PDF, 1.2 MB - Pfleiderer AG

PDF, 1.2 MB - Pfleiderer AG

PDF, 1.2 MB - Pfleiderer AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

financial statements of the legal entity pfleiderer ag notes pfleiderer ag 139<br />

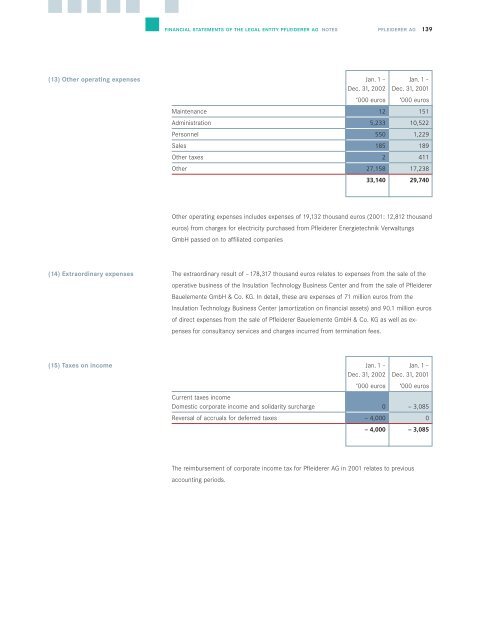

(13) Other operating expenses Jan. 1 – Jan. 1 –<br />

Dec. 31, 2002 Dec. 31, 2001<br />

‘000 euros ‘000 euros<br />

Maintenance 12 151<br />

Administration 5,233 10,522<br />

(14) Extraordinary expenses<br />

Personnel 550 1,229<br />

Sales 185 189<br />

Other taxes 2 411<br />

Other 27,158 17,238<br />

33,140 29,740<br />

Other operating expenses includes expenses of 19,132 thousand euros (2001: 12,812 thousand<br />

euros) from charges for electricity purchased from <strong>Pfleiderer</strong> Energietechnik Verwaltungs<br />

GmbH passed on to affiliated companies<br />

The extraordinary result of –178,317 thousand euros relates to expenses from the sale of the<br />

operative business of the Insulation Technology Business Center and from the sale of <strong>Pfleiderer</strong><br />

Bauelemente GmbH & Co. KG. In detail, these are expenses of 71 million euros from the<br />

Insulation Technology Business Center (amortization on financial assets) and 90.1 million euros<br />

of direct expenses from the sale of <strong>Pfleiderer</strong> Bauelemente GmbH & Co. KG as well as expenses<br />

for consultancy services and charges incurred from termination fees.<br />

(15) Taxes on income Jan. 1 – Jan. 1 –<br />

Dec. 31, 2002 Dec. 31, 2001<br />

‘000 euros ‘000 euros<br />

Current taxes income<br />

Domestic corporate income and solidarity surcharge 0 – 3,085<br />

Reversal of accruals for deferred taxes – 4,000 0<br />

– 4,000 – 3,085<br />

The reimbursement of corporate income tax for <strong>Pfleiderer</strong> <strong>AG</strong> in 2001 relates to previous<br />

accounting periods.