INTER-AGENCY LIVELIHOOD ASSESSMENT - ARUA DISTRICT NORTHERN UGANDA GOAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

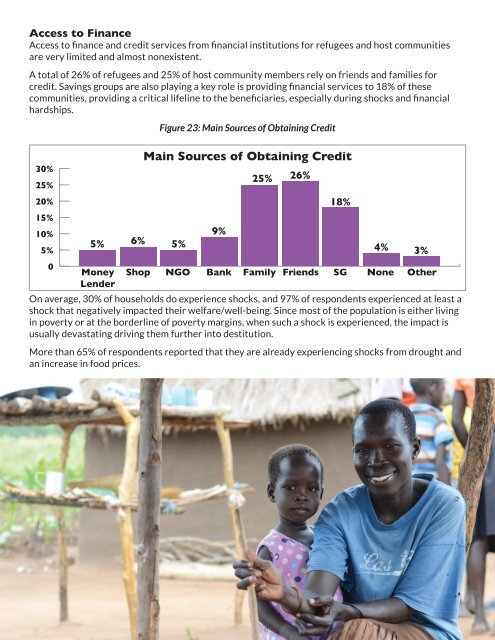

Access to Finance<br />

Access to finance and credit services from financial institutions for refugees and host communities<br />

are very limited and almost nonexistent.<br />

A total of 26% of refugees and 25% of host community members rely on friends and families for<br />

credit. Savings groups are also playing a key role is providing financial services to 18% of these<br />

communities, providing a critical lifeline to the beneficiaries, especially during shocks and financial<br />

hardships.<br />

Figure 23: Main Sources of Obtaining Credit<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0<br />

Main Sources of Obtaining Credit<br />

25% 26%<br />

18%<br />

9%<br />

5% 6% 5%<br />

4% 3%<br />

On average, 30% of households do experience shocks, and 97% of respondents experienced at least a<br />

shock that negatively impacted their welfare/well-being. Since most of the population is either living<br />

in poverty or at the borderline of poverty margins, when such a shock is experienced, the impact is<br />

usually devastating driving them further into destitution.<br />

More than 65% of respondents reported that they are already experiencing shocks from drought and<br />

an increase in food prices.