Technical Analysis within a Fundamental Framework Jeff Hochman I

Technical Analysis within a Fundamental Framework Jeff Hochman I

Technical Analysis within a Fundamental Framework Jeff Hochman I

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FIDELITY INTERNATIONAL<br />

<strong>Technical</strong> <strong>Analysis</strong> <strong>within</strong> a <strong>Fundamental</strong> <strong>Framework</strong><br />

<strong>Jeff</strong> <strong>Hochman</strong> I Director of <strong>Technical</strong> Research<br />

Frankfurt, 29. April 2009<br />

This presentation is for Investment Professionals only, and should not be relied upon by private investors

2<br />

The more things change, the more they stay the same…<br />

…whether in 1934… …or in 2009!<br />

Chicago Tribune The Economist, WSJ, Wiedenroth’s<br />

Vorborse

3<br />

…and therefore our BEHAVIOR is often repeated!<br />

THEN<br />

UP HERE<br />

STOCKS<br />

BUYS BACK<br />

AND<br />

BULLISH<br />

TURNS<br />

ONE<br />

EVERY-<br />

AND<br />

OR TWO<br />

PERCENT<br />

RISE A<br />

THEY<br />

THEN<br />

PRICES FALL A<br />

PER-<br />

CENT OR<br />

DOWN HERE<br />

TWO IN A<br />

DAY OR<br />

TWO AND<br />

EVERY-<br />

ONE<br />

TURNS<br />

BEARISH<br />

ON THE<br />

MARKET<br />

AND<br />

SELLS<br />

STOCKS

4<br />

Stock markets are semi-efficient at discounting the future…<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

0.90<br />

0.80<br />

0.70<br />

0.60<br />

0.50<br />

0.40<br />

0.30<br />

0.20<br />

0.10<br />

0.00<br />

-0.10<br />

Dec-94<br />

Dec-95<br />

MSCI AC EUROPE - 12MTH FWD WTD EPS and 12m Fwd<br />

Earnings Relatives<br />

MSEUROL 6 month(s) % chg.<br />

Europe Fwd EPS 6 month(s) % chg.<br />

lagged by 5 months (RHS)<br />

Rolling 3 Year<br />

Correlation<br />

Source: Datastream, FIL<br />

Dec-96<br />

Dec-97<br />

Dec-98<br />

Dec-99<br />

Dec-00<br />

Dec-01<br />

Dec-02<br />

Dec-03<br />

Correl.= 0.5<br />

Dec-04<br />

Dec-05<br />

Dec-06<br />

Dec-07<br />

Dec-08<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

0.90<br />

0.80<br />

0.70<br />

0.60<br />

0.50<br />

0.40<br />

0.30<br />

0.20<br />

0.10<br />

0.00<br />

-0.10<br />

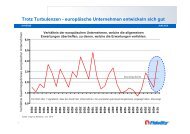

It’s a FACT…In the long run,<br />

EARNINGS are the main<br />

driver of stock market returns.<br />

BUT REMEMBER, the long<br />

run is comprised of many<br />

shorter runs!<br />

There are often significant<br />

periods of disconnect between<br />

earnings and actual stock<br />

price movements.

5<br />

…whether at the macro OR micro level<br />

Consensus GDP forecasts & Equity Market<br />

1800<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

Source: Reuters, MF Global, FIL<br />

Q1 06 Q1 07 Q1 08 Q1 09 Q1 10<br />

Eurozone Real GDP (% y/y, RH Scale) FTSE Eurofirst 300 Price Index (RH Scale)<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4

6<br />

Perhaps Anthony Bolton says it best…<br />

Source: Anthony Bolton, “Investing Against the Tide”, April 2009<br />

“The way I look at technical analysis today is as a<br />

framework or overlay into which I put my fundamental<br />

bets on individual stocks. I see it as a discipline for<br />

my stock picking.<br />

What I mean by this is that, if the technical analysis<br />

confirms my fundamental views, I may take a bigger bet<br />

than I would do otherwise.<br />

However, if the technical analysis doesn’t confirm my<br />

fundamental positive view, it makes me review my<br />

investment thesis on a company, for example checking<br />

that there aren’t negative factors we have overlooked. If<br />

my conviction is very strong I will often ignore the<br />

technical view; at other times if it conflicts I will take a<br />

smaller bet or reduce my position”.

