ExtraMileIssue12

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2019 ISSUE 1<br />

NOTES FROM NATIONAL INTERSTATE INSURANCE FOR OUR PARTNERS IN RISK<br />

This Reptile<br />

wants to<br />

Eat You Alive.<br />

Get to<br />

know<br />

the ReptileTheory before it<br />

's too late.

Contents2019 ISSUE 1<br />

LETTER FROM THE PRESIDENT AND CEO 3<br />

EXTRA MILER: DEBBIE FAIX 4<br />

INTRODUCING CONVOY:<br />

SAY HELLO TO UPSIDE WITHOUT THE DOWNSIDE 6<br />

EXECUTIVE SPOTLIGHT: MICHELLE WILTGEN 8<br />

TURNING RISK INTO REWARD 10<br />

UNDERWRITERS SPOTLIGHT: MEET A FEW<br />

MEMBERS OF OUR TEAM 12<br />

Proactive<br />

with a Purpose<br />

The Reptile Theory and How to Help Prevent It 20<br />

A PATH BACK TO WORK 22<br />

A TRUE PARTNERSHIP:<br />

NATIONAL INTERSTATE AND AKRON CHILDREN’S HOSPITAL<br />

AKRON MARATHON RACE SERIES 24<br />

HOW TO REPORT A CAT CLAIM 26<br />

Subscriptions:<br />

Extra Mile magazine is a free, quarterly publication offered by National Interstate Insurance<br />

Company in support of its customers. To subscribe, call 800-929-1500 or email amanda.<br />

genther@natl.com.<br />

Publisher:<br />

Established in 1989, National Interstate Insurance is one of the leading specialty property<br />

and casualty insurance companies in the country. Offering more than 30 different insurance<br />

products, including traditional insurance, innovative alternative risk transfer (ART) programs for<br />

commercial companies and insurance for specialty vehicle owners. Its customized solutions are<br />

made possible by its talented and dedicated team members. National Interstate employs over<br />

700 employees in offices in Northeast Ohio, HI, and MO.<br />

© 2019 National Interstate Insurance Company<br />

National Interstate Insurance Company<br />

National Interstate Insurance Company<br />

@NatlCareers<br />

@Natl_hq<br />

National Interstate Insurance Company<br />

Editorial Contributors:<br />

Amanda Genther<br />

Melanie Irvin<br />

Tony Mercurio<br />

Chris Mikolay<br />

Sandra Ritley<br />

Shawn Los<br />

Charlie Wendland<br />

Kimberly Wickert<br />

“New year — a new chapter, new verse, or just the same old story?<br />

Ultimately we write it. The choice is ours.”<br />

Alex Morritt<br />

Letter from the President and CEO<br />

TONY MERCURIO<br />

I like the quote above. It reminds me that we don’t have to accept<br />

the status quo, that each day is a choice to do something great, that<br />

we should seek constant improvement. And while I believe this<br />

attitude is hardwired into our DNA at National Interstate, the reality<br />

is we must continue to evolve and get better every day if we are to<br />

remain successful.<br />

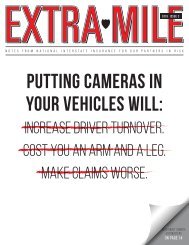

Our industry is changing rapidly. More and more vehicles are<br />

being equipped with technologies that promise to dramatically<br />

reduce the number of accidents on the road. Yet, the Commercial<br />

Auto insurance market remains unsettled – rising loss costs,<br />

distracted drivers, more congested roads, nuclear verdicts – these<br />

headwinds are causing problems for insureds and insurers alike.<br />

Inside this edition of the Extra Mile you’ll read about one of those<br />

issues in particular, the “Reptile Theory”. In short, Reptile Theory<br />

is a strategy plaintiff’s attorneys have been using to devastating<br />

effect – juries are giving eight and sometimes nine figure awards<br />

in accidents where the initial facts appear extremely favorable to<br />

the motor carrier. You need to know about Reptile Theory, and more<br />

importantly, what you can do to avoid falling prey to it.<br />

While the road ahead may be bumpy, National Interstate is working<br />

hard to make it as smooth as possible. Over the past year we have<br />

continued in our quest to build the insurance experience around<br />

you by investing in our people, our systems and even in our new<br />

building. And I’m proud to say our efforts were rewarded with an<br />

A.M. Best financial strength rating upgrade to A+ (Superior). This<br />

rating is only given to insurance companies A.M. Best determines<br />

have a superior ability to meet their financial obligations, and if you<br />

have been paying attention to the difficulty many insurers are facing<br />

in the Commercial Auto world, you would note our recent upgrade<br />

as particularly impressive. I could not be more proud of our team for<br />

achieving this milestone.<br />

Speaking of milestones, in 2019 National Interstate<br />

celebrates its 30th anniversary. As I take a<br />

moment to think about my 24- year career with<br />

the company and our humble roots, I’m awed<br />

at what we’ve achieved as a team. But I’m<br />

even more excited about what is yet to come,<br />

knowing our team has even greater chapters to<br />

write. To that end, this year we’ll be launching several innovative<br />

new insurance programs, including Convoy and Gibraltar. Convoy is<br />

geared toward more traditional truck insurance buyers, and it gives<br />

each participant the cash flow advantages of a deductible product<br />

coupled with the control and potential rewards of an alternative risk<br />

program. Gibraltar is a new member-owned group captive targeted<br />

to best-in-class energy and environmental service providers. I can’t<br />

wait to see these new programs gather momentum and provide<br />

exceptional value to our insureds.<br />

In closing, I wish you a healthy and prosperous 2019. As always,<br />

I thank you for your partnership, and may each mile you drive be a<br />

safe one.<br />

Best,<br />

Tony Mercurio<br />

President & CEO<br />

3

Debbie<br />

Faix<br />

At National Interstate, we take great pride in our promise to be your<br />

best partner on your worst day. That promise begins the moment a<br />

claim is reported and then processed by a Claim Processing Technician<br />

responsible for receiving, entering and assigning new claims. Debbie<br />

Faix, one of our Technicians, has claims cross her desk every day. While<br />

she hasn’t been with the company very long, she understands the impact<br />

she can have on a customer’s worst day.<br />

We met Debbie from an employee referral. She received a Bachelor<br />

of Science degree in Communication with a minor in Psychology and<br />

Sociology from Ohio University. Prior to joining National Interstate in<br />

early 2018, Debbie held many roles in various industries. From being<br />

a Personal Injury Protection (PIP) Adjuster and an immediate response<br />

adjuster, to working in a vet’s office and in a preschool setting, Debbie’s<br />

different experiences helped develop her communication and people<br />

skills into what they are today.<br />

Debbie also does her best to remember her customers. If she’s talked<br />

to someone before, she’ll reference prior conversations and joke that –<br />

given she’s on the phone talking about tough claims - she “hopes she<br />

doesn’t have to talk to you again any time soon.”<br />

Aside from her remarkable customer service skills, Debbie takes<br />

advantage of the training and volunteer opportunities our company<br />

offers. She volunteered at the fluid station during the Akron Marathon<br />

race series in the summer of 2018, and participates in state-specific<br />

training, job shadowing opportunities and medical training to name a<br />

few. In addition, Debbie is always good for sharing a positive word or<br />

sending kudos out to other departments. In the time that Debbie has<br />

been here, she has contacted several employees to thank them when<br />

they go an extra step to help her out. These small gestures can turn<br />

anyone’s day around.<br />

Recently, Debbie used an Ohio buckeye to share a positive message<br />

with her team. She stated that a buckeye forms in a rough, prickly shell<br />

not very appealing to the eye. However, when opened, the buckeye<br />

is beautiful, smooth and shiny. Debbie handed out buckeyes to her<br />

team with the message that with a little bit of guidance, training and<br />

teamwork, you have the ability to break through a rough outer shell to<br />

reveal something great on the inside.<br />

With a knack for making connections, Debbie is a true manifestation of<br />

our tagline “An insurance experience built around you.” She makes our<br />

customers feel welcome from the moment she picks up the phone and<br />

builds trust and rapport by making a personal connection to the caller.<br />

If you’re routed to Debbie, do not be surprised when she has the unique<br />

ability to take a small piece of information you provided and turn it into<br />

a conversation starter – “Hey! Your baseball team really gave our Indians<br />

a run for their money last night!” or “I remember vacationing in your city<br />

once! I really enjoyed having dinner at The Lobster Shack – have you<br />

been?” These statements go a long way in building a connection with<br />

the caller, putting them at ease during a time that likely may be stressful<br />

