic and business leaders shaping the future of their country and its industries.

The 2020 Cyprus Country Report features in-depth articles on the economy, foreign direct investment, international trade and headquartering as well as detailed sector profiles and insights from Cyprus’ 100 most influential political, economic and business leaders shaping the future of their country and its industries.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Country</strong>Profiler<br />

Global Edition <strong>2020</strong> | €10<br />

www.cyprusprofile.com<br />

CYPRUS<br />

COUNTRY REPORT<br />

Already the leader in EU funds per<br />

capita, a new deputy ministry and<br />

increased government spending<br />

are driving the research sector<br />

Increased investment in RES and a<br />

strong focus on research and innovation<br />

are fostering fresh efforts for <strong>Cyprus</strong><br />

to develop a zero-carbon economy<br />

Digital <strong>Cyprus</strong> is fast-tracked with<br />

added state support, the launch of new<br />

national strategies, and incentives<br />

to attract foreign IT companies<br />

Growing numbers of foreign students,<br />

new degrees to meet future demands<br />

and investment in top-tier campuses<br />

are strengthening the education sector<br />

Growth on the Horizon<br />

Despite the slowdown due to the global<br />

pandemic, <strong>Cyprus</strong> forecasts growth in 2021<br />

ECONOMY • FOREIGN DIRECT INVESTMENT • SECTOR PROFILES • BUSINESS OPERATING ENVIRONMENT • BUSINESS DIRECTORY<br />

Headquartering Companies<br />

choosing to establish a base<br />

in <strong>Cyprus</strong> on the rise<br />

Sectors to Watch Energy,<br />

Investment Funds, ICT, Film<br />

Production and Education<br />

Who’s Who The definitive guide<br />

to <strong>Cyprus</strong>’ leading companies,<br />

executives & professional advisers

First class<br />

legal services<br />

focused on<br />

results<br />

L Papaphilippou & Co LLC offers legal services to businesses, individuals,<br />

and public organizations. We have a strong litigation team handling<br />

also all forms of commercial dispute resolution and have considerable<br />

experience in arbitrations. Furthermore, our Immigration Department is<br />

well respected and renowned for leading by example in the field and our<br />

high calibre and experienced lawyers ensure first class service and results.<br />

Additionally, being a full-service law firm, L Papaphilippou & Co LLC is<br />

capable of delivering secure and compliant cross-border legal and wealth<br />

management solutions, as well as to coordinate international business<br />

structures, trusts and private banking matters for our clients.<br />

17 Ifigenias Street, 2007 Strovolos, P.O.Box 28541, 2080 Nicosia - <strong>Cyprus</strong><br />

T: (+357) 22 271 000 • F: (+357) 22 271 111 • E: info@papaphilippou.eu • www.papaphilippou.eu

DESTINATION<br />

DEVELOPMENTS<br />

BY CYBARCO<br />

More than a property<br />

A member of the reputable Lanitis Group, Cybarco has been<br />

shaping <strong>Cyprus</strong> since 1945. Celebrating decades of innovation<br />

and creativity, the island’s leading luxury property developer<br />

continues to push the boundaries, delivering iconic developments<br />

that transform lives and communities. Landmark projects like<br />

Aphrodite Hills Golf Resort, Sea Gallery Villas, Akamas Bay<br />

Villas, The Oval, Limassol Marina and Trilogy Limassol Seafront<br />

are part of Cybarco’s impressive portfolio, the foundation of a<br />

proven track record in property sales and customer satisfaction.<br />

Continuing to set new standards for property development<br />

in <strong>Cyprus</strong>, Cybarco combines world-class<br />

architecture, unique designs, and outstanding views<br />

in the finest locations to create “more than a property”.<br />

Michalis Hadjipanayiotou, CEO of Cybarco Development<br />

Ltd and Chairman of the <strong>Cyprus</strong> Land and Building<br />

Developers Association, shares the company’s vision: “We<br />

believe the perfect property isn’t just an object of desire or<br />

a financially savvy transaction, it’s something much more<br />

meaningful. We create homes and offices that are part of<br />

a destination and connect customers with the local community.”

Limassol Marina is just one example of a success story<br />

that saw a run-down part of <strong>Cyprus</strong>’ most vibrant city<br />

transformed into an award-winning and highly sought-after<br />

superyacht destination with its own residential community,<br />

dining, shopping, cultural and leisure facilities. Almost all<br />

properties have now been sold, exceeding a sales total of<br />

€500 million, and the project is nearing completion with<br />

its last phase apartments in the sea at Castle Residences -<br />

surrounded by the azure waters of the Mediterranean.<br />

A few kilometres to the east of Limassol Marina, Trilogy<br />

Limassol Seafront is the latest mixed-use destination by<br />

Cybarco. With financing secured, it offers the ultimate<br />

investment in a prime location and at great value across three<br />

shimmering beachfront towers. It is the only place to live,<br />

work and play in <strong>Cyprus</strong>, boasting offices and apartments<br />

with sea views from every window, dining, shopping, and<br />

leisure facilities. The two front towers’ construction is<br />

progressing apace, and piling of the North Tower has been<br />

completed. Sales and reservations for its luxury properties<br />

have now exceeded €170 million with interest still strong,<br />

despite the challenges of the pandemic.<br />

Just a few minutes from Trilogy, Cybarco’s boutique<br />

Aktea Residences offer an address for coastal living in one<br />

of Limassol’s up-and-coming areas. And from the vibrant<br />

shores of Limassol to the most serene and picturesque part<br />

of the island, Akamas Bay Villas is the developer’s private<br />

haven of natural beauty located near the Akamas Peninsula.<br />

Construction of its masterplan’s second phase is underway<br />

following the successful sales and completion of phase one.<br />

Undisturbed views of the sparkling blue sea and boundless<br />

sky, blend with harmonious architecture and outstanding<br />

design across a dozen newly released villas on fully<br />

landscaped plots, with show homes available for viewing.<br />

Michalis Hadjipanayiotou, is optimistic about the<br />

future: “We are particularly proud of our pioneering<br />

projects. We feel we have managed to raise the bar for<br />

development in <strong>Cyprus</strong> over the years. Projects like<br />

Limassol Marina and The Oval are landmarks in more ways<br />

than one. They have set the benchmark for future projects<br />

of their kind and given <strong>Cyprus</strong> much-needed exposure in<br />

markets we previously had no product to offer. We are very<br />

excited about the coming years and we strive to continue<br />

finding creative and unique ways to bring change for the<br />

better to <strong>Cyprus</strong>.”<br />

Trilogy Limassol Seafront<br />

Limassol Marina<br />

Shaping <strong>Cyprus</strong> since 1945<br />

For more information, contact 8000 50 30 or visit<br />

cybarco.com<br />

Aktea Residences<br />

Akamas Bay Villas

Publisher’s Information<br />

<strong>Country</strong>Profiler<br />

Global Edition <strong>2020</strong> | €10<br />

www.cyprusprofile.com<br />

CYPRUS<br />

COUNTRY REPORT<br />

Already the leader in EU funds per<br />

capita, a new deputy ministry and<br />

increased government spending<br />

are driving the research sector<br />

Increased investment in RES and a<br />

strong focus on research and innovation<br />

are fostering fresh efforts for <strong>Cyprus</strong><br />

to develop a zero-carbon economy<br />

Digital <strong>Cyprus</strong> is fast-tracked with<br />

added state support, the launch of new<br />

national strategies, and incentives<br />

to attract foreign IT companies<br />

Growing numbers of foreign students,<br />

new degrees to meet future demands<br />

and investment in top-tier campuses<br />

are strengthening the education sector<br />

Growth on the Horizon<br />

Despite the slowdown due to the global<br />

pandemic, <strong>Cyprus</strong> forecasts growth in 2021<br />

ECONOMY • FOREIGN DIRECT INVESTMENT • SECTOR PROFILES • BUSINESS OPERATING ENVIRONMENT • BUSINESS DIRECTORY<br />

<strong>Country</strong>Profiler Ltd is a specialist publisher of country<br />

information that assists corporations managing operations<br />

across national borders with trade, investment and<br />

relocation decisions. <strong>Country</strong>Profiler is recognised by<br />

senior business executives, government representatives,<br />

institutions and global organisations as a leading provider<br />

of informative and insightful country intelligence.<br />

EUROPE<br />

16, Elia Papakyriakou, Suite 101, Engomi, 2415 Nicosia, <strong>Cyprus</strong><br />

