2. Int'l Tax Update Significant Developments in the Global Tax System - Andrew Seidler

Base Erosion Anti-abuse Tax BEAT

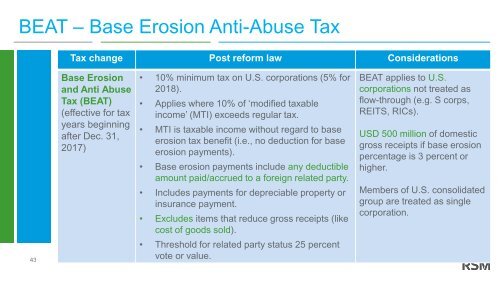

BEAT – Base Erosion Anti-Abuse Tax Tax change Post reform law Considerations 43 Base Erosion and Anti Abuse Tax (BEAT) (effective for tax years beginning after Dec. 31, 2017) • 10% minimum tax on U.S. corporations (5% for 2018). • Applies where 10% of ‘modified taxable income’ (MTI) exceeds regular tax. • MTI is taxable income without regard to base erosion tax benefit (i.e., no deduction for base erosion payments). • Base erosion payments include any deductible amount paid/accrued to a foreign related party. • Includes payments for depreciable property or insurance payment. • Excludes items that reduce gross receipts (like cost of goods sold). • Threshold for related party status 25 percent vote or value. BEAT applies to U.S. corporations not treated as flow-through (e.g. S corps, REITS, RICs). USD 500 million of domestic gross receipts if base erosion percentage is 3 percent or higher. Members of U.S. consolidated group are treated as single corporation.

- Page 1 and 2: Helping with tax challenges whereve

- Page 3 and 4: Overview BEPS Global Tax Reform US

- Page 5 and 6: Corporate changes Tax change Post r

- Page 7 and 8: Corporate changes Tax change Post r

- Page 9 and 10: UK Planning Considerations: NOL Lim

- Page 11 and 12: Withholding Taxes After Brexit •

- Page 13 and 14: Withholding Taxes and the Digital E

- Page 15 and 16: Common Consolidated Corporate Tax B

- Page 17 and 18: Digital Economy Interim Measure Exa

- Page 19 and 20: BEPS Measures: Anti-hybrid rules In

- Page 21 and 22: Anti-hybrid provisions

- Page 23 and 24: US Hybrid Counteraction The Act den

- Page 25 and 26: UK approach compared to US Type Mis

- Page 27 and 28: Interest Limitation

- Page 29 and 30: Interest deduction - comparison wit

- Page 31 and 32: Global Intangible Low Taxed Income

- Page 33 and 34: GILTI Example Calculation GILTI Cal

- Page 35 and 36: Foreign Derived Intangible Income F

- Page 37 and 38: FDII Example US Corp US sales $500

- Page 39 and 40: FDII Example Step 4: Determine Rati

- Page 41: UK Planning Considerations: FDII Pu

- Page 45 and 46: UK Planning Considerations: BEAT In

- Page 47 and 48: Brexit Monitor Visit https://www.rs

- Page 49: THANK YOU

BEAT – Base Erosion Anti-Abuse <strong>Tax</strong><br />

<strong>Tax</strong> change Post reform law Considerations<br />

43<br />

Base Erosion<br />

and Anti Abuse<br />

<strong>Tax</strong> (BEAT)<br />

(effective for tax<br />

years beg<strong>in</strong>n<strong>in</strong>g<br />

after Dec. 31,<br />

2017)<br />

• 10% m<strong>in</strong>imum tax on U.S. corporations (5% for<br />

2018).<br />

• Applies where 10% of ‘modified taxable<br />

<strong>in</strong>come’ (MTI) exceeds regular tax.<br />

• MTI is taxable <strong>in</strong>come without regard to base<br />

erosion tax benefit (i.e., no deduction for base<br />

erosion payments).<br />

• Base erosion payments <strong>in</strong>clude any deductible<br />

amount paid/accrued to a foreign related party.<br />

• Includes payments for depreciable property or<br />

<strong>in</strong>surance payment.<br />

• Excludes items that reduce gross receipts (like<br />

cost of goods sold).<br />

• Threshold for related party status 25 percent<br />

vote or value.<br />

BEAT applies to U.S.<br />

corporations not treated as<br />

flow-through (e.g. S corps,<br />

REITS, RICs).<br />

USD 500 million of domestic<br />

gross receipts if base erosion<br />

percentage is 3 percent or<br />

higher.<br />

Members of U.S. consolidated<br />

group are treated as s<strong>in</strong>gle<br />

corporation.