ExtraMileIssue10

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2018 ISSUE 2<br />

NOTES FROM NATIONAL INTERSTATE INSURANCE FOR OUR PARTNERS IN RISK<br />

For some companies<br />

THERE IS<br />

NO DRIVER<br />

SHORTAGE.<br />

See page 16 for ideas to increase driver retention and make<br />

your company a place where drivers want to work.<br />

Economic Outlook<br />

by Bob Costello<br />

on page 24

Contents2018 ISSUE 2<br />

LETTER FROM THE PRESIDENT AND CEO 3<br />

EXTRA MILERS JOE DARWAL, MEGAN BENDER, HOLLY SPEARS AND JELENA POVICH 4<br />

5 WAYS TO INFLUENCE YOUR INSURANCE RENEWAL 9<br />

EXECUTIVE SPOTLIGHT: STEVE WINBORN 10<br />

PRODUCT SPOTLIGHT: WASTECAP 12<br />

INSURANCE IN PLAIN ENGLISH: REINSURANCE 101 14<br />

While the team at National Interstate works hard every day to provide an insurance experience built around you, it is not always easy to<br />

provide world-class customer service every day to every customer. But, I like to think that as a company, we do often get things right, and in<br />

the long run, that extra effort really matters. Which is why I was so thrilled to recently receive the following message from one of our longtime<br />

customers, Dennis Altnow, CEO of Tiger Lines. Dennis forwarded me an email he sent to an insurance broker who was soliciting his business.<br />

With his permission, I’d like to share it here as Dennis captures the essence of what our 700+ team members seek to provide every day. Thank<br />

you, Dennis – I can’t think of a better testimonial, and thank you to all of our hardworking National Interstate employees who go the extra mile<br />

every day.<br />

Sincerely,<br />

Letter from the President and CEO<br />

TONY MERCURIO<br />

THE SECRET SAUCE TO INCREASING<br />

DRIVER RETENTION 16<br />

Dear (insurance broker):<br />

Tony Mercurio<br />

President & CEO<br />

INDUSTRY & ECONOMIC OUTLOOK BY BOB COSTELLO 24<br />

TRENDING TECHNOLOGY 26<br />

WORD SEARCH 28<br />

Thank you for reaching out to us!<br />

Your offer of a cheaper alternative, in my humble opinion and experience, may not be cheaper nor sustainable in the long term. As you are<br />

aware, there is a significant difference between low price, and lowest cost; between market pricing, and risk management.<br />

Allow me to clarify!<br />

Previous to our current arrangement, since 1977, I have participated in the annual insurance rate shopping exercise which was neither<br />

productive nor cost effective. We were constantly subject to the wild ride of the insurance market cycles.<br />

Subscriptions:<br />

In contrast to this circus, our rates have remained consistent for almost a decade on the front end yet have contributed significantly to the<br />

bottom line on the back end through our captive distributions. This arrangement has allowed us to regard our Risk Program as a profit center<br />

rather than a necessary evil. These distributions have only been made possible through the Safety Culture we have been a part of via consistent<br />

risk data feedback, workshops, captive group advisory board and safety committees (meeting four times per year), peer group feedback and<br />

insightful but intense quarterly claims meetings with our local broker. All together, these activities have allowed us to focus on what really<br />

matters; controlling our losses and running our business efficiently while minimizing our risks.<br />

Extra Mile magazine is a free, quarterly publication offered by National Interstate Insurance Company in<br />

support of its customers. To subscribe, call 800-929-1500 or email amanda.genther@natl.com.<br />

Publisher:<br />

Established in 1989, National Interstate Insurance is one of the leading specialty property and casualty<br />

insurance companies in the country. Offering more than 30 different insurance products, including traditional<br />

insurance, innovative alternative risk transfer (ART) programs for commercial companies and insurance for<br />

specialty vehicle owners. Its customized solutions are made possible by its talented and dedicated team<br />

members. National Interstate employs over 700 employees in offices in Northeast Ohio, HI, and MO.<br />

© 2018 National Interstate Insurance Company<br />

natl.com/facebook<br />

natl.com/linkedin<br />

natl.com/twitter<br />

natl.com/youtube<br />

Editorial Contributors:<br />

Mark Adriance<br />

Norris Beren<br />

Bob Costello<br />

Lauren Fronczek<br />

Amanda Genther<br />

Jody Jordan<br />

Tony Mercurio<br />

Chris Mikolay<br />

Kate Mitchell<br />

The service we receive from our broker at Dillon Risk is world-class with a local touch. Our carrier is personal to the point where I am afforded<br />

biannual meetings with National Interstate’s CEO and his executive staff. That would be impossible within any other insurance carrier scenario.<br />

Once again, thank you for your interest in Tiger Lines. I really do understand and appreciate that there is a huge place for many insurance<br />

brokers in the insurance market place. However, as noted, we have been with National Interstate and our insurance broker since 2007 and,<br />

because of the above reasoning, believe it’s still the most practical and logical choice for us. At this point, we have no intention of changing.<br />

