Alandsbanken SICAV SIMPLIFIED PROSPECTUS ... - Ålandsbanken

Alandsbanken SICAV SIMPLIFIED PROSPECTUS ... - Ålandsbanken

Alandsbanken SICAV SIMPLIFIED PROSPECTUS ... - Ålandsbanken

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

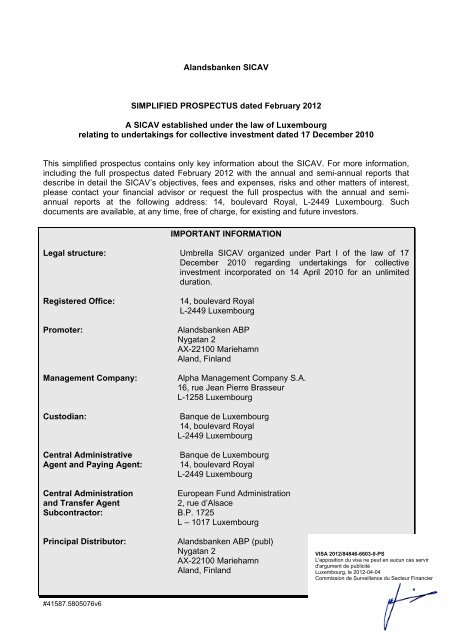

<strong>Alandsbanken</strong> <strong>SICAV</strong><br />

<strong>SIMPLIFIED</strong> <strong>PROSPECTUS</strong> dated February 2012<br />

A <strong>SICAV</strong> established under the law of Luxembourg<br />

relating to undertakings for collective investment dated 17 December 2010<br />

This simplified prospectus contains only key information about the <strong>SICAV</strong>. For more information,<br />

including the full prospectus dated February 2012 with the annual and semi-annual reports that<br />

describe in detail the <strong>SICAV</strong>’s objectives, fees and expenses, risks and other matters of interest,<br />

please contact your financial advisor or request the full prospectus with the annual and semiannual<br />

reports at the following address: 14, boulevard Royal, L-2449 Luxembourg. Such<br />

documents are available, at any time, free of charge, for existing and future investors.<br />

IMPORTANT INFORMATION<br />

Legal structure: Umbrella <strong>SICAV</strong> organized under Part I of the law of 17<br />

December 2010 regarding undertakings for collective<br />

investment incorporated on 14 April 2010 for an unlimited<br />

duration.<br />

Registered Office: 14, boulevard Royal<br />

L-2449 Luxembourg<br />

Promoter: <strong>Alandsbanken</strong> ABP<br />

Nygatan 2<br />

AX-22100 Mariehamn<br />

Aland, Finland<br />

Management Company: Alpha Management Company S.A.<br />

16, rue Jean Pierre Brasseur<br />

L-1258 Luxembourg<br />

Custodian: Banque de Luxembourg<br />

14, boulevard Royal<br />

L-2449 Luxembourg<br />

Central Administrative Banque de Luxembourg<br />

Agent and Paying Agent: 14, boulevard Royal<br />

L-2449 Luxembourg<br />

Central Administration European Fund Administration<br />

and Transfer Agent 2, rue d’Alsace<br />

Subcontractor: B.P. 1725<br />

L – 1017 Luxembourg<br />

Principal Distributor: <strong>Alandsbanken</strong> ABP (publ)<br />

Nygatan 2<br />

AX-22100 Mariehamn<br />

Aland, Finland<br />

VISA 2012/84846-6603-0-PS<br />

L'apposition du visa ne peut en aucun cas servir<br />

d'argument de publicité<br />

Luxembourg, le 2012-04-04<br />

Commission de Surveillance du Secteur Financier<br />

#41587.5805076v6 1

Listing Agent: Banque de Luxembourg<br />

14, boulevard Royal<br />

L-2449 Luxembourg<br />

Auditor: Ernst & Young S.A.<br />

7, parc d’activité Syrdall<br />

L-5365 Munsbach<br />

Supervisory authority: Commission de Surveillance du Secteur Financier<br />

(www.cssf.lu)<br />

Legal Adviser: Arendt & Medernach<br />

14, rue Erasme<br />

L-2082 Luxembourg<br />

#41587.5805076v6 2

Investment Objective and<br />

Policy<br />

Risk Profile / Risk<br />

Management<br />

Risk Profile<br />

INVESTMENT INFORMATION<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong>: Nordic Growth<br />