for him or her.<br />

Meet Debbie<br />

WHAT ARE YOUR FAVORITE THINGS TO DO<br />

OUTSIDE THE OFFICE?<br />

Biking, hiking, kayaking…anything outside.<br />

WHAT IS THE LAST MOVIE YOU WATCHED?<br />

I just watched Harry Potter and the Prisoner of Azkaban, AGAIN, since it<br />

was on TV when I was flipping through the stations – BIG HP fan! There’s<br />

a huge following here at National Interstate, too (#mischiefmanaged)!<br />

WHAT WOULD YOU DO IF YOU WON THE LOTTERY?<br />

I would make sure my family was taken care of, then I would travel, and<br />

paddle a kayak around all of the beautiful places across the country.<br />

PEOPLE WOULD BE SURPRISED TO KNOW…<br />

I’ve never been to Disney World. I guess I need to win the lottery!<br />

Debbie does her best to exemplify what every employee strives for at<br />

National Interstate. She embraces our company culture, puts a smile on<br />

your face and is someone you want to have around on your worst day.<br />

WHAT IS YOUR DREAM JOB?<br />

My dream job would be an elementary education teacher for first graders, if<br />

morphing into Mrs. Claus doesn’t work!<br />

MY DAY CAN’T START UNTIL…<br />

I have a cup of coffee and step outside to greet the day.<br />

WHAT IS YOUR FAVORITE HOLIDAY?<br />

Christmas.<br />

WHY DO YOU LOVE YOUR JOB?<br />

I love my job because I work with a wonderful, collaborative team in our<br />

Claims department, and I feel appreciated here at National Interstate.<br />

ARE YOU A CAT OR DOG PERSON?<br />

Dog, but I’d like one of each.<br />

4 5

INTRODUCING<br />

CONVOY<br />

Say Hello to upside<br />

without the downside.<br />

How does Convoy Work?<br />

1<br />

2<br />

Each participant purchases a $25k basket deductible policy<br />

from National Interstate.<br />

Other members join the group and 25-40% of each participant’s policy<br />

premium is placed into a shared pool to be used to pay claims above the<br />

deductible and up to $150,000. The pool earns investment income on that<br />

premium at a guaranteed rate of 3.65%. 1<br />

We’re kicking off 2019 with a new product we believe will be a huge<br />

hit in the marketplace, particularly for insurance buyers who have an<br />

aversion to the word “captive”. In Convoy, our new program geared<br />

toward mid-size trucking fleets, you’ll find evidence of our hallmark<br />

National Interstate creativity and win/win mentality. Convoy is an<br />

alternative risk program with a twist – we’re taking the best of a<br />

deductible program and the best of a captive to create an entirely new<br />

category of insurance program targeted to more traditional insurance<br />

buyers.<br />

We think many of your current and prospective insureds are going to<br />

love the programs key features, including:<br />

The benefits of a small deductible program<br />

➼ Lower upfront premium<br />

➼ Initial cash flow savings<br />

➼ Retain smaller, more frequent and more predictable losses<br />

➼ Basket coverage on Auto Liability, Physical Damage and Cargo<br />

The benefits of a captive program<br />

➼ Potential return of premium<br />

➼ Investment income accrues to members at 3.65%*<br />

➼ Greater control of insurance destiny<br />

➼ Alignment of interests with insurance carrier<br />

➼ United with other best-in-class motor carriers<br />

➼ Annual meeting<br />

With the insurance market in flux, we believe Convoy will be a great<br />

solution for controlling cost of risk and rewarding motor carriers with<br />

potential underwriting profit and investment income – without the<br />

downside risk that typically accompanies a higher risk program.<br />

Designed for insureds who have a lower risk tolerance and who may<br />

be reluctant to join a captive, Convoy members share risk from $25k<br />

to $150k in a fund that has no downside. If there is money left over,<br />

underwriting profit and investment income are returned to members on<br />

a pro rata basis. If the entire fund is used, National Interstate assumes<br />

the risk via an aggregate stop loss. The group is therefore incentivized<br />

to control losses and has the potential to see significant return, along<br />

with investment income, while stabilizing and controlling cost of risk.<br />

Source:<br />

3<br />

Claims occur and are paid out.<br />

1<br />

Effective 1/1/2019 - 12/31/2019. 3.25% through 12/31/2018<br />

2<br />

Subject to terms of Participation Agreement. Positive balance is not guaranteed and is determined by aggregate loss performance of the pool.<br />

If there is a positive balance at the end of a 3-year accounting cycle,<br />

National Interstate will return premium and investment income to each<br />

participant on a pro-rata basis determined by individual performance. 2<br />

Give us a call at 800-929-1500 x2279 to discuss Convoy in greater detail, or better yet, let’s do a Webinar (our PowerPoint is pretty slick).<br />

The insurance market continues to change, and trucking companies need innovative solutions to combat the climbing costs of risk.<br />