Best Regards,<br />

Dennis Altnow<br />

CEO<br />

Tiger Lines LLC<br />

3

Spotlights<br />

in Claims<br />

Too often in our industry, people love to Monday morning<br />

quarterback, especially when it comes to claims handling.<br />

We asked four of our Claims employees to share a specific<br />

claim outcome that they are most proud of – an outcome<br />

that was not just beneficial for our company, but also for<br />

the insured and claimant. Here are a few times when<br />

claim handling went right.<br />

In my instance, our<br />

insured driver was<br />

attempting to get off of<br />

a highway exit in the<br />

early morning hours.<br />

Our driver came up on<br />

a motorcyclist, resulting<br />

in a rear-end collision.<br />

The motorcyclist was<br />

propelled off of his<br />

motorcycle and scene<br />

photos and video footage<br />

captured the motorcycle underneath our insured’s semi-truck.<br />

Megan BenderClaim Representative<br />

The claimant in this case was an active member of the military who<br />

was on a leadership track to make General. As a result of the collision,<br />

he injured his wrist and sustained a head injury. Through the military<br />

medical facility he has access to, he was able to treat his injuries.<br />

Meet Megan<br />

What is the last book you read?<br />

Would you recommend it, and why?<br />

The last book I read was Extreme Ownership by Jocko Willink and Leif<br />

Babin. I would highly recommend this book as it provides a lot of good<br />

insight and direction into how to be an accountable leader who enlightens<br />

others to have the same accountability. It focuses on leading by example<br />

and not placing blame on others, but rather taking personal responsibility<br />

and working to find solutions.<br />

What are you personally most proud of?<br />

I am most proud of my Catholic faith and my family. My husband Dan and<br />

I have two girls - Madelyn Sophie, who is three years old, and Maria Rose,<br />

who turns two this month. We are also expecting our third girl in May!<br />

If I wasn’t working in claims, I would be…<br />

Working as a counselor of some sort.<br />

Very early on in the process, I reached out to the claimant and made<br />

contact. In terms of Personal Property Damage, we were able to<br />

take care of this very quickly. While no time is a good time to be<br />

unexpectedly off from work due to injury, this was a particularly bad<br />

time for the claimant as he was up for a review for his next promotion.<br />

To ease some of his concerns, I continued to maintain communication<br />

to keep him aware of where National Interstate was in the process,<br />

speaking at great length multiple times per week, all while assuring<br />

him that we would handle his claim fairly.<br />

Within less than two months of this claim being reported, we were<br />

able to reach an early, fair resolution without litigation. It was a<br />

resolution that both the claimant and insured were very happy with.<br />

The moral of the story is that timely claim reporting coupled with early<br />

contact with the claimant will usually result in better outcomes and<br />

lower claim costs.<br />

What are three words your co-workers would<br />

use to describe you?<br />

I think my co-workers would describe me as devoted, responsible<br />

and fun-loving.<br />

What motivates you to get out of bed each day?<br />

My family motivates me to get out of bed each day. I strive to be the best<br />

person both at work and at home, and to do the best that I can for them<br />

each and every day!<br />

Any pets?<br />

No Pets. We have a great arrangement with my dad’s dog, Rudy. He is a<br />

labradoodle that we will occasionally watch for extended periods of time,<br />

but then he returns home. My girls love him, and it is a good reminder that<br />

our lives are too hectic for us to get a dog right now!<br />

4<br />

5

Holly Spears<br />

Senior Claim Representative<br />

During my tenure with<br />

the company, I have had<br />

significant experience in<br />

dealing with fire losses.<br />

In my case, our customer<br />

was driving down the<br />

highway and felt his<br />

vehicle shimmy a little<br />

bit. After checking his<br />

mirrors to see if he had<br />

hit anything, he instead<br />

noticed smoke coming from the rear of the trailer. He safely pulled<br />

over onto the side of the roadway and jumped out to the trailer to see<br />

what had happened. At this point, flames had begun to significantly<br />

overtake the trailer, causing the driver to retreat back to the front of<br />

the tractor to retrieve his fire extinguisher. Unfortunately, the trailer<br />

was already fully engulfed in flames. When the fire department arrived<br />

on scene, they had a difficult time controlling the blaze due to the<br />

cargo on board – vegetable oil and other food products. Each time,<br />

fire personnel attempted to extinguish the fire, the oil only acted as<br />

an accelerant, reigniting the flames again and again. It took over 30<br />

minutes to fully put out the blaze and by this point the trailer and<br />

tractor were both completely engulfed.<br />

The semi-truck was towed to a towing and recovery facility, and while<br />

it was there, I sent a Cause and Origin Expert out to determine what<br />

caused the trailer to catch fire in the first place. Even though both the<br />

Meet Holly<br />

What is the last book you read?<br />

Would you recommend it, and why?<br />

I’m in the process of reading The Iliad by Homer, and I say “in the process”<br />

because it’s over 700 pages long. It’s a lot to comprehend, so reading it<br />

slowly is the way to go. I would absolutely recommend it to anyone who<br />

loves to dive into a book and stay there for a while.<br />

What are you personally most proud of?<br />

My strong will. Someone once told me, “When someone tells you that you<br />

can’t do something, you tell them ‘Watch me,’ and then you go do it.”<br />

If I wasn’t working in claims, I would be…<br />

Either an English Literature teacher or a History teacher.<br />

trailer and tractor were burnt down to the rails, the Cause and Origin<br />

Expert was able to determine that a brake issue caused the brakes<br />

to seize, creating friction and sparks – which then caused the fire.<br />

Thankfully, our driver was unharmed.<br />

When I received this claim, I immediately worked with the tow facility<br />

to reduce the insured’s towing expenses to a more acceptable amount,<br />

as they initially were inflated given what was towed to the facility.<br />

The insured and I created a united game plan to execute, one in<br />

which we were constantly speaking to one another and able to build a<br />

relationship. We spoke with the cargo insurance carrier and got them<br />

to cover part of the towing invoice because the cargo was also mostly<br />

destroyed and the tower had to remove what was left of it in order<br />

to safely tow our vehicle away. The trailer was self-insured, meaning<br />

National Interstate could not handle that loss, however I was able to<br />

quickly handle the total loss of the tractor and get the insured back to<br />

his pre-loss condition in regard to being down a unit and getting him<br />

paid quickly and accordingly per the policy.<br />

Overall, this claim settled in around two months, which is average for<br />

fire losses. I was proud that I was able to negotiate and reduce costs<br />

for the tow bill, because when you are dealing with a towing facility,<br />

every day counts for the insured. Every day is another bill for them,<br />

and I was able to quickly recognize that and work with multiple parties<br />

and carriers to create a fair and equitable resolution.<br />

What are three words your co-workers would<br />

use to describe you?<br />

Diligent, committed and opinionated<br />

What motivates you to get out of bed each day?<br />

The gym. Those weights aren’t going to lift themselves!<br />

Any pets?<br />

Madison, a Chow/Shepherd mix; Frankie J, a big, white cat; and Sophie, a<br />

dark gray, long hair cat.<br />

Joe Darwal<br />

Claim Attorney<br />

The claim outcome<br />

that I am most proud of<br />

occurred in Las Vegas,<br />

Nevada. The claimant<br />

was riding atop one of our<br />

insured’s double decker<br />

buses, and as the bus<br />

was approaching a local<br />

strip hotel, the claimant<br />

fell down from the second<br />

story to the first floor of<br />

the bus, striking her head. All of the witnesses to this accident were<br />

her family members. Based on this fact and discrepancies regarding<br />

whether a hard stop occurred, we had a claimant who would present<br />

well to a judge and jury in a difficult legal venue.<br />

However, there were additional features with this case that added<br />

further difficulty. First and foremost, our claimant was a teacher<br />

vacationing in Las Vegas from the United Kingdom. She received her<br />

medical treatment in the UK, and while her medical specials in the<br />

U.S. were somewhat high, her medical treatment would have been<br />

free in the UK. The claimant had a confirmed traumatic brain injury,<br />

which completely changed her life post-accident. She could no longer<br />

work as many hours, do household chores or be out in public for long<br />

periods of time.<br />

Meet Joe<br />

What is the last book you read?<br />

Would you recommend it, and why?<br />

Scorpions: The Battles and Triumphs of FDR’s Great Supreme Court Justices<br />

by Noah Feldman. This book is great for any History fan who wants to take<br />

a peek into the proverbial back room of the politicians, lawyers and judges<br />

