PDF, 3.2 MB - Pfleiderer AG

PDF, 3.2 MB - Pfleiderer AG PDF, 3.2 MB - Pfleiderer AG

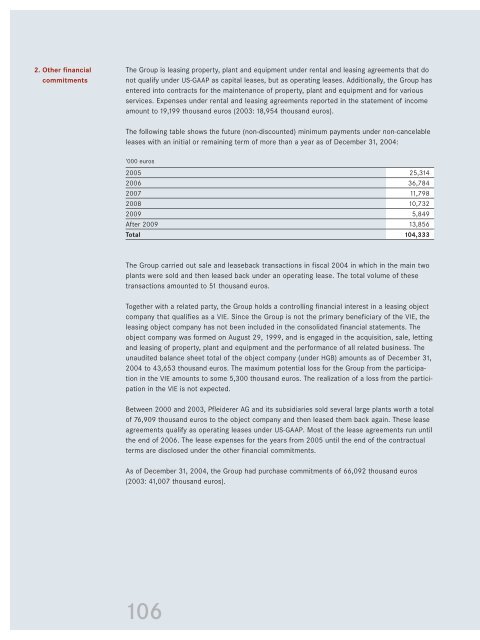

2. Other financial commitments The Group is leasing property, plant and equipment under rental and leasing agreements that do not qualify under US-GAAP as capital leases, but as operating leases. Additionally, the Group has entered into contracts for the maintenance of property, plant and equipment and for various services. Expenses under rental and leasing agreements reported in the statement of income amount to 19,199 thousand euros (2003: 18,954 thousand euros). The following table shows the future (non-discounted) minimum payments under non-cancelable leases with an initial or remaining term of more than a year as of December 31, 2004: ‘000 euros 2005 25,314 2006 36,784 2007 11,798 2008 10,732 2009 5,849 After 2009 13,856 Total 104,333 The Group carried out sale and leaseback transactions in fiscal 2004 in which in the main two plants were sold and then leased back under an operating lease. The total volume of these transactions amounted to 51 thousand euros. Together with a related party, the Group holds a controlling financial interest in a leasing object company that qualifies as a VIE. Since the Group is not the primary beneficiary of the VIE, the leasing object company has not been included in the consolidated financial statements. The object company was formed on August 29, 1999, and is engaged in the acquisition, sale, letting and leasing of property, plant and equipment and the performance of all related business. The unaudited balance sheet total of the object company (under HGB) amounts as of December 31, 2004 to 43,653 thousand euros. The maximum potential loss for the Group from the participation in the VIE amounts to some 5,300 thousand euros. The realization of a loss from the participation in the VIE is not expected. Between 2000 and 2003, Pfleiderer AG and its subsidiaries sold several large plants worth a total of 76,909 thousand euros to the object company and then leased them back again. These lease agreements qualify as operating leases under US-GAAP. Most of the lease agreements run until the end of 2006. The lease expenses for the years from 2005 until the end of the contractual terms are disclosed under the other financial commitments. As of December 31, 2004, the Group had purchase commitments of 66,092 thousand euros (2003: 41,007 thousand euros). 106

3. Pending litigation and claims 4. Transactions with related parties 5. Directors’ Dealings 6. Corporate Governance The Company is involved from time to time in litigation in the ordinary course of business. The Company is not aware of any matters that could have a significant negative impact on its results of operations, liquidity or financial position. Pfleiderer Unternehmensverwaltung GmbH & Co. KG held a substantial investment in Pfleiderer AG (subsidiary) until March 22, 2004 and was thus a related party to the Group. The Group had business relations with this company and its subsidiary, Pfleiderer Leasing GmbH & Co. KG, Delitzsch, both in the current and the prior financial year. The extent of the business relations in 2004 was as follows: ‘000 euros 2004 2003 Interest income 0 10 Income from cost allocations 7,138 5,051 Expenses from cost allocations 7,654 795 Rental expense 2,567 3,395 The expenses for power purchased from Pfleiderer Energietechnik Verwaltungs-GmbH, Neumarkt, amounted in 2004 to 988 thousand euros (2003: 12,067 thousand euros). Pursuant to Section 15a, German Securities Trading Act, members of the Board of Management and the Supervisory Board and members of their families are obliged to report to the Company and the German Federal Financial Services Supervisory Office without delay information about any securities trading relating to the Company (Directors’ Dealings) that exceed a minimum limit. These notifications are published on Pfleiderer AG’s website at www.pfleiderer.com. On September 30, 2004, Hans H. Overdiek (Spokesman of the Board of Management) announced that he had acquired 400,000 shares in Pfleiderer AG from Pfleiderer Unternehmensverwaltung GmbH & Co. KG at a price of 5.30 euros per share. Hanno C. Fiedler (a member of the Supervisory Board) acquired 2,000 shares at a price of 8.15 euros per share on December 27, 2004, and a further 2,000 shares on December 28, 2004 at a price of 8.20 euros per share. The Board of Management and the Supervisory Board have issued the statement of compliance for the year 2004 in accordance with Section 161 of the German Stock Companies Act on the recommendations of the German Corporate Governance Code Commission and have published this on the Company’s website. Pfleiderer AG has reported in detail on the subject of Corporate Governance in the chapter of the annual report entitled “Principles of Corporate Governance Pfleiderer Aktiengesellschaft” (see pages 11 to 17). 107 FINANCIAL STATEMENTS/NOTES PFLEIDERER GROUP

