PDF, 1.2 MB - Pfleiderer AG

PDF, 1.2 MB - Pfleiderer AG

PDF, 1.2 MB - Pfleiderer AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106 being focused: being better<br />

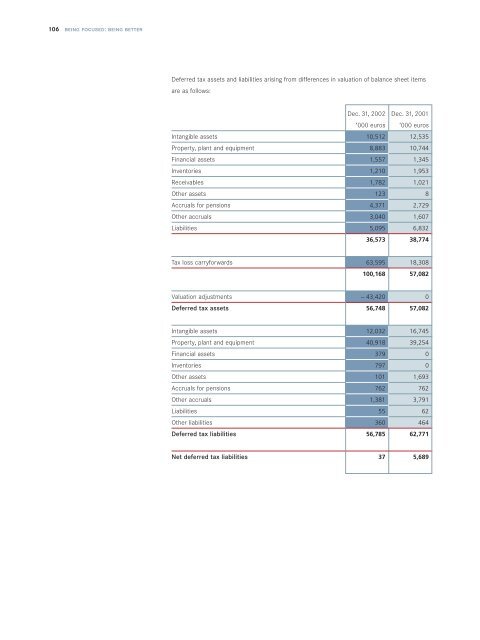

Deferred tax assets and liabilities arising from differences in valuation of balance sheet items<br />

are as follows:<br />

Dec. 31, 2002 Dec. 31, 2001<br />

‘000 euros ‘000 euros<br />

Intangible assets 10,512 12,535<br />

Property, plant and equipment 8,883 10,744<br />

Financial assets 1,557 1,345<br />

Inventories 1,210 1,953<br />

Receivables 1,782 1,021<br />

Other assets 123 8<br />

Accruals for pensions 4,371 2,729<br />

Other accruals 3,040 1,607<br />

Liabilities 5,095 6,832<br />

36,573 38,774<br />

Tax loss carryforwards 63,595 18,308<br />

100,168 57,082<br />

Valuation adjustments – 43,420 0<br />

Deferred tax assets 56,748 57,082<br />

Intangible assets 12,032 16,745<br />

Property, plant and equipment 40,918 39,254<br />

Financial assets 379 0<br />

Inventories 797 0<br />

Other assets 101 1,693<br />

Accruals for pensions 762 762<br />

Other accruals 1,381 3,791<br />

Liabilities 55 62<br />

Other liabilities 360 464<br />

Deferred tax liabilities 56,785 62,771<br />

Net deferred tax liabilities 37 5,689