AXA WORLD FUNDS A LUXEMBOURG INVESTMENT FUND ...

AXA WORLD FUNDS A LUXEMBOURG INVESTMENT FUND ... AXA WORLD FUNDS A LUXEMBOURG INVESTMENT FUND ...

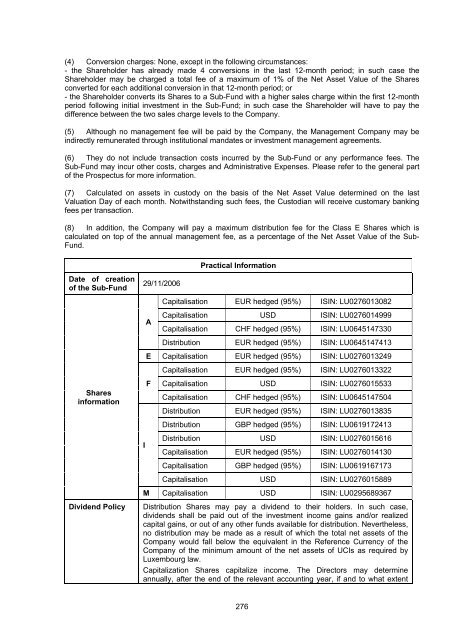

(4) Conversion charges: None, except in the following circumstances: - the Shareholder has already made 4 conversions in the last 12-month period; in such case the Shareholder may be charged a total fee of a maximum of 1% of the Net Asset Value of the Shares converted for each additional conversion in that 12-month period; or - the Shareholder converts its Shares to a Sub-Fund with a higher sales charge within the first 12-month period following initial investment in the Sub-Fund; in such case the Shareholder will have to pay the difference between the two sales charge levels to the Company. (5) Although no management fee will be paid by the Company, the Management Company may be indirectly remunerated through institutional mandates or investment management agreements. (6) They do not include transaction costs incurred by the Sub-Fund or any performance fees. The Sub-Fund may incur other costs, charges and Administrative Expenses. Please refer to the general part of the Prospectus for more information. (7) Calculated on assets in custody on the basis of the Net Asset Value determined on the last Valuation Day of each month. Notwithstanding such fees, the Custodian will receive customary banking fees per transaction. (8) In addition, the Company will pay a maximum distribution fee for the Class E Shares which is calculated on top of the annual management fee, as a percentage of the Net Asset Value of the Sub- Fund. Date of creation of the Sub-Fund Shares information 29/11/2006 I A Practical Information Capitalisation EUR hedged (95%) ISIN: LU0276013082 Capitalisation USD ISIN: LU0276014999 Capitalisation CHF hedged (95%) ISIN: LU0645147330 Distribution EUR hedged (95%) ISIN: LU0645147413 E Capitalisation EUR hedged (95%) ISIN: LU0276013249 F Capitalisation EUR hedged (95%) ISIN: LU0276013322 Capitalisation USD ISIN: LU0276015533 Capitalisation CHF hedged (95%) ISIN: LU0645147504 Distribution EUR hedged (95%) ISIN: LU0276013835 Distribution GBP hedged (95%) ISIN: LU0619172413 Distribution USD ISIN: LU0276015616 Capitalisation EUR hedged (95%) ISIN: LU0276014130 Capitalisation GBP hedged (95%) ISIN: LU0619167173 Capitalisation USD ISIN: LU0276015889 M Capitalisation USD ISIN: LU0295689367 Dividend Policy Distribution Shares may pay a dividend to their holders. In such case, dividends shall be paid out of the investment income gains and/or realized capital gains, or out of any other funds available for distribution. Nevertheless, no distribution may be made as a result of which the total net assets of the Company would fall below the equivalent in the Reference Currency of the Company of the minimum amount of the net assets of UCIs as required by Luxembourg law. Capitalization Shares capitalize income. The Directors may determine annually, after the end of the relevant accounting year, if and to what extent 276

