CIO & LEADER-November 2017 (1)

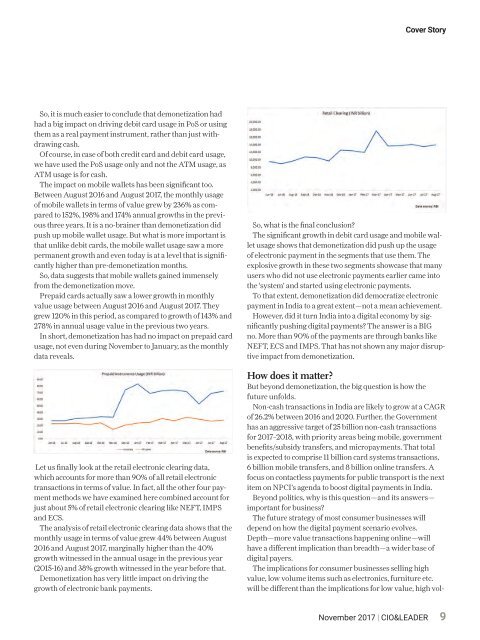

Cover Story So, it is much easier to conclude that demonetization had had a big impact on driving debit card usage in PoS or using them as a real payment instrument, rather than just withdrawing cash. Of course, in case of both credit card and debit card usage, we have used the PoS usage only and not the ATM usage, as ATM usage is for cash. The impact on mobile wallets has been significant too. Between August 2016 and August 2017, the monthly usage of mobile wallets in terms of value grew by 236% as compared to 152%, 198% and 174% annual growths in the previous three years. It is a no-brainer than demonetization did push up mobile wallet usage. But what is more important is that unlike debit cards, the mobile wallet usage saw a more permanent growth and even today is at a level that is significantly higher than pre-demonetization months. So, data suggests that mobile wallets gained immensely from the demonetization move. Prepaid cards actually saw a lower growth in monthly value usage between August 2016 and August 2017. They grew 120% in this period, as compared to growth of 143% and 278% in annual usage value in the previous two years. In short, demonetization has had no impact on prepaid card usage, not even during November to January, as the monthly data reveals. Let us finally look at the retail electronic clearing data, which accounts for more than 90% of all retail electronic transactions in terms of value. In fact, all the other four payment methods we have examined here combined account for just about 5% of retail electronic clearing like NEFT, IMPS and ECS. The analysis of retail electronic clearing data shows that the monthly usage in terms of value grew 44% between August 2016 and August 2017, marginally higher than the 40% growth witnessed in the annual usage in the previous year (2015-16) and 38% growth witnessed in the year before that. Demonetization has very little impact on driving the growth of electronic bank payments. So, what is the final conclusion? The significant growth in debit card usage and mobile wallet usage shows that demonetization did push up the usage of electronic payment in the segments that use them. The explosive growth in these two segments showcase that many users who did not use electronic payments earlier came into the ‘system’ and started using electronic payments. To that extent, demonetization did democratize electronic payment in India to a great extent—not a mean achievement. However, did it turn India into a digital economy by significantly pushing digital payments? The answer is a BIG no. More than 90% of the payments are through banks like NEFT, ECS and IMPS. That has not shown any major disruptive impact from demonetization. How does it matter? But beyond demonetization, the big question is how the future unfolds. Non-cash transactions in India are likely to grow at a CAGR of 26.2% between 2016 and 2020. Further, the Government has an aggressive target of 25 billion non-cash transactions for 2017–2018, with priority areas being mobile, government benefits/subsidy transfers, and micropayments. That total is expected to comprise 11 billion card systems transactions, 6 billion mobile transfers, and 8 billion online transfers. A focus on contactless payments for public transport is the next item on NPCI’s agenda to boost digital payments in India. Beyond politics, why is this question—and its answers— important for business? The future strategy of most consumer businesses will depend on how the digital payment scenario evolves. Depth—more value transactions happening online—will have a different implication than breadth—a wider base of digital payers. The implications for consumer businesses selling high value, low volume items such as electronics, furniture etc. will be different than the implications for low value, high vol- November 2017 | CIO&LEADER 9