The Nordic Growth Sub-Fund is an actively managed equity portfolio.<br />

It is a vehicle aiming to outperform its benchmark, the Nordic VINX<br />

Index, VINX Bench EUR NI Index (VBCEUN).<br />

The Nordic Growth Sub-Fund mainly invests in Nordic equities listed<br />

on stock exchanges in Iceland, Denmark, Norway, Sweden and<br />

Finland or as the securities of companies organised and located in<br />

other countries provided:<br />

(a) the principal securities trading market is in a Nordic<br />

country, or<br />

(b) where fifty per cent (50 %) of the company’s<br />

revenue alone or on a consolidated basis is derived<br />

from either goods produced or developed, sales<br />

made or services performed in Nordic countries.<br />

The Nordic Growth Sub-Fund will focus on companies which are<br />

expected to grow at a relatively high rate. Allocation between<br />

different markets and sectors is thus a consequence of the objective<br />

to invest in stocks which are estimated to deliver the best returns.<br />

Investments may include, to a lesser extent, warrants, convertibles<br />

and options on securities.<br />

On an ancillary basis, the Nordic Growth Sub-Fund may also hold<br />

liquid assets such as deposits and other regularly traded short term<br />

money market instruments issued or guaranteed by first class<br />

issuers or guarantors and having a residual maturity not exceeding<br />

twelve months.<br />

The Nordic Growth Sub-Fund may also deal in options on securities,<br />

financial futures and forward exchange contracts for hedging<br />

purposes so as to protect the value of the assets of the Nordic<br />

Growth Sub-Fund.<br />

The Nordic Growth Sub-Fund may also use various derivative<br />

instruments for efficient portfolio management purposes to the extent<br />

permitted by the investment restrictions detailed in the Prospectus.<br />

EUR is the reference currency of the Nordic Growth Sub-Fund, but<br />

assets may be denominated in other currencies and currency<br />

exposure may be hedged.<br />

Money invested in the Nordic Growth Sub-Fund can both increase<br />

and decrease in value and it is not certain that one will recoup the<br />

entire amount of the invested capital.<br />

Investments in the Nordic Growth Sub-Fund are generally tied to<br />

#41587.5805076v6 3

Risk Management<br />

Calculation of global<br />

exposure<br />

Profile of Targeted<br />

Investors<br />

large risks, as share prices can strongly fluctuate. Growth-oriented<br />

companies are largely valued based on future profits, which can<br />

cause large fluctuations in the share development.<br />

The Nordic Growth Sub-Fund’s investments are largely made in<br />

shares denominated in foreign currency, which means that the fund<br />

is sensitive to changes in the exchange rate against the euro (EUR).<br />

In accordance with the Law of 2010 and the applicable regulations,<br />

in particular Circular CSSF 11/512, the Nordic Growth Sub-Fund<br />

uses a risk-management process which enables it to assess its<br />

exposure to market, liquidity and counterparty risks, and to all other<br />

risks, including operational risks, which are material for the Nordic<br />

Growth Sub-Fund.<br />

As part of the risk-management process, the Nordic Growth Sub-<br />

Fund uses the commitment approach to monitor and measure the<br />

global exposure. This approach measures the global exposure<br />

related to positions on financial derivative instruments (“FDIs”) under<br />

consideration of netting and hedging effects which may not exceed<br />

the total net value of the portfolio of the Nordic Growth Sub-Fund.<br />

Under the standard commitment approach, each FDI position is<br />

converted into the market value of an equivalent position in the<br />

underlying asset of that FDI.<br />

The Nordic Growth Sub-Fund suits investors who are familiar with<br />

the risks of the stock market and who can accept the occurrence of<br />

rate fluctuations.<br />

The Nordic Growth Sub-Fund is suitable for investors who are<br />

seeking an investment horizon of 5 years or more.<br />

Classes of Shares Shares of any Class within the Nordic Growth Sub-Fund will be<br />

issued in registered book-entry form only.<br />

The Nordic Growth Sub-Fund offers Share Classes A and B and<br />

sub-Classes in EUR and SEK within Class A and Class B.<br />

Within the Nordic Growth Sub-Fund, Shares of Class A (EUR) and A<br />

(SEK) will exclusively be issued to retail investors, i.e. any investor<br />

who does not qualify as an institutional investor as defined below<br />

(the "Retail Investors") and Shares of Class B (EUR) and Class B<br />

(SEK) will exclusively be issued to institutional investors, i.e.<br />

investors within the meaning of the article 2 of the Luxembourg Law<br />

of 13th February 2007 relating to Specialized Investment Funds (the<br />

"Institutional Investors").<br />

The Fund will not accept to issue Class B Shares to investors who<br />

may not be considered as Institutional Investors. Furthermore, the<br />

board of directors will not give its approval to any transfer of Shares<br />

which would result in a non-institutional investor becoming a<br />

Shareholder of Class B Shares. The board of directors, at its full<br />

discretion, will refuse the issue or transfer of such Shares if there is<br />

not sufficient evidence that the investors to which the Shares are<br />

sold or transferred to are Institutional Investors.<br />

#41587.5805076v6 4

Sales and Redemption<br />

Charge<br />

Minimum Investment and<br />

Holding<br />

Considering the qualification of a subscriber or a transferee as<br />

Institutional Investor, the board of directors will have due regard to<br />

the guidelines or recommendations (if any) of the competent<br />

Supervisory Authorities.<br />

Institutional Investors subscribing in their own name, but on behalf of<br />

a third party, must certify such subscription is made on behalf of an<br />

Institutional Investor as aforesaid and the board of directors may<br />

require at its sole discretion, evidence that the beneficial owner of<br />

the Shares is an Institutional Investor.<br />

Class A and Class B Shares will only differentiate to the extent of the<br />

annual rate of the taxe d’abonnement applicable to the assets<br />

corresponding to the relevant Class.<br />

Classes A (EUR), A (SEK), B (EUR) and B (SEK) Shares are<br />

exclusively issued as distribution Shares.<br />

After the initial subscription period as defined hereafter, the offering<br />

price per Share of each Class within the Nordic Growth Sub-Fund<br />

corresponds to the Net Asset Value per Share of the relevant Class<br />

plus the sales charge as mentioned hereinafter.<br />

The sales charge levied is a maximum of three per cent (3 %) of the<br />

Net Asset Value per Share of the relevant Class, which shall revert<br />

to the relevant distributor.<br />

The sales charge will be levied for subscriptions during the Initial<br />

Subscription Period as well as for subscriptions after the Initial<br />

Subscription Period.<br />

The redemption charge levied is a maximum of two per cent (2 %) of<br />

the redemption amount, which shall revert to the relevant distributor.<br />

Class A Shares:<br />

There exists no minimum initial investment and holding requirement<br />

per investor for Class A Shares.<br />

There exists no minimum subsequent investment requirement per<br />

investor for Class A Shares.<br />

Class B Shares:<br />

There exists no minimum initial investment requirement per investor<br />

for Class B (SEK) Shares.<br />

There exists no minimum subsequent investment requirement per<br />

investor for Class B (SEK) Shares.<br />

For Class B (EUR) Shares the minimum initial investment and<br />

holding requirement per investor will be as follows:<br />

#41587.5805076v6 5

� Class B (EUR) Shares: EUR 1,000,000.-<br />

A redemption request which would reduce the value at such time of<br />

any holding to below such amount may be treated as a request to<br />

redeem the whole of such shareholding. The Board of Directors may<br />

waive the minimum amounts for the initial and/or subsequent<br />

subscriptions at their sole discretion.<br />

For Class B (EUR) Shares the minimum subsequent investment<br />

requirement per investor will be as follows:<br />

� Class B (EUR) Shares: EUR 100,000.-<br />

Subscriptions Investors whose applications are accepted will be allotted Shares<br />

issued on the basis of the Net Asset Value per Share determined as<br />

of the Valuation Day (as defined below), provided that such<br />

application is received by the Fund not later than 16:00, Luxembourg<br />

time, on the relevant Valuation Day. Applications received after<br />

16:00, Luxembourg time, on the relevant Valuation Day, will be dealt<br />

with on the following Valuation Day.<br />

Payment for subscriptions must be made within three Business Days<br />

after the applicable Valuation Day.<br />

Redemptions Shareholders whose applications for redemption are accepted will<br />

have their Shares redeemed on any Valuation Day provided that the<br />

applications have been received by the Fund prior to 16:00,<br />

Luxembourg time, on the relevant Valuation Day. Applications<br />

received after 16:00, Luxembourg time, on the relevant Valuation<br />

Day, will be dealt with on the following Valuation Day.<br />

The redemption price shall be equal to the Net Asset Value per<br />

Share of the Nordic Growth Sub-Fund on the relevant Valuation Day.<br />

The redemption price shall be paid no later than three Business<br />

Days after the applicable Valuation Day.<br />

Conversions The Shares of any class of the Nordic Growth Sub-Fund may be<br />

converted into Shares of any class of the Global Growth Sub-Fund or<br />

of another Sub-Fund according to the procedure described in the<br />

Prospectus on the basis of the respective Net Asset Values of the<br />

relevant Classes or Sub-Funds, calculated as of the relevant<br />

Valuation Day, provided that the request for conversion is received<br />

by the Fund not later than 16:00 noon, Luxembourg time, on the<br />

relevant Valuation Day. Requests received after 16:00 noon,<br />

Luxembourg time, on the relevant Valuation Day will be dealt with on<br />

the following Valuation Day.<br />

Reference Currency of<br />

the Nordic Growth Sub-<br />

Fund<br />

Frequency of the Net<br />

Asset Value Calculation<br />

A conversion fee of up to zero point five per cent (0.5 %) of the Net<br />

Asset Value per Share of the relevant Class which shall be<br />

converted shall be levied.<br />

The Net Asset Value per Share of all the Classes of the Nordic<br />

Growth Sub-Fund will be calculated in EUR.<br />

The Net Asset Value per Share of the Nordic Growth Sub-Fund will<br />

be determined in Luxembourg under the overall responsibility of the<br />

#41587.5805076v6 6

and Valuation Day Board of Directors as of every Business Day (the "Valuation Day")<br />

and has been determined for the first time on 1 September 2010.<br />

Investment Manager <strong>Alandsbanken</strong> Asset Management AB (Reg. number 59 32 00 -<br />