NORTH AMERICA<br />

21-2123 Walkers Line, Burlington Ontario, L7M 4Z9, Canada<br />

Email: cyprus@countryprofiler.com<br />

Website: www.countryprofiler.com • www.cyprusprofile.com<br />

RESEARCH AND CONTRIBUTIONS<br />

<strong>Country</strong>Profiler staff<br />

Headquartering Companies<br />

choosing to establish a base<br />

in <strong>Cyprus</strong> on the rise<br />

Sectors to Watch Energy,<br />

Investment Funds, ICT, Film<br />

Production and Education<br />

Who’s Who The definitive guide<br />

to <strong>Cyprus</strong>’ leading companies,<br />

executives & professional advisers<br />

PHOTOGRAPHY<br />

Heidi Marttinen, Jo Michaelides, Alan Carville, Mehdi Ezzitouni,<br />

Manos Botrini, Sara Zanardelli<br />

PRINTING<br />

Laser Graphics Ltd<br />

PUBLICATION DATE<br />

October <strong>2020</strong><br />

Kristina Ernst<br />

REGIONAL DIRECTOR<br />

ernst@countryprofiler.com<br />

Heidi Marttinen<br />

EDITOR<br />

marttinen@countryprofiler.com<br />

Victoria Vasiliou<br />

ADMINISTRATIVE MANAGER<br />

vasiliou@countryprofiler.com<br />

Ramon Micallef<br />

ART DIRECTOR<br />

ram@box-design.net<br />

The information included in this publication is for information<br />

purposes only and is subject to change. With regard to the licensing<br />

of a business, income generation or any other legal or accounting<br />

matters, the Publisher strongly recommends that the reader<br />

seeks the advice of an appropriately licensed professional.<br />

All rights reserved. Reproduction in whole or part is strictly<br />

prohibited without written permission. Opinions expressed in this<br />

publication are not necessarily those of the editor or publisher.<br />

All reasonable care is taken to ensure truth and accuracy, but the<br />

editor and publishers cannot be held responsible for errors or<br />

omissions in articles, advertising, photographs or illustrations.<br />

4 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

The Minthis Property Collection is a diverse<br />

range of contemporary customisable Residences,<br />

secluded neighbourhood Villas and exclusive Suites,<br />

situated in a destination lifestyle resort.<br />

VIEW THE PROPERTY COLLECTION AT MINTHISRESORT.COM<br />

To book an appointment, virtual tour<br />

or live property viewing please contact us on<br />

+357 26 842 244 sales@minthisresort.com<br />

Pafos, <strong>Cyprus</strong>

Contents<br />

Contents<br />

10<br />

12<br />

16<br />

18<br />

26<br />

32<br />

34<br />

40<br />

42<br />

46<br />

FOREWORD President of the Republic of<br />

<strong>Cyprus</strong>, Nicos Anastasiades<br />

CYPRUS AT A GLANCE Key Facts & Figures<br />

GOVERNMENT & POLITICS A Key EU Outpost<br />

ECONOMY Growth on the Horizon<br />

FOREIGN DIRECT INVESTMENT FDI Destination<br />

FDI INSIGHTS Why did you choose to invest in <strong>Cyprus</strong>?<br />

HEADQUARTERING East Med HQ<br />

HQ INSIGHTS Why did you choose <strong>Cyprus</strong>?<br />

INTERVIEW Minister of Energy, Commerce<br />

& Industry Natasa Pilides<br />

INTERNATIONAL TRADE Quality Exports<br />

6 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Expertise<br />

Solutions<br />

Value<br />

www.pwc.com.cy<br />

© <strong>2020</strong> PricewaterhouseCoopers Ltd. All rights reserved.

Contents<br />

Sector Profiles<br />

50 AGRICULTURE & FOOD Fostering Sustainable Farming<br />

56 BANKING Bolstering the Banks<br />

62 CAPITAL MARKETS Building a Dynamic Market<br />

66 CONSTRUCTION & REAL ESTATE Location <strong>Cyprus</strong><br />

74 EDUCATION Educating a New Generation<br />

79 ENERGY: OIL & GAS Harnessing the Hydrocarbons Potential<br />

84 ENERGY: RENEWABLES A Greener Future<br />

88 FILM PRODUCTION Joining the A-List<br />

92 HEALTH Streamlining Health<br />

98 INSURANCE Mitigating Risk<br />

102 INTERNATIONAL FINANCIAL SERVICES<br />

Towards a Diversified Future<br />

108 INVESTMENT FUNDS Ready for Bold Moves<br />

112 MANUFACTURING & INDUSTRY Modernising Manufacturing<br />

116 MARITIME & SHIPPING Navigating High Seas<br />

122 RESEARCH & DEVELOPMENT A Future of Innovation<br />

128 TECHNOLOGY & START-UPS An Era of Disruption<br />

132 TELECOMS & SATELLITE COMMUNICATIONS<br />

Building a Gigabit Future<br />

136 TOURISM The New Age of Tourism<br />

144 TRANSPORT & LOGISTICS East Med Transport Hub<br />

150<br />

158<br />

170<br />

BUSINESS OPERATING ENVIRONMENT<br />

Doing Business in <strong>Cyprus</strong><br />

TRAVEL & LIVING <strong>Country</strong>Profiler Expat Guide<br />

WHO’S WHO <strong>Cyprus</strong> Business Directory<br />

8 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Foreword<br />

Foreword<br />

Nicos Anastasiades<br />

President of the Republic of <strong>Cyprus</strong><br />

10 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Foreword<br />

Without any doubt, the Covid-19 pandemic has caused unprecedented<br />

challenges for all the countries around the globe with severe socio-economic<br />

consequences.<br />

In dealing with this, unfortunately, ongoing crisis, my Government<br />

has been assertive in its decision-making and proactive in providing<br />

medical and economic support to our citizens, workers and enterprises.<br />

Like many other countries, <strong>Cyprus</strong> had to take harsh, painful, but necessary<br />

measures, in order to deal in a timely and effective manner with this unprecedented<br />

public health crisis.<br />

We immediately acknowledged, however, that, beyond saving lives, we also had to<br />

safeguard livelihoods and address the potential economic and social disruption the<br />

lockdown measures would cause.<br />

We needed to ensure the sustainability of businesses, preserve jobs, maintain<br />

the income of our citizens, protect the rights of workers and provide the necessary<br />

support to our economy to recover as quickly as possible once the lockdown restrictions<br />

would gradually be eased and eventually lifted.<br />

To this end, we adopted one of the most comprehensive fiscal<br />

support packages within the European Union, without risking the<br />

long-term sustainability of public finances. This is due to the fact<br />

that the <strong>Cyprus</strong> Government accumulated the necessary fiscal surpluses<br />

in the past that could be used in emergency cases such as the<br />

current pandemic crisis.<br />

As regards the economic outlook, following the unavoidable<br />

recession of economic activity in <strong>2020</strong> due to the imposed lockdown<br />

measures, we expect a significant rebound in 2021, with<br />

positive growth rates, drop of unemployment, budget surplus and<br />

a reduced public debt.<br />

Our motto in <strong>Cyprus</strong> is that with every challenge there is opportunity.<br />

In this regard, the Government’s broader strategy for economic<br />

recovery also includes the implementation of much needed<br />

structural reforms for the further development of key economic<br />

sectors, fully exploiting newly established European mechanisms<br />

such as “SURE” and “Recovery and Resilience Facility”.<br />

Reforms, amongst others, as regards the pension, welfare and<br />

labour market system, the judicial and health care systems, and the sectors of digital<br />

transformation, tourism, research and innovation and green economy.<br />

We will also continue the sound governance of public finances, complemented<br />

by a business-friendly investment environment, moving forward with a comprehensive<br />

government strategy for investment facilitation and fully reforming the public<br />

service so that it facilitates growth in a modern, knowledge-based, scientific, hightech<br />

and innovative economy.<br />

We envisage that the <strong>Cyprus</strong> economy will be eventually transformed in such a<br />

way, in order to become even more competitive in the global economic stage. It’s up<br />

to us to make this happen and I am certain that we will deliver.<br />

In concluding, I wish to extend my deepest appreciation to the editors and publishers<br />

of the <strong>Cyprus</strong> <strong>Country</strong> <strong>Report</strong> for providing all these years essential insight<br />

on the Cypriot economy and the attractive investment opportunities in our country.<br />

