PDF, 1.2 MB - Pfleiderer AG

PDF, 1.2 MB - Pfleiderer AG PDF, 1.2 MB - Pfleiderer AG

134 being focused: being better Capital reserve In order to balance the net loss for the year, 190,575,717.34 euros were taken from capital reserve. Revenue reserve In order to balance the net loss for the year, 508,163.64 euros were taken from revenue reserve. Revenue reserve for treasury stock amounting to 7,566.75 euros were formed for treasury stock held as part of the stock option scheme. Dividends The Annual General Meeting on July 2, 2002 resolved to pay a dividend of 0.20 euro per share for 2001 and to carry forward the remaining 6,679 thousand euros. In order to avoid an accumulated deficit, the Executive Board proposed to the Supervisory Board that withdrawals be made from additional paid-in capital and retained earnings, and that no dividend be paid in accordance with Sec. 150 AktG (“Aktiengesetz”: German Stock Corporation Act). Sec. 150 AktG prohibits payment of a dividend from retained earnings when additional paid-in capital is used to compensate for an accumulated deficit. The Supervisory Board voted in favor of the proposal made by the Executive Board. Changes in stockholders’ equity Dec. 31, 2002 Dec. 31, 2001 ‘000 euros ‘000 euros 1. Statutory reserves 0 0 2. Reserves for treasury stock 8 0 3. Other retained earnings 50,613 51,129 50,621 51,129 Capital Additional Retained Unappropri- Total stock paid-in capital earnings ated profits ‘000 euros ‘000 euros ‘000 euros ‘000 euros ‘000 euros As of January 1, 2002 109,274 201,503 51,129 15,215 377,121 Dividend – 8,537 – 8,537 Net loss for the year Use of additional paid-in capital and retained earnings – 197,762 – 197,762 to balance accumulated deficit – 190,576 – 508 191,084 0 As of December 31, 2002 109,274 10,927 50,621 0 170,822

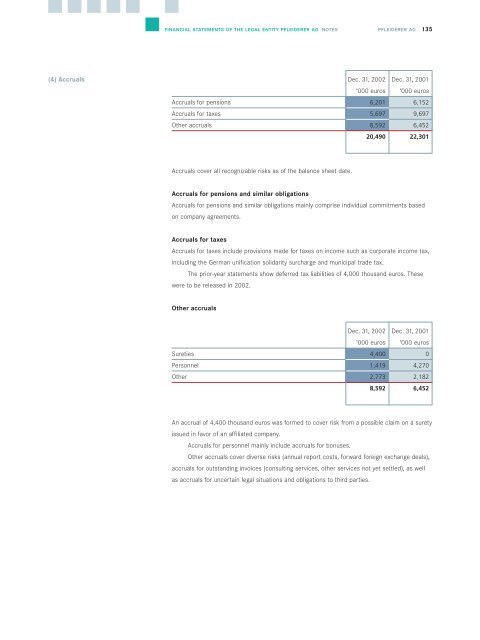

(4) Accruals financial statements of the legal entity pfleiderer ag notes pfleiderer ag 135 Dec. 31, 2002 Dec. 31, 2001 ‘000 euros ‘000 euros Accruals for pensions 6,201 6,152 Accruals for taxes 5,697 9,697 Other accruals 8,592 6,452 20,490 22,301 Accruals cover all recognizable risks as of the balance sheet date. Accruals for pensions and similar obligations Accruals for pensions and similar obligations mainly comprise individual commitments based on company agreements. Accruals for taxes Accruals for taxes include provisions made for taxes on income such as corporate income tax, including the German unification solidarity surcharge and municipal trade tax. The prior-year statements show deferred tax liabilities of 4,000 thousand euros. These were to be released in 2002. Other accruals Dec. 31, 2002 Dec. 31, 2001 ‘000 euros ‘000 euros Sureties 4,400 0 Personnel 1,419 4,270 Other 2,773 2,182 8,592 6,452 An accrual of 4,400 thousand euros was formed to cover risk from a possible claim on a surety issued in favor of an affiliated company. Accruals for personnel mainly include accruals for bonuses. Other accruals cover diverse risks (annual report costs, forward foreign exchange deals), accruals for outstanding invoices (consulting services, other services not yet settled), as well as accruals for uncertain legal situations and obligations to third parties.