- Page 60 and 61: Key Figures 2004 2003 No. of shares

- Page 62 and 63: Investor Relations Activities Indiv

- Page 64 and 65: While the prices paid for paraffin

- Page 67 and 68: TURKEY The Turkish economy reported

- Page 69 and 70: Liabilities and Shareholders’ Equ

- Page 71 and 72: Pfleiderer Consolidated Statement o

- Page 73 and 74: Comprehensive income 69 Other compr

- Page 75 and 76: Infrastructure Technology Consolida

- Page 77 and 78: Scope of Consolidation The consolid

- Page 79 and 80: The activities of the Poles & Tower

- Page 81 and 82: Sales of receivables are treated wi

- Page 83 and 84: Property, Plant and Equipment Prope

- Page 85 and 86: Accruals for Pensions and Similar O

- Page 87 and 88: 1. Liquid funds 2. Securities class

- Page 89 and 90: 7. Intangible assets As in the prev

- Page 91 and 92: 11. Financial liabilities 12. Other

- Page 93 and 94: 16. Long-term deferred income 17. D

- Page 95 and 96: 18. Stockholders’ equity The foll

- Page 97 and 98: Stock Appreciation Rights 2000 Unde

- Page 99 and 100: 20. Derivative financial instrument

- Page 101 and 102: Derivative financial instruments ar

- Page 103 and 104: The following table reconciles the

- Page 105 and 106: 22. Pensions and similar obligation

- Page 107 and 108: The following table explains the ch

- Page 109: 1. Contingent liabilities VII. Othe

- Page 113 and 114: Geographical Information Sales Reve

- Page 115 and 116: 1. Leases 2. Valuation of inventori

- Page 117 and 118: 8. Discontinued operations Under US

- Page 119 and 120: Accumulated amortization/depreciati

- Page 121 and 122: Pfleiderer track systems B.V. Deven

- Page 123 and 124: 119

- Page 125 and 126: Pfleiderer AG Statement of Income 2

- Page 127 and 128: Accumulated amortization/depreciati

- Page 129 and 130: Hanno C. Fiedler Chairman of the ma

- Page 131 and 132: Economic Glossary Asset deal Descri

- Page 133 and 134: P Particleboard 30, 32, 34, 43, 54

- Page 135 and 136: Income ratios Sales revenues 900,97

- Page 137 and 138: Financial Calendar 2005 April 7, 20

- Page 139 and 140: July Pfleiderer track systems wins

2. Other financial<br />

commitments<br />

The Group is leasing property, plant and equipment under rental and leasing agreements that do<br />

not qualify under US-GAAP as capital leases, but as operating leases. Additionally, the Group has<br />

entered into contracts for the maintenance of property, plant and equipment and for various<br />

services. Expenses under rental and leasing agreements reported in the statement of income<br />

amount to 19,199 thousand euros (2003: 18,954 thousand euros).<br />

The following table shows the future (non-discounted) minimum payments under non-cancelable<br />

leases with an initial or remaining term of more than a year as of December 31, 2004:<br />

‘000 euros<br />

2005 25,314<br />

2006 36,784<br />

2007 11,798<br />

2008 10,732<br />

2009 5,849<br />

After 2009 13,856<br />

Total 104,333<br />

The Group carried out sale and leaseback transactions in fiscal 2004 in which in the main two<br />

plants were sold and then leased back under an operating lease. The total volume of these<br />

transactions amounted to 51 thousand euros.<br />

Together with a related party, the Group holds a controlling financial interest in a leasing object<br />

company that qualifies as a VIE. Since the Group is not the primary beneficiary of the VIE, the<br />

leasing object company has not been included in the consolidated financial statements. The<br />

object company was formed on August 29, 1999, and is engaged in the acquisition, sale, letting<br />

and leasing of property, plant and equipment and the performance of all related business. The<br />

unaudited balance sheet total of the object company (under HGB) amounts as of December 31,<br />

2004 to 43,653 thousand euros. The maximum potential loss for the Group from the participation<br />

in the VIE amounts to some 5,300 thousand euros. The realization of a loss from the participation<br />

in the VIE is not expected.<br />

Between 2000 and 2003, <strong>Pfleiderer</strong> <strong>AG</strong> and its subsidiaries sold several large plants worth a total<br />

of 76,909 thousand euros to the object company and then leased them back again. These lease<br />

agreements qualify as operating leases under US-GAAP. Most of the lease agreements run until<br />

the end of 2006. The lease expenses for the years from 2005 until the end of the contractual<br />

terms are disclosed under the other financial commitments.<br />

As of December 31, 2004, the Group had purchase commitments of 66,092 thousand euros<br />

(2003: 41,007 thousand euros).<br />

106