“We adopted<br />

one of the most<br />

comprehensive<br />

fiscal support<br />

packages within<br />

the European<br />

Union, without<br />

risking the<br />

long-term<br />

sustainability of<br />

public finances”<br />

Nicos Anastasiades<br />

President of the Republic of <strong>Cyprus</strong><br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 11

Publisher’s <strong>Cyprus</strong> Information<br />

a Glance<br />

CYPRUS at a Glance<br />

Lying at the crossroads of Europe, Asia and Africa, <strong>Cyprus</strong><br />

has long served as a major eastern trading post. It is a small<br />

country, but the third largest island in the Mediterranean<br />

Sea and shares a maritime border with Egypt 300km to the<br />

south, Lebanon 108km to the east and Turkey 71km to the<br />

north, while inland Greece lies 800km to the north-west. With<br />

10,000 years of history, the island’s strategic location has<br />

long made it a jewel in the crown of the powers of the day.<br />

Cultural influences have come from all directions, with many<br />

civilisations leaving their mark on the island, contributing to<br />

the development of a rich and diverse cultural heritage.<br />

TOTAL POPULATION<br />

875,900<br />

Republic of <strong>Cyprus</strong><br />

Non-<br />

Cypriot<br />

18%<br />

Cypriot<br />

82%<br />

OFFICIAL LANGUAGES<br />

Greek &<br />

Turkish<br />

(business generally<br />

conducted in English)<br />

INDEPENDENCE DAY<br />

October<br />

1st<br />

MEMBERSHIPS<br />

EU & Eurozone<br />

World Trade<br />

Organization<br />

United Nations<br />

Council of Europe<br />

Commonwealth<br />

World Bank & IMF<br />

CURRENCY<br />

Euro (€)<br />

MAIN MEDIA<br />

<strong>Cyprus</strong> Mail<br />

Phileleftheros<br />

Politis<br />

CyBC<br />

12 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

35ºN 33ºE<br />

Publisher’s <strong>Cyprus</strong> at a Glance Information<br />

Nicosia<br />

(Lefkosia)<br />

Population:<br />

341,700<br />

Famagusta<br />

(Ammochostos)<br />

48,200<br />

Paphos<br />

94,100<br />

Paphos<br />

International<br />

Airport<br />

Limassol<br />

244,900<br />

Larnaca<br />

International<br />

Airport<br />

Larnaca<br />

147,000<br />

TIME<br />

+2 Hours<br />

ahead of GMT<br />

SUNSHINE<br />

340 Days<br />

of sunshine / year<br />

AREA / SIZE<br />

9,251 km 2<br />

(3,355 km 2 in the occupied area)<br />

POPULATION DENSITY<br />

128.7<br />

(PERSONS PER KM 2 )<br />

RELIGION<br />

89.1%<br />

Greek<br />

Orthodox<br />

AVERAGE TEMPERATURE<br />

Winter<br />

+13ºC<br />

Summer<br />

+34ºC<br />

ANNUAL RAINFALL<br />

790.1 mm<br />

average<br />

MEDIAN AGE<br />

37.9<br />

2.9% Roman Catholic<br />

2.0% Protestant/Anglican<br />

1.8% Muslim<br />

1.7% Unknown/Atheist<br />

1.4% Other 1.0% Buddhist<br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 13

Publisher’s <strong>Cyprus</strong> Information<br />

a Glance<br />

Business FIGURES<br />

GDP BY SECTOR<br />

TOTAL GDP<br />

€21.9 billion<br />

(2019)<br />

CORPORATE TAX RATE<br />

12.5%<br />

TIME TO START UP A BUSINESS<br />

1-3 days<br />

GDP PER CAPITA<br />

INFLATION<br />

ACCOUNTING STANDARD<br />

13.1%<br />

Taxes &<br />

subsidies<br />

71.9%<br />

Services<br />

€24,925<br />

(2019)<br />

0.5%<br />

(2019)<br />

IFRS<br />

6.1%<br />

Construction<br />

6.9%<br />

Mining,<br />

manufacturing,<br />

electricity & water<br />

2%<br />

Agriculture,<br />

forestry & fishing<br />

37th<br />

Economic Freedom Index <strong>2020</strong><br />

Heritage Foundation<br />

(out of 186 countries)<br />

GDP GROWTH<br />

3.2%<br />

(2019)<br />

INTERNATIONAL RANKINGS<br />

29th<br />

Global Innovation Index <strong>2020</strong><br />

INSEAD and the World Intellectual<br />

Property Organization<br />

(out of 131 countries)<br />

UNEMPLOYMENT<br />

6.9%<br />

(July <strong>2020</strong>)<br />

45th<br />

in World Happiness<br />

<strong>Report</strong> <strong>2020</strong><br />

(out of 153 countries)<br />

CRIME<br />

0.9 per<br />

100 persons<br />

<strong>Cyprus</strong> is the safest<br />

country in the world for<br />

young people out of 184<br />

countries across the globe.<br />

(World Health Organisation<br />

WHO 2017)<br />

Enforcing<br />

Contracts<br />

Dealing with<br />

Construction<br />

Permits<br />

Overall Doing Business ranking: 54th<br />

(out of 190 economies)<br />

Starting a<br />

Business<br />

Getting<br />

Electricity<br />

Registering<br />

Property<br />

Getting<br />

Credit<br />

Protecting<br />

Minority<br />

Investors<br />

Paying<br />

Taxes<br />

Trading<br />

across<br />

Borders<br />

Resolving<br />

Insolvency<br />

50 th 125 th 75 th 71 st 80 th 21 st 29 th 50 th 142 nd 31 st<br />

STANDARD<br />

& POOR’S<br />

BBB-<br />

(September <strong>2020</strong>)<br />

FITCH<br />

BBB-<br />

(September <strong>2020</strong>)<br />

MOODY’S<br />

Ba2<br />

(September <strong>2020</strong>)<br />

UK<br />

Germany<br />

Italy<br />

France<br />

Greece<br />

MAIN TRADING PARTNERS<br />

Israel<br />

China<br />

14 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Fast is<br />

too slow.<br />

Is the rapid pace<br />

of innovation passing<br />

your company by?<br />

By building innovation into your business and<br />

operating models, KPMG professionals can help your<br />

company increase its bottom line by continually<br />

delivering new value to your customers.<br />

Learn more at kpmg.com.cy<br />

Anticipate tomorrow. Deliver today.<br />

©<strong>2020</strong> KPMG Limited, a <strong>Cyprus</strong> limited liability company and member of the KPMG network<br />

of independent member firms affiliated with KPMG International Cooperative (”KPMG<br />

International”), a Swiss entity. All rights reserved.<br />

The KPMG name and logo are registered trademarks or trademarks of KPMG International.

Government & Politics<br />

A Key EU Outpost<br />

As the European Union’s easternmost member state, <strong>Cyprus</strong> has established<br />

itself as a geostrategic EU outpost at the crossroads of three continents.<br />

As an international business centre and with global cooperation in<br />

multiple sectors, <strong>Cyprus</strong>’ reach goes far beyond its borders, with <strong>2020</strong> also<br />

