2. Int'l Tax Update Significant Developments in the Global Tax System - Andrew Seidler

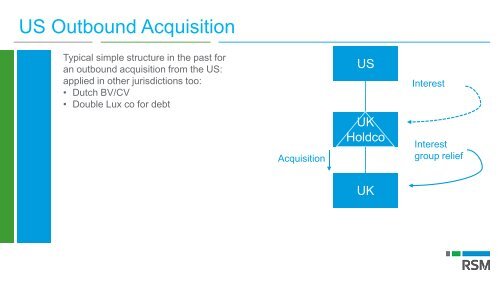

US Outbound Acquisition Typical simple structure in the past for an outbound acquisition from the US: applied in other jurisdictions too: • Dutch BV/CV • Double Lux co for debt Acquisition US UK Holdco Non-US Affiliate Interest Interest group relief UK

Anti-hybrid provisions

- Page 1 and 2: Helping with tax challenges whereve

- Page 3 and 4: Overview BEPS Global Tax Reform US

- Page 5 and 6: Corporate changes Tax change Post r

- Page 7 and 8: Corporate changes Tax change Post r

- Page 9 and 10: UK Planning Considerations: NOL Lim

- Page 11 and 12: Withholding Taxes After Brexit •

- Page 13 and 14: Withholding Taxes and the Digital E

- Page 15 and 16: Common Consolidated Corporate Tax B

- Page 17 and 18: Digital Economy Interim Measure Exa

- Page 19: BEPS Measures: Anti-hybrid rules In

- Page 23 and 24: US Hybrid Counteraction The Act den

- Page 25 and 26: UK approach compared to US Type Mis

- Page 27 and 28: Interest Limitation

- Page 29 and 30: Interest deduction - comparison wit

- Page 31 and 32: Global Intangible Low Taxed Income

- Page 33 and 34: GILTI Example Calculation GILTI Cal

- Page 35 and 36: Foreign Derived Intangible Income F

- Page 37 and 38: FDII Example US Corp US sales $500

- Page 39 and 40: FDII Example Step 4: Determine Rati

- Page 41 and 42: UK Planning Considerations: FDII Pu

- Page 43 and 44: BEAT - Base Erosion Anti-Abuse Tax

- Page 45 and 46: UK Planning Considerations: BEAT In

- Page 47 and 48: Brexit Monitor Visit https://www.rs

- Page 49: THANK YOU

US Outbound Acquisition<br />

Typical simple structure <strong>in</strong> <strong>the</strong> past for<br />

an outbound acquisition from <strong>the</strong> US:<br />

applied <strong>in</strong> o<strong>the</strong>r jurisdictions too:<br />

• Dutch BV/CV<br />

• Double Lux co for debt<br />

Acquisition<br />

US<br />

UK<br />

Holdco<br />

Non-US Affiliate<br />

Interest<br />

Interest<br />

group relief<br />

UK