Efiling guide

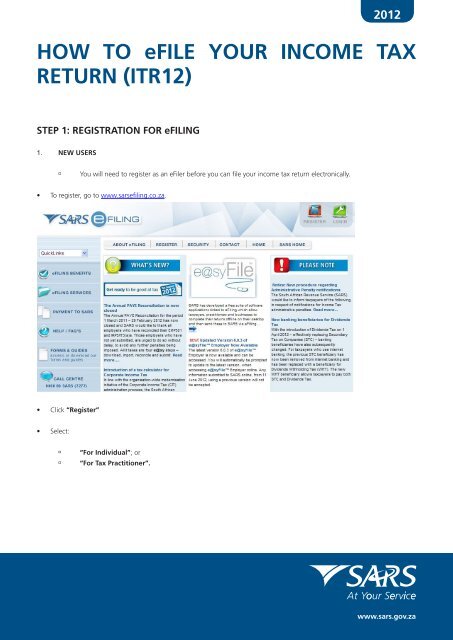

2012 HOW TO eFILE YOUR INCOME TAX RETURN (ITR12) STEP 1: REGISTRATION FOR eFILING 1. NEW USERS ú You will need to register as an eFiler before you can file your income tax return electronically. • To register, go to www.sarsefiling.co.za. • Click “Register” • Select: ú ú “For Individual”; or “For Tax Practitioner”. 1 | How to eFile your Income Tax Return (ITR12)

- Page 2 and 3: • Once you have read through and

- Page 4 and 5: • A Password Hint and security qu

- Page 6 and 7: • Open your income tax return by

- Page 8 and 9: website www.sars.gov.za. • The fo

- Page 10 and 11: Note 3: If you would like to remove

- Page 12 and 13: STEP 4: COMPLETING THE REMAINING PA

- Page 14 and 15: • Depending on the complexity of

- Page 16 and 17: • You will be asked “Are you su

2012<br />

HOW TO eFILE YOUR INCOME TAX<br />

RETURN (ITR12)<br />

STEP 1: REGISTRATION FOR eFILING<br />

1. NEW USERS<br />

ú<br />

You will need to register as an eFiler before you can file your income tax return electronically.<br />

• To register, go to www.sarsefiling.co.za.<br />

• Click “Register”<br />

• Select:<br />

ú<br />

ú<br />

“For Individual”; or<br />

“For Tax Practitioner”.<br />

1 | How to eFile your Income Tax Return (ITR12)

• Once you have read through and accepted the eFiling Terms and Conditions, check the “I Accept” box and then click<br />

“Continue” to proceed with your registration.<br />

• Select the “Individual” button to proceed with the registration.<br />

2 | How to eFile your Income Tax Return (ITR12)

• The following message will appear to confirm that the selection was correct. Select “OK” to continue with the individual<br />

registration and “Cancel” to register a different entity.<br />

• For an individual you will need to enter all your personal information in order to register as an eFiler. Ensure that all captured<br />

information is correct. You will need:<br />

ú<br />

ú<br />

ú<br />

ú<br />

ú<br />

ú<br />

ú<br />

ú<br />

ú<br />

Personal details<br />

ID number<br />

Tax Reference number<br />

Select, “Yes”, if you are registered for Provisional Tax<br />

Select whether you are married<br />

o “Out of community of property/not married”; or<br />

o “In community of property”.<br />

Preferred method of contact<br />

Address details<br />

Banking details<br />

Practitioner’s details, if applicable.<br />

• For Tax Practitioner you will need to select “Tax Practitioner”<br />

ú<br />

ú<br />

Complete your personal details<br />

Organisation information.<br />

• Complete your registration by choosing your Login Name and Password. Click on the “I” information button for further<br />

information about your login ad password rules.<br />

3 | How to eFile your Income Tax Return (ITR12)

• A Password Hint and security questions are required in the event that you forget your password. Verifying of the security pin<br />

is required.<br />

• Click “Register” and you will automatically receive your unique login name – which is the login you choose along with four<br />

digits.<br />

2. REGISTERED USERS<br />

• Simply login to eFiling using your existing Login Name and Password.<br />

ú<br />

If you have forgotten your Login Name and/or Password, click on the question mark icon.<br />