bringing new efforts to finally reach a solution for this divided island.<br />

The Republic of <strong>Cyprus</strong> is a unitary presidential<br />

representative republic, where the<br />

President of <strong>Cyprus</strong> is both head of state and<br />

head of government, and executive power is<br />

exercised by the government. Legislative power<br />

is vested in both the government and the parliament,<br />

and the judiciary is independent of the executive<br />

and the legislature. The seventh president<br />

of the Republic of <strong>Cyprus</strong>, Nicos Anastasiades,<br />

was re-elected for another five-year term on 4<br />

February 2018. The conservative candidate and<br />

head of the DISY party won his second term<br />

following a run-off presidential election with a<br />

majority of 55.99% of the vote. Embarking on<br />

his second term in office, the President called for<br />

unity to address future challenges.<br />

At the start of his first term, <strong>Cyprus</strong> suffered a<br />

major financial crisis, and President Anastasiades<br />

had to take robust measures to steer the country<br />

back on track from one of the most challenging<br />

economic times in the island’s history. The<br />

economy bounced back swiftly returning to<br />

growth in 2015, investment grade rating in 2018<br />

and recording an average GDP growth of 5.4%<br />

in 2016-19, making <strong>Cyprus</strong> one of the fastest<br />

growing economies in the European Union. In<br />

<strong>2020</strong>, this growth momentum has been stalled by<br />

the consequences of the Covid-19 pandemic, but<br />

with strong action and robust support packages<br />

in place the country has fared better than many<br />

of its European peers.<br />

The division of <strong>Cyprus</strong> remains one of the<br />

most long-standing and prominent issues in the<br />

political arena. UN-brokered peace talks between<br />

the Greek and Turkish Cypriot leaderships,<br />

which first began in 1968, had gained significant<br />

momentum in 2015 only to collapse in 2017.<br />

In October this year, following the presidential<br />

election win of Ankara-backed Turkish Cypriot<br />

leader Ersin Tatar, the ‘<strong>Cyprus</strong> Problem’, which<br />

led to the de facto division of the island between<br />

the mainly Greek-speaking south and the mainly<br />

Turkish-speaking north for over four decades,<br />

may have become a tougher puzzle to solve. The<br />

change in leadership comes amid rising ten-<br />

sions between <strong>Cyprus</strong>, Greece and Turkey over<br />

hydrocarbons explorations in <strong>Cyprus</strong>’ Exclusive<br />

Economic Zone (EEZ) and the controversial<br />

partial reopening of the coastal city of Varosha<br />

in Famagusta. However, the new Turkish Cypriot<br />

leader has already accepted Cypriot President<br />

Nicos Anastasiades' offer to resume talks, backed<br />

by the encouragement from the UN and the EU<br />

to show “constructive engagement”.<br />

DIVIDED ISLAND<br />

In 1960 <strong>Cyprus</strong> gained independence from<br />

Britain and became a unitary state of both Greekand<br />

Turkish-Cypriots (respectively around 80%<br />

and 20% of the population). In July 1974, a rightwing<br />

coup backed by the military junta in power<br />

in Greece overturned the democratically elected<br />

government, forcing the Cypriot President<br />

Archbishop Makarios to flee. This prompted<br />

Turkey, one of the guarantor powers, which also<br />

include Greece and the UK, to send its troops<br />

into the island to support the Turkish Cypriot minority.<br />

Fierce fighting followed and the ensuing<br />

ceasefire line – known as the Green Line and patrolled<br />

by United Nations troops – has effectively<br />

partitioned the island ever since. However, visitors<br />

can safely access either side through various<br />

checkpoints along the Green Line. Today, Nicosia<br />

is the world’s last divided capital, since the fall of<br />

Political Parties<br />

Constitution, Institutions<br />

and Administration<br />

The 1960 constitution provided<br />

for power sharing between<br />

the Greek Cypriot and Turkish<br />

Cypriot communities. Votes<br />

on important issues required<br />

separate parliamentary<br />

majorities, and the Greek<br />

Cypriot president and the<br />

Turkish Cypriot vice president<br />

both had the right of veto<br />

on important decisions.<br />

The system of government<br />

is presidential, with the<br />

separation of powers between<br />

the executive and the<br />

legislature. The presidential<br />

term lasts five years, with the<br />

next presidential election due<br />

in 2023. Ministers, who are<br />

appointed by the president,<br />

cannot hold seats in the<br />

House of Representatives.<br />

The House of Representatives<br />

is elected by proportional<br />

representation. Its normal<br />

term is five years.<br />

Dominant Political Parties:<br />

Democratic Rally (DISY), a right-wing party led by Averof Neophytou<br />

Progressive Party of the Working People (AKEL), a left-wing party led by Andros Kyprianou<br />

Democratic Party (DIKO), a centre-right party led by Nicolas Papadopoulos<br />

Movement of Social Democracy (EDEK), a social democratic party led by Marinos Sizopoulos<br />

Smaller Political Parties:<br />

Ecologists Movement, also known as the <strong>Cyprus</strong> Green Party, led by Charalambos Theopemptou<br />

Allileggii (Solidarity), a nationalist party led by Eleni Theocharous<br />

Citizens’ Alliance (Symmaxia Politon), a centre-left party led by Giorgos Lillikas<br />

National People’s Front (E.L.A.M.), an ultranationalist party led by Christos Christou<br />

16 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Government Structure<br />

President of the<br />

Republic of <strong>Cyprus</strong><br />

Nicos Anastasiades<br />

Minister of Foreign Affairs<br />

Nikos Christodoulides<br />

Government & Politics<br />

Minister of Finance<br />

Constantinos Petrides<br />

Minister of Interior<br />

Nicos Nouris<br />

Minister of Defence<br />

Charalambos Petrides<br />

Minister of Health<br />

Constantinos Ioannou<br />

Minister of Education<br />

and Culture<br />

Prodromos Prodromou<br />

Minister of Transport,<br />

Communications and Works<br />

Yiannis Karousos<br />

Minister of Energy,<br />

Commerce and Industry<br />

Natasa Pilides<br />

Minister of Agriculture,<br />

Rural Development<br />

and Environment<br />

Costas Kadis<br />

Minister of Labour, Welfare<br />

and Social Insurance<br />

Zeta Emilianidou<br />

Minister of Justice<br />

and Public Order<br />

Emily Yiolitis<br />

Government Spokesman<br />

Kyriacos Kousios<br />

Under Secretary to<br />

the President<br />

Vasilis Palmas<br />

Shipping Deputy Minister<br />

Vassilis Demetriades<br />

Deputy Minister for Tourism<br />

Savvas Perdios<br />

the Berlin Wall. The population of the southern<br />

two-thirds of the island, controlled by the government<br />

of the Republic of <strong>Cyprus</strong>, is almost entirely<br />

Greek Cypriot, while the population of the northern<br />

third, controlled by the breakaway Turkish<br />

Republic of Northern <strong>Cyprus</strong> (recognised only<br />

by Turkey) comprises Turkish Cypriots, settlers<br />

from the Turkish mainland and around 42,000<br />

Turkish troops.<br />

FROM FOREIGN RULE TO THE<br />

REPUBLIC OF CYPRUS<br />

Colonised by the ancient Greeks in 1400 BC,<br />

<strong>Cyprus</strong> has had a succession of foreign rulers<br />

through the centuries, including the Romans, the<br />

Byzantines, the Franks and the Venetians, whose<br />

300-year rule ended in 1571 when the island<br />

became part of the Ottoman Empire. After almost<br />

250 years of Ottoman rule, <strong>Cyprus</strong> was placed<br />

under British administration in 1878. The island<br />

finally became independent in 1960 after a protracted<br />

and violent struggle against the colonial<br />

power between 1955 and 1959. After lengthy negotiations,<br />

Britain, Greece and Turkey drafted a<br />

constitution for the new state, along with Treaties<br />

of Guarantee and Alliance. The Republic of <strong>Cyprus</strong><br />

came into being in August 1960. The constitution<br />

and the two accompanying treaties established a<br />

complex power-sharing structure between Greek<br />

and Turkish Cypriots, which precluded partition<br />

of the island, or union with Greece or Turkey. Both<br />

countries, along with Britain, were also designated<br />

guarantors of the independence, territorial integrity<br />

and security of the Republic. The constitution<br />

provided for a Greek Cypriot president and a<br />

Turkish Cypriot vice president, while the Turkish<br />

Cypriot community was granted three ministerial<br />

positions out of a total of 10, and 15 out of<br />

the 50 seats in the House of Representatives. After<br />

intercommunal strife between the two communities<br />

in 1963, Turkish Cypriots vacated their seats.<br />

Since then, ministerial positions have increased to<br />

11, all duties carried out by Greek Cypriots and<br />

the number of parliamentary seats has extended<br />

to 80 of which 30% (24) are allocated to Turkish<br />

Cypriots as per the constitution but remain vacant.<br />

INTERNATIONAL RELATIONS<br />

<strong>Cyprus</strong> joined the EU on 1 May 2004 together<br />

with nine other European countries. Under the<br />

terms of its accession the entire island is considered<br />

technically to be a member of the European<br />

Union, despite its continued division and the fact<br />

that the government of the Republic has no effective<br />

authority in the northern part of the island.<br />

However, the terms of the acquis communautaire,<br />

the EU’s body of laws, have been suspended<br />

in the north. <strong>Cyprus</strong> has historically followed a<br />

non-aligned foreign policy, although it increasingly<br />

identifies with the West in its cultural affinities<br />

and trade patterns, and maintains close relations<br />

with Greece. Turkey refuses to recognise the<br />

government of the Republic of <strong>Cyprus</strong>, arguing<br />

that the latter – as established by the Constitution<br />

of 1960 – ceased to exist when the intercommunal<br />

violence that broke out in December 1963 ended<br />

Turkish Cypriot participation in government.<br />

As a result, Turkey still refuses to allow Cypriotflagged<br />

vessels access to its ports, despite pressure<br />

from the European Union. <strong>Cyprus</strong> is a member<br />

of the United Nations and most of its agencies,<br />

as well as the Commonwealth of Nations, World<br />

Bank, International Monetary Fund and Council<br />

of Europe. In addition, the country has signed the<br />

General Agreement on Tariffs and Trade (GATT)<br />

and the Multilateral Investment Guarantee<br />

Agency Agreement (MIGA). n<br />

Discover more at www.cyprusprofile.com<br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 17