1745) has been appointed as Investment Manager for the Nordic<br />

Growth Sub-Fund. <strong>Alandsbanken</strong> Asset Management AB has been<br />

incorporated under the laws of Sweden. The registered office is at<br />

Stureplan 19, SE-107 81 Stockholm. On December 1, 2011, its<br />

capital and reserves amounted to SEK 493.000.000,-. <strong>Alandsbanken</strong><br />

Asset Management AB is an asset manager institution and is<br />

licensed under the Swedish law (2007:528), Chapter 2, Section 1,<br />

items 1, 2, 4 and 5.<br />

Investment Management<br />

Fee<br />

Listing on the<br />

Luxembourg Stock<br />

Exchange<br />

Publication of the Net<br />

Asset Value<br />

The Management Company will be entitled to receive, payable out of<br />

the assets attributable to the relevant Class of Shares of the Nordic<br />

Growth Sub-Fund, the following management fees calculated as of<br />

each Valuation Day on the basis of the Net Asset Value of the<br />

relevant Valuation Day and paid out monthly in arrears:<br />

� Class A (EUR) Shares: up to 2.5 percent per annum;<br />

� Class A (SEK) Shares: up to 2.5 percent per annum;<br />

� Class B (EUR) Shares: up to 2.5 percent per annum;<br />

� Class B (SEK) Shares: up to 2.5 percent per annum.<br />

The Shares of the Nordic Growth Sub-Fund are not listed on the<br />

Luxembourg Stock Exchange.<br />

The Net Asset Value per Share as well as the issue, redemption and<br />

conversion prices will be available at the registered office of the Fund<br />

and will be available on each Valuation Day.<br />

Taxation The Nordic Growth Sub-Fund is liable to an annual taxe<br />

d’abonnement in the Grand Duchy of Luxembourg, such tax being<br />

payable quarterly on the basis of the value of the aggregate net<br />

assets of the Nordic Growth Sub-Fund at the end of the relevant<br />

calendar quarter. The taxe d’abonnement shall be levied at the<br />

annual rate of 0.05% in respect of the assets of the Nordic Growth<br />

Sub-Fund attributable to Class A Shares and at the annual rate of<br />

0.01% in respect of the assets of the Nordic Growth Sub-Fund<br />

attributable to Class B Shares.<br />

Investment Objective and<br />

Policy<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong>: Swedish Growth<br />

The Swedish Growth Sub-Fund is an actively managed equity<br />

portfolio. It is a vehicle aiming to outperform its benchmark,<br />

Scandinavian Information Exchange Portfolio Return Index<br />

(SIXPRX).<br />

The Swedish Growth Sub-Fund will focus on companies which are<br />

expected to grow at a relatively high rate. Allocation between<br />

different sectors is thus a consequence of the objective to invest in<br />

stocks which are estimated to deliver the best returns.<br />

Investments made include, to a lesser extent, warrants, convertibles<br />

#41587.5805076v6 7

Risk Profile / Risk<br />

Management<br />

Risk Profile<br />

Risk Management<br />

Calculation of global<br />

exposure<br />

Profile of Targeted<br />

Investors<br />

and options on securities.<br />

On an ancillary basis, the Swedish Growth Sub-Fund may also hold<br />

liquid assets such as deposits and other regularly traded short term<br />

money market instruments issued or guaranteed by first class<br />

issuers or guarantors and having a residual maturity not exceeding<br />

twelve months.<br />

The Swedish Growth Sub-Fund may also deal in options on<br />

securities, financial futures and forward exchange contracts for<br />

hedging purposes so as to protect the value of the assets of the<br />

Swedish Growth Sub-Fund.<br />

The Swedish Growth Sub-Fund may also use various derivative<br />

instruments for efficient portfolio management purposes to the extent<br />

permitted by the investment restrictions detailed in the Prospectus.<br />

SEK is the reference currency of the Swedish Growth Sub-Fund but<br />

assets may be denominated in other currencies and currency<br />

exposure may be hedged.<br />

Money invested in the Swedish Growth Sub-Fund can both increase<br />

and decrease in value and it is not certain that one will recoup the<br />

entire amount of the invested capital.<br />

Investments in the Swedish Growth Sub-Fund are generally tied to<br />

large risks, as share prices can strongly fluctuate. Growth-oriented<br />

companies are largely valued based on future profits, which can<br />

cause large fluctuations in the share development.<br />

In accordance with the Law of 2010 and the applicable regulations,<br />

in particular Circular CSSF 11/512, the Swedish Growth Sub-Fund<br />

uses a risk-management process which enables it to assess its<br />

exposure to market, liquidity and counterparty risks, and to all other<br />

risks, including operational risks, which are material for the Swedish<br />

Growth Sub-Fund.<br />

As part of this risk-management process, the Swedish Growth Sub-<br />

Fund uses the commitment approach to monitor and measure the<br />

global exposure. This approach measures the global exposure<br />

related to positions on financial derivative instruments (“FDIs”) under<br />

consideration of netting and hedging effects which may not exceed<br />

the total net value of the portfolio of the Swedish Growth Sub-Fund.<br />

Under the standard commitment approach, each FDI position is<br />

converted into the market value of an equivalent position in the<br />

underlying asset of that FDI.<br />

The Swedish Growth Sub-Fund suits investors who are familiar with<br />

the risks of the stock market and who can accept the occurrence of<br />

rate fluctuations. The Swedish Growth Sub-Fund is suitable for<br />

investors who are seeking an investment horizon of 5 years or more.<br />

Classes of Shares Shares of any Class within the Swedish Growth Sub-Fund will be<br />

