Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2017</strong> EMPLOYER’S GUIDE TO <strong>PAYE</strong> | KENYA REVENUE AUTHORITY<br />

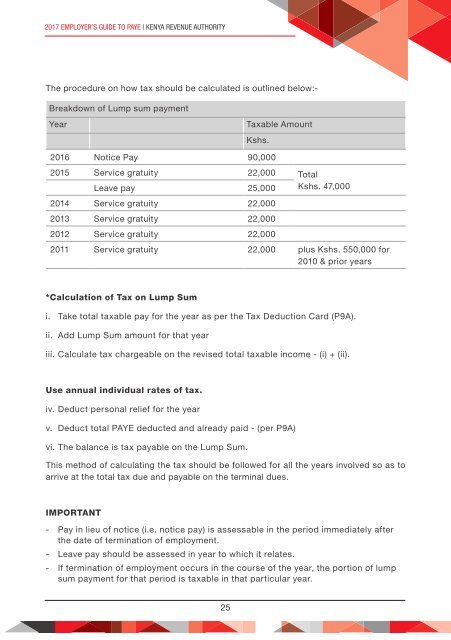

The procedure on how tax should be calculated is outlined below:-<br />

Breakdown of Lump sum payment<br />

Year<br />

Taxable Amount<br />

Kshs.<br />

2016 Notice Pay 90,000<br />

2015 Service gratuity 22,000 Total<br />

Leave pay 25,000 Kshs. 47,000<br />

2014 Service gratuity 22,000<br />

2013 Service gratuity 22,000<br />

2012 Service gratuity 22,000<br />

2011 Service gratuity 22,000 plus Kshs. 550,000 for<br />

2010 & prior years<br />

*Calculation of Tax on Lump Sum<br />

i. Take total taxable pay for the year as per the Tax Deduction Card (P9A).<br />

ii. Add Lump Sum amount for that year<br />

iii. Calculate tax chargeable on the revised total taxable income - (i) + (ii).<br />

Use annual individual rates of tax.<br />

iv. Deduct personal relief for the year<br />

v. Deduct total <strong>PAYE</strong> deducted and already paid - (per P9A)<br />

vi. The balance is tax payable on the Lump Sum.<br />

This method of calculating the tax should be followed for all the years involved so as to<br />

arrive at the total tax due and payable on the terminal dues.<br />

IMPORTANT<br />

--<br />

Pay in lieu of notice (i.e. notice pay) is assessable in the period immediately after<br />

the date of termination of employment.<br />

--<br />

Leave pay should be assessed in year to which it relates.<br />

- - If termination of employment occurs in the course of the year, the portion of lump<br />

sum payment for that period is taxable in that particular year.<br />

25