4 | How to eFile your Income Tax Return (ITR12)

Note: If the login and password details are incorrect, an error message will be displayed on the screen for the user.<br />

STEP 2: GETTING STARTED<br />

Remember – Do not submit supporting documentation to SARS, you must retain the documents for a period of five years<br />

should SARS require them in the future.<br />

1. THE INCOME TAX WORK PAGE<br />

• The Income Tax Return page is displayed when you login to eFiling. It is within this page that you request, complete, save and<br />

file your ITR12 return to SARS.<br />

ú<br />

A message will appear informing you that your ITR12 return has been generated and contains the latest information<br />

SARS has on record for you. Please read this and select “OK”.<br />

• If your ITR12 return has been issued to you, it will appear within the Income Tax Work Page, displayed within the grid.<br />

5 | How to eFile your Income Tax Return (ITR12)

• Open your income tax return by clicking on “ITR12”.<br />

ú<br />

If your ITR12 return has not been issued, this means that your registration information could not be verified against<br />

the SARS system. Please call the SARS Contact Centre on 0800 00 SARS (7277) to resolve the problem.<br />

• The Income Tax Work Page also provides you with the ability to obtain a preliminary calculation of your tax liability once you<br />

have completed your ITR12 return.<br />

ú<br />

ú<br />

Click on “Tax Calculator” to gain the preliminary indication of your likely assessment<br />

Use the “Tax Calculator” button only after you have completed your ITR12 return.<br />

• Before opening your ITR12 return, click the “Refresh IRP5 Data” to ensure your populated ITR12 return contains the most<br />

updated data, as supplied to SARS by your employer/pension fund.<br />

• If you have already submitted your ITR12 return to SARS via one of the alternative channels, you can update your eFiling<br />

profile to reflect your submission.<br />

ú<br />

ú<br />

Click “Manually submitted” to change the status of your ITR12 return to “Filed”<br />

You will be prompted to confirm the submission of your return, via any other channel except eFiling, as you will not<br />

be able to file after clicking “Manually submitted”.<br />

• Click “Request Historic Documents” which enables you to request a Statement of Account or a historic Assessment notice.<br />

ú<br />

ú<br />

Select “I want to request a historic Notice of Assessment”<br />

o Select the year, from 1999 – 2010<br />

o Select “Next”; or<br />

Select “I want to request a Statement of Account”<br />

o Select the period, for which you would like to receive your Statement of Account, either six months to<br />

o<br />

date or user defined date range and enter the dates as required<br />

Select “Request”.<br />

STEP 3: INCOME TAX RETURN (ITR12)<br />

• If you are using “Flash Player” to complete you ITR12 return, the following toolbar will appear:<br />

ú<br />

To navigate from page to page, either make use of the arrow keys on the keyboard or the blue arrow keys as<br />

indicated above.<br />

• If you are using “ADOBE Reader” to complete you ITR12 return, the following toolbar will appear, as per last year’s return:<br />

6 | How to eFile your Income Tax Return (ITR12)

• Open your income tax return by clicking on “ITR12”. A warning message regarding your banking details will be displayed.<br />

The warning message indicates that any changes to banking details will be verified before your banking profile is updated. It<br />

also states that any refund due to you (if applicable) will be processed after your banking details are received and verified. It<br />

also advises you that you may be required to visit a SARS branch to present supporting documents and that SARS will inform<br />

you of this if required. Once you have read the warning click “OK”.<br />

• A questionnaire is displayed as the first page of your ITR12 return. This is a wizard which will help you to create a customised<br />

ITR12 return. However, you only need to update the information if your tax affairs have changed over the past year, as your<br />

ITR12 return will be customised with the same fields that you requested last year. To add extra income and deductions sections<br />

to your ITR12 return, select the relevant options on the wizard. Once completed click “Create Form”.<br />