who shaped our country.<br />

What are you personally most proud of?<br />

Winning the American Association for Justice Mock Trial National<br />

Championship while at the University of Akron School of Law and now<br />

being able to coach the very same program.<br />

My favorite podcast is:<br />

Hardcore History by Dan Carlin.<br />

Traditionally, this kind of claim in this type of venue has a very<br />

high exposure should it go to trial. From our analysis, we believe<br />

that a verdict would have come from a jury had we taken this to<br />

trial, possibly above our policy limits. I recommended that rather<br />

than trial, we instead go into mediation. Normally, when I go into<br />

a mediation, I prefer to not have an opening statement because it<br />

tends to stall settlement negotiations instead of positively pushing<br />

them forward. Rather than having an opening statement in this<br />

case, I asked the claimant to tell us her story – how her life has<br />

changed and what she believes would be a fair resolution. Following<br />

her narrative, settlement negotiations began.<br />

In the end, we reached a fair settlement that our insured was very<br />

happy with. A couple of months after the settlement, I received an<br />

email from the claimant via our insured thanking both of us for the<br />

mediation and our handling of her claim. She was grateful for not only<br />

having the opportunity to tell us her story, but for the respect that we<br />

showed to her throughout the process and ensuring that all of her<br />

expenses were covered and that she would be able to live her life in<br />

the same fashion she had before the accident. I can tell you that it’s<br />

not every day that I receive an email from a claimant like this one and<br />

it has definitely stuck with me.<br />

If I wasn’t working in claims, I would be…<br />

Working as a litigation attorney for a civil defense firm.<br />

What are three words your co-workers would<br />

use to describe you?<br />

Confident, ambitious and social.<br />

What motivates you to get out of bed each day?<br />

The expectations that I have for myself.<br />

My favorite TV show is:<br />

Seinfeld.<br />

6<br />

7

Jelena Povich<br />

Senior Claim Representative<br />

My area of claim<br />

specialty is in workers’<br />

compensation and I<br />

recently had a claim<br />

in which the claimant<br />

was involved in a motor<br />

vehicle accident after<br />

losing control of his work<br />

vehicle and drifting into<br />

the highway median.<br />

Another vehicle then<br />

struck his truck at the gas<br />

tank, causing the truck to erupt in flames. Our insured’s employee<br />

suffered 12% burns to his body as a result of the fire. Additionally, the<br />

accident did not occur in his home state, meaning we transported his<br />

care across state lines to one of the best burn centers in the country<br />

where he lived.<br />

In this case, our insured’s employee not only drove his vehicle for<br />

a living, but he also lived in his truck. After he was released from<br />

Meet Jelena<br />

What is the last book you read?<br />

Would you recommend it, and why?<br />

The last book I read was Is Everyone Hanging Out Without Me? (And Other<br />

Concerns) by Mindy Kaling. I would definitely recommend it and found it<br />

very empowering!<br />

What are you personally most proud of?<br />

I am most proud of the relationships that I have in my life including my<br />

family, boyfriend and my friends. As I grow older, it’s amazing watching all<br />

of our accomplishments unfold!<br />

If I wasn’t working in claims, I would be…<br />

Selling conch shells on the beaches of Turks and Caicos.<br />

emergency medical care, he did not have a home to return to, which is<br />

concerning in a case like this for a couple of reasons. With after-burn<br />

care, we were very worried about the spread of infection and ensuring<br />

that the claimant was continuing his wound and medical care. With<br />

that said, I was able to secure a long-term stay at a hotel, which<br />

afforded him a place to stay while he was healing. I also assigned<br />

a local Nurse Case Manager to his case to assist in the management<br />

of his care. The nurse was key in the claimant’s recovery as she was<br />

able to visit him regularly to confirm his care was maintained and his<br />

wounds were kept clean.<br />

Throughout the course of his care, we communicated often, so I<br />

developed a close relationship with him. He healed surprisingly quickly,<br />

and soon after, I was able to offer him a fair settlement to resolve his<br />

claim. He was highly-motivated to get back to work. I’m proud that in<br />

this situation, I was able to get the insured’s employee back to work<br />

as swiftly and safely as possible.<br />

What are three words your co-workers would<br />

use to describe you?<br />

Positive, approachable and bubbly<br />

My favorite movie is:<br />

Silver Linings Playbook.<br />

What motivates you to get out of bed each day?<br />

Learning new things has always been a great motivator for me. Working in<br />

the claims area is great for that because every day is different!<br />

Any pets?<br />

I have a soft-coated Wheaton Terrier named Josie. She is only 3 months old<br />

and is the best.<br />

5<br />

Do not dread renewal time, embrace it. When your insurance renewal is approaching, use these tips to<br />

W A Y S T O I N F L U E N C E<br />

Y O U R I N S U R A N C E<br />

R E N E W A L<br />

avoid a last-minute fire drill, unplanned changes or misguided surprises. With ample timing, this list of<br />

practical and proven risk financing tips will help you earn the best results from your next renewal.<br />

1The THINK FINANCING RISK, NOT BUYING INSURANCE. savviest insurance buyers take into consideration<br />

how they are going to manage risk over a time horizon 1<br />

much longer than a 1-year insurance contract. They also<br />

consider how they will balance collateral and cash flow by analyzing and understanding the ways in which large<br />

deductibles, varying retentions, captives and other insurance products will impact their business over time. Often, a<br />

cheap, short-term option can lead to years of heartburn.<br />

MEET YOUR UNDERWRITER. Ask your insurance broker to facilitate a meeting with your current insurance carrier<br />

well in advance of your renewal. Ask what influences 2<br />

his or her pricing decisions, and how you can improve as a risk<br />

in their eyes. Address any concerns the insurance company personnel may have, and work on developing a healthy<br />

partnership so you are best positioned for the renewal.2<br />

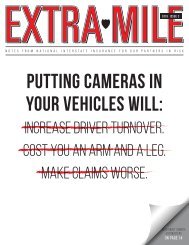

EMBRACE TECHNOLOGY, particularly in-cab video technology. We believe, particularly as Excess pricing has<br />

3<br />

significantly hardened and jury verdicts can be unpredictable, the best insurance policy against large claims can be<br />

in-cab video cameras. Not only does a recording stand as an irrefutable witness, with coaching, you can improve<br />

driver behavior.<br />

AVOID HIRING YOUR CLAIMS. Incorporate Physical Abilities Testing (PAT) programs into your hiring process, and<br />

4<br />

ensure you are enforcing your hiring guidelines. A driver who is unable to physically perform the duties of the job<br />

could end up costing your operation hundreds of thousands of dollars in potential workers’ compensation claims.<br />

Make sure you are consistent throughout your hiring process.<br />

TAKE THE RIGHT AMOUNT OF RISK. Work with a seasoned insurance professional to evaluate how much risk<br />

a transportation company of your size should take. 5<br />

What risk can you control and should you retain, and what risk<br />

should you transfer? Understanding this distinction can help reduce your overall cost of risk.<br />

Don’t wait, talk with your agent now about which of these tips would be most impactful for your next renewal.<br />