Economy<br />

H<br />

18 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Economy<br />

GROWTH ON<br />

THE<br />

ORIZON<br />

Following the banking crisis of 2013, <strong>Cyprus</strong> exceeded<br />

expectations and propelled itself into a front-runner as one of the<br />

fastest growing EU economies. Implementing critical reforms,<br />

strengthening investor confidence and launching new incentives<br />

were key to achieving this success. With the break of the<br />

coronavirus pandemic the economy has taken a severe hit along<br />

with many other countries, but early action has proved key in<br />

<strong>Cyprus</strong>’ efforts to secure a sustainable and competitive economy.<br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 19

Economy<br />

The small, open economy<br />

of <strong>Cyprus</strong> is known for its<br />

resilience, having enjoyed<br />

uninterrupted expansion<br />

for more than 30 years<br />

until the global financial<br />

crisis pushed the country<br />

into recession in 2009. The<br />

economy bounced back<br />

swiftly after the banking<br />

crisis in 2013, returning to<br />

growth in 2015, investment<br />

grade rating in 2018 and<br />

recording annual average<br />

real GDP growth of 5.4% in 2016-19. During this<br />

period the banks took the opportunity to consolidate,<br />

boost and diversify their capital base and cut<br />

non-performing loans by over two-thirds. At the<br />

same time, the government reformed its public<br />

finances, brought debt back below 100% of GDP<br />

and paid off its debt to the IMF five years early.<br />

The medium-term focus is on continuing<br />

structural reforms that will encourage investment,<br />

raise the economy’s competitiveness and<br />

leverage the eurozone economy’s highly educated<br />

population. The immediate impact of the Covid-<br />

19 pandemic on the economy has of course been<br />

significant, but the government has marshalled<br />

considerable domestic and eurozone resources to<br />

support business activity. Early signs of returning<br />

confidence suggest that the country’s legendary<br />

resilience will prevail.<br />

KEY SECTORS<br />

The <strong>Cyprus</strong> economy is dominated by services,<br />

which accounted for 82.7% of gross value added<br />

in 2019, while industry accounted for 8%, construction<br />

7% and agriculture, forestry and fishing<br />

2.3%. Over the past two decades the economy<br />

has diversified. While tourism remains one of the<br />

most significant sectors, especially because of its<br />

wider impact on retail, transport, construction<br />

and employment, its value-added contribution,<br />

when narrowly defined as accommodation and<br />

food services, has now been overtaken by professional<br />

services, financial services and real estate.<br />

Diversification has been made possible by the<br />

growing importance of <strong>Cyprus</strong> as an international<br />

business centre. Information and communication<br />

services are also expanding rapidly from a<br />

low base, as the country takes advantage of its ge-<br />

In addition to the upheaval it caused to peoples’ lives<br />

and its continued health threat, unavoidably, the Covid<br />

pandemic also has a momentous impact on businesses<br />

and the economy. From the onset of the crisis, maintaining<br />

positive epidemiological conditions was at the cornerstone of<br />

government policy response. Having achieved to contain the<br />

spread of the virus helps us now to enter the recovery phase<br />

with more confidence despite the uncertainty that still lie ahead.<br />

In the economic front we responded with early and frontloaded<br />

economic measures to address the effects of the pandemic, adopting a generous fiscal stimulus<br />

package mainly based on short term income support and liquidity measures for the employees<br />

and the businesses affected by the pandemic. Those measures have delivered and we can<br />

now focus on the broader recovery strategy for the medium and long term. A strategy which<br />

includes the use of the medium-term budget and the EU recovery fund to achieve two main<br />

recovery goals: to strengthen the resilience of the Cypriot economy and to give a new impetus<br />

to its transformation. A transformation through structural reforms, into the era of a digital,<br />

green and sustainable economy. Taking into consideration the demonstrated flexibility of the<br />

Cypriot economy, I am confident that by following the correct policies through the necessary<br />

political consensus, we will also emerge strong from this crisis as we did in the near past.<br />

Constantinos Petrides<br />

Minister of Finance<br />

20 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Economy<br />

Real<br />

GDP<br />

Growth<br />

Source: European<br />

Commission,<br />

European<br />

Economic Forecast,<br />

Summer <strong>2020</strong><br />

GDP in<br />

€ Billions<br />

Source: Cystat<br />

19.4<br />

19.8<br />

19.4<br />

18.0<br />

17.4<br />

17.8<br />

18.9<br />

20.0<br />

21.1<br />

21.9<br />

4.1% 3.2% -7.7% 5.3%<br />

2018 2019 <strong>2020</strong><br />

(forecast)<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

2019<br />

GDP per<br />

capita in €<br />

Source: Cystat<br />

23,402<br />

23,273<br />

22,502<br />

20,877<br />

20,421<br />

21,031<br />

22,163<br />

23,315<br />

24,294<br />

24,925<br />

2021<br />

(forecast)<br />

ographic location at the crossroads of three continents.<br />

Administrative services are also rising fast,<br />

boosted by the growing compliance industry. As<br />

in many advanced countries, the largest single<br />

sector is wholesale and retail trade, serving the<br />

general population as well as incoming tourists.<br />

CHALLENGES AND OPPORTUNITIES<br />

The immediate challenge for the economy is to<br />

limit the impact of the Covid-19 pandemic. By<br />

September <strong>2020</strong> the government had committed<br />

€1.3 billion (6.4% of GDP) to businesses, mainly<br />

to support salaries and another €1.9 billion in<br />

liquidity support to the banking sector. The<br />

country will also be eligible for €479 million of the<br />

EU’s Support to mitigate Unemployment Risks<br />

in an Emergency (SURE) programme and €968<br />

million from the EU’s Recovery and Resilience<br />

Facility, while the European Central Bank (ECB)<br />

is also providing support via the Public Sector<br />

Purchase Programme (PSPP) and the Pandemic<br />

Emergency Purchase Programme (PEPP).<br />

Dealing with the short-term crisis has not distracted<br />

the government from pursuing structural<br />

reforms. A new Deputy Ministry of Research,<br />

Innovation and Digital Policy was established in<br />

March <strong>2020</strong> and was key to accelerating digitisation<br />

of the public sector at the height of the pandemic.<br />

The government approved the Fast Track<br />

Business Activation Mechanism for non-EU nationals<br />

in September <strong>2020</strong>, building on the Fast<br />

Track Headquartering scheme introduced in<br />

2019.<br />

Key prospects lie in energy, interconnectivity,<br />

tourism and headquartering. Energy prospects<br />

arise from offshore natural gas finds, further<br />

electricity liberalisation and investment in renewables,<br />

while opportunities for interconnectivity<br />

will come from the submarine electricity<br />

cables that will link <strong>Cyprus</strong> to the European and<br />

African continents. Investment in expanding and<br />

upgrading the island’s tourism offering will continue,<br />

while prospects for headquartering have<br />

been boosted by the government’s early public<br />

health interventions to rapidly contain the pandemic.<br />

This has further enhanced the country’s<br />

reputation as a safe eurozone location in which<br />

to do business. n<br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 21

Economy<br />

7.6%<br />

Financial Services<br />

8.9%<br />

Public administration<br />

& defence<br />

10.9%<br />

Wholesale &<br />

7.9%<br />

Manufacturing,<br />

electricity,<br />

gas & water<br />

2.4%<br />

Agriculture & mining<br />

retail trade 7.0%<br />

Accommodation<br />

& food services<br />

Key sectors<br />

as % of total<br />

Gross value added<br />

(GVA)<br />

Source: Cystat<br />

8.2%<br />

Professional<br />

services<br />

7.0%<br />

Construction<br />

40.1%<br />

Other services<br />

Gross public debt<br />

as % of GDP<br />

Source for 2018-19: Ministry of Finance<br />

Forecast source: Sapienta Economics,<br />

<strong>Country</strong> Analysis <strong>Cyprus</strong>, August <strong>2020</strong>.<br />