*Guaranteed investment yield effective 1/1/19. Determined annually.<br />

CHRIS MIKOLAY<br />

VP, National Accounts and Truck Alternative Products<br />

6<br />

7

EXECUTIVE SPOTLIGHT<br />

Michelle<br />

Wiltgen<br />

NATIONAL MARKETING MANAGER<br />

IN YOUR OWN WORDS, CAN YOU TELL ME WHAT YOU DO?<br />

As the National Marketing Manager for the Passenger division, I am<br />

responsible for marketing all available insurance solutions including<br />

traditional and alternative risk transfer, or “captive,” products to<br />

prospective companies. That said, I think most of our current partners<br />

and even prospective partners will tell you that I am the face of<br />

National Interstate, not only to our Passenger accounts, but to many<br />

of our other products as well. I feel the biggest responsibility I have,<br />

regardless of how big our company gets, is to make our partners,<br />

both customers and brokers/agents, feel that they are part of our<br />

family. That responsibility is something I don’t take lightly and I know<br />

our partners don’t either.<br />

WHAT ARE THE MOST IMPORTANT DECISIONS YOU MAKE AS A LEADER?<br />

I have been with National Interstate for almost 28 years. When<br />

I started at the company, there were only 23 other employees.<br />

Back then, it was about building the business and survival. Now,<br />

it’s still about building the business, but my role has transformed<br />

in a way that I think about the example I can set for our younger<br />

team members, and how I can help them learn the business and<br />

our culture. We are a proud company that has worked hard to<br />

get to where we are today, and I want to do my part to see that<br />

legacy continue. Our core values of integrity, transparency, fairness,<br />

accountability, empowerment and collaboration will help that<br />

become a reality. Being a leader isn’t a title, it’s a position you earn<br />

throughout your career by the example that you set every day.<br />

YOU’VE BEEN IN THE INSURANCE INDUSTRY YOUR ENTIRE<br />

CAREER. CAN YOU TALK ABOUT WHAT MOST SURPRISES<br />

YOU ABOUT THE INDUSTRY AND KEEPS YOU IN IT?<br />

The number of insurance companies that have entered into this<br />

business and have had to exit because they could not figure out how<br />

to do it successfully always surprises me. I consider it a badge of<br />

honor that National Interstate has endured for 30 years in an often<br />

volatile market. My passion about what this company does and the<br />

relationships that we have with our partners is what keeps me in this<br />

ever-changing industry.<br />

CAN YOU NAME SOMEONE WHO HAS HAD A TREMENDOUS<br />

IMPACT ON YOUR CAREER? WHY AND HOW DID<br />

THIS PERSON IMPACT YOUR LIFE?<br />

My family has had the biggest impact on my career. I grew up<br />

with four older brothers, and we were poor. But, we didn’t know it<br />

because everyone in our neighborhood was poor. My parents taught<br />

all of us work ethics, respect and that hard work really does pay<br />

off in the end. I was never told I couldn’t do something “because I<br />

was a girl”. During my senior year of high school, I started working<br />

at a local insurance company. The following year, knowing I would<br />

be responsible for my college tuition, I worked there full-time during<br />

the day and went to college full-time at night to earn my degree.<br />

That experience taught me how to support myself and become<br />

independent.<br />

MY MORNING CAN’T START WITHOUT…<br />

If I am home, a 125-degree latte that my husband makes me...on the<br />

road I settle for whatever latte I can get!<br />

YOU TRAVEL 40-45 WEEKS A YEAR FOR NATIONAL<br />

INTERSTATE. HAVE ANY GOOD TRAVEL TIPS TO SHARE?<br />

I know that to some people, travel may sound glamorous and to<br />

others a nightmare. I can tell you that travel is not glamorous and<br />

many times, when travel is disrupted, it is a nightmare! The best<br />

advice I can give is to be organized, don’t sweat the small stuff and<br />

don’t believe travel will go smoothly 100% of the time. Also, I am a<br />

master at packing a suitcase – just call me for tips!<br />

WHAT DO YOU ENJOY DOING WHEN YOU’RE NOT WORKING?<br />

Believe it or not, my husband and I love to travel – traveling for fun<br />

is totally different than traveling for business! I enjoy finding great<br />

new places in the U.S. and beyond, and finding delicious restaurants<br />

and wine along the way! One of our favorite spots is Ocean Reef Club<br />

in the Florida Keys, which is only a two-hour drive for us, but still<br />

feels like we’re on vacation once we get there.<br />

WILL WE EVER SEE A ROAD OF DRIVERLESS BUSES AND COACHES?<br />

While I think we will eventually see driverless buses and coaches,<br />

I think we are further away than many people believe. I think the<br />

technology is absolutely there, but improved infrastructure including<br />

roads and bridges need to be built to support this type of vehicle.<br />

Without the proper roads to accommodate driverless technology,<br />

there will be no place for these vehicles to operate. I think about this<br />

a lot and the one question that is always on my mind is if something<br />

comes towards a driverless vehicle, how can the decision be made,<br />

either way, to either veer into a crosswalk or into traffic? How does<br />

the vehicle make that kind of split-second decision? It definitely<br />

keeps me up at night.<br />

WHAT BOOKS ARE YOU CURRENTLY READING?<br />

I’m actually reading two – one called You are Driving Me Crazy –<br />

written by June Bratcher, owner of Daisy Charters and a long-time<br />

National Interstate partner. June was unable to make our last Calypso<br />

captive advisory meeting, so she gave the book to her son, David<br />

who informed me, “Mom sent you a present.” I was so excited! In the<br />

book, June writes about how she started Daisy Charters and built it<br />

to what it is today. I’m also reading A Spark of Light by Jodi Picoult<br />

because I read anything and everything she writes.<br />

WHAT WILL THE INSURANCE MARKET LOOK LIKE IN FIVE YEARS?<br />

The insurance market changes every year, so I expect it to continue<br />

evolving. The game changer for the future will be the use of technology<br />

– telematics and data analytics will have the biggest impact on<br />

insurance that we’ve ever seen. This technology will change how<br />

we underwrite and therefore, will change the market as a whole. For<br />

example, National Interstate is on the leading edge of using this kind<br />

of technology and it’s already changing how we look at exposures.<br />

That will continue, the more that the data becomes available through<br />

increased customer use of automated event recorders and telematics,<br />

providing us with the ability to be even more predictive.<br />

8<br />

9

TURNING<br />

RISK<br />

INTO<br />

Reward<br />

Ensuring safety at every site should be a top priority in the crane<br />

and rigging industry.<br />

Yet, even with the most sophisticated technologies and best riskmanagement<br />

techniques, bad things can happen to good operations.<br />

Crane operations are inherently risky, and managing risk properly is not<br />

easy. Smart executives should take the time to properly understand the<br />

many ways risk can be transferred, when risk should be retained and<br />

how various risk-financing techniques affect a company’s cash flow<br />

and bottom line.<br />

Alternative Risk Transfer Programs<br />

An alternative risk transfer (ART) program, also known as captive<br />

insurance, is created specifically to insure only the risks of a single<br />

company or a defined group of companies.<br />

Once available only to very large firms, ART program participation has<br />

grown and is now available to a wide variety of organizations. In these<br />

programs, the participant pays a premium similar to a guaranteed-cost<br />

policy, but a portion of that premium is designated to pay for expected<br />

losses up to a certain limit.<br />

If the participant has fewer losses than expected, part of the premium<br />

may be returned, along with any investment income accrued.<br />

Conversely, if losses are higher than expected, the participant will pay<br />

additional premiums up to a specified maximum.<br />

ART premiums are not determined by the whims of the insurance<br />

market, but largely by the individual operator’s loss experience.<br />

For better operators, the long-term cost of risk can be substantially<br />

lower and more stable than if they had been insured with a more<br />

traditional product. That’s a primary reason better operators continue<br />

to migrate to this option.<br />

Navigating this Field<br />

However, an ART program isn’t for everyone.<br />

To benefit, a participant must hold a longer-term vision, partner with<br />

insurance companies and agents who are experts in alternative risk<br />

products, and, above all, understand the product.<br />

There are many myths and misconceptions about alternative risk, and<br />

navigating this field of insurance requires unbiased, expert advice.<br />

First, find an insurance agent who understands ART and has access to<br />

it. Second, demand transparency from the agent and insurance carrier<br />

about how premiums are spent, about the best and worst case claims<br />

scenarios and about how premium and collateral are to be returned.<br />

Finally, when exploring a group option, ask for data highlighting past<br />

financial performance and speak with current members about their<br />

experience.<br />

Turning Risk into Competitive<br />

Advantage<br />

Speaking with hundreds of company executives over many years, I<br />

have observed two distinct mentalities about insurance coverage.<br />

Some buy insurance; others manage risk. There is a world of difference.<br />

To illustrate, let’s consider two fictitious fleet companies: Randy’s<br />

Crane and Dave’s Rigging. Both are experienced operations, but also<br />

face a myriad of challenges trying to run a profitable company.<br />

Randy likens insurance premiums to fuel costs. He may look for<br />

the lowest price, but he basically views insurance as a commodity<br />

beyond his control. He also believes accidents are more or less random<br />

occurrences, a cost of doing business. As you’d expect, Randy’s annual<br />

insurance renewal is one of the most stressful parts of his job.<br />

Dave’s Rigging, in contrast, decided to control its risk. It took steps to<br />

reduce accidents and workers’ compensation claims, such as using a<br />

return to work program and pre-hire physical abilities testing, which<br />

greatly improved its safety program and reduced the frequency of<br />

workers’ compensation claims.<br />

Dave also challenged his insurance broker to help him control losses<br />

and fight claims more aggressively. The effort not only helped Dave’s<br />

Rigging drive down its total cost of risk, but also turned that risk into<br />

competitive advantage. The company is now positioned to thrive in<br />

the future, while companies that leave risk management to chance<br />

will continue to struggle.<br />

Risk can be controlled to a greater degree than many imagine.<br />

However, this requires a holistic approach to risk management,<br />

including vision and support from senior management, a commitment<br />

to reducing accidents before they happen and aggressively managing<br />

losses that do occur.<br />

Article originally seen in Crane Hotline magazine as Turning Risk into<br />

Competitive Advantage<br />

SHAWN LOS<br />

VP, Specialty Transportation<br />

10<br />

11

It<br />

UNDERWRITERS SPOTLIGHT:<br />

Team<br />

MEET A FEW MEMBERS OF OUR<br />

has been said that the art of underwriting is akin to driving a bus by looking<br />