• A new question is included in the standard wizard of the form, relating to expenditure against the employer provided vehicle.<br />

If this section is selected, a container will be created on the form to be completed.<br />

• For a more detailed explanation of the various sections of the Income Tax Act No.58 of 1962 that will be applied during the<br />

assessment process of the ITR12 income tax returns, please refer to the ITR12 Comprehensive Guide published on the SARS<br />

7 | How to eFile your Income Tax Return (ITR12)

website www.sars.gov.za.<br />

• The following page of your ITR12 return is displayed with your personal information. You will notice that your residential<br />

address information is blank. As part of a standardisation process and for verification purpose, you need to enter your address.<br />

Note 1: The personal information must be that of the taxpayer and not those of the tax practitioner completing the return on<br />

behalf of a client.<br />

Note 2: Mandatory fields are shown with a red ring around the required fields. It means these fields must be completed.<br />

• Ensure all the information on the first page is correct and up-to-date.<br />

ú<br />

If you select “Married in community of property”, the following fields become mandatory:<br />

o Spouse initials<br />

o Spouse ID No.; or<br />

o Spouse Passport No<br />

o Passport Country.<br />

• If the populated information is incorrect, enter the correct information in the fields provided.<br />

• Changes to Banking Details<br />

• With effect from 1 July 2011 any changes to your banking details will be verified by SARS before your profile is updated.<br />

• SARS will notify you if you are required to visit a SARS branch to present supporting documentation.<br />

• If you are requested to present yourself at a SARS branch, the following documentation must be submitted in order for the<br />

banking detail changes to be effected:<br />

ú<br />

ú<br />

ú<br />

ú<br />

Original identity document/passport or affidavit to justify the absence of identity document/passport together with<br />

a temporary identity document/passport<br />

Certified copy of identity document or passport<br />

Original stamped bank statement depending on the bank format (in colour or on a bank letterhead) not more than<br />

three months old that confirms the account holder’s name, account number, account type, and branch code where<br />

applicable<br />

In the case where the taxpayer has opened a new bank account and cannot produce a bank statement:<br />

o An original letter from the bank on the bank’s letterhead with the bank stamp stating the date that the<br />

bank account was opened.<br />

8 | How to eFile your Income Tax Return (ITR12)

ú<br />

ú<br />

Original proof of residential address e.g. a municipal account/ telephone account of the taxpayer which is not more<br />

than three months old, reflecting the name and residential address of the taxpayer; or<br />

A confirmation of another individual’s or entity’s residential address, in which instance a CRA01 – Confirmation<br />

of Entity Residential Address form must be completed. The CRA01 can be obtained on the SARS website www.<br />

sars.gov.za, or may be obtained from your nearest SARS branch. In the case where the taxpayer does not own a<br />

property, but lives on the property of the Tribal Chief, the Acting Chief can complete the CRA01 or a signed letter<br />

indicating that the taxpayer resides on that property will be acceptable.<br />

• There are certain exceptional circumstances under which SARS will allow verification of banking details to be done by a person<br />

who is not the account holder and who has power of attorney. Such a person will still have to visit a SARS branch with the<br />

relevant supporting documentation depending on the exceptional circumstances.<br />

ú<br />

The exceptional circumstances are:<br />

o<br />

o<br />

o<br />

o<br />

o<br />

Any estate due to death or sequestration<br />

Taxpayer who is incapacitated / terminally ill<br />

Taxpayer who is a non-resident (emigrant, expatriate, foreigner and temporarily outside the Republic)<br />

Taxpayer who is imprisoned<br />

Taxpayer is a minor.<br />

• For a list of supporting documentation required for these exceptional circumstances, refer to the SARS website www.sars.<br />

gov.za > I want to > Change my bank details<br />

ú<br />

Joint bank account – Where a joint bank account is held with another person, both members of the joint account<br />

are required to present themselves at the SARS branch to have their details verified before SARS can accept the<br />

change of banking details.<br />

• Banking detail changes cannot be made via:<br />

ú<br />

ú<br />

ú<br />

ú<br />

E-mail<br />

Fax<br />

Post<br />

The SARS Contact Centre.<br />

• Should you require any further information concerning banking detail changes, you can:<br />

