Eastlife Autumn 2020

Dear Reader, we’re back! There’s been a few changes at eastlife during lockdown. We have a new publisher, new team members and a fantastic newly designed website! I hope you enjoy!

Dear Reader, we’re back! There’s been a few changes at eastlife during lockdown. We have a new publisher, new team members and a fantastic newly designed website!

I hope you enjoy!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

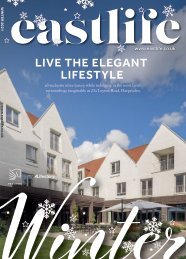

Lovell

Homes

offers its

top tips for

homebuyers

Written by Adrian Garrood,

regional sales manager at Lovell

Moving home can be very confusing, with masses of

information available which can often make the process feel

overwhelming.

Top tips for ensuring purchasers can make the most out of their

home moving experience include:

1. Research the area and developer

Before committing to a new-build property, do thorough

research into the area you want to live in and into the

housebuilder. Find out what developments they’ve built in the

past, as this will provide a good insight into the quality of their

homes.

2. Get the most out of your first

appointment at the development

Exploring the development and showhomes available is

hugely beneficial, and is an ideal opportunity to talk with sales

executives to find out more about if the development suits your

requirements.

3. Ask what is included in your new

build

Finding out exactly what your new home includes before

signing a contract is hugely important and will avoid any future

problems. By querying with the developer about white goods,

gardens, parking arrangements and more, you can ensure that

your home will perfectly suit your needs before moving in.

4. Take advantage of the Governmentbacked

Help to Buy: Equity Loan

scheme

For first and second-time buyers, the Help to Buy scheme can

massively help financially. Brand-new properties can be bought

with just a 5% deposit, and the remaining amount is made up of

a 75% mortgage and a 20% equity loan, which is interest free for

the first five years.

5. Use the Part Exchange scheme

The Part Exchange scheme guarantees a genuine cash buyer,

meaning purchasers can have a stress and hassle-free buying

experience, and eliminates the need to pay estate agent fees.

6. Research the reservation process

Once you’ve selected a property, keep on top of the reservation

process. This is a great time to discuss the above-mentioned

financial schemes, or contact an Independent Financial Adviser

if you need extra support.

For further information about the homes Lovell has available in

East Anglia, visit www.lovell.co.uk

79