7<br />

…a picture paints a thousand words, and them some more<br />

Source: Anthony Bolton, “Investing Against the Tide”, April 2009<br />

“Although at heart I’m a fundamentalist I have definitely<br />

found that the combination of two approaches seems to<br />

work better than just one on its own.<br />

A few years ago I spoke at a technical analysis<br />

conference and said that if I was on a desert island and<br />

was only allowed one input for my investment decisions,<br />

it would be an up-to-date chart book. I think today<br />

I would still be of the same opinion.<br />

The trouble with fundamental data is that I can’t<br />

single out only one source that on its own would be<br />

sufficient. I could, if pushed, run a portfolio with<br />

just a chart book…”

8<br />

When to SELL as important as when to BUY!<br />

Source: Bloomberg Data

9<br />

How & Why does Fidelity use <strong>Technical</strong> <strong>Analysis</strong>?<br />

<strong>Technical</strong> <strong>Analysis</strong> @ Fidelity is employed as a value added Tactical tool to<br />

our Strategic fundamental research<br />

Charts provide a visual “Reality Check” to the fundamental assumptions made<br />

by our PM’s and Analysts<br />

Main focus is on Stock picking, but also integral in the Asset Allocation<br />

process<br />

Primary idea is to increase our level of conviction in the decision making<br />

process – after all, it is a game of probabilities!<br />

<strong>Technical</strong> <strong>Analysis</strong> therefore provides an element<br />

of Risk Control for all our fund offerings

10<br />

Equities have likely reached the “Tipping Point”<br />

The Markets<br />

Wow, I feel GREAT<br />

Point of<br />

Maximum<br />

about this<br />

financial RISK<br />

investment!<br />

Euphoria<br />

Anxiety<br />

Temporary setback, I’m a long term<br />

investor…<br />

Optimism<br />

Excitement<br />

Thrill<br />

2006<br />

Maybe the markets just<br />

aren’t for me<br />

Denial<br />

Sentiment is now moving up the emotional<br />

pendulum from the “quicksand phase” to<br />

steadily climbing a new Wall of Worry<br />

Fear<br />

Desperation<br />

Panic<br />

2008/09<br />

2002/03<br />

Capitulation<br />

Despondency<br />

Point of Maximum<br />

financial<br />

OPPORTUNITY<br />

Hope<br />

Depression<br />

Optimism<br />

Relief

11<br />

Love goes, cash stays, and equities will finally bottom…<br />

NDR Total Market Value vs Money Market Fund Assets / NDR Total Market Value<br />

NDR Total Market Value Gain / Annum When:<br />

Money Market Fund Assets/ Gain/ % of<br />

NDR Total Market Value Annum Time<br />

* Above 10.80<br />

99 89.4<br />

10.80 and Below<br />

-125 106<br />

3541<br />

2907<br />

2386<br />

1959<br />

1608<br />

1320<br />

1083<br />

889<br />

730<br />

599<br />

492<br />

404<br />

331<br />

272<br />

223<br />

183<br />

150<br />

123<br />

101<br />

(S423)<br />

1055.64<br />

1981<br />

1982<br />

276.66<br />

Source: NDR, ICI<br />

196.81<br />

1983<br />

1984<br />

1985<br />

1986<br />

1987<br />

1988<br />

NDR Total Market Value<br />

(Billions, Scale Right)<br />

3/31/2009 = 8916.7<br />

613.84<br />

570.10<br />

Monthly Data 10/31/1980 - 3/31/2009 (Log Scale)<br />

17102.05<br />

9715.02 9322.61<br />

2382.00<br />

Money Market Fund Assets / NDR Total Market Value<br />

(Scale Right)<br />

3/31/2009 = 43.0%<br />

1989<br />

1990<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1862.00<br />

18082.49<br />

Total Money Market Fund Assets<br />

(Scale Left In Billions)<br />

3/31/2009 = $3834<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

High Liquidity<br />

Low Liquidity<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

18646<br />

15978<br />

13692<br />

11733<br />

10054<br />

8615<br />

7383<br />

6326<br />

5421<br />

4645<br />

3981<br />

3411<br />

2923<br />

2505<br />

2146<br />

1839<br />

1576<br />

1351<br />

1157<br />

43.9<br />

38.3<br />

33.4<br />

29.1<br />

25.4<br />

22.2<br />

19.3<br />

16.9<br />

14.7<br />

12.8<br />

11.2<br />

9.8<br />

8.5<br />

7.4<br />

All of the net selling<br />

the past 18 months<br />

has left a dramatic<br />

pile of cash on the<br />

sidelines, especially<br />

as a % of the total<br />

value of equities.<br />

Indeed, the ratio of<br />

cash to equities is<br />

now near 43%, or 2x<br />

the levels at the<br />

market lows in 1982,<br />

1991, and 2003.<br />

So if near everyone<br />

has already sold, is it<br />

not a good time to<br />

BUY???