ú Go to the SARS website www.sars.gov.za > I want to > Change my bank details<br />

ú Visit your nearest SARS branch<br />

ú Call the SARS Contact Centre on 0800 00 SARS (7277).<br />

REMEMBER: Without accurate bank details SARS cannot issue you a refund, where this is due.<br />

ú<br />

A warning message will appear to inform you that all changes to your banking details will be verified before<br />

updating your banking profile. Once you have read the information click “OK” and then select the relevant bank<br />

name from the displayed list.<br />

9 | How to eFile your Income Tax Return (ITR12)

Note 3: If you would like to remove the left hand menu to make the screen bigger, click on the double arrow in the top right<br />

hand corner. Also, if you click on the zoom percentage arrow and click on “Fit Width” it will enlarge the screen.<br />

• If you have no local savings or cheque account, select “No local savings or cheque account declaration” box.<br />

ú<br />

ú<br />

ú<br />

Select “Yes” or “No” to answer the question on the declaration<br />

Select the relevant reason for no savings or cheque bank account<br />

Mark the agreement statement box with “X”.<br />

• You will be required to complete the declaration for no local savings/cheque account.<br />

• Please note: If you indicated that you do not have a local savings or cheque account and later this is found to be incorrect,<br />

SARS will impose administrative penalties of up to R16000 depending on your taxable income.<br />

• You are reminded to your check banking details if the system identifies that you have filed incorrect banking account number.<br />

• To correct your banking account number:<br />

▫<br />

▫<br />

Click “Correct Banking Details” to rectify the account number; or<br />

Click “Continue” if you certain are that your banking details are correct:<br />

o If you choose to continue and your banking details are incorrect, your return will not be filed but will be<br />

saved until you correct the banking details.<br />

10 | How to eFile your Income Tax Return (ITR12)

2012<br />

• If the banking details are incorrect the status of the return will be displayed as “Saved with invalid bank details”.<br />

▫<br />

Capture your correct banking details and file the return.<br />

Remember – check the status of your return to ensure that it reflects as filed.<br />

• Compare your IRP5/IT3 (a) certificate(s) received to the populated information provided on your ITR12 return.<br />

• Where your employer/pension fund has not submitted your IRP5/IT3 (a) information to SARS, your ITR12 return will not be<br />

populated. You have two options:<br />

ú<br />

ú<br />

Click on “Save Return” and try again later<br />

Enter the information yourself in the fields provided.<br />

• To try again later, save your partially completed ITR12 return and login at a later stage to check if your IRP5/IT3(a) information<br />

has been updated. You do this by clicking “Refresh IRP5 data” to ensure your ITR12 return contains the most up-to-date<br />

information provided to SARS.<br />

• If you choose to file your ITR12 return when all your IRP5/IT3(a) information has not been submitted by your employer/pension<br />

fund(s), your assessment may be delayed and you may be required to submit supporting documentation.<br />

11 | How to eFile your Income Tax Return (ITR12)

STEP 4: COMPLETING THE REMAINING PARTS OF THE INCOME TAX RETURN (ITR12)<br />

• Depending on which of the wizard options were selected, sections on additional income and deductions must be completed,<br />

were applicable.<br />

Please note: Medical deductions in respect of a person with a disability – As a result of a change in legislation, an ITR-DD<br />

form, Confirmation of diagnosis of disability for an individual taxpayer, which is available on the SARS website<br />

www.sars.gov.za, has been designed and contains the criteria for the diagnosis of disability. These legislative changes are effective<br />

from 1 March 2009 and are applicable for the 2012 year of assessment.<br />

• For further assistance, please refer to the Tax Guide on the Deduction of Medical Expenses available on the SARS website<br />

www.sars.gov.za.<br />

STEP 5: FILE YOUR INCOME TAX RETURN (ITR12)<br />

• At any stage you can save your ITR12 return before filing it by clicking on “Save Return”. Once you have captured all the<br />

information on your ITR12 return and you are ready to submit it to SARS, simply click “File”.<br />

