2. Int'l Tax Update Significant Developments in the Global Tax System - Andrew Seidler

Interest deduction limitations Tax Change New Interest Deduction Limitation Post Reform Law • Limits the net interest expense deduction to 30 percent of adjusted taxable income (ATI) • For 2018 through 2021, ATI will approximate earnings before interest, taxes, depreciation and amortization (EBITDA) • After 2021, ATI will approximate earnings before interest and taxes (EBIT) • Disallowed interest generally may be carried forward indefinitely • Limitation does not apply to businesses with an average gross receipts of ≤$25 million USD and certain agricultural, farming and real estate businesses • “Net interest expense” so back to back loans remain viable for intercompany financing activities • Real property trade or businesses that use ADS and farming businesses may elect not to be subject to the business interest deduction limitation 28

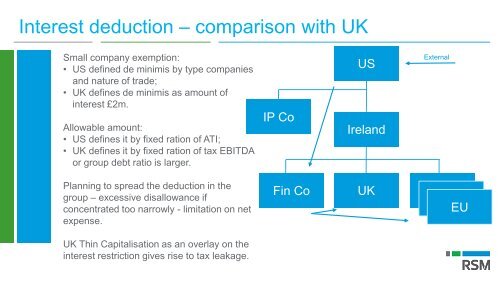

Interest deduction – comparison with UK Small company exemption: • US defined de minimis by type companies and nature of trade; • UK defines de minimis as amount of interest £2m. Allowable amount: • US defines it by fixed ration of ATI; • UK defines it by fixed ration of tax EBITDA or group debt ratio is larger. IP Co US Ireland Non-US Affiliate External Planning to spread the deduction in the group – excessive disallowance if concentrated too narrowly - limitation on net expense. Fin Co UK EU EUEU UK Thin Capitalisation as an overlay on the interest restriction gives rise to tax leakage.

- Page 1 and 2: Helping with tax challenges whereve

- Page 3 and 4: Overview BEPS Global Tax Reform US

- Page 5 and 6: Corporate changes Tax change Post r

- Page 7 and 8: Corporate changes Tax change Post r

- Page 9 and 10: UK Planning Considerations: NOL Lim

- Page 11 and 12: Withholding Taxes After Brexit •

- Page 13 and 14: Withholding Taxes and the Digital E

- Page 15 and 16: Common Consolidated Corporate Tax B

- Page 17 and 18: Digital Economy Interim Measure Exa

- Page 19 and 20: BEPS Measures: Anti-hybrid rules In

- Page 21 and 22: Anti-hybrid provisions

- Page 23 and 24: US Hybrid Counteraction The Act den

- Page 25 and 26: UK approach compared to US Type Mis

- Page 27: Interest Limitation

- Page 31 and 32: Global Intangible Low Taxed Income

- Page 33 and 34: GILTI Example Calculation GILTI Cal

- Page 35 and 36: Foreign Derived Intangible Income F

- Page 37 and 38: FDII Example US Corp US sales $500

- Page 39 and 40: FDII Example Step 4: Determine Rati

- Page 41 and 42: UK Planning Considerations: FDII Pu

- Page 43 and 44: BEAT - Base Erosion Anti-Abuse Tax

- Page 45 and 46: UK Planning Considerations: BEAT In

- Page 47 and 48: Brexit Monitor Visit https://www.rs

- Page 49: THANK YOU

Interest deduction – comparison with UK<br />

Small company exemption:<br />

• US def<strong>in</strong>ed de m<strong>in</strong>imis by type companies<br />

and nature of trade;<br />

• UK def<strong>in</strong>es de m<strong>in</strong>imis as amount of<br />

<strong>in</strong>terest £2m.<br />

Allowable amount:<br />

• US def<strong>in</strong>es it by fixed ration of ATI;<br />

• UK def<strong>in</strong>es it by fixed ration of tax EBITDA<br />

or group debt ratio is larger.<br />

IP Co<br />

US<br />

Ireland<br />

Non-US Affiliate<br />

External<br />

Plann<strong>in</strong>g to spread <strong>the</strong> deduction <strong>in</strong> <strong>the</strong><br />

group – excessive disallowance if<br />

concentrated too narrowly - limitation on net<br />

expense.<br />

F<strong>in</strong> Co<br />

UK<br />

EU EUEU<br />

UK Th<strong>in</strong> Capitalisation as an overlay on <strong>the</strong><br />

<strong>in</strong>terest restriction gives rise to tax leakage.