issued in registered book-entry form only.<br />

#41587.5805076v6 8

Sales and Redemption<br />

Charge<br />

Minimum Investment and<br />

Holding<br />

The Swedish Growth Sub-Fund offers Share Classes A and B and<br />

sub-Classes in EUR and SEK within Class A and Class B.<br />

Within the Swedish Growth Sub-Fund, Shares of Class A (EUR) and<br />

A (SEK) will exclusively be issued to retail investors, i.e. any investor<br />

who does not qualify as an institutional investor as defined below<br />

(the "Retail Investors") and Shares of Class B will exclusively be<br />

issued to institutional investors, i.e. investors within the meaning of<br />

the article 2 of the Luxembourg Law of 13th February 2007 relating<br />

to Specialized Investment Funds (the "Institutional Investors").<br />

The Fund will not accept to issue Class B Shares to investors who<br />

may not be considered as Institutional Investors. Furthermore, the<br />

board of directors will not give its approval to any transfer of Shares<br />

which would result in a non-institutional investor becoming a<br />

Shareholder of Class B Shares. The board of directors, at its full<br />

discretion, will refuse the issue or transfer of such Shares if there is<br />

not sufficient evidence that the investors to which the Shares are<br />

sold or transferred to are Institutional Investors.<br />

Considering the qualification of a subscriber or a transferee as<br />

Institutional Investor, the board of directors will have due regard to<br />

the guidelines or recommendations (if any) of the competent<br />

Supervisory Authorities.<br />

Institutional Investors subscribing in their own name, but on behalf of<br />

a third party, must certify such subscription is made on behalf of an<br />

Institutional Investor as aforesaid and the board of directors may<br />

require at its sole discretion, evidence that the beneficial owner of<br />

the Shares is an Institutional Investor.<br />

Class A and Class B Shares will only differentiate to the extent of the<br />

annual rate of the taxe d’abonnement applicable to the assets<br />

corresponding to the relevant Class.<br />

Classes A (EUR), A (SEK), B (EUR) and B (SEK) Shares are<br />

exclusively issued as distribution Shares.<br />

The offering price per Share of each Class within the Swedish<br />

GrowthSub-Fund corresponds to the Net Asset Value per Share of<br />

the relevant Class plus the sales charge as mentioned hereinafter.<br />

The sales charge levied is a maximum of three per cent (3 %) of the<br />

Net Asset Value per Share of the relevant Class, which shall revert<br />

to the relevant distributor.<br />

The sales charge will be levied for subscriptions during the Initial<br />

Subscription Period as well as for subscriptions after the Initial<br />

Subscription Period.<br />

The redemption charge levied is a maximum of two per cent (2%) of<br />

the redemption amount, which shall revert to the relevant distributor.<br />

Class A Shares:<br />

There exists no minimum initial investment and holding requirement<br />

#41587.5805076v6 9

per investor for Class A Shares.<br />

There exists no minimum subsequent investment requirement per<br />

investor for Class A Shares.<br />

Class B Shares:<br />

There exists no minimum initial investment requirement per investor<br />

for Class B (SEK) Shares.<br />

There exists no minimum subsequent investment requirement per<br />

investor for Class B (SEK) Shares.<br />

For Class B (EUR) Shares the minimum initial investment and<br />

holding requirement per investor will be as follows:<br />

� Class B (EUR) Shares: EUR 1,000,000.-<br />

A redemption request which would reduce the value at such time of<br />

any holding to below such amount may be treated as a request to<br />

redeem the whole of such shareholding. The Board of Directors may<br />

waive the minimum amounts for the initial and/or subsequent<br />

subscriptions at their sole discretion.<br />

For Class B (EUR) Shares the minimum subsequent investment<br />

requirement per investor will be as follows:<br />

� Class B (EUR) Shares: EUR 100,000.-<br />

Subscriptions Investors whose applications are accepted will be allotted Shares<br />

issued on the basis of the Net Asset Value per Share determined as<br />

of the Valuation Day (as defined below) on which the application<br />

form is received, provided that such application is received by the<br />

Fund not later than 16:00, Luxembourg time, on the relevant<br />

Valuation Day. Applications received after 16:00, Luxembourg time,<br />

on the relevant Valuation Day, will be dealt with on the following<br />

Valuation Day.<br />

Payment for subscriptions must be made within three Luxembourg<br />

Business Days after the applicable Valuation Day.<br />

Redemptions Shareholders whose applications for redemption are accepted will<br />

have their Shares redeemed on any Valuation Day provided that the<br />

applications have been received by the Fund prior to 16:00,<br />

Luxembourg time, on the relevant Valuation Day. Applications<br />

received after 16:00, on the relevant Valuation Day, will be dealt with<br />

on the following Valuation Day.<br />

The redemption price shall be equal to the Net Asset Value per<br />

Share of the Swedish Growth Sub-Fund on the relevant Valuation<br />

Day.<br />

The redemption price shall be paid no later than three Luxembourg<br />

Business Days after the applicable Valuation Day.<br />

#41587.5805076v6 10

Conversions The Shares of any class of the Swedish Growth Sub-Fund may be<br />

converted into Shares of any class of the Swedish Growth Sub-Fund<br />

or of another Sub-Fund according to the procedure described in this<br />

Prospectus on the basis of the respective Net Asset Values of the<br />

relevant Classes or Sub-Funds, calculated as of the relevant<br />

Valuation Day, provided that the request for conversion is received<br />

by the Fund not later than 16:00, Luxembourg time on the relevant<br />

Valuation Day. Requests received after 16:00, Luxembourg time on<br />

the relevant Valuation Day will be dealt with on the following<br />

Valuation Day.<br />

Reference Currency of<br />

the Swedish Growth Sub-<br />

Fund<br />

Frequency of the Net<br />

Asset Value Calculation<br />

and Valuation Day<br />

A conversion fee of up to zero point five per cent (0.5 %) of the Net<br />

Asset Value per Share of the relevant Class which shall be<br />

converted shall be levied.<br />

The Net Asset Value per Share of all the Classes of the Swedish<br />

Growth Sub-Fund will be calculated in SEK.<br />

The Net Asset Value per Share of the Swedish Growth Sub-Fund will<br />

be determined in Luxembourg under the overall responsibility of the<br />

Board of Directors as of every Business Day (the "Valuation Day")<br />

and has been determined for the first time on 1 September 2010.<br />

Investment Manager <strong>Alandsbanken</strong> Asset Management AB (Reg. number 59 32 00 -<br />

1745) has been appointed as Investment Manager for the Swedish<br />

Growth Sub-Fund. <strong>Alandsbanken</strong> Asset Management AB has been<br />

incorporated under the laws of Sweden. The registered office is at<br />

Stureplan 19, SE-107 81 Stockholm. On December 1, 2011, its<br />

capital and reserves amounted to SEK 493.000.000,-. <strong>Alandsbanken</strong><br />