only at the rearview mirror. Without a doubt, selecting and then pricing risks<br />

correctly is no easy feat, but National Interstate is proud to employ many<br />

talented underwriters who seem to have a knack for seeing around corners. In<br />

this feature, we spotlight 10 of our underwriters who have more than 110 years of<br />

underwriting experience combined. Read on as we pick their brains on creative<br />

financing strategies, predictive modeling and much more.<br />

AJ Pero<br />

SENIOR UNDERWRITER<br />

Years Underwriting: 2<br />

How have you personally made National Interstate a more successful<br />

underwriting company? In addition to my underwriting role, I try to add an analytical component to the group by creating various<br />

performance reports relating to Alternative Risk Transfer (Captive) Performance, Monthly Loss Development and the Summarizing of Accident<br />

Year Loss Experience by Coverage Line. These reports allow our Specialty Managers to analyze and act on trends in their product and make<br />

more educated underwriting decisions moving forward.<br />

What is it about the underwriter role that gives you job satisfaction? There are three main things that<br />

contribute to my job satisfaction – responsibility for the bottom line, building relationships with internal and external partners and working<br />

extremely hard on a competitive quote and getting the bid.<br />

With the growth and impact of predictive modeling, why does underwriting still matter? Predictive<br />

modeling is great, but there are two things the model can’t predict: an insured being lucky and lack of data. In the Specialty area, I see that<br />

there is just not as much industry information as you can find in other business units, which equates to less credibility with the predictive<br />

model for our insureds. Also, an account can be in the right venue and losses may look good on paper, but if you dive deep into their<br />

processes, you can see they might lack sophistication, or the business culture lacks a focus on safety, which could lead to losses in the future.<br />

Describe the most creative underwriting strategy you have used to win a deal. For our largest traditional<br />

account in our specialized carrier product, we utilized a large basket deductible covering multiple coverage lines and partnered with our parent<br />

company, Great American Insurance Group, on the Occupational Accident coverage for their IOOs.<br />

What one department outside of underwriting is most critical to our success as an organization<br />

and why? Far and away, it has to be Risk Management. They are the eyes and ears of the company, and they can provide honest,<br />

unbiased insight into a risk that only an in-person visit, kicking the tires and meeting with an organization’s personnel can accomplish.<br />

James Hannon<br />

SENIOR UNDERWRITING MANAGER<br />

Years Underwriting: 41<br />

With the growth and impact of predictive modeling, why does underwriting<br />

still matter? Predictive Analytics modeling is a tool for Underwriters’ use. The subtleties of understanding,<br />

comparing and weighing data presented (including the PA information) with prior experience and innate underwriting<br />

knowledge enhances the decision making process. The model alone cannot do that.<br />

How have you personally made Vanliner Insurance Company a more successful<br />

underwriting company? Guidance for my underwriting staff has hopefully provided them with better<br />

insights into the nuances of the underwriting process, allowing them to make better decisions. Supporting their<br />

decisions and encouraging their input should give them a greater sense of ownership of their books, acknowledging<br />

their true value to the company.<br />

What three characteristics are most influential in your decision process? First<br />

and foremost, good management. Everything else falls from that. Good management will hire, train and retain good<br />

drivers. It will also put those drivers in good equipment. The result of demonstrating these critical features will be<br />

increased profitability from fewer claims.<br />

How do you negotiate when working with your internal or external customers?<br />

First...listen. Allow the other person to explain all the issues that need resolution. Then, ask questions to make sure<br />

the REAL issues at hand are understood (get to the facts beyond the emotion). Next, offer a compromise and have a<br />

willingness to negotiate to resolution.<br />

Describe the most creative underwriting strategy you have used to win a deal.<br />

By understanding the real needs of a very large prospective insured, we gathered a team of critical experts to assist<br />

the agent with the sales presentation to the decision makers at the company. This included the claims manager, for<br />

reassurance about how we would be handling the customer’s money with a large retention being proposed; the loss<br />

control manager, who would outline the truly useful and value-added components of a risk management program;<br />

and me (Underwriting Manager) to fill in any blank spots and expand on answers related to the agent’s presentation.<br />

What is it about the underwriter role that gives you satisfaction on the job?<br />

Being the gatekeeper for the company and having a real impact on its profitability and success is very satisfying.<br />

Knowing that, by staying focused on the major issues, we can win the day.<br />

What one department outside of underwriting is most critical to our success?<br />

Claims. They are critical to our ultimate success because they need to be good stewards of our money and, at the<br />

same time, be good ambassadors for us by being fair with good settlements that help solidify the customer’s thinking<br />

that they made the right decision to purchase our product. Risk Management follows very closely for similar reasons.<br />

12<br />

13

April Colagiovanni<br />

UNDERWRITING SUPERVISOR, TRUCK<br />

Years Underwriting: 12<br />

What is it about the underwriter role that gives you satisfaction on the job? Being<br />

an underwriter allows me to utilize my decision-making skills and employ my sense of curiosity every day. I like to<br />

analyze a risk, understand the potential exposures and find a resolution that will make sense for National Interstate<br />

and the insured.<br />

Describe the most creative underwriting strategy you have used to win a deal.<br />

Creative underwriting strategies are important since we cannot always rely on price to sell a deal. We have used the<br />

following strategies to help win an account: Amended pay plans to fit an insured’s budget (with approval of course!),<br />

deductible options and facultative reinsurance including driver carve outs and buffer layers.<br />

With the growth and impact of predictive modeling, why does underwriting<br />

still matter? There is a science and an art to underwriting. We rely on the data and science provided in loss<br />

rating and predictive variables, but we cannot overlook the art of a human underwriter. A predictive model cannot<br />

interpret the character or safety culture of an operation like a person can.<br />

A human underwriter is able to survey the character of a risk by crosschecking and validating information, speaking<br />

with the potential insured, reviewing websites, reading loss control reports and being inquisitive. A human underwriter<br />

is also keener to the conditions of the external market, allowing them to be more effective.<br />

Having an even balance of art and science in underwriting will help us have an advantage over those who are moving<br />

towards automating the underwriting process.<br />

How do you negotiate or resolve conflicts when working with your internal or<br />

external customers? Listen. Listen. Listen. Listen and understand what is being asked of you and this will<br />

go a long way.<br />

What one department outside of underwriting is most critical to our success<br />

as an organization and why? Technology. Keeping up with the world around us and continuing to be<br />

innovative will set National Interstate apart. Offering our customers a product that our competitors cannot will create<br />

a more “sticky” sales situation.<br />

What was the last book you read? I re-read the book Lean In by Sheryl Sandberg.<br />

Mike Krainz<br />

ASSISTANT PRODUCT MANAGER<br />

Years Underwriting: 7<br />

What gives you job satisfaction? I like winning. In insurance, I don’t think there’s a more exhilarating<br />

feeling than working as a team to land a new account that we have a high degree of confidence will perform well.<br />

How have you made National Interstate a successful underwriting company?<br />

Personally, I pride myself on bringing a certain amount of grittiness to work on a day-to-day basis. Attributes like<br />

effort, attitude and toughness are controllable and can be infectious. Adding humor once in a while helps, too! As<br />

a division, we thrive in uncomfortable situations, finding creative solutions for outside-the-box, complicated risks.<br />