JODY JORDAN<br />

8<br />

Business Development Manager<br />

9

Executive Spotl ight<br />

Steve Winborn<br />

SVP Claims and Risk Management<br />

In your own words, can you tell me what you do?<br />

I have the privilege of leading National Interstate’s Claims and Risk<br />

Management functions. This includes claim operations in Richfield, St.<br />

Louis and Hawaii. Given the mobile nature of our niche products, our<br />

claims professionals adjust hundreds of millions of dollars in claims<br />

each year in every jurisdiction across the U.S. The Claims and Risk<br />

organization serves our insureds in their time of need and provides a<br />

superior level of personalized communication and customer focus. We<br />

deliver on the promises that are at the core of each insurance policy<br />

we provide.<br />

What are the most import decisions you make as a leader?<br />

The environment in Claims and Risk is fast-paced, and our approach<br />

is one of proactive, aggressive claim handling to achieve fair, costeffective<br />

resolutions. Therefore, it isn’t any one major decision that<br />

you make that is the most important, but instead it is a series of<br />

hundreds of everyday decisions you must properly and quickly make<br />

that moves the needle in a positive direction. In building out the Claims<br />

and Risk departments, there is no more critical decision than choosing<br />

the best new claims and risk professionals to join our team and serve<br />

our customers well.<br />

You spent some time as the Vice President of Operations for<br />

Vanliner, our subsidiary. Can you share how your experience there<br />

prepared you for your position at National Interstate?<br />

I began my insurance career at Vanliner, the leader in moving and<br />

storage insurance, in 1997 and held a variety of positions in various<br />

areas including Claims, Legal, Risk Management, the TransProtection<br />

Insurance Agency and Operations. These varying assignments gave<br />

me a more holistic understanding of how critical it is to have each<br />

major area of the company working together to achieve sustained<br />

success. Vanliner’s unique understanding of and commitment to the<br />

moving and storage industry, strong long-term relationships with its<br />

customers, along with its culture of prompt personalized customer<br />

service, prepared me well for the way National Interstate, as a<br />

specialty carrier, serves all its unique niche product segments.<br />

In what ways have you seen National Interstate change during<br />

your time here?<br />

Since the Vanliner acquisition in 2010, the company’s largest to date,<br />

I’ve seen National Interstate continue to grow responsibly with a<br />

focus on profitable, quality new business. Growth is in the company<br />

DNA. Along the way, our company has maintained its own unique<br />

feel and culture, while blending in the best new ideas, processes, and<br />

opportunities offered from our subsidiary and parent companies.<br />

Can you name a person who has had a tremendous impact on your<br />

career? How did this person impact your life?<br />

Two people. The first is my mother. She was a working mom, who<br />

somehow managed to balance work and family with a tireless work<br />

ethic. She valued education, supported my career aspirations, always<br />

treated others with respect and modeled selfless servant leadership.<br />

The second was an early hockey coach who was both an attorney and<br />

successful businessman. He helped inspire my passion for business<br />

and law, which I first pursued as individual disciplines and roles, and<br />

eventually was able to combine in my career in insurance, claims and<br />

risk management.<br />

What are you most proud of?<br />

Being a good spouse to Kathleen and father to our two daughters.<br />

Raising responsible, independent, empowered young women who will<br />

make their mark on this world pursuing their own chosen passions in<br />

speech pathology and law is something to be proud of.<br />

What motivates you to get out of the bed in the morning?<br />

The joy I get watching my 14-year old mutt wait for me to let her out<br />

and bound down our porch steps like a puppy for the first time, having<br />

coffee with my family and hearing about their plans for the day ahead<br />

before I head off to work and the ever-changing challenges that my<br />

work presents me each day I arrive at National Interstate.<br />

What do you enjoy doing when you are not working?<br />

Spending time with my wife and two adult daughters, watching or<br />

traveling to an occasional St. Louis Blues or St. Louis Cardinals game,<br />

traveling to and exploring new places in the U.S. or abroad, walking to<br />

town and watching action or science fiction movies on the home theater.<br />

What have you been listening to in your car to and from work?<br />

Local news and sports radio; I’m still learning all I can about my new city.<br />

If you could trade places with any other person for a week,<br />

famous or not, living or dead, real or fictional, with whom would<br />

it be?<br />

Han Solo, so that I can travel the galaxy in the Millennium Falcon and<br />

hang with Princess Leia.<br />

What book have your read that you would recommend others to<br />

read and why?<br />

Anything from Stephen R. Covey (start with The 7 Habits) to be<br />

effective in business and life, John O’Leary (On Fire) to be inspired<br />

and Dave Ramsey (start with The Total Money Makeover) for personal<br />

finance and leadership.<br />

10<br />

11

PRODUCT SPOTLIGHT:<br />

WASTECAP ALTERNATIVE<br />

RISK PROGRAM<br />

Ace Disposal opened their state-of-the-art facility to fellow WasteCap members, agents and guests for a tour during the November 2017 Advisory Board Meeting.<br />

When someone mentions a garbage man to you, what are the first<br />

thoughts that come to mind? For me, I likely think of words that are<br />

very different than yours. Innovative. Accountable. Problem Solver.<br />

Entrepreneurial. Progressive. Strong work ethic. Adaptable. Pillar of<br />

their community. Early riser!<br />

I’ll be honest, before I started working in this industry five years ago,<br />

I didn’t give much thought to what happened to my garbage after<br />

I set it on the curb every Monday night. When National Interstate<br />

launched WasteCap, an Alternative Risk Transfer, or ART insurance<br />

program in 2013, it was clear that the insurance industry had<br />

neglected the waste and recycling industry in the same way.<br />

Created from a need to provide both an innovative and stable<br />

insurance product to best-in-class waste haulers and recyclers,<br />

WasteCap is comprised of progressive operators who wanted<br />

a different way to finance risk. These owners grew tired of the<br />

fragmented insurance market.<br />

Over the past six months, there has been more interest than ever<br />

before on how to join this exclusive ART program. It is clear that<br />

industry leaders are looking for a better way to ‘skin the cat’ when<br />

it comes to insuring their assets and managing risk. Elite operators<br />

understand the importance of taking on more risk, managing safety<br />

and being rewarded for their success.<br />

Are you a fit for WasteCap?<br />

We have operators from the east coast to west coast and everywhere<br />

in between. If you currently pay at least $200,000 in insurance<br />

premiums, have a continued focus on safety, maintain a strong balance<br />

sheet and are willing to bear some risk, you should contact me.<br />

One last thing about WasteCap – we work with an appointed agency<br />

distribution as it is critical for us to have partners who understand<br />

both Alternative Risk Transfer and the complex nature of the waste<br />

industry. I can introduce you to one of our select agency partners if<br />

your agent doesn’t represent WasteCap.<br />

For more information on WasteCap, please contact the author<br />

of this article, Lauren Fronczek at 800-929-1500 x1141 or<br />

lauren.fronzcek@natl.com.<br />

➼<br />

➼<br />

➼<br />

WHAT ARE THE PROGRAM BENEFITS OF WASTECAP?<br />

Take Control: Unlike traditional insurance, you pay your<br />

premium into a customized program and, with your favorable<br />

loss experience, you could receive funds back along with<br />

investment income.<br />

Continuously Improve: Enhance your operation with our<br />

superior risk management services, consultants and tools.<br />

Collaborate: Work together and share best practices with other<br />

like-minded, best-in-class members that have the same safetycentered<br />

mindset you have. Our members take full advantage<br />

of this and may call a fellow member for a variety of reasons,<br />

such as when they are vetting new technology to pick their<br />

brain on their experience with that new system. Or, perhaps<br />

a member recently put together a comprehensive Lock Out/<br />

Tag Out procedure and wants to share the experience with<br />

the group.<br />

➼<br />

➼<br />

➼<br />

Personalized Service: Get to know your program team and<br />

senior management at your insurance company at twice-ayear<br />

Advisory Board Meetings.<br />

We Have Your Back: With a dedicated claims handling team<br />

focused specifically on waste transportation operations, we<br />

strive to be your best partner on your worst day.<br />

Stability: Exit the traditional insurance market and the<br />

headaches that come with it.<br />

LAUREN FRONCZEK<br />

Senior Marketing Manager<br />

12<br />

13

Plain<br />

English<br />

INSURANCE IN<br />

In Plain English is an ongoing feature designed to take the mystery out of all the agreements,<br />