Asset Management AB is an asset manager institution and is<br />

licensed under the Swedish law (2007:528), Chapter 2, Section 1,<br />

items 1, 2, 4 and 5.<br />

Investment Management<br />

Fee<br />

Listing on the<br />

Luxembourg Stock<br />

Exchange<br />

Publication of the Net<br />

Asset Value<br />

The Management Company will be entitled to receive, payable out of<br />

the assets attributable to the relevant Class of Shares of the Swedish<br />

Growth Sub-Fund, the following management fees calculated as of<br />

each Valuation Day on the basis of the Net Asset Value of the<br />

relevant Valuation Day and paid out monthly in arrears:<br />

� Class A (EUR) Shares: up to 2.5 percent per annum;<br />

� Class A (SEK) Shares: up to 2.5 percent per annum;<br />

� Class B (EUR) Shares: up to 2.5 percent per annum;<br />

� Class B (SEK) Shares: up to 2.5 percent per annum.<br />

The Shares of the Swedish Growth Sub-Fund are not listed on the<br />

Luxembourg Stock Exchange.<br />

The Net Asset Value per Share as well as the issue, redemption and<br />

conversion prices will be available at the registered office of the Fund<br />

and will be available on each Valuation Day.<br />

Taxation The Swedish Growth Sub-Fund is liable to an annual taxe<br />

d’abonnement in the Grand Duchy of Luxembourg, such tax being<br />

payable quarterly on the basis of the value of the aggregate net<br />

#41587.5805076v6 11

Investment Objective and<br />

Policy<br />

Investment Objective<br />

Investment Policy<br />

assets of the Swedish Growth Sub-Fund at the end of the relevant<br />

calendar quarter. The taxe d’abonnement shall be levied at the<br />

annual rate of 0.05% in respect of the assets of the Swedish Growth<br />

Sub-Fund attributable to Class A Shares and at the annual rate of<br />

0.01% in respect of the assets of the Swedish Growth Sub-Fund<br />

attributable to Class B Shares.<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Brig 6<br />

The investment objective of the Brig 6 Sub-Fund is to create positive<br />

returns with an annualized standard deviation of 6%. The Sub-Fund<br />

will pursue an investment policy similar to a traditional balanced<br />

fund, but will in addition make use of the possibilities for<br />

diversification and alpha generation within the restrictions of the Law<br />

of 17 December 2010.<br />

To achieve this objective, the Brig 6 Sub-Fund will uphold a stable ex<br />

ante portfolio volatility of 6% by investing in a well diversified portfolio<br />

of assets aiming to capture uncorrelated risk premiums. The portfolio<br />

composition, the individual weighting of the assets, will depend on<br />

the risk characteristics of the constituent assets. On an ancillary<br />

basis, the Brig 6 Sub-Fund may hold short positions via derivatives in<br />

one or more asset classes as referred to hereafter, based on the<br />

view from a tactical asset allocation strategy.<br />

The risk thus specified (measured as annualized historical standard<br />

deviation of daily returns or volatility) is an indication of the market<br />

risk involved in investing in the Brig 6 Sub-Fund. Inasmuch as<br />

historical volatility is a fair indication of the future risk, this measure<br />

implies that the annual return which the Brig 6 Sub-Fund can be<br />

expected to generate over time will range between -6% and 6%<br />

around the expected yearly return of the Net Asset Value in<br />

approximately 2/3 of the cases. The specified level of risk only takes<br />

into consideration market risk, as opposed to any other types of risk<br />

set forth in Part A chapter V. above.<br />

The main drivers for the Brig 6 Sub-Funds returns are based on<br />

diversification, constant risk, manager selection and tactical asset<br />

allocation. Diversification enables exposure to more risk premiums<br />

without increasing the overall portfolio risk, constant risk ensures the<br />

risk target to be met and yield an efficient risk allocation with respect<br />

to time, manager selection enables access to superior external<br />

portfolio managers and tactical asset allocation give possibilities to<br />

position the portfolio with respect to the macro environment.<br />

The main asset classes for the Brig 6 Sub-Fund are equities and<br />

fixed income. On an ancillary basis, the Brig 6 Sub-Fund may also<br />

invest in currencies. The decision between instruments in the same<br />

asset class is based on both cost efficiency and efficient portfolio<br />

management.<br />

The Brig 6 Sub-Fund may invest directly in the targeted main asset<br />

classes or through UCITS and also UCI´s and may also use financial<br />

derivative instruments for investment purposes and these may<br />

include, but are not limited to, futures, options and swaps. Financial<br />

#41587.5805076v6 12

Risk Profile / Risk<br />

Management<br />

Risk Profile<br />

Risk Management<br />

Calculation of global<br />

exposure<br />

Leverage<br />

Profile of Targeted<br />

Investors<br />

derivative instruments may also be used for hedging purposes.<br />

The Sub-Fund may not invest in single commodities derivative<br />

contracts.<br />

All instruments used in the Brig 6 Sub-Fund, directly or indirectly<br />

should have daily liquidity. However, holdings up to a maximum of<br />

10% of the Brig 6 Sub–Fund’s net assets may have a weekly<br />

liquidity.<br />

The Brig 6 Sub-Fund's long positions will be sufficiently liquid to<br />

cover at all times the Brig 6 Sub-Fund's obligations arising from its<br />

short positions.<br />

SEK is the reference currency of the Brig 6 Sub-Fund but assets<br />

may be denominated in other currencies and currency exposure may<br />

be hedged. The Sub-Fund will bear the cost involved with such<br />

currency hedging.<br />

Brig 6 Sub-Fund is only a suitable vehicle for investors who<br />

understand and can bear the high degree of economic risk involved<br />

in an investment therein, including the risk of loss of the entire<br />

amount invested, and believe that the investments is suitable based<br />

upon their financial needs, resources and objectives. An investment<br />

in Brig 6 Sub-Fund is not intended to be a complete investment<br />

program for an investor. Investment results may vary substantially<br />

over time. Past performance is not necessarily indicative of future<br />

results.<br />

In accordance with the Law of 2010 and the applicable regulations,<br />

in particular Circular CSSF 11/512, the Brig 6 Sub-Fund uses a riskmanagement<br />

process which enables it to assess the exposure of the<br />

Brig 6 Sub-Fund to market, liquidity and counterparty risks, and to all<br />

other risks, including operational risks, which are material for the Brig<br />

6 Sub-Fund.<br />

As part of this risk-management process and in view of the absolute<br />

return strategy of the Brig 6 Sub-Fund, the global exposure of the<br />

Brig 6 Sub-Fund is measured and controlled by the absolute Value at<br />

Risk (the "VaR") approach.<br />

The method used for the determination of the level of leverage of the<br />

Brig 6 Sub-Fund is the sum of the notionals for financial derivative<br />

instruments. The expected level of leverage may vary between 0%<br />

and 70% based on the net asset value of the Brig 6 Sub-Fund.<br />

Under certain circumstances the level of leverage might exceed the<br />

before mentioned range, without however exceeding a maximum of<br />

100%.<br />

The Brig 6 Sub-Fund suits investors who are seeking an alternative<br />

to a traditional bond portfolio. The Brig 6 Sub-Fund is suitable for<br />

investors who are seeking an investment horizon of 5 years or more.<br />

Techniques and Subject to the provisions set forth in Part A of this Prospectus, the<br />