- Page 87 and 88: consolidated financial statements n

- Page 89 and 90: consolidated financial statements n

- Page 91 and 92: consolidated financial statements n

- Page 93 and 94: 4. Inventories 5. Property, plant a

- Page 95 and 96: 7. Financial assets 8. Other long-l

- Page 97 and 98: 11. Other short-term accruals 12. C

- Page 99 and 100: 15. Deferred income 16. Discontinue

- Page 101 and 102: consolidated financial statements n

- Page 103 and 104: 18. Stock appreciation rights and s

- Page 105 and 106: 19. Derivative financial instrument

- Page 107 and 108: consolidated financial statements n

- Page 109 and 110: consolidated financial statements n

- Page 111 and 112: 21. Pensions and similar obligation

- Page 113 and 114: V. Notes to Statement of Income 1.

- Page 115 and 116: 2. Other financial obligations 3. L

- Page 117 and 118: IX. Earnings per Ordinary Share con

- Page 119 and 120: 3. Long-term investments and securi

- Page 121 and 122: 11. Revenues XIII. Changes in Asset

- Page 123 and 124: consolidated financial statements a

- Page 125 and 126: consolidated financial statements b

- Page 127 and 128: consolidated financial statements c

- Page 129 and 130: consolidated financial statements g

- Page 131 and 132: Pfleiderer AG Statement of Income 2

- Page 133 and 134: financial statements of the legal e

- Page 135 and 136: III. Principles of Accounting and V

- Page 137: (2) Current assets (3) Stockholders

- Page 141 and 142: V. Notes to Statement of Income fin

- Page 143 and 144: financial statements of the legal e

- Page 145 and 146: financial statements of the legal e

- Page 147 and 148: financial statements of the legal e

- Page 149 and 150: Audit Opinion financial statements

- Page 151 and 152: economic glossary ■ capital emplo

- Page 153 and 154: ■ p Particleboard 15f, 25ff, 9ff

- Page 155 and 156: in brief multi-year summary pfleide

- Page 157: financial calendar contacts imprint

(4) Accruals<br />

financial statements of the legal entity pfleiderer ag notes pfleiderer ag 135<br />

Dec. 31, 2002 Dec. 31, 2001<br />

‘000 euros ‘000 euros<br />

Accruals for pensions 6,201 6,152<br />

Accruals for taxes 5,697 9,697<br />

Other accruals 8,592 6,452<br />

20,490 22,301<br />

Accruals cover all recognizable risks as of the balance sheet date.<br />

Accruals for pensions and similar obligations<br />

Accruals for pensions and similar obligations mainly comprise individual commitments based<br />

on company agreements.<br />

Accruals for taxes<br />

Accruals for taxes include provisions made for taxes on income such as corporate income tax,<br />

including the German unification solidarity surcharge and municipal trade tax.<br />

The prior-year statements show deferred tax liabilities of 4,000 thousand euros. These<br />

were to be released in 2002.<br />

Other accruals<br />

Dec. 31, 2002 Dec. 31, 2001<br />

‘000 euros ‘000 euros<br />

Sureties 4,400 0<br />

Personnel 1,419 4,270<br />

Other 2,773 2,182<br />

8,592 6,452<br />

An accrual of 4,400 thousand euros was formed to cover risk from a possible claim on a surety<br />

issued in favor of an affiliated company.<br />

Accruals for personnel mainly include accruals for bonuses.<br />

Other accruals cover diverse risks (annual report costs, forward foreign exchange deals),<br />

accruals for outstanding invoices (consulting services, other services not yet settled), as well<br />

as accruals for uncertain legal situations and obligations to third parties.