Cover Story “Beyond demonetization, the big question is how the future unfolds” ume businesses like retail, telecom, transport and FMCG. A wrong assumption—like demonetization has significantly increased the value of online transactions in India—will result in wrong expectation and possibly wrong business strategy. Similarly, not taking into account the significant upsurge noticed in terms of spread of digital payments may cost companies in terms of opportunity lost while formulating future selling and distribution strategies. A wider digital payment network impacts most industries, especially B2C businesses, in more ways than one. Most obvious, though less dramatic, impact of this democratization of digital payment will be enhanced efficiency of revenue cycles. This will be fairly secular across industries. Secondly, as digital payments become more widespread, companies can reach segments hitherto unreachable. This will be enabled by the fintechs whose models allow them to reach these sections at a fraction of the costs than the traditional banks. B2C businesses can take their help to reach out to these segments. “As collaboration becomes more accepted, merchant and third-party provider (TPP) partnerships are expected to become widespread as banks are bypassed in the development of customized offerings and innovative and secure payments solutions,” notes World Payment Report 2017, released by Capgemini and BNP Paribas. And finally, certain segments such as retail can directly leverage the hitherto unreachable to offer innovative value ads. “The increased digitization of services means retail merchants must find new and better ways to engage with their customers, and payments will be central to this,” says the World Payment Report. In India, many large consumer businesses have taken to creation of their mobile wallets. In e-commerce, it has almost become an industry standard. While Snapdeal started it by buying Freecharge (since then it has sold it to Axis Bank), Flipkart bought PhonePe. Amazon has been aggressively pushing its own Amazon Pay, offering attractive incentives to its customers for using it. Ola Cabs, the prime challenger to Uber, has its own Ola Money. The telecom companies—Airtel, Vodafone and Jio—have their own wallets; not to talk of banks, which have launched them for their non-customers too. “India has lower per capita non-cash transactions, therefore there is substantial opportunity for growth, particularly as financial inclusion and digital payments initiatives are rolled out,” it notes. As digital allows greater flexibility, newer business models will emerge. Payment APIs can be integrated to the service itself. However, like all business model shifts do, this change will be accompanied by new questions about value chains as they will get readjusted. Security will be a big concern, as in a digital payment regime where all sections of society use digital payments, the possibility of direct impact on consumers, of a security breach, is high. One large incident at this stage will significantly derail the shift. That is another story, for another day. The democratization of digital payment has laid the foundation stone of a digital India far more realistically than disparate, disjointed big bang digital projects. To that extent, it is truly the beginning of a new phase 10 CIO&LEADER | November 2017

- Page 1 and 2: FEATURE 15 must-haves for the IT le

- Page 3 and 4: S P I N E A 9.9 Media Publication F

- Page 5 and 6: INTERVIEW "Manufacturing of tomorro

- Page 7 and 8: THE DEMOCRATIZATION OF DIGITAL PAYM

- Page 9: Cover Story A wrong assumption—li

- Page 13 and 14: Insight Source: Freedom of the net

- Page 15 and 16: Insight 1. SDN has lift off! With s

- Page 17 and 18: Insight FFour out of five responden

- Page 19 and 20: Insight T The onslaught of cyberatt

- Page 21 and 22: Insight similarly be replaced by se

- Page 23 and 24: Insight A According to 2018 Gartner

- Page 25 and 26: Insight II. Digital transformation

- Page 27 and 28: Insight DDon’t fear AI Machine le

- Page 29 and 30: Insight Anthony Thomas to Join Niss

- Page 31 and 32: OPINION Peanut Butter and Jelly Fin

- Page 33 and 34: FEATURE 15 Books For The IT Leader'

