2. Int'l Tax Update Significant Developments in the Global Tax System - Andrew Seidler

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

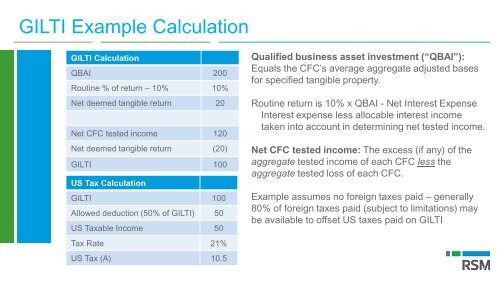

GILTI Example Calculation<br />

GILTI Calculation<br />

QBAI 200<br />

Rout<strong>in</strong>e % of return – 10% 10%<br />

Net deemed tangible return 20<br />

Net CFC tested <strong>in</strong>come 120<br />

Net deemed tangible return (20)<br />

GILTI 100<br />

US <strong>Tax</strong> Calculation<br />

GILTI 100<br />

Allowed deduction (50% of GILTI) 50<br />

US <strong>Tax</strong>able Income 50<br />

<strong>Tax</strong> Rate 21%<br />

US <strong>Tax</strong> (A) 10.5<br />

Qualified bus<strong>in</strong>ess asset <strong>in</strong>vestment (“QBAI”):<br />

Equals <strong>the</strong> CFC’s average aggregate adjusted bases<br />

for specified tangible property.<br />

Rout<strong>in</strong>e return is 10% x QBAI - Net Interest Expense<br />

Interest expense less allocable <strong>in</strong>terest <strong>in</strong>come<br />

taken <strong>in</strong>to account <strong>in</strong> determ<strong>in</strong><strong>in</strong>g net tested <strong>in</strong>come.<br />

Net CFC tested <strong>in</strong>come: The excess (if any) of <strong>the</strong><br />

aggregate tested <strong>in</strong>come of each CFC less <strong>the</strong><br />

aggregate tested loss of each CFC.<br />

Example assumes no foreign taxes paid – generally<br />

80% of foreign taxes paid (subject to limitations) may<br />

be available to offset US taxes paid on GILTI