Describe your biggest underwriting achievement. My greatest underwriting achievement<br />

actually happened a few years ago on a prospect that we declined. Without naming the company, it looked like an<br />

A+ account on paper: low frequency, no severity, exceptionally strong financials, good venue, etc. They had the most<br />

comprehensive safety manual that I have ever seen. It was over 200 pages! We set up a pre-quote loss control visit,<br />

and I was able to tag along. Within 30 seconds of meeting the “safety director”, I knew we would not be quoting<br />

them. At one point, he actually had the gall to tell us that he drafted his safety manual only to impress insurance<br />

companies and he doesn’t actually enforce it. That specific situation taught me that underwriting is a much broader<br />

endeavor than merely analyzing data. It also gave me a greater sense of appreciation for what our Risk Management<br />

team does on a day-to-day basis.<br />

Why does underwriting still matter? Underwriting will always be an essential part of sustainable<br />

profitability in insurance. There is no single computer program, equation or “magic elixir” that can manufacture a<br />

profitable book with a high new business success rate. I believe there will always be a human, “artsy” element to<br />

underwriting.<br />

Who has been most influential on your underwriting career to help get you<br />

where you are today? There are too many to list out. For the last three years, Scott Clough, Director of<br />

National Accounts, has invested a ton of time showing me what it means to be an inward and outward-facing<br />

professional. I am still learning!<br />

What superpower do you wish you had to enhance your underwriting skills?<br />

Ideally, I wish I could be the male version of Jean Grey. I would use telekinesis to move claimant vehicles out of our<br />

insureds’ paths, preventing accidents. For good measure, I would use telepathy to influence our insureds to install<br />

DriveCams in every vehicle. To top it off, I would be able to fly, which would save money on travel expenses, lowering<br />

our expense ratio. I think I just established how much of a nerd I am.<br />

14<br />

15

16<br />

Jonathan Hicks<br />

DIRECTOR, PASSENGER TRANSPORTATION<br />

Years Underwriting: 13<br />

What is it about the underwriter role that gives you satisfaction on the job? The<br />

ability to clearly see how my actions influence our corporate results. While all roles at National Interstate have a<br />

significant impact on the results, I particularly enjoy seeing how my decisions favorably impact our net income.<br />

Describe the most creative underwriting strategy you have used to win a deal.<br />

When I managed an agency captive, we ran into a phase where new business growth had become stagnant.<br />

We learned from our agency partner that their business had an immediate cash flow need that was better met<br />

by a competitor’s higher, up-front commission offering. While our agency compensation offering was superior in<br />

total, it often took three to four years before all of it was realized. To combat this, we offered a different agency<br />

compensation structure that provided higher up-front commission but took them out of the risk-tasking game. Not<br />

only did we meet the needs of our business partner, we also increased sales and did so at higher margins than the<br />

prior program structure.<br />

How have you personally made National Interstate a more successful<br />

underwriting company? By continuing to develop and empower our underwriting team. One of the<br />

easiest traps for lesser experienced underwriters to find themselves in is the tendency to do all the analysis, point<br />

out the pros and cons, but then wait for an authority figure to make the decision for them. The underwriter is by far<br />

the most knowledgeable person on that account and should be the one making the decision.<br />

What can the “young guns” learn most from the “grizzled veterans”? You are in<br />

the business of taking calculated risk. If it hasn’t already happened, one of your customers will eventually have a<br />

catastrophic loss. That doesn’t make you a poor underwriter. It shouldn’t cause you to underwrite “scared”, or lose<br />

confidence in the underwriting process. It should help reinforce the fact that we need to approach each risk with a<br />

healthy amount of caution.<br />

Talk about a time that you made a mistake and what you learned from that<br />

experience. Early in my career at National Interstate, I was obsessed with being right no matter the cost. This<br />

alienated some coworkers and external business partners. A colleague helped me realize the cost of that fixation<br />

after an important business meeting. While I would be lying if I said I don’t still revel in being right, I realize it should<br />

never stand in the way of getting the job done.<br />

How do you negotiate or resolve conflicts when working with your internal or<br />

external customers? It has been my experience that treating people like you would like to be treated is a<br />

game changer. This requires listening to the other person’s perspective and working to find common ground. Once<br />

you’ve established common ground and shown respect, it’s much easier to get to the root of the conflict and find an<br />

acceptable solution.<br />

Brandi Fredeking<br />

PRODUCT MANAGER<br />

Years Underwriting: 5<br />

What is it about the underwriter role that gives you satisfaction on the job? I enjoy<br />

the way underwriting combines both quantitative and qualitative analysis. This forces me to become more rounded in my approaches, which<br />

is a comfortable challenge.<br />

How have you personally made Vanliner Insurance Company a more successful underwriting<br />

company? I recently developed a quantitative system to determine which captive members should be on the “Watch List”. The watch<br />

list consists of members who may need assistance or improvement in order to achieve better results and compliance with group mandates.<br />

This system takes a variety of loss control and results-oriented measures into effect and allows us to be unbiased when developing this list<br />

as each member is evaluated against the same metrics.<br />

What can the “grizzled veteran” underwriter/manager learn most from the “young guns”? I think<br />

the main thing the “grizzled veterans” can learn from the “young guns” is change management – whether it be technology, new policies or<br />

new processes. The younger generations tend to adapt to change much easier.<br />

What can the “young guns” learn most from the “grizzled veterans”? The “young guns” need to take<br />

advantage of the “grizzled veteran’s” wealth of underwriting knowledge – especially their expertise on coverage forms and endorsements,<br />

and how they translate to how/what claims are paid out. The “grizzled veterans” have years of experience in the industry performing the job<br />

and should not be dismissed by the “young guns”.<br />

What one department outside of underwriting is most critical to our success as an organization<br />

and why? I feel that our Loss Control team provides an instrumental role in our success as an organization, as they are the ones helping<br />

our insureds to improve their operations, which leads to improved results. This team also contributes by providing additional details about a<br />

risk that may not have been included in the original application allowing for better underwriting.<br />

Al Franko<br />

UNDERWRITER<br />

Years Underwriting: 4.5<br />

What is the most innovative change you or someone in your department has<br />

made to the underwriting process within the last year? One of the more innovative changes that two underwriters<br />

made in our department over the past year was overhauling our pricing model, allowing us to be more responsive to our business development<br />

and customer pricing requests. It has also enabled us to eliminate a number of repetitive manual calculations that we were previously doing<br />

on every account. Because of this change, we are able to spend more time with our current customers on their renewals and with future<br />

customers on new business submissions.<br />

Who has been the most influential on your underwriting career to help get you where you are<br />

today? There are a number of people who have had an influence on my underwriting career over the years. The first is a friend that I used<br />

to volunteer with. He was the individual who initially introduced me to the insurance industry and helped guide me to my first underwriting<br />

position with a Managing General Agency underwriting commercial umbrella insurance. In addition, the National Accounts team has been<br />

a huge influence on career development. We are constantly challenging and pushing each other to develop our knowledge base and skills.<br />

What gives you job satisfaction? There are many things at National Interstate that give me satisfaction on the job, but if I<br />

had to pick one, it would be the people that I work with daily. Through them I’ve been able to learn different approaches to the underwriting<br />

process and grow as an individual while becoming better at my job. Individuals both in my department and around the company also bring a<br />

positive attitude to the job and approach problems as something to be overcome rather than permanent roadblocks.<br />

How have you made National Interstate a successful underwriting company? Through my time here I’ve<br />

been able to contribute to our success by working with the National Accounts team to help select accounts that contribute to our company<br />

goals. Within our team we take more of a collaborative approach to the underwriting process and challenge each other.<br />

What was the last book you read? Persepolis Rising by James S. A. Corey, which is a part of the Expanse series.<br />

