Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

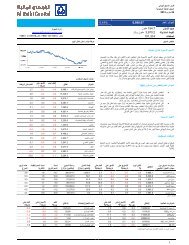

Saudi Banks Sector<br />

Banks –Finance<br />

6 April 2017<br />

Figure 30 NIM (as a % of interest earning assets)<br />

Change (bps)<br />

Bank Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 y-o-y q-o-q<br />

Al Rajhi 3.6% 3.7% 3.9% 4.1% 4.2% 59.5 0.9<br />

Samba 2.3% 2.4% 2.6% 2.9% 2.8% 50.7 (14.4)<br />

Riyad 2.7% 2.5% 2.6% 2.6% 2.8% 0.8 17.5<br />

BSF 2.5% 2.5% 2.4% 2.5% 2.3% (20.8) (26.4)<br />

SABB 2.4% 2.6% 2.7% 2.9% 3.1% 61.3 17.1<br />

ANB 2.4% 2.6% 2.9% 2.9% 2.8% 40.4 (6.1)<br />

Alawwal 2.5% 2.4% 2.4% 2.7% 2.6% 17.3 (4.0)<br />

SIB 2.1% 1.9% 1.9% 2.1% 1.8% (27.0) (34.8)<br />

Alinma 3.0% 2.9% 2.8% 2.9% 3.0% 6.0 7.7<br />

AlJazira 2.7% 2.5% 2.5% 2.6% 2.7% 1.9 4.0<br />

Albilad 2.8% 2.8% 2.8% 3.0% 3.1% 29.0 1.0<br />

NCB 3.2% 3.3% 3.3% 3.5% 3.5% 31.2 (1.9)<br />

Total: 2.8% 2.8% 2.9% 3.1% 3.1% 27.4 (2.3)<br />

Source: Company data, Al Rajhi Capital<br />

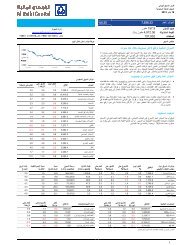

Figure 31 Net income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 1,941 2,009 2,047 5.5% 1.9% 19.6% 25.3%<br />

Samba 1,232 1,341 1,090 -11.6% -18.8% 12.4% 13.5%<br />

Riyad 851 729 293 -65.5% -59.8% 8.6% 3.6%<br />

BSF 950 1,010 374 -60.6% -63.0% 9.6% 4.6%<br />

SABB 939 995 606 -35.5% -39.1% 9.5% 7.5%<br />

ANB 586 722 562 -4.1% -22.2% 5.9% 7.0%<br />

Al Awwal 451 263 (249) -155.2% -194.9% 4.6% -3.1%<br />

SIB 72 219 302 321.1% 37.7% 0.7% 3.7%<br />

Alinma 391 312 390 -0.2% 25.2% 3.9% 4.8%<br />

AlJazira 155 161 152 -1.9% -5.1% 1.6% 1.9%<br />

Albilad 217 228 223 2.5% -2.2% 2.2% 2.8%<br />

NCB 2,127 1,962 2,287 7.5% 16.6% 21.5% 28.3%<br />

Total 9,912 9,951 8,077 -18.5% -18.8% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 32 Net loans (SAR bn)<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 210.2 225.9 225.0 7.0% -0.4% 15.3% 16.1%<br />

Samba 130.0 129.8 125.2 -3.7% -3.5% 9.4% 9.0%<br />

Riyad 145.1 152.6 142.9 -1.5% -6.4% 10.5% 10.2%<br />

BSF 123.8 133.9 129.5 4.6% -3.3% 9.0% 9.3%<br />

SABB 125.9 125.9 121.0 -4.0% -3.9% 9.1% 8.7%<br />

ANB 115.7 115.6 115.5 -0.1% -0.1% 8.4% 8.3%<br />

Al Awwal 76.4 77.3 72.7 -4.8% -5.9% 5.5% 5.2%<br />

SIB 60.3 61.3 60.2 0.0% -1.7% 4.4% 4.3%<br />

Alinma 57.0 69.3 70.3 23.3% 1.5% 4.1% 5.0%<br />

AlJazira 42.2 43.2 42.1 -0.2% -2.5% 3.1% 3.0%<br />

Albilad 34.3 36.2 36.2 5.6% -0.2% 2.5% 2.6%<br />

NCB 256.6 259.9 257.5 0.3% -0.9% 18.6% 18.4%<br />

Total 1,377.4 1,430.9 1,398.2 1.5% -2.3% 100% 100%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 33 Interest earning assets (SAR bn)<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 277.0 276.5 285.6 3.1% 3.3% 14.1% 14.9%<br />