exclusions, conditions and definitions found in your insurance policy. We’ll choose topics based<br />

on the questions we hear most often, as well as suggestions we receive directly from you.<br />

14<br />

Since the first recorded contract of insurance nearly 700 years ago,<br />

the insurance industry has continuously evolved to meet the shifting<br />

needs of the market. While we know what insurance is: the payment<br />

of premium to your insurance company in exchange for a promise<br />

that they will be there for you in the event of a loss; that is only<br />

the tip of the insurance iceberg. Beyond the insurance agreement<br />

between you and your insurance company exists a web of other<br />

financial arrangements that support those promises. One important<br />

part of that support system is reinsurance.<br />

Reinsurance provides an avenue for insurance companies to transfer<br />

a portion of their risk exposure in exchange for a fee. Sound familiar?<br />

Simply put, reinsurance is insurance for insurance companies.<br />

Without it, insurance companies would not be able to insure as<br />

many clients or provide the coverage and limits their clients require.<br />

With it, volatility stemming from large, unusual, unpredictable and<br />

catastrophic losses is mitigated, and the financial security of the<br />

insurance company with which you do business is maintained and<br />

even strengthened. This system of spreading risk works so well that<br />

even reinsurance companies purchase reinsurance.<br />

There are two basic types of reinsurance: Treaty and Facultative.<br />

Treaty reinsurance provides coverage for a broader portfolio of risk<br />

and most times is a strategic, corporate-level decision. Treaties<br />

typically cover books of business at a pre-negotiated price or rate.<br />

Facultative reinsurance, commonly referred to as “FAC”, provides<br />

coverage for one specific risk or exposure and is usually a tactical<br />

decision made by the underwriter. Facultative reinsurers underwrite<br />

each exposure individually, develop their own price if they are<br />

interested and are free to decline to quote. National Interstate uses<br />

both forms of reinsurance throughout the organization in order to<br />

maximize the product offering for its customers.<br />

REINSURANCE 101<br />

How does a reinsurer determine price for the reinsurance coverage<br />

it is providing? Much like the process National Interstate goes<br />

through to develop the appropriate price for the coverage provided<br />

to your company, reinsurance pricing involves consideration of<br />

many aspects of the business and industry. Reinsurers use actuarial<br />

models to analyze historical results and exposures, and supplement<br />

that with a qualitative analysis of company management, risk<br />

appetite, underwriting expertise, etc. Similar to how National<br />

Interstate underwriters evaluate your operation, National Interstate<br />

is evaluated by its reinsurers with a keen eye and from multiple<br />

angles.<br />

Reinsurance pricing is also impacted by industry-wide results that<br />

can favorably or adversely influence year-over-year pricing. National<br />

Interstate works to combat negative industry trends by leveraging<br />

its transportation industry expertise, strong underwriting and claims<br />

reputation and long-established reinsurance relationships to help<br />

optimize the reinsurance agreement.<br />

Effectively using reinsurance allows National Interstate to provide<br />

its insureds with a broad offering of customized insurance solutions<br />

at competitive prices.<br />

MARK ADRIANCE<br />

Senior Reinsurance Specialist<br />

15

The Secret<br />

Sauce to<br />

Increasing<br />

Driver<br />

Retention<br />

Are you a best-in-class company when it comes to getting and<br />

retaining drivers? What is your driver turnover? How much is the cost<br />

of turnover affecting your bottom line?<br />

Most motor carrier CEOs probably don’t know as much as they think<br />

they do about their recruiting and retention regime. It means that<br />

they think they fully understand something that they actually don’t;<br />

however, it’s time they learn the “secret sauce” to shake up the recipe<br />

for recruiting and retention.<br />

For the most part, motor carrier CEOs and their executive team are<br />

constantly talking about the industry driver shortage and retention<br />

problem, as well as their own turnover. See the stats below.<br />

They find it difficult to accept the reality that the problem really can be<br />