12<br />

Risk spreads continue to moderate, a precursor to recovery…<br />

Emerging Market spreads<br />

3m Swap spreads<br />

3m LIBOR<br />

CDS spreads<br />

Source: Bloomberg<br />

Stabilizing

13<br />

Earnings will continue to fall, but this is now “old news”…<br />

98<br />

88<br />

79<br />

70<br />

63<br />

56<br />

50<br />

45<br />

40<br />

36<br />

32<br />

29<br />

26<br />

23<br />

21<br />

19<br />

17<br />

15<br />

13<br />

12<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

FID84<br />

World Earnings and Growth Rate<br />

Consensus growth rates<br />

% Over Or Under<br />

Trendline Growth<br />

* Trailing 12-Month Reported Earnings Per Share<br />

Weak Earnings<br />

Monthly Data 1/31/1970 - 3/31/2009 (Log Scale)<br />

Strong Earnings<br />

MSCI World Earnings Growth * = 6.1% per annum<br />

( )<br />

Trendline Growth = 6.6% per annum<br />

( )<br />

Trendline based on linear regression = average<br />

growth weighted for extreme observations.<br />

(Line will change very slightly with new updates)<br />

3/31/2009 = -16.7%<br />

1970 1975 1980 1985 1990 1995 2000 2005<br />

Source: NDR, Goldman Sachs<br />

98<br />

88<br />

79<br />

70<br />

63<br />

56<br />

50<br />

45<br />

40<br />

36<br />

32<br />

29<br />

26<br />

23<br />

21<br />

19<br />

17<br />

15<br />

13<br />

12<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30

14<br />

Global EPS estimates are becoming “less bad”, which is “good”<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

-80%<br />

Number of upgrades minus downgrades / total number of estimates (2-week rolling avg)<br />

Pan-Europe Index<br />

JP<br />

Asia ex-Japan Index<br />

Emerging Markets Index<br />

US<br />

Falling EPS should not<br />

come as a major surprise<br />

to anyone<br />

anymore, so maybe<br />

the surprise will be on<br />

the upside…<br />

Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09<br />

Source: Datastream, FIL, FactSet, MSCI, Soc Gen<br />

Net Downgrades<br />

Net Upgrades<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

-80%

15<br />

Trends are all a matter of proper perspective!<br />

As my grandfather once told me, the<br />

secret to investing is just living long<br />

enough…<br />

1929<br />

Bear<br />

Source: Bloomberg<br />

Bull<br />

Bear<br />

80 year secular uptrend from 1931/32 lows +7% pa<br />

% decline from S&P 500 Quarterly peaks<br />

Bull<br />

Bear<br />

The average secular bear market<br />

has lasted about 14 years, so we<br />

likely still have a few years to go…<br />

2009

16<br />

Is the “V” flashing Victory sign for the Bulls?<br />

Although we like to see large base<br />

patterns to help raise our level of<br />

conviction, monthly “V” shaped<br />

reversals do occur more often than we<br />

like to admit.<br />

Source: Bloomberg<br />

2000 -2003<br />

- 60%<br />

36 months<br />

2007 – 2009<br />

-61%<br />

18 months<br />

It sure feels that March/April has marked<br />

a significant cyclical turning point.

17<br />

A cyclical bull market <strong>within</strong> a secular bear has likely begun…<br />

Source: Bloomberg<br />

The past 6 week +25% sharp advance was in line with<br />

previous bear market rallies, yet was set up by a host of<br />

positive internal breadth divergences. If March was the<br />

low, then current set back should be limited in scope,<br />

and indicators stay at high end of recent ranges.<br />

Minimum<br />

H2 target

18<br />

After a pause in the action, Emerging Markets are re - emerging<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

