2. Int'l Tax Update Significant Developments in the Global Tax System - Andrew Seidler

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

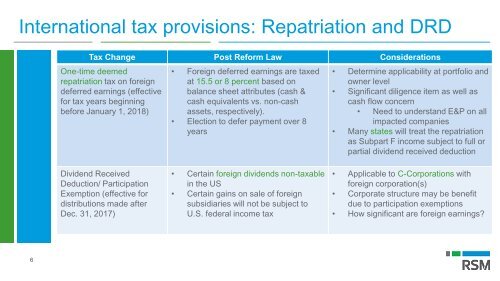

International tax provisions: Repatriation and DRD<br />

<strong>Tax</strong> Change Post Reform Law Considerations<br />

One-time deemed<br />

repatriation tax on foreign<br />

deferred earn<strong>in</strong>gs (effective<br />

for tax years beg<strong>in</strong>n<strong>in</strong>g<br />

before January 1, 2018)<br />

• Foreign deferred earn<strong>in</strong>gs are taxed<br />

at 15.5 or 8 percent based on<br />

balance sheet attributes (cash &<br />

cash equivalents vs. non-cash<br />

assets, respectively).<br />

• Election to defer payment over 8<br />

years<br />

• Determ<strong>in</strong>e applicability at portfolio and<br />

owner level<br />

• <strong>Significant</strong> diligence item as well as<br />

cash flow concern<br />

• Need to understand E&P on all<br />

impacted companies<br />

• Many states will treat <strong>the</strong> repatriation<br />

as Subpart F <strong>in</strong>come subject to full or<br />

partial dividend received deduction<br />

Dividend Received<br />

Deduction/ Participation<br />

Exemption (effective for<br />

distributions made after<br />

Dec. 31, 2017)<br />

• Certa<strong>in</strong> foreign dividends non-taxable<br />

<strong>in</strong> <strong>the</strong> US<br />

• Certa<strong>in</strong> ga<strong>in</strong>s on sale of foreign<br />

subsidiaries will not be subject to<br />

U.S. federal <strong>in</strong>come tax<br />

• Applicable to C-Corporations with<br />

foreign corporation(s)<br />

• Corporate structure may be benefit<br />

due to participation exemptions<br />

• How significant are foreign earn<strong>in</strong>gs?<br />

6