managed much better. And, they just don’t know how and don’t have<br />

the talent internally that will lead to improved results.<br />

Experience proves that adding more recruiters and continuing to offer<br />

sign-on bonuses, using technology to increase the speed of mobile<br />

applications being loaded or increasing the number of applications<br />

being generated or completed are not the ways to increase a<br />

company’s capacity or retention. In fact, sign-on bonuses and these<br />

other strategies actually encourage turnover and inhibit retention.<br />

The simple truth is that there are solutions, but too many CEOs think<br />

that they can make a difference doing what they always have done,<br />

just more of it, with the same team of people and the same old school<br />

ideas to get better results.<br />

HIRED (NEW) DRIVERS • FIRST 6 MONTHS<br />

Drivers stay past 6 months<br />

51% 27%<br />

22%<br />

NORRIS BEREN<br />

Chief Executive Advisor, Speaker, Consultant<br />

Risk Reward Consulting, Inc.<br />

The introduction of fresh ideas learned from many other carriers and<br />

the use of “Next Practices” thinking instead of living on old, outdated<br />

and ineffective best practices thinking will improve the driver retention<br />

problem so it becomes less and less of a barrier to getting and keeping<br />

more drivers.<br />

If you think you have the talent internally to fine-tune and retool your<br />

driver hiring and retention processes, then make it happen. If you<br />

don’t, then you have to go outside your company for experienced help.<br />

Where Do You Start?<br />

Are you ready to stop or at least slow down the revolving door?<br />

First, you have to learn why your drivers are REALLY leaving, and to<br />

do this you must conduct an intense assessment of your operations<br />

to eliminate the threats to retention that exist. Are you prepared to do<br />

that? Do you or your team know the questions to ask?<br />

Real change requires a thorough understanding by the CEO and<br />

executive team of the need to look at every touchpoint with every<br />

driver in your company to see how well you are creating a favorable<br />

driver experience, or not.<br />

This requires a complete review of all areas of your business that<br />

affect the driver experience including but not limited to marketing,<br />

advertising, recruiting, hiring, orientation, onboarding, human<br />

resources, training, payroll/settlements, operations, dispatch, safety,<br />

Drivers leave in months 1-3<br />

Drivers leave in months 4-6<br />

50%<br />

72%<br />

43%<br />

are due to unmet expectations<br />

and broken promises<br />

are preventable<br />

would return<br />

16<br />

17

Do you have<br />

a favorite<br />

restaurant?<br />

Why is it your<br />

favorite?<br />

compliance, maintenance and interpersonal skills interactions, as well<br />

as the driver experience with every shipper, receiver and your vendors<br />

(fuel, roadside repairs and others).<br />

Asking dozens of questions about every interaction with your driver will<br />

reveal the real threats to retention and will allow for the development<br />

of the necessary fine tuning and retraining required to improve the<br />

driver experience. Fix that and you will see more drivers staying and<br />

the evolution of a new culture that will become an attractor factor<br />

to create a pipeline of drivers that want to come and work for your<br />

company. You will no longer be a “me too” company, but instead be a<br />

unique and great place to work.<br />

An Analogy – Get and Keep Drivers<br />

Let’s prove the point just made.<br />

Do you have a favorite restaurant? Why is it your favorite?<br />

Probably, at every touchpoint, from the moment you arrive and<br />

throughout the entire time you are there, you are treated like a VIP<br />

with loads of respect, enormous attention to detail, an impeccable<br />

meal and wonderful, polite, high-level service. Correct?<br />

If just a couple of these touchpoints were a disappointment, not up<br />

to expectations, would you come back, much less be a raving fan?<br />

Probably not.<br />

How did you learn about the restaurant — an ad or were you referred by a<br />

friend or colleague?<br />

Circling back to your organization, what is the first touchpoint that a<br />

new driver will experience with your company — an ad, a sign or one<br />

of your branded trailers? Another employee or driver? What do any of<br />

these first impressions say about your company? Come work for us,<br />

it’s all about money?<br />

How were you greeted by the host or valet at the restaurant on your first<br />

visit?<br />

Suppose Billy Driver calls the phone number given on the ad, sign or<br />

referral from one of your drivers. How is the phone answered? Is the<br />

driver put on hold or is the call sent to voicemail? What is the driver’s<br />

expectation? How will this phone call impress the driver among the<br />

five or eight or ten other companies he or she also calling?<br />

Did the first experience at your favorite restaurant live up to your<br />

expectations?<br />

Are you building a relationship with the driver so that there is a<br />

feeling that finally she or he is coming to a company that matches<br />

expectations with representations? Is what the driver was told by<br />

the recruiter about your company regarding lanes, miles, home time,<br />

equipment, etc. actually being followed through on?<br />

What makes this restaurant your favorite? Why is it different? Why do you<br />

continue to return?<br />

Are you a “me too” company? Do you make the same promises as<br />

others to attract applicants — sign-on bonus, great home time, pay,<br />

insurance and guaranteed miles? How do you differentiate yourself?<br />

An intelligent driver retention system starts with the fundamentals —<br />

from the first impression the driver experiences with your company<br />

and continues at every single touchpoint along the way.<br />

I know. You are thinking to yourself, “We are already doing all of this.”<br />

Well, here is a fact: 9.9 out of 10 CEOs don’t know what’s REALLY<br />

going on with driver retention and recruiting in their company. And,<br />

that’s why turnover is almost 100%. While driver treatment is critically<br />

important, it is not so much about the culture of your company but<br />

more about the driver experience. From the first contact to every day<br />

working, a driver needs to feel that he or she is an important and<br />

contributing member of the company.<br />

Do you know about the driver experience in your company?<br />

You need to assess your operations and eliminate the threats to<br />

retention that exist in your company by becoming a more curious<br />

organization - knowing, thinking, measuring, monitoring and making<br />

changes that will create a WOW driver experience at every touchpoint.<br />

Just like the restaurant experience, everything has to be real in an<br />

organic sense, friendly, high-quality and not designed only to fill seats.<br />

Those seats will be empty once again if the touchpoints are not done<br />

properly and designed for building a long-term relationship.<br />

Just like your favorite restaurant, drivers need a favorite trucking<br />

company to come back to every day for a long time and become the<br />

main source of new drivers.<br />

Your favorite restaurant has a ‘Secret Sauce’; they provide an<br />

experience that is superior to others. The same concept that applies to<br />

attracting and keeping restaurant customers applies to attracting and<br />

keeping quality drivers.<br />

What if you had access to a secret sauce - a strategy that will help<br />

you find out what you don’t know and narrow down what needs to be<br />

fine-tuned and how to do it?<br />

18<br />

19

The “Secret Sauce” to Creating an Intelligent Driver Retention System<br />

How You Can Move the Needle – This Is How Successful Companies Do It<br />

If you want to know how to increase your driver retention, then let’s<br />

learn the recipe for the “Secret Sauce” to attract and keep more drivers.<br />

By using the “recipe” correctly, over time you will move the needle to<br />

reduce turnover significantly.<br />

Here are just a few of the fundamental ingredients of the “Secret<br />

Sauce”. Remember, you hire your turnover. Change the way you hire<br />

drivers and you will improve retention.<br />

pounds of training and retraining for the people who are doing<br />

5 the recruiting, so that they will WOW prospective driver leads into<br />

knowing how different your company is<br />

pounds of creating a curiosity that will attract the prospect and<br />

2 turn him away from “shopping” for his next driving job<br />

pounds of asking a lot of questions about the person, not so<br />

10 much about home time, lanes, money, experience, the driver<br />

wants, etc. But, instead asking about what their “I won’t do’s” are so<br />

you can manage expectations. Also, try asking what they like to do.<br />

gallon of creating two-way value with the driver and<br />

1 the company<br />

pounds of creating a desire to work for your company. Truthful but<br />

3 believable.<br />

There are more ingredients to this “recipe,” but starting with these five<br />

can put you on the path to success.<br />

Here are some additional fundamental principles of the “secret sauce”<br />

that will further enhance retention:<br />

➼ Every new driver should meet and be introduced to the people<br />

that he or she will interact with the most. If necessary, you can<br />

do the introductions online, but it is important to put a name and<br />

face together, so it becomes part of the driver support team.<br />

➼ Match expectations – have alignment with what drivers are told<br />

by recruiters, at orientation and by all personnel they interact<br />

with. This concept is well known but not well understood as to<br />

its importance, nor is it enforced vigorously.<br />

➼ You may need to make staff realignments; employees who are<br />

not nice to drivers need to be reassigned, retrained or removed.<br />

➼ Based on the overall assessment, you will need to develop, train<br />

and enforce new procedures to impact the driver experience<br />

positively. Failure to do this will be a failure to retain drivers.<br />

➼ Create an early warning system to identify at risk of leaving<br />

drivers. Everyone who interacts with drivers needs to say<br />

something if they hear something or know something.<br />

➼ Monitor and measure results frequently. Remember, happy<br />

drivers STAY.<br />

HAPPINESS<br />

The best-in-class companies know exactly what the root cause of<br />

their unhappy drivers is and don’t assume that they know why. They<br />

understand that their retention is directly proportional to their favorable<br />