Source: Datastream<br />

GLOBAL REGIONAL EQUITY RELATIVES<br />

The starting point one chooses means everything<br />

for performance!<br />

Beginning at the peak of the 2000 bull market, the Emerging<br />

Markets and Asia did extremely well, only to do poorly during the<br />

2008 downturn. But since November 2008 they have emerged<br />

again, outperforming even as the global economy has worsened.<br />

This trend seems set to continue into H2 2009.<br />

Europe<br />

UK<br />

Pac basin x jp<br />

US<br />

Japan<br />

Emerging Markets<br />

Since 01/01/09<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

22/4/09

19<br />

There’s been nowhere to run baby, nowhere to hide…<br />

30<br />

20<br />

10<br />

Agg<br />

cash infl FI<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

Annualized Returns<br />

L/S<br />

HF<br />

FoF<br />

BAL<br />

PORT<br />

EMBI<br />

HY<br />

ALT<br />

CNV<br />

Gold<br />

comm<br />

LG<br />

SPX<br />

Japan<br />

EQTY SG<br />

RUT<br />

LV EAFE<br />

EUR<br />

SV<br />

The Efficient Frontier<br />

The 2007-2009 Bear Market<br />

Compound Annual Return vs.<br />

Standard Deviation of Monthly Return.<br />

PORT: 50/30/20 model portfolio<br />

(stocks/bonds/alternatives).<br />

0 1 2 3 4 5 6 7 8 9 10 11 12<br />

Source: Ibbotson Associates, NAREIT, Lehman Bros., FMR Co.<br />

This bear market has distinguished itself in that<br />

historical correlations have been thrown out<br />

the door, with very little room to manoeuvre<br />

(except Gold). This is causing everyone to<br />

revaluate former beliefs about inter market<br />

relationships and economic principles.<br />

EM<br />

REITs<br />

Volatility<br />

of Returns

20<br />

Intermediate momentum suggests yields may fall again…<br />

The directional correlation between bond markets<br />

is also very high, with currency movements often the big<br />

determinant of performance.<br />

Quantitative Easing policies might keep yields<br />

lower for now, but eventually they are set to rise,<br />

maybe back to mid 2008 levels.<br />

Source: Bloomberg

21<br />

…and High Yield is beginning to show strength<br />

Despite growing fears of increasing default rates, HY<br />

spreads continue to contract somewhat, especially as<br />

equities have rallied, suggesting a more risk taking<br />

appetite amongst investors.<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

15/4/09<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Source: DATASTREAM<br />

1.50<br />

1.40<br />

1.30<br />

1.20<br />

1.10<br />

1.00<br />

0.90<br />

0.80<br />

0.70<br />

0.60<br />

x10 -3<br />

BARCLAYS HIGH YIELD BANKING - RED. YIELD<br />

BARCLAYS HIGH YIELD TELECOMM. - RED. YIELD<br />

BARCLAYS HIGH YIELD TECHNOLOGY - RED. YIELD<br />

BARCLAYS HIGH YIELD UTILITY - RED. YIELD<br />

US HY SPREADS(R.H.SCALE)<br />

EUROPEAN HY SPREADS (R.H.SCALE)<br />

INVERSE S&P 500<br />

HY Europe<br />

S&P (inverted)<br />

HY US<br />

2007 2008 2009<br />

15/4/09<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0

22<br />

Busted bubble, regroup, reform, reflate, and rise again…<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Source: DATASTREAM<br />

The Super Cycle is dead, long live the Super Cycle!<br />

Despite the strong correction past 18 months,<br />

commodity prices are stabilizing and should<br />

tend to move higher next several years.<br />

CRB Index<br />

CRB Energy<br />

CRB Grains<br />

CRB Industrials<br />

CRB Livestock<br />

CRB Precious Metals<br />

CRB Softs<br />

EMG Markets Relative<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

23/4/09<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0

23<br />

Though both have fallen lately, secular trends favour commodities…<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

A long-Term History of Stocks & Commodities<br />

The average commodities secular bull market<br />

has lasted about 18 years, which would mean<br />

we are right now just in the middle of it.<br />

1800 1812 1824 1836 1848 1860 1872 1884 1896 1908 1920 1932 1944 1956 1968 1980 1992 2004<br />

Annual Data. Source: FMRCo | Source: Haver Analytics, FactSet, FMR<br />

DJIA (log)<br />

Recessions<br />

DJIA/CRB<br />

Secular Trend: Stocks<br />

Secular Trend: Commodities<br />

`<br />

100<br />

10<br />

1<br />

0<br />

0

24<br />

In summary…<br />

Whether in a Bull Market or Bear, <strong>Technical</strong> <strong>Analysis</strong> is an efficient and<br />

objective method of determining if one’s fundamental beliefs are translated<br />

into actual money making opportunities <strong>within</strong> our portfolios.<br />

Charts therefore provide a visual “Reality Check” and help keep one honest<br />

in all market environments.<br />

Very good chance that markets are now transitioning into a cyclical Bull<br />

market <strong>within</strong> a secular bear, with a promising H2 2009 outlook.<br />

Therefore, tilting portfolios to favour more Offense vs. Defense in both stock<br />

and asset allocation selection.