100.6 95.5 117.6 114.9 108.1<br />

2018 2019 <strong>2020</strong><br />

(forecast)<br />

2021<br />

(forecast)<br />

2022<br />

(forecast)<br />

Current account<br />

balance (% of GDP)<br />

Source for 2018-19: Central Bank of <strong>Cyprus</strong><br />

Forecast source: Sapienta Economics, <strong>Country</strong><br />

Analysis <strong>Cyprus</strong>, August <strong>2020</strong>.<br />

-4.4 -7.6<br />

-1.0 -4.1<br />

22 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Harmonised Consumer price inflation (%)<br />

Source: European Commission, European Economic Forecast, Summer <strong>2020</strong><br />

0.8 0.5 0.8<br />

Economy<br />

2018 2019<br />

Credit ratings September <strong>2020</strong><br />

<strong>2020</strong><br />

(forecast)<br />

-0.5<br />

2021<br />

(forecast)<br />

BBB- BBB- BBB (L) Ba2<br />

Standard & Poor’s<br />

Stable Outlook<br />

Fitch Ratings<br />

Stable Outlook<br />

Unemployment rate<br />

Source for 2018-19: Cystat<br />

Forecast source: Sapienta Economics, <strong>Country</strong><br />

Analysis <strong>Cyprus</strong>, August <strong>2020</strong><br />

DBRS<br />

Stable Outlook<br />

8.4% 7.1% 9.8% 9.1%<br />

Moody’s<br />

Positive Outlook<br />

The priority of the<br />

Ministry’s policies is<br />

to address the immediate<br />

issues arising as a result<br />

of the pandemic and<br />

the challenges that will<br />

be posed, in the best<br />

possible way for the<br />

benefit of the whole of<br />

society. Τhe Government<br />

and the Ministry of<br />

Labour, Welfare and<br />

Social Insurance, in<br />

parallel with the gradual<br />

upgrading of social<br />

benefits and the provision<br />

of care to citizens in<br />

need, closely monitors<br />

developments in the<br />

economy and business<br />

and makes every effort<br />

to strengthen businesses<br />

and, by extension, the<br />

economy, so that we can<br />

return to positive growth<br />

rates as soon as possible,<br />

safeguarding jobs and<br />

workers’ rights. We will<br />

use the resources of the<br />

European Social Fund<br />

to launch new Incentive<br />

Plans for the recruitment<br />

of the unemployed, as<br />

well as new projects<br />

combining training with<br />

employment subsidy<br />

and other measures<br />

aimed at preventing<br />

a large increase in<br />

unemployment.<br />

2018 2019 <strong>2020</strong><br />

(forecast)<br />

2021<br />

(forecast)<br />

Zeta Emilianidou<br />

Minister of Labour,<br />

Welfare and Social<br />

Insurance<br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 23

Economy<br />

The challenges of maintaining<br />

economic prosperity in a<br />

Covid-impacted world is a key<br />

inflection point for countries<br />

and requires really significant<br />

changes in the way governments<br />

and businesses will need to adapt. The rate of<br />

digital transformation has never been higher and<br />

will be maintained. EY will invest substantially<br />

in our strategic advisory capabilities in <strong>Cyprus</strong><br />

and we will look to attract the best and most<br />

diverse talent into our Firm to help our clients<br />

thrive amidst all the current uncertainties.<br />

David Barker<br />

<strong>Country</strong> Managing Partner<br />

EY <strong>Cyprus</strong><br />

Exports of goods by economic destination<br />

in 2019 €/million (includes re-exports)<br />

Transport<br />

equipment<br />

1,018<br />

Machinery &<br />

electrical equipment<br />

239<br />

Mineral<br />

products<br />

666 Chemicals<br />

405<br />

Base metals<br />

& products<br />

95<br />

Vegetable<br />

products<br />

78<br />

Live animals<br />

& products<br />

270<br />

Unclassified<br />

78<br />

It is no secret that <strong>Cyprus</strong>’<br />

economic activity in <strong>2020</strong> has<br />

been significantly affected as a<br />

result of the global outbreak of<br />

Covid-19 and the confinement<br />

measures that followed.<br />

Even though <strong>Cyprus</strong>’ performance in containing<br />

the spread of the virus has been remarkable,<br />

the contraction of the economy is expected to<br />

be over 7% of the GDP. The outlook for 2021<br />

is quite encouraging though, with growth<br />

rates that are expected to be between 5-6%<br />

of GDP. Various reforms are already under<br />

way, while the country has embarked on an<br />

ambitious programme of digital transformation<br />

that will increase further its efficiency and its<br />

international competitiveness as an established<br />

business and services centre in the area.<br />

Source: Cystat<br />

Netherlands<br />

Food, beverages<br />

& tobacco<br />

135<br />

Libya<br />

Other<br />

171<br />

TOTAL EXPORTS<br />

3,146<br />

Top export markets for goods in<br />

2019 €/million (includes re-exports)<br />

Greece<br />

United Kingdom<br />

Hong Kong<br />

Marshall Islands<br />

Christodoulos Angastiniotis<br />

President<br />

<strong>Cyprus</strong> Chamber of Commerce and Industry (CCCI)<br />

The main question for the<br />

economy in the next 12 months<br />

is whether the legendary<br />

resilience of the <strong>Cyprus</strong> economy<br />

will prevail. There are some<br />

signs of life outside tourism,<br />

but this will not prevent negative growth rates<br />

in 2021. I am currently forecasting a real GDP<br />

contraction of 5.0% in <strong>2020</strong> and growth of 1.8%<br />

in 2021 but with the caveat that all forecasts<br />

are subject to more uncertainty than usual.<br />

Fiona Mullen<br />

Director<br />

Sapienta Economics<br />

406 315 235 189 81 71<br />

Top suppliers of goods in 2019 €/million<br />

Source: Cystat<br />

UK 588<br />

Germany 496<br />

Italy 844<br />

Greece 1,669 Israel 489<br />

Source: Cystat<br />

China 412<br />

24 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

Foreign Direct Investment (FDI)<br />

FDI Liabilities (Investments in <strong>Cyprus</strong>)<br />

FDI Assets (Investments abroad)<br />

Economy<br />

53,807<br />

57,985<br />

19,586<br />

22,539<br />

38,828<br />

49,707<br />

26,118<br />

39,939<br />

7,722<br />

5,699<br />

16,216<br />

14,835<br />

4,684<br />

-2,617<br />

21,174<br />

12,068<br />

2012 2013 2014 2015 2016 2017 2018 2019<br />

Cumulative inward FDI<br />

stock by country €/million<br />

Russian Federation 45,191<br />

Jersey 33,708<br />

British Virgin Islands 18,856<br />

Netherlands 18,071<br />

United Kingdom 16,219<br />

Germany 8,216<br />

Bermuda 6,047<br />

Poland 3,223<br />

Marshall islands 3,188<br />

Ireland 2,408<br />

Inward FDI flow by country<br />

in 2018 €/million<br />

Russian Federation 5,224<br />

China 165<br />

Germany 136<br />

Other Near and Middle East countries 99<br />

Greece 98<br />

Israel 44<br />

Lebanon 29<br />

Ukraine 22<br />

Jordan 20<br />

Vietnam 8<br />

Total including others<br />

€374,172m<br />

Source: Central Bank of <strong>Cyprus</strong><br />

Total including others<br />

€5,478m<br />

Source: Central Bank of <strong>Cyprus</strong><br />

Imports of goods by economic destination in 2019 €/million<br />

2,325<br />

1,857<br />

1,980<br />

Consumer goods<br />

Intermediate inputs<br />

Transport equipment & parts<br />

of which ships & boats<br />

489<br />

1,468<br />

117<br />

Capital goods<br />

Fuels & lubricants<br />

Unclassified<br />

TOTAL IMPORTS<br />

8,236<br />

Source: Cystat<br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 25

Foriegn Direct Investment<br />

FDI Destination<br />

<strong>Cyprus</strong> has attracted formidable foreign investment over the last five years<br />

with billions of euros flowing into multiple sectors. Although the coronavirus<br />

pandemic has slowed down the global economy, the country has forged ahead<br />

with the launch of new incentives and reforms that continue to offer interesting<br />

opportunities to investors with capital and interest in the East Med region.<br />