driver experience at all points of interaction. These companies create<br />

“raving fans” of their drivers and other employees.<br />

You too can move the needle from high turnover and lots of unhappy<br />

drivers with one simple principle.<br />

Assess the impact on your drivers at every touchpoint.<br />

Here are my Top 12 Action Steps to begin to set the stage for ‘driverfriendly’<br />

policies, procedures and behavior execution:<br />

1. Select top management officials to conduct one-to-one on-site<br />

chats with each driver over a period of a few weeks. Learn what<br />

you don’t know.<br />

2. Reduce the silos between departments: train on interdepartmental<br />

communications, collaboration and cooperation<br />

with drivers. Bring in an outside trainer who is an expert in these<br />

matters.<br />

3. Empower fleet managers/dispatchers to be advocates for drivers.<br />

4. Train your dispatchers and fleet managers how to listen to,<br />

honor and respect drivers. As your ‘front line,’ they should also<br />

be aware of how to be sensitive to unspoken problems and<br />

obstacles drivers face on the job and know when to report issues<br />

that need attention. Teach them to provide personal, one-on-one<br />

contact and attention to drivers; call them by name, not their<br />

truck number, know their spouse/significant other’s name, etc.<br />

5. Do retention seminars for all employees and include<br />

communication skills and sensitivity training.<br />

6. Begin the process of building your company brand by developing<br />

the attractor factors that draw and retain drivers. This will become<br />

your competitive advantage.<br />

7. Conduct live interviews with existing drivers continuously and in<br />

a structured format when possible. You will be surprised about<br />

what you will learn. You will need to create a sample interview<br />

survey script for this to work properly.<br />

20<br />

21

Ask not what<br />

your drivers<br />

can do for you,<br />

ask what you<br />

should do for<br />

your drivers.<br />

8. Send out regular questionnaires to drivers and ask them to ’rate’<br />

your customers and your key staff from their point of view. Then,<br />

take action on problems or explain why no action is warranted -<br />

but stay connected and be responsive. You will have to separate<br />

legitimate comments with merit from comments that are selfserving.<br />

Create a perception survey.<br />

9. Introduce a high-level executive to all new drivers at orientation,<br />

in person or electronically when there are multiple locations.<br />

10. Avoid the usual practice of classroom orientations that go on too<br />

long by reviewing policy after policy on PowerPoint presentations.<br />

11. Let drivers know the CEO is committed and open to hearing<br />

their questions and concerns, and invite them to have open and<br />

honest conversations with management. The development of a<br />

culture where “Drivers Are Really Everything” must begin at the<br />

highest level of management, and that must be the CEO/Owner.<br />

12. Create a driver advisory council to find out what is really going on<br />

with your drivers, not what you think is going on.<br />

Make these necessary fine-tuning adjustments and then watch<br />

the needle move toward more retention and more qualified drivers<br />

applying. Execute these action steps and you could see a 10%<br />

or greater increase in retention in the first 90 days. CEOs who are<br />

committed to making changes along these lines have been successful<br />

in fine-tuning their recruiting and retention significantly and getting<br />

higher-quality drivers to apply and sign on with their companies.<br />

They have cut the number of recruiters needed because they are having<br />

fewer drivers shop their company in spite of their higher standards.<br />

You will increase your conversion rate from applications to hire well<br />

beyond the 3-5% that is common today.<br />

Successful companies have cut their turnover because of improvement<br />

in unsuccessful procedures and in the driver experience at all<br />

touchpoints. The vision of the leadership is now shared with everyone<br />

and is in alignment with all departments, their employees and their<br />

performance.<br />

To paraphrase a ‘famous’ line in American politics:<br />

Ask not what your drivers can do for you, ask what you should do<br />

for your drivers.<br />

The most important takeaway you should have from this article is that<br />

every touchpoint in your company needs to show drivers that they are<br />

valued – that drivers are first.<br />

From the first contact they encounter and every day working, a driver<br />

needs to feel that he or she is going to be an important, contributing<br />

member of your company.<br />

After all, without drivers, nothing happens! Drivers don’t stay with you<br />

because of what you do, but why you do it… and this is how you can<br />

stop the revolving door of drivers at your organization.<br />

Norris Beren is Risk Reward Consulting’s Chief Executive Advisor<br />

who provides guidance to trucking CEOs. He is author of the book<br />

How to Create an Intelligent Driver Retention System and of strategic<br />

resources such as The Driver Turnover Assessment and The Secret Sauce<br />

to Get and Keep Drivers.<br />

22<br />

23

INDUSTRY&<br />

ECONOMIC<br />

OUTLOOK<br />

QUITE SIMPLY, the motor carrier industry is in what is likely to be one of the BEST,<br />

if not the best, periods in the post-deregulation era. MANY factors have come together to boost<br />

demand while supply is constrained, putting motor carriers in the driver’s seat.<br />