17

Corey Ricketts<br />

UNDERWRITER<br />

Years Underwriting: 3.5<br />

What is it about the underwriter role that gives you satisfaction on the job? One<br />

of the main tasks of an underwriter is to identify and analyze trends. I find it particularly satisfying when you can<br />

identify the root cause driving a trend and in turn, make specific recommendations that can have a direct impact on<br />

the trend itself.<br />

An opportunity fits our underwriting appetite; what three characteristics are<br />

most influential in your decision process? When reviewing an account during our team meetings,<br />

the first few things my eyes go toward are the territory factor, claims reporting time and the driver profile. Loss history<br />

is a huge factor as well, but the aforementioned characteristics are some of the main drivers of loss experience.<br />

Claim reporting time and the sampling of MVR’s can be a huge indicator of how serious an insured takes safety and<br />

in turn, how you can anticipate them to perform. The territory factor is important in the decision process due to the<br />

direct relationship it has with claims costs.<br />

How have you personally made National Interstate a more successful<br />

underwriting company? During our account review meetings, I do my best to be an active participant<br />

and provide feedback when appropriate. As a young underwriter, I find great value in getting feedback during these<br />

meetings, and it is my hope that I am doing the same for those around me.<br />

What do you do to continue to learn and develop as an underwriter outside<br />

of your daily job? One of the most valuable lessons that I have learned in my time as an Underwriter is<br />

that putting yourself in uncomfortable and challenging situations can only benefit you in the end. Taking on new<br />

opportunities, whether it is a new position or an additional responsibility will further your growth and allow you to<br />

be better equipped when the next challenge comes along.<br />

What one department outside of underwriting is most critical to our success as<br />

an organization and why? While all departments play a vital role in the success of the organization, the<br />

Risk Management department is critical because they are, in most cases, the face of the company and our eyes on<br />

the ground. In the field, they are critical in determining if an insured is a cultural and safety fit for National Interstate.<br />

In most cases, underwriting only has a paper submission to go off when evaluating a risk, which does not always<br />

tell the full story.<br />

Michael Winchell<br />

DIRECTOR, SPECIALTY TRANSPORTATION<br />

Years Underwriting: 13<br />

Describe the most creative underwriting strategy you have used to win a deal.<br />

Rather than focusing on a single deal, I think it’s the way we’ve adapted to the rapidly changing landscape in the towing industry that’s<br />

been successful. Traditional tow was losing money. Rather than exiting the space entirely, we identified the large fleet, lower utilization,<br />

heavy-duty, recovery-focused segment as one where we thought we could differentiate ourselves with service, claims, risk management and<br />

unique structures like liability deductibles and alternative risk, or “captives”. Deductibles have been an effective and attractive option in the<br />

marketplace, and we launched the first group captive, TowCap Premier, designed specifically for the industry. We feel we’re writing the types<br />

of risks that make sense, and National Interstate is now being viewed as the market of choice for best-in-class heavy-duty towers.<br />

Who has been most influential on your underwriting career and how did they have impact?<br />

Shawn Los, VP, Specialty Transportation, has had the biggest influence on me from an underwriting perspective. Shawn is a notoriously<br />

conservative underwriter, but over the years I’ve appreciated his willingness to get aggressive on the right accounts. I’ve tried, hopefully with<br />

some success, to model that approach. There are opportunities out there where the price and/or terms may make you uneasy, but you know<br />

that account will make your book better AND encourage more quality opportunities to come in the door – either because the customer is<br />

connected or the agent has a quality book.<br />

What can the “grizzled veteran” underwriter/manager learn most from the “young guns”?<br />

Anytime a new underwriter starts, it’s a good time to evaluate the “why” in your underwriting guidelines, processes, etc. If you can’t answer<br />

why you do something, or if the answer is “because we’ve always done it that way” then it’s probably time to re-evaluate things because<br />

you’re likely to get the question and you’ll need to have an explanation.<br />

What is it about the underwriter role that gives you satisfaction on the job? Underwriting sits at the core<br />

of our business practices. Underwriting challenges you to take a collection of subjective and objective information and distill it into a strategy.<br />

Michael Wilson<br />

DIRECTOR, UNDERWRITING & ANALYTICS, TRUCK<br />

Years Underwriting: 12<br />

What is it about the underwriter role that gives you satisfaction on the job? I enjoy<br />

the challenge of selecting the right accounts for the right price in an industry that has gone through some significant changes over the last<br />

10 years. There is always something new to learn, and I try to keep improving every day.<br />

What do you do to continue to learn and develop as an underwriter outside of your daily job? I<br />

think it’s important to follow trends and innovations that not only impact our industry, but other industries as well. There are always lessons<br />

to learn and innovations that can be implemented in our business that come from outside the insurance world.<br />

Describe the most creative underwriting strategy you have used to win a deal. Our department has<br />

always done a great job of not turning away unique or difficult-to-understand accounts, and we have embraced finding solutions for these<br />

risks. We have used different options like deductibles and reinsurance. We always try to provide as much information as possible in order to<br />

educate the insured as to why the option we chose is the right one for them.<br />

What can the “grizzled veteran” underwriter/manager learn most from the “young guns”? I<br />

don’t know if I can be considered a “grizzled veteran” yet, but I think it’s important to listen to anyone that is new to the industry or your<br />

department. A new set of eyes allows someone to question and challenge long standing practices that may not be the best or most efficient<br />

way of doing something. Some of the best innovations in our pricing model have come from our newer underwriters who challenged the<br />

standard and thought of a better way.<br />

What superpower do you wish you had to enhance your underwriting skills? Teleportation<br />