#41587.5805076v6 13

Instruments Brig 6 Sub-Fund may engage, for hedging purposes, in various<br />

portfolio strategies to attempt to reduce certain risks of its<br />

investments. These strategies currently include the use of options,<br />

forward currency exchange contracts and futures contracts and<br />

options thereon, as described under the section "Investment<br />

Objectives, Policies, Techniques and Investment Restrictions" of Part<br />

A of this Prospectus. In addition, the Brig 6 Sub-Fund may also use,<br />

for the purpose of efficient portfolio management and proxy hedging,<br />

currency forwards, options and swaps, as well as listed futures (and<br />

related options) related to equities, bonds, interest rates and<br />

currencies. Participation in the options, forwards or futures markets<br />

and in currency exchange transactions involves investment risks and<br />

transaction costs to which the Brig 6 Sub-Fund would not be subject<br />

in the absence of the use of these strategies.<br />

Classes of Shares Shares of any Class within the Brig 6 Sub-Fund will be issued in<br />

registered book-entry form only.<br />

Within the Brig 6 Sub-Fund, Shares of Class A (SEK) and B (SEK)<br />

will be issued to all types of investors.<br />

Classes A (SEK) Shares are exclusively issued as capitalisation<br />

Shares.<br />

Classes B (SEK) Shares are exclusively issued as capitalisation<br />

Shares.<br />

Sales Charge After the initial subscription period as defined hereafter, the offering<br />

price per Share of each Class within the Brig 6 Sub-Fund<br />

corresponds to the Net Asset Value per Share of the relevant Class<br />

plus the sales charge as mentioned hereinafter.<br />

Minimum Investment and<br />

Holding<br />

The sales charge levied is a maximum of 5 per cent of the Net Asset<br />

Value per Share of the relevant Class, which shall revert to the<br />

relevant distributor.<br />

The sales charge will be levied for subscriptions during the Initial<br />

Subscription Period as well as for subscriptions after the Initial<br />

Subscription Period.<br />

Class A Shares:<br />

The minimum initial investment and holding requirement per investor<br />

will be as follows:<br />

� Class A (SEK) Shares: SEK 200.-<br />

� Class B ( SEK) Shares no minimum limit<br />

A redemption request which would reduce the value at such time of<br />

any holding to below such amount may be treated as a request to<br />

redeem the whole of such shareholding. The Board of Directors may<br />

waive the minimum amounts for the initial and/or subsequent<br />

subscriptions at their sole discretion.<br />

The minimum subsequent investment requirement per investor will<br />

be as follows:<br />

#41587.5805076v6 14

� Class A (SEK) Shares: SEK 200.-<br />

� Class B ( SEK) Shares no minimum limit<br />

Subscriptions Shares of any Class within the Brig 6 Sub-Fund may be subscribed<br />

between 3 February 2012 and 24 February 2012 (the “Initial<br />

Subscription Period”) for a subscription price of SEK 200 plus the<br />

sales charge mentioned hereabove.<br />

Redemptions<br />

Conversions<br />

Reference Currency of<br />

the Brig 6 Sub-Fund<br />

Frequency of the Net<br />

Asset Value Calculation<br />

and Valuation Day<br />

After the Initial Subscription Period, investors whose applications are<br />

accepted will be allotted Shares issued on the basis of the Net Asset<br />

Value per Share determined as of the Valuation Day (as defined<br />

below), provided that such application is received by the Fund not<br />

later than 12.00 noon, Luxembourg time, one business day<br />

preceding the relevant Valuation Day. Applications received after<br />

12.00 noon, Luxembourg time, on the relevant Valuation Day, will be<br />

dealt with on the following Valuation Day.<br />

Payment for subscriptions must be made within three Business Days<br />

after the applicable Valuation Day.<br />

Shareholders whose applications for redemption are accepted will<br />

have their Shares redeemed on any Valuation Day provided that the<br />

applications have been received by the Fund prior to 12.00 noon,<br />

Luxembourg time, one business day preceding the relevant<br />

Valuation Day. Applications received after 12.00 noon, Luxembourg<br />

time, on the relevant Valuation Day, will be dealt with on the<br />

following Valuation Day.<br />

The redemption price shall be equal to the Net Asset Value per<br />

Share of the Brig 6 Sub-Fund on the relevant Valuation Day.<br />

The redemption price shall be paid no later than three Business<br />

Days after the applicable Valuation Day.<br />

The Shares of any class of the Brig 6 Sub-Fund may be converted<br />

into Shares of any class of the Brig 6 Sub-Fund or of another Sub-<br />

Fund according to the procedure described in the Prospectus on the<br />

basis of the respective Net Asset Values of the relevant Classes or<br />

Sub-Funds, calculated as of the relevant Valuation Day, provided<br />

that the request for conversion is received by the Fund not later than<br />

12.00 noon, Luxembourg time, one business day preceding the<br />

relevant Valuation Day. Requests received after 12.00 noon,<br />

Luxembourg time, on the relevant Valuation Day will be dealt with on<br />

the following Valuation Day. No conversion fee shall be levied,<br />

except as stated in Part A of the full Prospectus.<br />

The Reference Currency of the Brig 6 Sub-Fund will be the Swedish<br />

Krona (SEK).<br />

The Net Asset Value per Share of the Brig 6 Sub-Fund will be<br />

determined in Luxembourg under the overall responsibility of the<br />

Board of Directors as of every Business Day (the "Valuation Day")<br />

and for the first time on 1 March 2012.<br />

Investment Manager <strong>Ålandsbanken</strong> Asset Management AB (Reg. number 59 32 00 -<br />

#41587.5805076v6 15

Management Company<br />

Fee<br />

1745) has been appointed as Investment Manager for the Brig 6<br />

Sub-Fund. <strong>Ålandsbanken</strong> Asset Management AB has been<br />

incorporated under the laws of Sweden. The registered office is at<br />

Stureplan 19, SE-107 81 Stockholm. On December 1, 2011, its<br />

capital and reserves amounted to SEK 493.000.000.-. <strong>Ålandsbanken</strong><br />