Samba 214.4 195.3 186.2 -13.1% -4.6% 10.9% 9.7%<br />

Riyad 199.1 203.2 192.6 -3.2% -5.2% 10.1% 10.1%<br />

BSF 168.5 182.0 178.9 6.2% -1.7% 8.6% 9.4%<br />

SABB 172.9 165.7 158.5 -8.4% -4.4% 8.8% 8.3%<br />

ANB 154.5 148.9 145.1 -6.1% -2.6% 7.9% 7.6%<br />

Al Awwal 98.4 98.9 95.0 -3.4% -3.9% 5.0% 5.0%<br />

SIB 85.7 85.5 84.0 -1.9% -1.7% 4.4% 4.4%<br />

Alinma 80.6 92.7 94.1 16.8% 1.5% 4.1% 4.9%<br />

AlJazira 58.3 60.7 59.9 2.7% -1.4% 3.0% 3.1%<br />

Albilad 45.6 48.3 47.2 3.6% -2.3% 2.3% 2.5%<br />

NCB 407.9 390.2 384.3 -5.8% -1.5% 20.8% 20.1%<br />

Total 1,962.9 1,947.7 1,911.4 -2.6% -1.9% 100% 100%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 34 Provisions<br />

Market share<br />

Banks Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 950 571 508 -46.5% -11.0% 39.1% 12.3%<br />

Samba 33 62 55 65.3% -11.9% 1.4% 1.3%<br />

Riyad 241 385 761 215.2% 97.6% 9.9% 18.4%<br />

BSF 51 54 636 1158.2% 1069.0% 2.1% 15.4%<br />

SABB 113 190 557 392.4% 193.8% 4.7% 13.5%<br />

ANB 216 241 192 -10.9% -20.3% 8.9% 4.6%<br />

Al Awwal 123 340 745 507.3% 119.3% 5.1% 18.0%<br />

SIB 169 195 40 -76.3% -79.5% 7.0% 1.0%<br />

Alinma 38 150 121 222.6% -19.4% 1.5% 2.9%<br />

AlJazira (12) 29 38 NM 33.4% -0.5% 0.9%<br />

Albilad 8 51 44 470.3% -13.1% 0.3% 1.1%<br />

NCB 499 956 439 -12.0% -54.1% 20.6% 10.6%<br />

Total 2,428 3,224 4,137 70.4% 28.3% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 35 Asset yield<br />

Change (bps)<br />

Bank Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 y-o-y q-o-q<br />

Al Rajhi 3.7% 3.8% 4.1% 4.4% 4.4% 71.9 1.2<br />

Samba 2.6% 2.8% 3.1% 3.6% 3.8% 117.0 21.5<br />

Riyad 3.3% 3.3% 3.5% 3.7% 3.9% 67.8 24.5<br />

BSF 3.0% 3.2% 3.3% 3.5% 3.5% 49.6 6.0<br />

SABB 2.8% 3.2% 3.5% 3.8% 3.9% 109.3 18.1<br />

ANB 3.0% 3.4% 3.9% 4.0% 4.2% 118.1 19.4<br />

Al Awwal 3.3% 3.6% 3.9% 4.4% 4.6% 132.6 21.9<br />

SIB 3.1% 3.3% 3.5% 4.0% 4.0% 90.9 2.9<br />

Alinma 3.4% 3.5% 3.7% 4.0% 4.2% 82.8 29.1<br />

AlJazira 4.9% 3.5% 3.8% 4.0% 6.2% 138.3 219.2<br />

Albilad 3.1% 3.3% 3.5% 3.8% 4.0% 93.1 14.1<br />

NCB 4.1% 4.1% 4.2% 4.4% 4.9% 86.4 54.1<br />

Market 3.4% 3.5% 3.7% 4.0% 4.3% 90.9 29.2<br />

Source: Company data, Al Rajhi Capital<br />

Disclosures Please refer to the important disclosures at the back of this report. 9