18<br />

19

Proactive<br />

Purpose<br />

The Reptile Theory and<br />

How to Help Prevent it<br />

with a<br />

When it comes to handling claims in<br />

the modern world, do facts still matter?<br />

Of course, they do. However, when it comes<br />

to claims involving the Reptile Theory, a jury’s<br />

reliance on the basic facts of the accident begin to<br />

diminish. Should these basic facts, like who had the green light,<br />

who made the left turn and who received a citation not be the only<br />

factors considered when it comes to determining fault and returning<br />

a verdict? The Reptile Theory seeks to render all of these basic facts<br />

irrelevant and instead appeal to the jury’s primitive, “Reptilian Brain”.<br />

In the 1960s, Paul MacLean, an American neuroscientist, created<br />

the “Triune Brain” model, which divided the human brain into three<br />

regions and organized into a hierarchy. The three regions are the<br />

Reptilian Brain (Primal), the Paleomammalian (Emotional) Brain<br />

and the Neomammalian (Rational) Brain. 1 Now, the human brain is<br />

obviously a complex organ and dividing it into three regions may<br />

be overly simplistic. That said, when it comes to the Reptile Theory,<br />

awakening the Reptilian Brain in the jury can lead to potential serious<br />

consequences for the defense.<br />

The Reptilian Brain is responsible for our primitive survival instincts.<br />

When that survival is threatened, the Reptilian Brain takes over and<br />

can overpower logic and reason. Plaintiff attorneys may seek to<br />

awaken these primitive instincts by attempting to show that the motor<br />

carrier or their driver is a danger to the jury, their families and the<br />

community. They further attempt to convince the jury that they are the<br />

only ones with the power to eliminate this danger and should do so by<br />

awarding excessive monetary damages.<br />

The formula is a simple one: Safety Rule + Danger = Reptile. The<br />

concept of the “Safety Rule” is paramount to the Reptile Theory. A<br />

plaintiff attorney will point out the safety rule to the jury, get the<br />

defendant to agree with that rule, and then demonstrate to the jury<br />

that the defendant broke the rule, thereby needlessly putting the entire<br />

community at risk. The semantics of Reptile Theory are also important.<br />

For instance, according to Reptile Theory, it would be improper to say,<br />

“The truck driver ran the red light”, but rather “The trucker violated the<br />

➼<br />

public safety-rule to watch where he was<br />

going and obey traffic signals”.<br />

These rules also come from a variety of credible<br />

sources. Some of the most common are:<br />

Driver/employee manuals<br />

➼ Company policies and procedures<br />

➼ Training materials<br />

➼ Federal Motor Carrier Safety Regulations (FCMSRs)<br />

➼ Truck driver school books<br />

➼ Defensive driver courses<br />

➼ Preventable accident manuals<br />

As an easy example, let us focus on the Federal Motor Carrier Safety<br />

Regulations. Specifically, §382.303, Post-Accident Testing. If it was<br />

required that the driver submit to post accident drug and alcohol testing<br />

and failed, the plaintiff attorney has a clear path to establishing the<br />

Reptile Theory. The claim becomes less about what actually occurred<br />

or who was at fault and more about the company’s hiring practices<br />

and the unnecessary danger they created by placing an unsafe driver<br />

on the road.<br />

After establishing the rules, the next step would be getting the<br />

defendant to agree with the rule. This is generally accomplished<br />

through the deposition of the driver or safety director. The following<br />

demonstrates a typical line of questioning in a driver’s deposition:<br />

Q. You would agree with me that if you followed at such a speed<br />

or at such a short distance that you couldn’t stop your vehicle, then<br />

that would be disregarding the safety of other people on the roadway;<br />

wouldn’t it?<br />

Q. You should never, as a commercial driver, needlessly endanger other<br />

members of the public that are using the roadway with you; right?<br />

20<br />

21

Q. And if you did and you hurt someone, you would be<br />

responsible; correct?<br />

hard to enforce consistently, and failure to consistently enforce your<br />

policies is an open invitation for scrutiny by a claimant’s attorney.<br />

This pattern of questioning demonstrates the reptilian tactics of the<br />

plaintiff’s attorney. Once the driver agrees to one of these questions,<br />

the attorney will then attempt to influence the jury to believe that their<br />

responsibility is larger than the case at hand. This is about making<br />

the community a safer place and the jury must do something about it.<br />

WHAT STEPS CAN WE TAKE TO PREVENT<br />

THE REPTILE?<br />

As discussed above, the claimant attorney’s main objective here is to<br />

enhance the value of a case, sometimes exponentially, by appealing<br />

to the simplest and oldest area of the human brain. While often<br />

involving complex issues and technicalities, the strategy is really quite<br />

simple. A claimant attorney using the reptile approach is trying to: 1)<br />

frame the case in such a way that helps jurors make their decision;<br />

2) present what the jurors can agree are fair rules of conduct; 3)<br />

present a violation as one that needlessly endangers the public; and 4)<br />

give the jurors a reason to care. When deployment of this strategy is<br />

successful, it can be hard for defendants to overcome the effects even<br />

when the relevant facts and logic are on their side. In this case, the<br />

best defense is a good offense. There are several ways that you can<br />

help stop the reptile in its tracks before an accident occurs.<br />

EDUCATE PERSONNEL<br />

Educate all drivers, safety personnel and operations managers on<br />

the importance of understanding basic safety regulations such as<br />

federal and state regulations, CDL manuals, truck driver<br />

school books, defensive driver courses and company<br />

policies and procedures. Develop and stick to a plan<br />

for ongoing training to keep up with new regulations,<br />

new avenues for exposure and new technology.<br />

Practice what to do in an accident, and do it often.<br />

Pro tip: the National Interstate Risk Management<br />

team is a great resource.<br />

DON’T CREATE STANDARDS YOU<br />

CAN’T ENFORCE<br />

You should establish company policies and<br />

procedures that are clear, concise and consistent.<br />

Examine those policies closely and regularly. Do your<br />

policies contain higher standards than those required<br />

by law? If so, consider whether those policies are<br />

essential. Unnecessarily stringent policies may be<br />

PROACTIVELY ENFORCE YOUR POLICIES<br />

Don’t wait until an accident occurs to question whether polices have<br />

been followed. You should have a system in place to help ensure the<br />

investment you have made in education and training is paying off.<br />

How often are you looking at driver logs? How often are you reviewing<br />

AER or GPS data? Are you taking corrective action when violations<br />

are discovered? Identifying and addressing issues before they become<br />

issues will make you safer on the road and better equipped to defend<br />

a claim when an accident occurs.<br />

TIMELY REPORTING – HELP US HELP YOU!<br />

Unfortunately, accidents are never convenient. They can occur at odd<br />

hours and in unfamiliar places. Don’t wait for Monday morning. Contact<br />

your insurance carrier immediately. National Interstate has a 24-hour<br />

response hotline available. CALL IT! The number is 800-929-0870.<br />

Claims don’t typically get better over time, and even claims involving<br />

favorable liability scenarios can develop adversely overnight. Our<br />

catastrophic “CAT” loss handling process identifies claims that require<br />

immediate escalation, and ensures they are handled immediately by<br />

our most senior claim professionals.<br />

A CAT loss is typically a claim involving a fatality, pedestrian or<br />

motorcycle accidents, serious injury, substantial cargo damage, fire,<br />

a multi-vehicle accident, substantial property damage or a fuel spill.<br />

When a CAT loss is identified, the handling adjuster will act quickly to<br />

assess the situation and determine an appropriate response.<br />

This often includes retaining local defense counsel. The reasons to<br />

retain defense counsel are numerous and include:<br />

➼➼<br />

Securing the best independent adjusters and accident<br />

reconstruction experts<br />

➼➼<br />

Getting “boots to the ground” quickly<br />

➼➼<br />

Serving as a conduit between the insured driver and the<br />

investigating agency<br />

➼➼<br />

Ensuring compliance with post-accident testing<br />

➼➼<br />

Identifying witnesses<br />

➼➼<br />

Preserving evidence<br />

➼➼<br />

Obtaining relevant information weeks or sometimes even months<br />

before an official report is released.<br />

Most importantly, having defense counsel involved early also maintains<br />

the legal privilege of the investigation and provides easy access to<br />

invaluable guidance and advice in those vital early stages of the claim.<br />

Our 24-Hour Reporting Hotline - 800-929-0870.<br />

WHY IS IT IMPORTANT TO BE PROACTIVE?<br />

As noted above, being proactive with safety and risk management<br />

can be a huge investment of time and resources. Being proactive in<br />

accident investigation can also involve significant time and expense.<br />

We understand this can sometimes be frustrating when you are<br />

focused on your business. While the aim is to prevent a claimant’s<br />

attorney from even having the opportunity to use the reptile theory, it<br />

is equally important to recognize even the slightest potential early in<br />

an accident investigation, even in cases where your driver does not<br />

appear to be at fault or the other party may not be seriously injured.<br />

Recently, a jury in a neutral<br />

Texas venue awarded<br />

a claimant with a neck<br />

and back injury more<br />

than $101 million dollars in<br />

a lawsuit against a<br />

trucking company. Liability<br />

was not disputed, and<br />

the claimant sought chiropractic treatment and underwent<br />

one surgery. His total medical expenses were no more than $250,000.<br />

So, what happened? The insured driver had a poor driving record<br />

(three moving violations within three months of hire and was on<br />

company probation for three other accidents while employed by the<br />

trucking company). He also tested positive for both marijuana and<br />

methamphetamines. 2 This information was used by the claimant’s<br />

attorney in a reptile fashion to inflate the award.<br />

The scary thing is that this verdict is no longer an outlier. In some<br />

venues, large verdicts like this are a regular occurrence. Obviously, if<br />

this driver was not on the road in the first place, this accident would<br />

not have occurred. Would your policies with respect to accidents and<br />

drug testing have worked here? Hopefully yes, but even the most<br />

proactive policies and enforcement strategy don’t always work. When<br />

faced with adverse facts, it is important to recognize them early so<br />

that we can properly evaluate the potential exposure and position the<br />

claim for resolution as soon as possible - ideally before the adverse<br />

facts have to be disclosed to the other party.<br />

CHARLES WENDLAND<br />

Director of Claims<br />

MELANIE IRVIN<br />

Claim Attorney<br />

1<br />

“The Triune Brain in Evolution: Role in Paleocerebral Functions” – Paul D. MacLean, National Institute of Mental Health, Bethesda,<br />