Asset Management AB is an asset manager institution and is<br />

licensed under the Swedish law (2007:528), Chapter 2, Section 1,<br />

items 1, 2, 4 and 5.<br />

The Management Company will be entitled to receive, payable out of<br />

the assets attributable to the relevant Class of Shares of the Brig 6<br />

Sub-Fund, the following management fees calculated as of each<br />

Valuation Day on the basis of the Net Asset Value of the relevant<br />

Valuation Day and paid out monthly in arrears:<br />

.<br />

� Class A (SEK) Shares: up to 2,0 percent per annum<br />

� Class B (SEK) Shares: up to 2,0 percent per annum<br />

Performance Fee In addition, the Management Company will receive from the Fund,<br />

payable out of the assets attributable to the relevant Class of Shares<br />

of the Brig 6 Sub-Fund, a performance fee (the “Performance Fee”)<br />

calculated as follows:<br />

The Performance Fee will be calculated daily in respect of each<br />

Valuation Day (a “Calculation Period”). The Performance Fee shall<br />

be subject to a high watermark principle and will be equal to 20<br />

percent of the out performance for the Brig 6 Sub-Fund collectively of<br />

the Net Asset Value per Share against the OMRX T-bond Total<br />

Return index (Swedish Government Bond Index Total Returns)<br />

measured in SEK (the “Hurdle”) on each Valuation Day.<br />

The Performance Fee is calculated on the basis of a relative<br />

performance index (“RPI”). Such RPI is calculating the relative daily<br />

performance of the Fund as compared to the Hurdle on a daily basis.<br />

The RPI index is calculated as follows:<br />

RPI = 100*(1+ RFund_1 – RHurdle_1)* (1+ RFund_2 – RHurdle_2)*…* (1+<br />

RFund_N – RHurdle_N)<br />

Where RFund_i is the daily return for the Sub-Fund net of all fees on<br />

day i and RHurdle_i is the daily performance of the Hurdle on day i.<br />

The Performance Fee that will be charged will amount to 20 % of the<br />

performance of the RPI, subject to a High Water Mark as defined<br />

below.<br />

The Performance Fee will be charged to the Brig 6 Sub-Fund even if<br />

the performance of the Brig 6 Sub-Fund is negative in absolute<br />

terms, but the Brig 6 Sub-Fund is nevertheless still outperforming the<br />

Hurdle.<br />

The use of the high watermark ensures that the performance fee is<br />

charged only in case that the shares outperform in relation to the<br />

hurdle and that the highest RPI is reached since the last reset. A<br />

performance fee will not be charged until any previous losses since<br />

the last reset are recovered.<br />

#41587.5805076v6 16

Publication of the Net<br />

Asset Value<br />

Taxation<br />

Taxation<br />

The High Water Mark on the RPI after Performance Fee will be reset<br />

quarterly with a 12 month rear view window, using the highest RPI<br />

after Performance Fee per Share during that 12 month period. The<br />

first reset of the High Watermark will be done at the nearest calendar<br />

quarter, five quarters after the launch of the Brig 6 Sub-Fund.<br />

The Performance Fee will be crystallised for every Valuation Day<br />

and paid to the Management Company.<br />

The Performance Fee will be calculated and accrued as an expense<br />

of the relevant Class of Shares as of each Valuation Day and will be<br />

payable to the Management Company monthly in arrears.<br />

The Performance Fee in respect to each Calculation Period will be<br />

calculated by reference to the Net Asset Value calculated on each<br />

Valuation Day after deduction for management fees.<br />

The use of a high watermark ensures that the Performance Fee is<br />

charged only to those shares that have outperformed the Hurdle and<br />

reached the highest RPI since the last payment of the Performance<br />

Fee and investors will not be charged a Performance Fee until any<br />

previous losses since the last reset are recovered , within the 12<br />

month period.<br />

The Performance Fee is paid collectively from the Brig 6 Sub-fund to<br />

the Management Company, with the effect that every shareholder<br />

will pay the same Performance Fee per Share and all shareholders<br />

will have the same Net Asset Value per Share. This could cause<br />

differences between different shareholders going in and out of the<br />

Brig 6 Sub-Fund at different times.<br />

The examples in the appendix 1 will show different scenarios for<br />

different shareholders with possible market conditions.<br />

The Net Asset Value per Share as well as the issue, redemption and<br />

conversion prices will be available at the registered office of the Fund<br />

and will be available on each Valuation Day.<br />

The Brig 6 Sub-Fund is liable to a tax of 0.05% per annum of its Net<br />

Asset Value, such tax being payable quarterly on the basis of the<br />

value of the aggregate net assets of the Brig 6 Sub-Fund at the end<br />

of the relevant calendar quarter.<br />

FINANCIAL INFORMATION<br />

The following summary is based on the law and practice currently<br />

applicable in the Grand Duchy of Luxembourg and is subject to<br />

changes therein.<br />

A. Taxation of the Fund in Luxembourg<br />

The Fund is not liable to any Luxembourg tax on profits or income.<br />

The Fund is, however, liable in Luxembourg to a tax of 0.05% per<br />

annum of its Net Asset Value, such tax being payable quarterly on<br />

#41587.5805076v6 17

Fees of the Custodian,<br />

Paying, Domiciliary,<br />

the basis of the value of the aggregate net assets of the Sub-Funds<br />

at the end of the relevant calendar quarter. No stamp duty or other<br />

tax is payable in Luxembourg on the issue of Shares. No<br />

Luxembourg tax is payable on the realised capital appreciation of the<br />

assets of the Fund.<br />

General<br />

Dividends and interest received by the Fund on its investments may<br />

be subject to non-recoverable withholding or other taxes in the<br />

countries of origin.<br />

B. Luxembourg Taxation of Shareholders<br />

Under current legislation, shareholders are not subject to any capital<br />

gains or income tax in Luxembourg (except for (i) those domiciled,<br />

resident or having a permanent establishment in Luxembourg or (ii)<br />

non-residents of Luxembourg who hold (personally or by attribution)<br />

more than 10% of the Shares of the Fund and who dispose of all or<br />

part of their holdings within 6 months from the date of acquisition or<br />

(iii) in some limited cases, some former residents of Luxembourg<br />

who hold (personally or by attribution) more than 10% of the Shares<br />

of the Fund).<br />

General<br />

It is expected that shareholders in the Fund will be resident for tax<br />

purposes in many different countries. Consequently, no attempt is<br />

made in this Prospectus to summarize the taxation consequences for<br />

each investor of subscribing, converting, holding or redeeming or<br />

otherwise acquiring or disposing of Shares in the Fund. These<br />

consequences will vary in accordance with the law and practice<br />

currently in force in a shareholder's country of citizenship, residence,<br />

domicile or incorporation and with his personal circumstances.<br />

On 3 June 2003, the EU Council of Economic and Finance Ministers<br />