Starting with demand, the economy is accelerating, which is unusual<br />

for being so late in an economic expansion. Already, this is the third<br />

longest expansion in history, and will become the second longest<br />

this spring. Even before the new tax law, which is an economic shot<br />

in the arm, general economic growth was accelerating, including<br />

two quarters in 2017 with over 3% gross domestic product growth.<br />

Expect GDP to increase 2.8% this year (a half of a percent faster<br />

than in 2017 overall), with 0.3 percentage points of that due to the<br />

new tax law. The economy is now increasing fast enough that it<br />

will generate higher wages for workers and slightly more inflation.<br />

Those, in turn, will push the Federal Reserve to increase interest<br />

rates a total of four times this year resulting in a 1% increase in the<br />

federal funds interest rate, which is the rate with which the Fed sets<br />

monetary policy. That means banks and other financial institutions<br />

will raise interest rates as well. This, though, will likely lead to more<br />

lending by banks as their margins rise.<br />

More importantly, the three large buckets of truck freight, including<br />

consumption, construction and factory output, are all simultaneously<br />

doing well, a first in this cycle. Consumer spending picked up in<br />

2017, culminating in the best holiday spending season since<br />

2005. In addition, housing construction is increasing nicely and<br />

factory output has snapped back. But perhaps the most important<br />

development for fleets on the economic front is the improvement in<br />

inventories throughout the supply chain. That means that stocks,<br />

which are back in the normal range, are no longer a drag on freight<br />

volumes. Add it all up, and freight levels are solid.<br />

The improvement of freight has absorbed the excess capacity that<br />

plagued the industry from 2015 through the first quarter in 2017.<br />

And, although you would expect fleets to boost truck counts due to<br />

the better volumes, they haven’t because of the difficulty of finding<br />

qualified drivers. In fact, large TL carriers reduced tractor counts by<br />

5% in 2017, while smaller fleets saw a 0.2% reduction over 2016.<br />

LTL carriers also reduced truck counts in 2017, by 2.4%. Add in the<br />

new electronic logging device rule and we have some of the tightest<br />

capacity the industry has seen in several years. This environment<br />

will lead to continued driver pay increases this year.<br />

So, the only question that remains is, how long will the tight<br />

capacity market remain? For it to end, one of two things has<br />

to change. One would be that the industry suddenly finds<br />

significantly more new drivers, which is unlikely. The more likely<br />

ending of the party will come from a drop in freight volumes,<br />

which is what happened in 2015 after a stellar 2014. While the<br />

economy will grow nicely this year, one of the best years of this<br />

economic expansion, keep an eye on inventory levels (relative to<br />

sales). If this key metric rises consistently over a quarter or so, it<br />

would likely reduce demand and result in a softer market. But, we<br />

project that you won’t need to worry too much about this for at<br />

least six months or more, at this point.<br />

*Written February 7, 2018<br />

As the economy picks up, truck freight volumes have risen<br />

significantly. Truck loads increased 2.9% in 2017, the best annual<br />

gain since 2011. But during the second half of the year, volumes<br />

were up 5% from the same period in 2016. LTL tonnage increased<br />

1.5% last year, the largest annual increase since 2014, but during the<br />

final quarter tonnage jumped 4% from the fourth quarter in 2016.<br />

BOB COSTELLO<br />

Chief Economist, American Trucking Associations<br />

24<br />

25

-vehicle technology has been an integral part of our business<br />

In since 2006, supporting the utilization of automatic event<br />

recorder systems (AERs) in over 30,000 vehicles to date. The use<br />

of AERs has played an important role in protecting our customers,<br />

streamlining claims processes, mitigating costs and even alerting<br />

driver’s to health concerns before they became life-altering. It is<br />

safe to say in-vehicle videos have changed the playing field for<br />

commercial vehicles and continues to improve our ability to build<br />

on safety and operational efficiency. However, we aren’t just talking<br />

about video anymore. The industry has changed over the last 12<br />

years – new companies, new products and an overall access to<br />

more efficient technologies has evolved this space into something<br />

of a tech jungle of new solutions.<br />

Traditionally, we have encouraged new technology users to consider<br />

the following important factors to determine the best fit for their fleet:<br />

Recording Type (Event vs. Continuous), Download Style (Manual,<br />

Wireless or Cellular) and Management Platform (Managed Services<br />

or Self-Managed). While these are still important considerations,<br />

with the rise of new and improved technology, they are becoming<br />

increasingly more difficult to identify. New algorithms, merging<br />

technology companies and Silicon Valley start-ups are changing the<br />

game and the classifications previously used aren’t quite so distinct<br />

anymore.<br />

There has been a shift from self-managed to managed services<br />

among new customers investing in fleet systems. The overall theme<br />

is a need for efficiency and quick, actionable tasks delivered to an<br />

online platform instead of burdening company personnel to keep up<br />

with video downloads and constant reviews. However, this doesn’t<br />

mean the solutions traditionally thought of as ‘self-managed’ are<br />

taking a step back or exiting the market. One way these companies<br />

are simplifying the management process for their customers is<br />

merging with other leading technology products in other spaces<br />

such as telematics. Users of both systems can filter triggered videos<br />

through their telematics platform as their single source of managing<br />

their fleet data and videos. These partnerships are happening across<br />

the technology world – ELD’s adding camera solutions and AERs<br />

adding lane departure or forward collision warning for example.<br />

New competitors entering each space will ultimately benefit end<br />

users by creating more comprehensive single unit solutions at more<br />

competitive pricing.<br />

Another new player to the “AER space”, although I use this term<br />

loosely here, are those companies classifying themselves as Vision<br />

versus Video. These emerging companies deliver real-time reporting<br />

based on driver performance, following distance and even driver<br />

status such as eating or becoming fatigued, using triggered videos<br />

as more of a secondary value. Additionally, they provide more<br />

specific, near real-time feedback to the end-user through improved<br />

algorithms, instead of third-party reviewers. These companies are<br />

landing in the middle of managed services and self-managed,<br />

forging their way into the market by hoping to deliver the best of<br />

both worlds – more detailed, immediate knowledge of your fleet<br />

without the additional price tag of a live reviewer. This market is still<br />

young and in need of testing and growth to establish its footprint,<br />

but one to keep an eye on.<br />

Whether you’re looking for a new camera solution or hoping to<br />

improve operational efficiency through telematics, the world of<br />

transportation technology is moving fast and adapting to industry<br />

needs. New solutions and expanding options bring exciting<br />

opportunities to managing your fleet, but two factors still remain<br />

when considering your options that are just as important as they<br />

were 12 years ago – the right fit and your management plan. First,<br />

take the time to evaluate how these products can fit into your<br />

operation and deliver to your unique needs – there is not one best<br />

choice that applies to everyone. Second, understand the information<br />

that will be coming into your company and how you plan to manage<br />

it. No matter what technology company you choose, the data is<br />

only as valuable as the action you take on it. The same solution<br />

provides varying levels of ROI to different companies based on how<br />

effectively they are able to manage the information it delivers.<br />

For more information, please contact the author of this article, Kate<br />

Mitchell at 800-929-1500 x1405 or kate.mitchell@natl.com.<br />

KATE MITCHELL<br />

Risk Management Team Lead<br />

26<br />

27

3250 Interstate Drive<br />

Richfield, Ohio 44286<br />

About Us<br />

All about National Interstate and its brands<br />

E N H I G H W A Y S U L V V J K G<br />

C K W C D S S E N R I A F G C I K<br />

I B K V A L Y T R M C T E O N E S<br />

V U U Y C O J S O T W X L T M M I<br />

R Z N W C H C U Y G P L E P I I R<br />

E A D B O N S R A L A R O A V U V<br />

S Y E T U I E T O B S W L F F N Z<br />

P T R A N S P R O T E C T I O N V<br />

D S W E T C E R A R O X E I O U A<br />

S E R N A R A T M P M M T W G G N<br />

F N I Z B T E E A E S A H Y N T L<br />

F O T G I E N W F R V N G T Z R I<br />

E H I O L T L A N O I T A N M A N<br />

E J N F I R U E N E R P E R T N E<br />

N W G P T M A N A G E M E N T S R<br />

Q V V G Y T I R G E T N I Q N I T<br />

NATIONAL<br />

INTERSTATE<br />

VANLINER<br />

EXPLORER<br />

HIGHWAYS<br />

TRANSPROTECTION<br />

HONESTY<br />

INTEGRITY<br />

FAIRNESS<br />

COLLABORATION<br />

TRUST<br />

MOTORCOACH<br />

UNDERWRITING<br />

ENTREPRENEUR<br />

ACCOUNTABILITY<br />

TRANSIT<br />

RISK<br />

LIMOUSINE<br />

BUS<br />

CLAIMS<br />

EMPOWERMENT<br />

INNOVATION<br />

MANAGEMENT<br />

FLEET<br />

RATES<br />

INNOVATION<br />

SERVICE<br />

TRANSPARENCY<br />

E L C M R D S A D G F K E N Q T Z