the Company will pay dividends. Interim dividends may be paid if and when decided by the Directors in compliance with applicable law. Any dividend payments will be confirmed in writing to the holders of Distribution Shares. Unless otherwise specifically requested on the application form, dividends will be reinvested in further Shares of the same Class within the same Sub-Fund and shareholders will be advised of the details by a contract note. Holders of Shares held in Euroclear or Clearstream are not able to have their dividends reinvested. Dividends will be paid to Euroclear or Clearstream which will account for these amounts to the relevant shareholders. Tax information This Sub-Fund might be subject to specific tax treatment in Luxembourg. Depending on your own country of residence, this might have an impact on your investment. For further details, please speak to an adviser. Sub-Fund's Depositary Sub-Fund's Auditor State Street Bank Luxembourg S.A. 49, Avenue J.F. Kennedy L-1855 Luxembourg PricewaterhouseCoopers Sàrl 400, Route d’Esch L-1471 Luxembourg Other The AXA WORLD FUNDS – US HIGH YIELD BONDS is a Sub-Fund of AXA WORLD FUNDS. Other Sub-Funds exist for this umbrella and the assets of this Sub-Fund are independent from those of other Sub-Funds. Information about them can be found online at www.axa-im-international.com Date of publication August 2012 For this Sub-Fund, a Business Day shall be understood as a day on which banks are open all day for business in Luxembourg and in the United States of America. The value of this Sub-Fund is calculated and published each Business Day. It is available online at www.axa-im-international.com. Subscription and redemption of units in this Sub-Fund can be arranged through your adviser or distributor, in which case different subscription, redemption and conversion procedures and time limits may apply. Direct orders can also be sent to your national representative listed on our website at www.axa-im-international.com You can obtain copies of a more comprehensive document on this Sub-Fund in English (the Key Investor Information Document), as well as annual and half-yearly financial reports at any time, free of charge, by contacting us online at www.axa-im-international.com You can find other information about this Sub-Fund at www.axa-iminternational.com 277 Regulatory Authority Commission de Surveillance du Secteur Financier