The growth performance of <strong>Cyprus</strong> over<br />

the last five years has been exceptional<br />

and even exceeded international expectations,<br />

while successive credit<br />

rating upgrades and new incentives<br />

have attracted billions in foreign investment<br />

since 2015, with significant<br />

inflows from the US, Asia, Russia and<br />

the Middle East. <strong>Cyprus</strong>’ return to an investmentgrade<br />

credit rating in 2018 gave both the economy<br />

and investor confidence a much-needed boost,<br />

and the successful recapitalisation of its major<br />

banks and numerous large-scale projects, have all<br />

contributed to the resurgence of <strong>Cyprus</strong> as a top<br />

foreign direct investment (FDI) destination. The<br />

sectors that have seen the most significant FDI<br />

are banking, shipping, retail, tourism, pharmaceuticals<br />

and energy, while new luxury and infrastructure<br />

developments are underway across the<br />

country with significant foreign investor backing.<br />

A fast-track system is also encouraging international<br />

companies to set up international and<br />

regional headquarters on the island, which is becoming<br />

an increasingly attractive gateway to both<br />

established and emerging growth markets.<br />

DIVERSIFIED INVESTMENT OPTIONS<br />

For the last few years, <strong>Cyprus</strong> has been a hive of<br />

activity with several notable projects already implemented<br />

or in the pipeline, strengthening the<br />

country’s image and appeal. Foreign investment<br />

flows have been significant. In the ten-year period<br />

2010-19, inflows of FDI averaged €24 billion per<br />

year, while cumulative net FDI reached €17.3<br />

billion. This investment was driven by equity,<br />

with the shipping and real estate sectors playing<br />

a significant role.<br />

New large-scale real estate projects, luxury<br />

marinas and tourism infrastructure, coupled with<br />

exciting opportunities in the energy and shipping<br />

sectors have all reinforced <strong>Cyprus</strong>’ status as an interesting<br />