Maryland<br />

22<br />

2<br />

https://www.news-journal.com/news/local/avinger-man-awarded-million-verdict-from-fort-worth-trucking-company/article_6d3af616-<br />

8c3e-11e8-8835-cb8c102ab13e.html<br />

23

A Path Back to Work<br />

KIMBERLY WICKERT<br />

MRC, CRC, Director, Return to Works Programs, York<br />

In 2016, Employers paid out more than $96 billion in workers’<br />

compensation costs. 1 While these figures are staggering, the National<br />

Safety Council estimates adding in uninsured costs, administrative<br />

expenses and loss of productivity may also add to the medical<br />

and benefit costs, and may not reflect the real costs to employers,<br />

individuals and society as a whole. Employer organizations are<br />

not only searching for ways to continue to minimize their workers’<br />

compensation claims, but to also decrease the indemnity associated<br />

with lost time days when an employee is off work following an injury.<br />

The goal of return to work (RTW) programs has long been getting<br />

employees back to work following a work-related injury. According to<br />

Kimberly Wickert, Director, Return to Work Programs at York, proactive<br />

organizations not only look at return to work in their risk management,<br />

but they focus on Remain at Work to avoid lost-time days when an<br />

employee is injured on the job. Developing remain-at-work and returnto-work<br />

programs for industries like transportation and trucking, where<br />

injuries often stem from the heavy physical requirements of the job,<br />

have historically been challenging due to the lack of modified or<br />

transitional duty jobs offering lighter physical effort.<br />

York has partnered with trucking companies to identify transitional duty<br />

tasks at terminals that employees who drive trucks can perform while<br />

they are on restricted duty following an injury. It may be challenging<br />

to identify several job titles an individual can perform. However, it is<br />

feasible to identify multiple sedentary or light work tasks at a terminal<br />

that can be combined to create a full-time job an injured employee can<br />

perform while working under physical capabilities that are restricted in<br />

nature from their position of injury.<br />

While the on-site transitional duty jobs are the first option for<br />

employers, other alternatives to return employees to work quickly and<br />

safely are needed. Over 18 years ago, York developed a way around this<br />

obstacle by identifying an innovative alternative when an employee<br />

is unable to work within their physician-documented restrictions in<br />

a light or modified duty position at the employer worksite. In these<br />

circumstances, York partners with non-profit organizations to design a<br />

program where employees can work as a volunteer while recovering<br />

until they can transition back to their original job. York has relationships<br />

with thousands of non-profit organizations across the country and<br />

continues to develop sites based on each individual employee’s needs<br />

in this modified duty work program.<br />

While York provides traditional rehabilitation and wellness services,<br />

its Modified Duty Offsite (MDOS) program allows employers another<br />

option to offer employees to avoid them sitting at home and becoming<br />

socially isolated and physically deconditioned while they are on<br />

restricted duty. York prides itself on matching the injured employees’<br />

current skills with the non-profit’s needs. “Non-profits are always<br />

looking for volunteers and we help them avoid the recruiting and initial<br />

screening process,” says Wickert. Employees volunteering at the nonprofit<br />

as part of the MDOS program are expected to follow not only<br />

their company’s workplace policies with respect to dress, time cards<br />

and breaks, but also those of the non-profit.<br />

York “vets” the non-profit organization through a multi-level screening<br />

process by completing a job analysis of the identified non-profit job.<br />

The job analysis will show the physical demands are within the<br />

physician prescribed restrictions. A case manager will attend the<br />

initial meeting with the injured employee and non-profit supervisor to<br />

observe the actual job and assess the overall safety of the non-profit<br />

organization. York can have the case manager continue to remain on<br />

to oversee the program in its entirety or National Interstate and the<br />

insured employer can take over supervision for the remainder of the<br />

program. “We encourage employers to run the program for up to 90<br />

days or 120 days at most,” says Wickert. “If a longer timeframe is<br />

needed, we can extend on a case by case basis but will begin to<br />

question if the restrictions are temporary.”<br />

While recovering workers serve in a volunteer capacity, they are paid<br />

their wages by their employer. The employer also assumes liability<br />

if the recovering worker is reinjured but based on York’s process of<br />

documentation and vetting the non-profit, this has not been a barrier<br />

to the success of the MDOS program. With current unemployment<br />

rates so low, employers are challenged to find experienced workers<br />

and this program allows National Interstate’s insured employers to<br />

retain those individuals and avoid turnover associated with workrelated<br />

injuries. The fact that the employer has identified alternative<br />

ways to accommodate the employee’s restrictions conveys an added<br />

level of commitment that may help motivate the employee during their<br />

recovery.<br />

While employers see dollar savings by keeping or returning employees<br />

to work quickly following a work-related injury, the MDOS program<br />

also has intangible benefits in its service as a community outreach for<br />

many employers who have incorporated the program into their social<br />

responsibility goals. Often, employees continue to volunteer at the nonprofit<br />

following their return to work at their employer site as they have<br />

seen the value in helping others in their local communities. Wickert<br />

recommends employers add this program to their benefit package<br />

information during the onboarding process, as well as annually during<br />

benefits enrollment to create the culture of this program as a benefit<br />

to help the employee return to work in the unfortunate event of an<br />

injury. This also enhances the “work culture” of the organization and<br />

lets everyone know the company invests in its employees and their<br />

return to work.<br />

Source:<br />

1<br />

According to the National Academy of Social Insurance<br />

24<br />

25

a<br />

True<br />

Partnership<br />

National Interstate and Akron Children’s Hospital<br />

Akron Marathon Race Series<br />

SANDRA RITLEY<br />

Human Resources Supervisor<br />

What started five years ago as an opportunity to expand our<br />

employer brand presence within the Northeast Ohio community has<br />

since developed into an employee engagement, total wellness and<br />

community partnership staple.<br />

National Interstate began its partnership with the Akron Children’s<br />

Hospital Akron Marathon in 2014 as a Bronze Sponsor of its race<br />

series, allowing our company to experience a first-time connection<br />

to this local event. It didn’t take long for us to understand the<br />

value, energy and fun the series brought to the community and our<br />

employees. It also provided a venue for our team to volunteer two<br />

times during the summer months right in their own backyards.<br />

In 2016, we increased our commitment, becoming the title sponsor<br />

of the 8k and 1-mile race series and Corporate Cup Challenge<br />

participant. Corporate Cup companies compete against each other<br />

to receive the title of Corporate Cup Champion. Points are given to<br />

participating companies based on the number of employees who<br />

run or volunteer, philanthropic fundraising for local charities and top<br />

race finishers. We are proud to say that in our first year participating,<br />

National Interstate won the Corporate Cup!<br />

The Akron Marathon race series offers 8k, 10k, 1-mile, half marathon,<br />

marathon and team relay opportunities. To promote physical and<br />

mental wellness, National Interstate employees can run in any of the<br />

races courtesy of the company. Additionally, to promote team and<br />

community involvement, National Interstate hosts fluid stations at<br />

both the 8k/1-mile and FirstEnergy Akron Marathon, Half Marathon<br />

and Team Relay to keep runners hydrated and motivated along<br />

the way. In addition to fluid stations at the 8k and 1-mile race,<br />

the NATMobile, our branded company car, serves as the race pace<br />

car. We are proud to share that each year National Interstate has<br />

roughly 150 employees and family members participate as a runner<br />

or volunteer throughout the series.<br />

Leading up to the 8k/1-mile and Marathon, National Interstate<br />