- Page 225 and 226: Appendix 40: AXA WORLD FUNDS - FRAM

- Page 227 and 228: Minimum subscriptions and maximum c

- Page 229 and 230: In case of redemption of Shares or

- Page 231 and 232: Date of publication August 2012 Sub

- Page 233 and 234: with highly rated financial institu

- Page 235 and 236: One-off charges (3) Ongoing charges

- Page 237 and 238: Date of creation of the Sub-Fund Sh

- Page 239 and 240: Appendix 42: AXA WORLD FUNDS - GLOB

- Page 241 and 242: Minimum subscriptions and maximum c

- Page 243 and 244: - the Shareholder converts its Shar

- Page 245 and 246: Appendix 43: AXA WORLD FUNDS - GLOB

- Page 247 and 248: Minimum subscriptions and maximum c

- Page 249 and 250: (6) They do not include transaction

- Page 251 and 252: Other The AXA WORLD FUNDS - GLOBAL

- Page 253 and 254: Risk Profile This Sub-Fund is mainl

- Page 255 and 256: One-off charges (3) Ongoing charges

- Page 257 and 258: Date of creation of the Sub-Fund Sh

- Page 259 and 260: Appendix 45: AXA WORLD FUNDS - GLOB

- Page 261 and 262: Minimum subscriptions and maximum c

- Page 263 and 264: (4) Conversion charges: None, excep

- Page 265 and 266: contract note. Holders of Shares he

- Page 267 and 268: Special Risk Consideration Derivati

- Page 269 and 270: One-off charges (3) Ongoing charges

- Page 271 and 272: Date of creation of the Sub-Fund Sh

- Page 273 and 274: Appendix 47: AXA WORLD FUNDS - US H

- Page 275: Subscription, redemption, and conve

- Page 279 and 280: The Reference Currency of the Sub-F

- Page 281 and 282: Date of creation of the Sub-Fund Sh

- Page 283 and 284: Appendix 49: AXA WORLD FUNDS - EMER

- Page 285 and 286: Minimum subscriptions and maximum c

- Page 287 and 288: (1) Subscriptions in EUR or the equ

- Page 289 and 290: Sub-Fund's Depositary Sub-Fund's Au

- Page 291 and 292: the standard terms laid down by the

- Page 293 and 294: Ongoing charges (5) Maximum annual

- Page 295 and 296: Date of publication August 2012 For

- Page 297 and 298: it is in its exclusive interest, th

- Page 299 and 300: One-off charges (3) Ongoing charges

- Page 301 and 302: Date of creation of the Sub-Fund Sh

- Page 303 and 304: Appendix 52: AXA WORLD FUNDS - FORC

- Page 305 and 306: Subscription, redemption, and conve

- Page 307 and 308: Sub-Fund's Depositary Sub-Fund's Au

- Page 309 and 310: and market price of the said bond o

- Page 311 and 312: Ongoing charges (5) Maximum annual

- Page 313 and 314: Date of publication August 2012 abo

- Page 315 and 316: Use of Derivatives: In order to ach

- Page 317 and 318: One-off charges (3) Ongoing charges

- Page 319 and 320: Sub-Fund's Auditor PricewaterhouseC

- Page 321 and 322: In order to achieve its management

- Page 323 and 324: Ongoing charges (6) Maximum annual

- Page 325 and 326: Unless otherwise specifically reque

(4) Conversion charges: None, except in the following circumstances:<br />

- the Shareholder has already made 4 conversions in the last 12-month period; in such case the<br />

Shareholder may be charged a total fee of a maximum of 1% of the Net Asset Value of the Shares<br />

converted for each additional conversion in that 12-month period; or<br />

- the Shareholder converts its Shares to a Sub-Fund with a higher sales charge within the first 12-month<br />

period following initial investment in the Sub-Fund; in such case the Shareholder will have to pay the<br />

difference between the two sales charge levels to the Company.<br />

(5) Although no management fee will be paid by the Company, the Management Company may be<br />

indirectly remunerated through institutional mandates or investment management agreements.<br />

(6) They do not include transaction costs incurred by the Sub-Fund or any performance fees. The<br />

Sub-Fund may incur other costs, charges and Administrative Expenses. Please refer to the general part<br />

of the Prospectus for more information.<br />

(7) Calculated on assets in custody on the basis of the Net Asset Value determined on the last<br />

Valuation Day of each month. Notwithstanding such fees, the Custodian will receive customary banking<br />

fees per transaction.<br />

(8) In addition, the Company will pay a maximum distribution fee for the Class E Shares which is<br />

calculated on top of the annual management fee, as a percentage of the Net Asset Value of the Sub-<br />

Fund.<br />

Date of creation<br />

of the Sub-Fund<br />

Shares<br />

information<br />

29/11/2006<br />

I<br />

A<br />

Practical Information<br />

Capitalisation EUR hedged (95%) ISIN: LU0276013082<br />

Capitalisation USD ISIN: LU0276014999<br />

Capitalisation CHF hedged (95%) ISIN: LU0645147330<br />

Distribution EUR hedged (95%) ISIN: LU0645147413<br />

E Capitalisation EUR hedged (95%) ISIN: LU0276013249<br />

F<br />

Capitalisation EUR hedged (95%) ISIN: LU0276013322<br />

Capitalisation USD ISIN: LU0276015533<br />

Capitalisation CHF hedged (95%) ISIN: LU0645147504<br />

Distribution EUR hedged (95%) ISIN: LU0276013835<br />

Distribution GBP hedged (95%) ISIN: LU0619172413<br />

Distribution USD ISIN: LU0276015616<br />

Capitalisation EUR hedged (95%) ISIN: LU0276014130<br />

Capitalisation GBP hedged (95%) ISIN: LU0619167173<br />

Capitalisation USD ISIN: LU0276015889<br />

M Capitalisation USD ISIN: LU0295689367<br />

Dividend Policy Distribution Shares may pay a dividend to their holders. In such case,<br />

dividends shall be paid out of the investment income gains and/or realized<br />

capital gains, or out of any other funds available for distribution. Nevertheless,<br />

no distribution may be made as a result of which the total net assets of the<br />

Company would fall below the equivalent in the Reference Currency of the<br />

Company of the minimum amount of the net assets of UCIs as required by<br />

Luxembourg law.<br />

Capitalization Shares capitalize income. The Directors may determine<br />

annually, after the end of the relevant accounting year, if and to what extent<br />

276