- Page 35 and 36: Feature BIG PICTURE World Without M

- Page 37 and 38: Feature TECHNOLOGY Doing Digital Ri

- Page 39: Feature SELF IMPROVEMENT/PERSONAL M

Cover Story<br />

So, it is much easier to conclude that demonetization had<br />

had a big impact on driving debit card usage in PoS or using<br />

them as a real payment instrument, rather than just withdrawing<br />

cash.<br />

Of course, in case of both credit card and debit card usage,<br />

we have used the PoS usage only and not the ATM usage, as<br />

ATM usage is for cash.<br />

The impact on mobile wallets has been significant too.<br />

Between August 2016 and August <strong>2017</strong>, the monthly usage<br />

of mobile wallets in terms of value grew by 236% as compared<br />

to 152%, 198% and 174% annual growths in the previous<br />

three years. It is a no-brainer than demonetization did<br />

push up mobile wallet usage. But what is more important is<br />

that unlike debit cards, the mobile wallet usage saw a more<br />

permanent growth and even today is at a level that is significantly<br />

higher than pre-demonetization months.<br />

So, data suggests that mobile wallets gained immensely<br />

from the demonetization move.<br />

Prepaid cards actually saw a lower growth in monthly<br />

value usage between August 2016 and August <strong>2017</strong>. They<br />

grew 120% in this period, as compared to growth of 143% and<br />

278% in annual usage value in the previous two years.<br />

In short, demonetization has had no impact on prepaid card<br />

usage, not even during <strong>November</strong> to January, as the monthly<br />

data reveals.<br />

Let us finally look at the retail electronic clearing data,<br />

which accounts for more than 90% of all retail electronic<br />

transactions in terms of value. In fact, all the other four payment<br />

methods we have examined here combined account for<br />

just about 5% of retail electronic clearing like NEFT, IMPS<br />

and ECS.<br />

The analysis of retail electronic clearing data shows that the<br />

monthly usage in terms of value grew 44% between August<br />

2016 and August <strong>2017</strong>, marginally higher than the 40%<br />

growth witnessed in the annual usage in the previous year<br />

(2015-16) and 38% growth witnessed in the year before that.<br />

Demonetization has very little impact on driving the<br />

growth of electronic bank payments.<br />

So, what is the final conclusion?<br />

The significant growth in debit card usage and mobile wallet<br />

usage shows that demonetization did push up the usage<br />

of electronic payment in the segments that use them. The<br />

explosive growth in these two segments showcase that many<br />

users who did not use electronic payments earlier came into<br />

the ‘system’ and started using electronic payments.<br />

To that extent, demonetization did democratize electronic<br />

payment in India to a great extent—not a mean achievement.<br />

However, did it turn India into a digital economy by significantly<br />

pushing digital payments? The answer is a BIG<br />

no. More than 90% of the payments are through banks like<br />

NEFT, ECS and IMPS. That has not shown any major disruptive<br />

impact from demonetization.<br />

How does it matter?<br />

But beyond demonetization, the big question is how the<br />

future unfolds.<br />

Non-cash transactions in India are likely to grow at a CAGR<br />

of 26.2% between 2016 and 2020. Further, the Government<br />

has an aggressive target of 25 billion non-cash transactions<br />

for <strong>2017</strong>–2018, with priority areas being mobile, government<br />

benefits/subsidy transfers, and micropayments. That total<br />

is expected to comprise 11 billion card systems transactions,<br />

6 billion mobile transfers, and 8 billion online transfers. A<br />

focus on contactless payments for public transport is the next<br />

item on NPCI’s agenda to boost digital payments in India.<br />

Beyond politics, why is this question—and its answers—<br />

important for business?<br />

The future strategy of most consumer businesses will<br />

depend on how the digital payment scenario evolves.<br />

Depth—more value transactions happening online—will<br />

have a different implication than breadth—a wider base of<br />

digital payers.<br />

The implications for consumer businesses selling high<br />

value, low volume items such as electronics, furniture etc.<br />

will be different than the implications for low value, high vol-<br />

<strong>November</strong> <strong>2017</strong> | <strong>CIO</strong>&<strong>LEADER</strong><br />

9