e_Paper, Monday, July 03, 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

MONDAY, JULY 3, <strong>2017</strong><br />

DT<br />

News<br />

Banks’ operating profits rise<br />

despite excess liquidity, NPLs<br />

• Shariful Islam<br />

BUSINESS <br />

Despite the pressure of excess liquidity<br />

and non-performing loans<br />

(NPLs), most public and private<br />

banks have seen an increase in their<br />

operating profits in the first six<br />

months of the calendar year compared<br />

to the same period a year ago.<br />

As there is an embargo from<br />

Bangladesh Securities and Exchange<br />

Commission (BSEC) and<br />

Bangladesh Bank on disclosing<br />

information about the operating<br />

profits, the Dhaka Tribune collected<br />

a total of 45 banks’ profit data by<br />

contacting them respectively.<br />

The authorities concerned<br />

marked down the information<br />

about profit data as “sensitive”.<br />

The data shows that at least 22<br />

banks have made significant profit<br />

at the end of June while only three<br />

of them have seen profit downturn.<br />

Though the fiscal year is counted<br />

from <strong>July</strong> to June period, banks<br />

maintain January to December period<br />

as their fiscal year. For this,<br />

every year banks settle accounts by<br />

June 30 and enjoy holiday known<br />

as bank holiday on <strong>July</strong> 1, thus<br />

making a half-yearly calculation.<br />

But this year has been an exception<br />

because <strong>July</strong> 1 fell on Saturday.<br />

Moreover, settling accounts was<br />

easier than previous years as most<br />

banks automate their business process,<br />

said sources in the banks.<br />

According to the banks calculation,<br />

Islami banks have made more<br />

profits than others in the first half<br />

of the current year.<br />

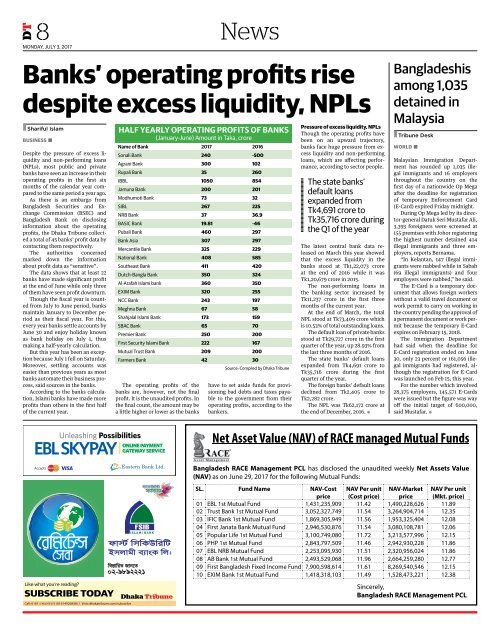

HALF YEARLY OPERATING PROFITS OF BANKS<br />

(January-June) Amount in Taka, crore<br />

Name of Bank <strong>2017</strong> 2016<br />

Sonali Bank 240 -500<br />

Agrani Bank 300 102<br />

Rupali Bank 35 260<br />

IBBL 1050 854<br />

Jamuna Bank 200 201<br />

Modhumoti Bank 73 32<br />

SIBL 267 225<br />

NRB Bank 37 36.9<br />

BASIC Bank 19.81 -46<br />

Pubali Bank 460 297<br />

Bank Asia 307 297<br />

Mercantile Bank 325 229<br />

National Bank 408 585<br />

Southeast Bank 411 420<br />

Dutch-Bangla Bank 350 324<br />

Al-Arafah Islami bank 360 350<br />

EXIM Bank 320 255<br />

NCC Bank 243 197<br />

Meghna Bank 67 58<br />

Shahjalal Islami Bank 173 159<br />

SBAC Bank 65 70<br />

Premier Bank 250 200<br />

First Security Islami Bank 222 167<br />

Mutual Trust Bank 209 200<br />

Farmers Bank 42 30<br />

Source: Compiled by Dhaka Tribune<br />

The operating profits of the<br />

banks are, however, not the final<br />

profit. It is the unaudited profits. In<br />

the final count, the amount may be<br />

a little higher or lower as the banks<br />

have to set aside funds for provisioning<br />

bad debts and taxes payable<br />

to the government from their<br />

operating profits, according to the<br />

bankers.<br />

Pressure of excess liquidity, NPLs<br />

Though the operating profits have<br />

been on an upward trajectory,<br />

banks face huge pressure from excess<br />

liquidity and non-performing<br />

loans, which are affecting performance,<br />

according to sector people.<br />

The state banks’<br />

default loans<br />

expanded from<br />

Tk4,691 crore to<br />

Tk35,716 crore during<br />

the Q1 of the year<br />

The latest central bank data released<br />

on March this year showed<br />

that the excess liquidity in the<br />

banks stood at Tk1,22,073 crore<br />

at the end of 2016 while it was<br />

Tk1,20,679 crore in 2015.<br />

The non-performing loans in<br />

the banking sector increased by<br />

Tk11,237 crore in the first three<br />

months of the current year.<br />

At the end of March, the total<br />

NPL stood at Tk73,409 crore which<br />

is 10.53% of total outstanding loans.<br />

The default loan of private banks<br />

stood at Tk29,727 crore in the first<br />

quarter of the year, up 28.93% from<br />

the last three months of 2016.<br />

The state banks’ default loans<br />

expanded from Tk4,691 crore to<br />

Tk35,716 crore during the first<br />

quarter of the year.<br />

The foreign banks’ default loans<br />

declined from Tk2,405 crore to<br />

Tk2,282 crore.<br />

The NPL was Tk62,172 crore at<br />

the end of December, 2016. •<br />

Bangladeshis<br />

among 1,<strong>03</strong>5<br />

detained in<br />

Malaysia<br />

• Tribune Desk<br />

WORLD <br />

Malaysian Immigration Department<br />

has rounded up 1,<strong>03</strong>5 illegal<br />

immigrants and 16 employers<br />

throughout the country on the<br />

first day of a nationwide Op Mega<br />

after the deadline for registration<br />

of temporary Enforcement Card<br />

(E-Card) expired Friday midnight.<br />

During Op Mega led by its director-general<br />

Datuk Seri Mustafar Ali,<br />

3,393 foreigners were screened at<br />

155 premises with Johor registering<br />

the highest number detained 414<br />

illegal immigrants and three employers,<br />

reports Bernama.<br />

“In Kelantan, 147 illegal immigrants<br />

were nabbed while in Sabah<br />

(69 illegal immigrants) and four<br />

employers were nabbed,” he said.<br />

The E-Card is a temporary document<br />

that allows foreign workers<br />

without a valid travel document or<br />

work permit to carry on working in<br />

the country pending the approval of<br />

a permanent document or work permit<br />

because the temporary E-Card<br />

expires on February 15, 2018.<br />

The Immigration Department<br />

had said when the deadline for<br />

E-Card registration ended on June<br />

30, only 23 percent or 161,056 illegal<br />

immigrants had registered, although<br />

the registration for E-Card<br />

was launched on Feb 15, this year.<br />

For the number which involved<br />

28,375 employers, 145,571 E-Cards<br />

were issued but the figure was way<br />

off the initial target of 600,000,<br />

said Mustafar. •<br />

Like what you’re reading?<br />

SUBSCRIBE TODAY<br />

Call: 0161-I-WANT-DT (01614926838) | Visit: dhakatribune.com/subscribe<br />

Dhaka Tribune