• When you click “File”, your ITR12 return will be submitted to SARS. eFiling will check the correctness of specific information.<br />

Where information is incorrect and/or incomplete, eFiling will prompt you to correct the captured information before your<br />

ITR12 return can be submitted.<br />

12 | How to eFile your Income Tax Return (ITR12)

Note: If you would like to change any information on your return after you have filed, click on “Request Correction’ on the<br />

Income Tax Work Page. Your return will appear and you can make the necessary changes and resubmit.<br />

• You will receive confirmation when your ITR12 return has been filed.<br />

• Once you click “Continue”, a button will appear on the Income Tax Work Page, enabling you to query the status of your<br />

ITR12 return.<br />

• This is an example of a status report:<br />

STEP 6: USING THE TAX CALCULATOR TO CHECK FOR ACCURACY<br />

• Before filing your ITR12 return to SARS, we recommend that you check your return for accuracy using the tax calculator<br />

function which will provide you with an indication of your expected assessment. If the result is significantly different from<br />

what you are expecting, you may have made an error in completing your return. To use the tax calculator, save your return<br />

(“Save Return”) and click on “Tax Calculator”.<br />

13 | How to eFile your Income Tax Return (ITR12)

• Depending on the complexity of your return, either a standard or complex calculation will be performed. Pictured is an<br />

example of a standard calculation. If the complex calculation is performed, the results may only be available within 72 hours.<br />

• This version will be saved as is available on the work page under “Calculation results”. If you make changes on your return<br />

subsequent to this, a message will appear giving you the option to re-calculate.<br />

STEP 7: VIEW YOUR ASSESSMENTS (ITA34) AND STATEMENT OF ACCOUNT (ITSA)<br />

• Once your ITR12 return has been assessed by SARS, the ITA34 will appear under Notice of Assessment. Click on “ITA34” to<br />

view the assessment.<br />

• If you wish to view your history of transactions with SARS, you must request a Statement of Account. Click “Request Historic<br />

Notice”.<br />

• Select the year for which you would like to view historic transactions.<br />

• Choose the option for request of statement of account and then click “Next”.<br />

14 | How to eFile your Income Tax Return (ITR12)

• Select the period, for which you would like to receive your Statement of Account and then click “Request”.<br />

• A message will be displayed to indicate that the Statement of Account is being requested from SARS and the screen below<br />

indicates that the request has been submitted successfully.<br />

• Click on the link provided to view your statement of account.<br />

• The Statement of Account can also be viewed on the Income Tax Work page.<br />

STEP 8: OBJECTING TO YOUR ASSESSMENT<br />

• If you object to the calculated assessment received from SARS, click “Dispute”.<br />

• Select<br />

ú<br />

ú<br />

“I would like to file a Notice of Objection”; or<br />

“I would like to file a Notice of Appeal”.<br />

15 | How to eFile your Income Tax Return (ITR12)

• You will be asked “Are you sure you want to create a new dispute”, Select “OK”.<br />

• The NOO1 - Notice of Objection form, or NOA1 - Notice of Appeal, will open.<br />

NOO1 - Notice of Objection form<br />

NOA1 - Notice of Appeal<br />

16 | How to eFile your Income Tax Return (ITR12)

Note: Mandatory fields are shown with a red ring around the required fields<br />

• Complete the form, and select “File”.<br />

• For more information on the dispute process, please refer to www.sars.gov.za > All publications > Taxes - Operating Procedures<br />

- Income Tax and then click on “More”.<br />

STEP 9: OBTAINING HELP<br />

• Should you require any further assistance, you can:<br />

ú<br />

ú<br />

Call the SARS Contact Centre on 0800 00 SARS (7277) where the operating hours are: 08:00 - 17:00 on weekdays<br />

(excluding Wednesdays, which are from 09:00 to 17:00). The Contact Centre is closed on weekends and public<br />

holidays<br />

Visit your local SARS branch.<br />

17 | How to eFile your Income Tax Return (ITR12)