investment location. An added benefit<br />

of <strong>Cyprus</strong> is its secure and stable EU environment<br />

in a turbulent region, which provides an ideal<br />

base for regional headquarters or ancillary and<br />

support services for investors with clients in the<br />

wider Eastern Mediterranean region.<br />

Already renowned as a popular holiday destination<br />

and a thriving business hub servicing<br />

international companies with multinational<br />

26 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

operations, the island is sharpening its competitive<br />

edge by streamlining processes, modernising<br />

legislation, introducing incentives and<br />

speeding up licensing procedures to better cater<br />

to investors. Special schemes and incentives are<br />

in place to facilitate headquartering, which covers<br />

the sectors of technology, asset management, investment<br />

funds, shipping and higher education,<br />

‘Olivewood’ for the international film industry,<br />

the Startup Visa for non-EU nationals and a<br />

Fast Track Business Activation Mechanism for<br />

non-EU nationals approved in September <strong>2020</strong>.<br />

PRIVATISATIONS AND LARGE-<br />

SCALE PROJECTS<br />

<strong>Cyprus</strong>’ FDI appeal has been on an upward trajectory<br />

with the economy posting a healthy 3.2%<br />

growth in 2019 and following improvements in<br />

its macroeconomic and financial environment,<br />

factors that have also revived international interest<br />

in around 30 major development projects on<br />

the island. Investment opportunities in <strong>Cyprus</strong>’<br />

large-scale projects span various sectors, including<br />

high-value tourism and housing developments,<br />

projects with a special focus on golf<br />

courses and luxury marinas, as well as education,<br />

energy and, more lately, the international film<br />

sector.<br />

The liberalisation of markets in which stateowned<br />

entities used to dominate presents new<br />

opportunities in terms of FDI. The 2017 commercialisation<br />

of the country’s largest port in<br />

Limassol marked a new era for <strong>Cyprus</strong> as a commercial<br />

hub. The privatisation deal with Eurogate<br />

International GmbH and DP World Limited is<br />

expected to boost state coffers with €2 billion<br />

over the next 25 years, while the new port operators<br />

are injecting millions in upgrading services<br />

and infrastructure. The coming full liberalisation<br />

of electricity is also presenting new opportunities<br />

in the natural gas and renewables sectors.<br />

PERFECTING THE TOURISM PRODUCT<br />

Tourism has long been a driving force of the<br />

Cypriot economy and a concerted effort to diversify<br />

its offering in recent years has paid off.<br />

Ahead of the global pandemic, expansion of capacity<br />

as well as quality upgrades saw both arrivals<br />

and expenditure break new records for four<br />

years running. <strong>Cyprus</strong> has been attracting new<br />

interest by developing conference, sports, health<br />

and wellness and by extending the tourist season.<br />

The construction and investment in multipurpose<br />

projects and mixed-use developments such as<br />

luxury marinas, golf courses and more recently<br />

the island’s first-ever and only integrated luxury<br />

casino resort, are all part of the ongoing strategy to<br />

upgrade <strong>Cyprus</strong>’ tourism product. The temporary<br />

casino has started operations and the full integrated<br />

casino resort, City of Dreams Mediterranean,<br />

will have extensive facilities and five-star status<br />

by 2021. The casino resort is Hong Kong-based<br />

Melco’s first expansion outside of Asia and will be<br />

the biggest casino of its kind in Europe, with the<br />

investment for this mega project at €600 million.<br />

Following the success of Limassol Marina,<br />

there has been a swell of interest in these types<br />

of projects. The €300 million luxury Ayia Napa<br />

Marina – which is transforming the area – has<br />

graduated to its second phase, with berthing facilities<br />

now fully operational. The marina offers<br />

capacity for 600 yachts of up to 60 metres, a shipyard,<br />

and a range of luxury villas and facilities.<br />

With significant Egyptian investment backing<br />

the innovative project, the seafront residences,<br />

which will be completed by 2023, are already<br />

being marketed to investors worldwide. In addition,<br />

the €110 million Paralimni Marina project<br />

is well under way, with additional development<br />

incentives approved by the government in <strong>2020</strong>.<br />

The tender for Larnaca Marina received approval<br />

in August <strong>2020</strong> and is expected to attract €1.2<br />

billion in construction and real estate development,<br />

while plans are in place for a luxury marina<br />

in Paphos.<br />

The number of foreign investors closing<br />

multimillion-euro deals in the last few years<br />

underlines the fact that tourism-related real<br />

estate and infrastructure continues to be one of<br />

the most attractive investment opportunities in<br />

<strong>Cyprus</strong>. With solid and continuous interest in the<br />

tourism sector, the country’s investment promotion<br />

agency Invest <strong>Cyprus</strong> has set up a dedicated<br />

and specialised unit, TourInvest, to promote investment<br />

opportunities in the tourism and hospitality<br />

sector. In cooperation with the Deputy<br />

Ministry of Tourism and other stakeholders, the<br />

unit focuses on attracting investment into largescale<br />

infrastructure projects that exist in diversified<br />

thematic areas.<br />

Worthwhile investments have already been<br />

made in the hospitality industry with acquisitions<br />

and the construction of new luxury hotels of wellknown<br />

hotel management chains. These include<br />

the prestigious Sun City Spa and Residences by<br />

Chinese group Jim Chang Global with an initial<br />

investment of €100 million to construct a fivestar<br />

resort hotel and exclusive beachfront residences<br />

in cooperation with the Giovani Group.<br />

The Radisson Hotel Group, one of the largest and<br />

most dynamic hotel groups in the world, has big<br />

plans to grow its existing portfolio in the country<br />

to six hotels and almost 1,000 rooms by 2025.<br />

In 2019, the Luxury Collection, part of<br />

Marriott International, opened the Parklane<br />

Luxury Collection Resort & Spa resort in<br />

Foriegn Direct Investment<br />

<strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong> 27

Foriegn Direct Investment<br />

Limassol. Owned and operated by Parklane<br />

Hotels Limited, the property marks Marriott<br />

International’s entry into <strong>Cyprus</strong>. Another major<br />

international deal in recent years was South<br />

African Atterbury acquiring two of the country’s<br />

flagship Nicosia retail outlets, the Mall of <strong>Cyprus</strong><br />

and the Mall of Engomi, for €200 million.<br />

In July <strong>2020</strong>, Hyatt Hotels Corporation announced<br />

a management agreement with Anolia<br />

Holdings Limited for the launch of the first Hyatt<br />

hotel in <strong>Cyprus</strong>. The 300-room luxury resort<br />

Grand Hyatt Limassol is expected to open in<br />

2025. The new beachfront resort will also be a<br />

key element of Zaria Resort, a mixed-use luxury<br />

development, comprised of residential apartments<br />

and private villas totaling more than 80,000<br />

square meters. The announcement of Grand Hyatt<br />

Limassol follows a significant expansion in Hyatt’s<br />

brand footprint in Europe over the last year, and<br />

<strong>Cyprus</strong> has proven to attract travellers from Hyatt’s<br />

key strategic markets including the UK, Russia,<br />

Greece, Germany and the Middle East.<br />

EXPANDING PROPERTY MARKET<br />

<strong>Cyprus</strong> continues to be on the top of the list for<br />

investors, holiday-home seekers, expats and retirees,<br />

with the traditionally popular areas of<br />

Paphos and Limassol leading the way. One of<br />

the latest projects is the Sofitel Resort & Spa, a<br />

joint venture between Singapore-headquartered<br />

Oxley Holdings and Planetvision on the Limassol<br />

beachfront. The project will be the first Sofitel<br />

Resort with branded residences in Europe and is<br />

expected to be completed by 2022.<br />

Health and wellness developments are increasingly<br />

popular, and a prime example of<br />

this is the Eden Seniors Resort in Larnaca<br />

which opened its doors in 2018. The project,<br />

developed by the Cypriot-Lebanese joint<br />

venture Eveningfall Investments Ltd, is a wellness<br />

and rehabilitation centre, with spa and<br />

relaxation facilities for the elderly. In 2021,<br />

Paphos is due to see the first dedicated retirement<br />

village in <strong>Cyprus</strong> – a segment that has<br />

much potential in <strong>Cyprus</strong> along with rehabilitation<br />

related projects. The €16 million retirement<br />

village, branded Lazaris Mill, will consist of 82<br />

individual apartments, ranging from studios<br />

to larger flats and a small 24-room hotel, and<br />

provide both necessary and bespoke facilities.<br />

Until now, no retirement villages were available<br />

on the island and whilst common in many other<br />

countries, this project is a first for <strong>Cyprus</strong>.<br />

The high-end residential property segment<br />

accounted for 20% of the total transaction value<br />

of real estate in <strong>Cyprus</strong> during the first half of<br />

2019, with a keen interest from foreigners. For<br />

the whole of 2019, 66% of properties were acquired<br />

by non-EU buyers.<br />

NEO, Pafilia<br />

FDI LIABILITIES (INVESTMENTS IN CYPRUS) Source: Central Bank of <strong>Cyprus</strong><br />

8,511<br />

47,099<br />

23,419<br />

28,909<br />

53,807<br />

19,586<br />

38,828<br />

26,118<br />

7,722<br />

16,216<br />

4,684<br />

21,174<br />

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019<br />

28 <strong>Country</strong> <strong>Report</strong> CYPRUS <strong>2020</strong>

A GROWING ENERGY SECTOR<br />

Since US company Noble Energy made the first<br />

natural gas discovery in 2011 with estimated<br />

resources of 4.5 trillion cubic feet (tcf) in the<br />

Aphrodite field, <strong>Cyprus</strong>’ hydrocarbons discoveries<br />

have captured the attention of several global<br />

energy giants. ENI, Kogas, ExxonMobil, Royal<br />

Dutch Shell, and Total have all secured exploration<br />

licences and conducted exploratory drilling<br />

while US giant Chevron will be taking a stake in<br />

Block 12 after announcing its intention in July<br />

<strong>2020</strong> to buy out Noble Energy Inc. ExxonMobil<br />

announced the discovery of an estimated 5 to 8<br />

tcf in Block 10 in early 2019 and ENI announced<br />

a promising discovery in Block 6 in early 2018.<br />

More drilling is expected in the next few years<br />

and in 2019 <strong>Cyprus</strong> agreed to build a subsea pipeline<br />

connecting Aphrodite to Egypt’s liquefaction<br />

plants and concluded a production-sharing<br />

deal with Noble Energy and its partners over the<br />

Aphrodite gas reservoir.<br />

New opportunities are being created for<br />

a range of energy investments, including gas<br />

imports for power generation, the expected liberalisation<br />

of the electricity market by 2021,<br />

the growing share of renewables, the EuroAsia<br />

Interconnector project to connect <strong>Cyprus</strong>, Israel<br />

and Greece via submarine electricity cable, the<br />

related EuroAfrica Interconnector to connect<br />

Egypt, and the potential for the world’s longest gas<br />

pipeline from Israel via <strong>Cyprus</strong> to Italy. The discoveries<br />

have boosted the development of a new<br />

energy industry in the country, which is also well<br />

positioned to offer a multitude of auxiliary services<br />

to companies operating in the wider region.<br />

A floating storage and regasification unit (FSRU)<br />

terminal in Vassilikos, which will transform domestic<br />

power production, attracted finance in<br />

<strong>2020</strong> from the European Investment Bank (EIB)<br />

and the European Bank for Reconstruction and<br />

Development (EBRD).<br />

A LEANER BANKING SECTOR<br />

In the era of globalisation,<br />

boundaries between<br />

international politics<br />

and international<br />

economic relations have<br />

become even more<br />

blurred. The outbreak<br />

of Covid-19 pandemic<br />

has posed additional,<br />

unprecedented challenges<br />

on governments and<br />

businesses alike and<br />

has accelerated the<br />

changes that were already<br />

underway. Overcoming<br />

these challenges<br />

successfully will<br />

ultimately depend on how<br />

countries are able to adapt<br />

to the new environment.<br />

I am confident that our<br />

new strategy for Economic<br />

Diplomacy will stand us in<br />

a strong position to bring<br />

into play all elements<br />

that make <strong>Cyprus</strong> an<br />

attractive investment<br />

destination: membership<br />

of the EU with easy access<br />

to a market of 500 million<br />

consumers, a modern<br />

legal framework, an<br />

attractive tax system,<br />

an extensive network<br />

of more than 60 Double<br />

Tax Treaties, a highly<br />

skilled workforce<br />

and high-quality<br />

professional services,<br />

to mention but a few.<br />

Nikos Christodoulides<br />

Minister of Foreign Affairs<br />

<strong>Cyprus</strong> banks maintain high levels of capital adequacy<br />

and liquidity. The gradual restructuring<br />

of the banking sector after 2013 has attracted important<br />

institutional investors and fresh foreign<br />

capital, and encouraged accelerated sales of nonperforming<br />

loans. These developments have substantially<br />

reduced risk and enabled the financial<br />

system to operate on a more sound basis.<br />

The island’s biggest lender, Bank of <strong>Cyprus</strong>,<br />

secured €1 billion of investment from worldrenowned<br />

investors in 2014 and issued another<br />

€220 million in Additional Tier 1 (AT1) capital in<br />

December 2018. The bank listed on the London<br />

Stock Exchange in January 2017, which has substantially<br />

opened up access to large foreign investors,<br />

such as Morgan Stanley.<br />

Hellenic Bank completed a capital increase<br />

of €150 million in March 2019 to support its acquisition<br />

of mainly performing loans from the<br />

former <strong>Cyprus</strong> Cooperative Bank. The acquisition<br />

boosted the bank’s assets to €16 billion and<br />

raised market share for loans to 30%. The capital<br />

raise brought in new international investors, such<br />

as US-based Poppy Sarl (PIMCO), with the other<br />

major shareholders being Demetra Investments<br />

Ltd, Wargaming, Third Point and investment<br />