25<br />

Rechtliche Hinweise<br />

Dieses Dokument ist nur für professionelle Investoren und nicht für Privatanleger bestimmt.<br />

Diese Präsentation darf ohne vorherige Erlaubnis weder reproduziert oder veröffentlicht werden. Eine<br />

Anlageentscheidung sollte in jedem Fall auf Grundlage der Prospekte, des letzten Geschäftsberichtes<br />

und – sofern nachfolgend veröffentlicht – des jüngsten Halbjahresberichtes getroffen werden. Diese<br />

Unterlagen sind die allein verbindliche Grundlage des Kaufes. Fidelity veröffentlicht ausschließlich<br />

produktbezogene Informationen und erteilt keine Anlageempfehlung. Die Prospekte, den Geschäftsbericht<br />

und den Halbjahresbericht erhalten Sie kostenlos bei FIL Investment Services GmbH, Postfach<br />

200237, D-60606 Frankfurt/ Main oder über www.fidelity.de. Anleger in Österreich erhalten diese<br />

Dokumente kostenlos bei FIL Investments International – Zweigniederlassung Wien, Schottenring 16,<br />

A-1010 Wien oder bei der österreichischen Zahlstelle Bank Austria Creditanstalt AG, Vordere Zollamtsstraße<br />

13, A-1030 Wien. Der Wert der Anteile sowie die Höhe der Erträge kann schwanken und<br />

wird nicht garantiert. Fidelity, Fidelity International und das Pyramiden-Logo sind eingetragene<br />

Warenzeichen von FIL Limited. Die genannten Unternehmen dienen zu rein illustrativen Zwecken.<br />

Dies stellt keine Aufforderung zum Kauf oder Verkauf der jeweiligen Werte dar, und die genannten<br />

Unternehmen können ggfls. nicht zu den Fondsbeständen zählen. Herausgeber für Deutschland: FIL<br />

Investment Services GmbH, Postfach 200237, D-60606 Frankfurt/ Main. Herausgeber für Österreich:<br />

FIL Investments International – Zweigniederlassung Wien, Schottenring 16, A-1010 Wien. Für<br />

institutionelle Investoren in Deutschland gilt als Herausgeber: FIL Investment Management GmbH,<br />

Kastanienhöhe 1, D-61476 Kronberg im Taunus. Stand, falls nicht anders vermerkt: April 2009.<br />

Alle Angaben ohne Gewähr. MK4372

26<br />

Rechtliche Hinweise<br />

Dieses Dokument ist nur für professionelle Investoren und nicht für Privatanleger bestimmt.<br />

Diese Präsentation darf ohne vorherige Erlaubnis weder reproduziert oder veröffentlicht werden. Eine<br />

Anlageentscheidung sollte in jedem Fall auf Grundlage der Prospekte, des letzten Geschäftsberichtes und –<br />

sofern nachfolgend veröffentlicht – des jüngsten Halbjahresberichtes getroffen werden. Diese Unterlagen<br />

sind die allein verbindliche Grundlage des Kaufes. Fidelity veröffentlicht ausschließlich produktbezogene<br />

Informationen und erteilt keine Anlageempfehlung. Die Prospekte, den Geschäftsbericht und den<br />

Halbjahresbericht erhalten Sie kostenlos bei FIL Investment Services GmbH, Postfach 200237, D-60606<br />

Frankfurt/ Main oder über www.fidelity.de. Anleger in Österreich erhalten diese Dokumente kostenlos bei<br />

FIL Investments International – Zweigniederlassung Wien, Schottenring 16, A-1010 Wien oder bei der<br />

österreichischen Zahlstelle Bank Austria Creditanstalt AG, Vordere Zollamtsstraße 13, A-1030 Wien.<br />

Der Wert der Anteile sowie die Höhe der Erträge kann schwanken und wird nicht garantiert. Fidelity, Fidelity<br />

International und das Pyramiden-Logo sind eingetragene Warenzeichen von FIL Limited. Die genannten<br />

Unternehmen dienen zu rein illustrativen Zwecken. Dies stellt keine Aufforderung zum Kauf oder Verkauf der<br />

jeweiligen Werte dar, und die genannten Unternehmen können ggfls. nicht zu den Fondsbeständen zählen.<br />

Herausgeber für Deutschland: FIL Investment Services GmbH, Postfach 200237, D-60606 Frankfurt/ Main.<br />

Herausgeber für Österreich: FIL Investments International – Zweigniederlassung Wien, Schottenring 16, A-<br />

1010 Wien. Für institutionelle Investoren in Deutschland gilt als Herausgeber: FIL Investment Management<br />

GmbH, Kastanienhöhe 1, D-61476 Kronberg im Taunus. Stand, falls nicht anders vermerkt: April 2009.<br />

Alle Angaben ohne Gewähr. MK4372