adopted a new directive regarding the taxation on savings income. It<br />

has been transposed into Luxembourg law by the 21 June 2005 Law.<br />

Under the new regulations, each Member State is required to provide<br />

to the tax authorities of another Member State details of payment of<br />

interest or other similar income (including in certain circumstances<br />

interest accrued in the proceeds of unit redemptions) paid by a<br />

person within its jurisdiction to an individual resident in that other<br />

member State. However, Austria, Belgium and Luxembourg may<br />

instead apply a withholding system for a transitional period in relation<br />

to such payments, in lieu of exchange of information. The rate of<br />

withholding tax is of 35%.<br />

Investors should inform themselves of, and when appropriate<br />

consult their professional advisers on, the possible tax<br />

consequences of subscribing for, buying, holding, converting,<br />

redeeming or otherwise disposing of Shares under the laws of<br />

their country of citizenship, residence, domicile or<br />

incorporation.<br />

The Custodian, Paying, domiciliary, administrative, registrar and<br />

transfer agent is entitled to receive out of the assets of each Sub-<br />

#41587.5805076v6 18

Administrative, Registrar<br />

and Transfer Agent<br />

Fund a fee of up to 0.30 % per annum of the average quarterly Net<br />

Asset Value thereof during the relevant quarter and payable<br />

quarterly in arrears, subject to a minimum that will not exceed an<br />

amount of EUR 50,000 per annum. In addition the Custodian Paying,<br />

domiciliary, administrative, registrar and transfer agent is entitled to<br />

be reimbursed by the Fund for its reasonable out-of-pocket expenses<br />

and disbursements and for the charges of any correspondents.<br />

COMMERCIAL INFORMATION<br />

Distribution Policy Within each Sub-Fund, Shares may be issued as capitalisation<br />

Shares and/or as distribution Shares. The features of the Shares<br />

available within each Sub-Fund are set out in Part B of the full<br />

Prospectus.<br />

Net Asset Value<br />

Information<br />

The board of directors of the Fund may propose to the annual<br />

general meeting of Shareholders to decide the payment of a cash<br />

dividend for the different Sub-Funds. Distributions may be made out<br />

of income, realised and unrealised capital gains, provided however<br />

that no distribution may be made if, as a result, the Net Asset Value<br />

of the Fund would fall below the equivalent of EUR 1,250,000.<br />

The Fund may thus distribute its net income on investments, allowing<br />

for realized or unrealized depreciations and realized or unrealized<br />

gains on capital. The board of directors of the Fund shall normally<br />

make the payment of these dividends after the closing of the Fund’s<br />

accounts. However, it may also decide to pay interim dividends.<br />

Dividends not claimed within five years of their due date will lapse<br />

and revert to the relevant Class within the relevant Sub-Fund.<br />

No interest shall be paid on a distribution declared by the Fund and<br />

kept by it at the disposal of its beneficiary.<br />

The Net Asset Value per Share of each class in respect of each Sub-<br />

Fund shall be determined in the Reference Currency of that class or<br />

Sub-Fund.<br />

The Net Asset Value per share in respect of each Sub-Fund is<br />

determined in Luxembourg under the overall responsibility of the<br />

Board of Directors as of every Business Day.<br />

The Net Asset Value per share of each Sub-Fund is available at the<br />

registered office of the Fund.<br />

Further Information For further information please do not hesitate to contact:<br />

Alpha Management Company S.A.<br />

16, rue Jean Pierre Brasseur<br />

L-1258 Luxembourg<br />

Grand-Duchy of Luxembourg<br />

#41587.5805076v6 19

Historical performance *)<br />

30.00%<br />

25.00%<br />

20.00%<br />

15.00%<br />

10.00%<br />

5.00%<br />

0.00%<br />

Historical Performance as at 31.12.2010<br />

Nordic Growth Sub-Fund<br />

31.08.10 ‐<br />

31.12.10<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Nordic<br />

Growth Class A (EUR) Share (in<br />

EUR)<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Nordic<br />

Growth Class A (SEK) Share (in SEK)<br />

Nordic VINX Index, VINX Bench<br />

EUR NI Index (in EUR)<br />

Performance of Class A (EUR) Share (in %)<br />

- from 31.08.2010 (launch date) to 31.12.2010 25.53<br />

Performance of Class A (SEK) Share (in %)<br />

- from 31.08.2010 (launch date) to 31.12.2010 20.80<br />

*) The historical performance is not an indication of future results.<br />

#41587.5805076v6 20

Historical performance *)<br />

30.00%<br />

25.00%<br />

20.00%<br />

15.00%<br />

10.00%<br />

5.00%<br />

0.00%<br />

Swedish Growth Sub-Fund<br />

31.08.10 ‐<br />

31.12.10<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Swedish<br />

Growth Class A (EUR) Share (in<br />

EUR)<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Swedish<br />

Growth Class A (SEK) Share (in SEK)<br />

Scandinavian Information<br />

Exchange Portfolio Return Index (in<br />

SEK)<br />

Performance of Class A (EUR) Share (in %)<br />

- from 31.08.2010 (launch date) to 31.12.2010 26.67<br />

Performance of Class A (SEK) Share (in %)<br />

- from 31.08.2010 (launch date) to 31.12.2010 21.88<br />

*) The historical performance is not an indication of future results.<br />

#41587.5805076v6 21

Historical performance *)<br />

30.00%<br />

20.00%<br />

10.00%<br />

0.00%<br />

‐10.00%<br />

‐20.00%<br />

‐30.00%<br />

Historical Performance as at 31.12.2011<br />

31.08.10 ‐<br />

31.12.10<br />

Nordic Growth Sub-Fund<br />

01.01.11 ‐<br />

31.12.11<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Nordic<br />

Growth Class A (EUR) Share (in<br />

EUR)<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Nordic<br />

Growth Class A (SEK) Share (in SEK)<br />

Nordic VINX Index, VINX Bench<br />

EUR NI Index (in EUR)<br />

Performance of Class A (EUR) Share (in %)<br />

- as at 31.12.2011 -22.62<br />

- from 31.08.2010 (launch date) to 31.12.2010 25.53<br />

Performance of Class A (SEK) Share (in %)<br />

- as at 31.12.2011 -23.54<br />

- from 31.08.2010 (launch date) to 31.12.2010 20.80<br />

*) The historical performance is not an indication of future results.<br />

#41587.5805076v6 22

Historical performance *)<br />

30.00%<br />

20.00%<br />

10.00%<br />

0.00%<br />

‐10.00%<br />

‐20.00%<br />

‐30.00%<br />

31.08.10 ‐<br />

31.12.10<br />

Swedish Growth Sub-Fund<br />

01.01.11 ‐<br />

31.12.11<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Swedish<br />

Growth Class A (EUR) Share (in<br />

EUR)<br />

<strong>Alandsbanken</strong> <strong>SICAV</strong> : Swedish<br />

Growth Class A (SEK) Share (in SEK)<br />

Scandinavian Information<br />

Exchange Portfolio Return Index (in<br />

SEK)<br />

Performance of Class A (EUR) Share (in %)<br />

- as at 31.12.2011 -20.19<br />

- from 31.08.2010 (launch date) to 31.12.2010 26.67<br />

Performance of Class A (SEK) Share (in %)<br />

- as at 31.12.2011 -21.11<br />

- from 31.08.2010 (launch date) to 31.12.2010 21.88<br />

*) The historical performance is not an indication of future results.<br />

#41587.5805076v6 23