PDF, 3.2 MB - Pfleiderer AG

PDF, 3.2 MB - Pfleiderer AG

PDF, 3.2 MB - Pfleiderer AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

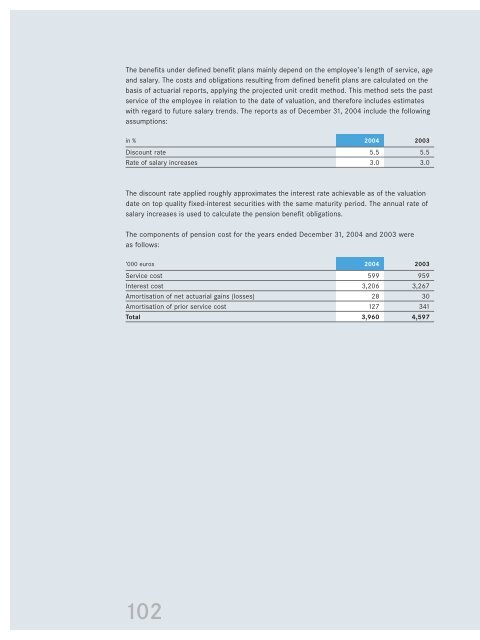

The benefits under defined benefit plans mainly depend on the employee’s length of service, age<br />

and salary. The costs and obligations resulting from defined benefit plans are calculated on the<br />

basis of actuarial reports, applying the projected unit credit method. This method sets the past<br />

service of the employee in relation to the date of valuation, and therefore includes estimates<br />

with regard to future salary trends. The reports as of December 31, 2004 include the following<br />

assumptions:<br />

in % 2004 2003<br />

Discount rate 5.5 5.5<br />

Rate of salary increases 3.0 3.0<br />

The discount rate applied roughly approximates the interest rate achievable as of the valuation<br />

date on top quality fixed-interest securities with the same maturity period. The annual rate of<br />

salary increases is used to calculate the pension benefit obligations.<br />

The components of pension cost for the years ended December 31, 2004 and 2003 were<br />

as follows:<br />

‘000 euros 2004 2003<br />

Service cost 599 959<br />

Interest cost 3,206 3,267<br />

Amortisation of net actuarial gains (losses) 28 30<br />

Amortisation of prior service cost 127 341<br />

Total 3,960 4,597<br />

102