Framework for a Strategy of UP Revenue/Resource Mobilisation ...

Framework for a Strategy of UP Revenue/Resource Mobilisation ... Framework for a Strategy of UP Revenue/Resource Mobilisation ...

Annex- 2 : Holding Tax Assessment Register Holding Tax Rate Selected (3% / 5% / 7%) Year: Residential Property Holding Number Name of Occupier / Owner Occupation / Income Numbe r of Rooms Construction Type Basic Assessment 33 +10% if water on plot by UP Total Assessment Reasons for Any Reduction Amount of Reduction (%) Adjusted Assessment 1 2 3 4 5 6 7 = 6 x 0.25 8 = 6 + 7 9 10 11 = 7-10 Non-Residential Property Plot Number Name of Occupier / Owner Type of Business / Activity Buildin g Size (sq ft) Construction Type Construction Rate (PWD rate per sq ft) Rental Value Or Actual Annual Rent x 10/12 Total Assessment 1 2 3 4 5 6 7 = 4 x 6 x 7.5% 8 9 = 7 (or 8) x tax rate All buildings should be included, either under residential or non-residential. Mobile phone masts can also be included. Reductions may be given for residential assessments for reasons of poverty, under the following conditions: � all reductions should be agreed by the Ward Committee and approved by the UP � the published assessment register for residential properties should indicate the reasons for the reduction (column 9) � reductions should normally be limited to 50% of the assessment � not more than 25% of the households in the ward should be given reductions

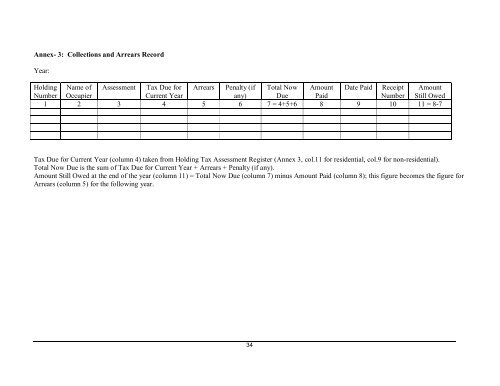

Annex- 3: Collections and Arrears Record Year: Holding Name of Assessment Tax Due for Arrears Penalty (if Total Now Amount Date Paid Receipt Amount Number Occupier Current Year any) Due Paid Number Still Owed 1 2 3 4 5 6 7 = 4+5+6 8 9 10 11 = 8-7 Tax Due for Current Year (column 4) taken from Holding Tax Assessment Register (Annex 3, col.11 for residential, col.9 for non-residential). Total Now Due is the sum of Tax Due for Current Year + Arrears + Penalty (if any). Amount Still Owed at the end of the year (column 11) = Total Now Due (column 7) minus Amount Paid (column 8); this figure becomes the figure for Arrears (column 5) for the following year. 34

- Page 1 and 2: Local Governance Support Project- L

- Page 3 and 4: ABBREVIATIONS AND ACRONYMS ADP Annu

- Page 5 and 6: feed these “second generation”

- Page 7 and 8: III. Legal Status of UPs Revenue Mo

- Page 9 and 10: � Regular transfers from central

- Page 11 and 12: official formula. 6 However, in man

- Page 13 and 14: at the ceiling rate of Taka 500, in

- Page 15 and 16: Table 1: Holding Tax Assessment Pil

- Page 17 and 18: It should be pointed out that there

- Page 19 and 20: probably be paid more than the 15%

- Page 21 and 22: � increasing UPs’ share of the

- Page 23 and 24: e. Fifth UP will be selected where

- Page 25 and 26: about the level of business taxes,

- Page 27 and 28: � Policy Advocacy a. Policy advoc

- Page 29 and 30: Ups’ self sufficiency and better

- Page 31 and 32: Tax Schedule, 2003 to at least refl

- Page 33 and 34: 5. Motivation and Incentive system

Annex- 3: Collections and Arrears Record<br />

Year:<br />

Holding Name <strong>of</strong> Assessment Tax Due <strong>for</strong> Arrears Penalty (if Total Now Amount Date Paid Receipt Amount<br />

Number Occupier<br />

Current Year<br />

any) Due Paid<br />

Number Still Owed<br />

1 2 3 4 5 6 7 = 4+5+6 8 9 10 11 = 8-7<br />

Tax Due <strong>for</strong> Current Year (column 4) taken from Holding Tax Assessment Register (Annex 3, col.11 <strong>for</strong> residential, col.9 <strong>for</strong> non-residential).<br />

Total Now Due is the sum <strong>of</strong> Tax Due <strong>for</strong> Current Year + Arrears + Penalty (if any).<br />

Amount Still Owed at the end <strong>of</strong> the year (column 11) = Total Now Due (column 7) minus Amount Paid (column 8); this figure becomes the figure <strong>for</strong><br />

Arrears (column 5) <strong>for</strong> the following year.<br />

34