Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

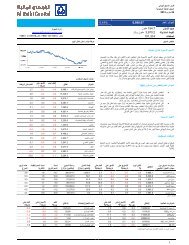

Saudi Banks Sector<br />

Banks –Finance<br />

6 April 2017<br />

Company-wise information<br />

Figure 24 Net special Income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 2,487 2,913 2,921 17.5% 0.3% 18.4% 19.8%<br />

Samba 1,189 1,466 1,325 11.5% -9.6% 8.8% 9.0%<br />

Riyad 1,341 1,321 1,363 1.6% 3.2% 9.9% 9.2%<br />

BSF 1,032 1,136 1,017 -1.5% -10.4% 7.6% 6.9%<br />

SABB 1,076 1,222 1,236 14.8% 1.1% 8.0% 8.4%<br />

ANB 901 1,067 1,031 14.4% -3.4% 6.7% 7.0%<br />

Al Awwal 593 664 638 7.6% -4.0% 4.4% 4.3%<br />

SIB 428 461 378 -11.7% -18.0% 3.2% 2.6%<br />

Alinma 571 665 706 23.7% 6.2% 4.2% 4.8%<br />

AlJazira 390 407 405 3.7% -0.6% 2.9% 2.7%<br />

Albilad 310 370 365 17.6% -1.5% 2.3% 2.5%<br />

NCB 3,211 3,470 3,365 4.8% -3.0% 23.7% 22.8%<br />

Market 13,529 15,162 14,749 9.0% -2.7% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

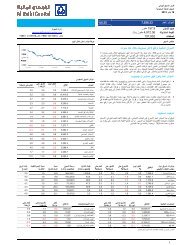

Figure 25 Fees and Commission<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 849 693 580 -31.7% -16.3% 19.7% 15.1%<br />

Samba 359 354 400 11.3% 13.1% 8.3% 10.4%<br />

Riyad 438 320 356 -18.9% 11.3% 10.2% 9.2%<br />

BSF 278 313 324 16.6% 3.6% 6.5% 8.4%<br />

SABB 339 303 283 -16.3% -6.4% 7.9% 7.4%<br />

ANB 252 251 219 -13.2% -12.9% 5.9% 5.7%<br />

Al Awwal 209 186 177 -15.4% -4.9% 4.8% 4.6%<br />

SIB 119 96 103 -12.7% 8.2% 2.8% 2.7%<br />

Alinma 182 142 169 -6.9% 19.2% 4.2% 4.4%<br />

AlJazira 251 141 261 4.0% 84.8% 5.8% 6.8%<br />

Albilad 192 199 201 4.7% 0.8% 4.5% 5.2%<br />

NCB 839 754 779 -7.1% 3.4% 19.5% 20.2%<br />

Total 4,307 3,751 3,852 -10.6% 2.7% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 26 Total operating income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 3,594 3,877 3,812 6.1% -1.7% 18.3% 18.7%<br />

Samba 1,843 2,019 1,848 0.3% -8.5% 9.4% 9.1%<br />

Riyad 1,884 1,855 1,843 -2.2% -0.6% 9.6% 9.1%<br />

BSF 1,534 1,616 1,554 1.3% -3.8% 7.8% 7.6%<br />

SABB 1,549 1,687 1,664 7.4% -1.4% 7.9% 8.2%<br />

ANB 1,349 1,510 1,322 -2.0% -12.4% 6.9% 6.5%<br />

Al Awwal 865 911 910 5.1% -0.2% 4.4% 4.5%<br />

SIB 615 633 570 -7.4% -10.0% 3.1% 2.8%<br />

Alinma 780 829 957 22.7% 15.5% 4.0% 4.7%<br />

AlJazira 581 575 590 1.6% 2.6% 3.0% 2.9%<br />

Albilad 588 647 683 16.1% 5.6% 3.0% 3.4%<br />

NCB 4,444 4,725 4,600 3.5% -2.6% 22.6% 22.6%<br />

Total: 19,626 20,884 20,354 3.7% -2.5% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 27 All operating costs<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 1,653 1,867 1,765 6.8% -5.5% 17.0% 14.4%<br />

Samba 610 678 758 24.3% 11.9% 6.3% 6.2%<br />

Riyad 1,033 1,125 1,550 50.0% 37.7% 10.6% 12.6%<br />

BSF 584 605 1,180 102.0% 95.0% 6.0% 9.6%<br />

SABB 611 692 1,058 73.3% 52.8% 6.3% 8.6%<br />

ANB 763 789 761 -0.3% -3.5% 7.9% 6.2%<br />

Al Awwal 414 648 1,159 180.1% 78.8% 4.3% 9.4%<br />

SIB 543 414 268 -50.8% -35.3% 5.6% 2.2%<br />

Alinma 389 517 567 45.7% 9.6% 4.0% 4.6%<br />

AlJazira 425 415 438 2.9% 5.6% 4.4% 3.6%<br />

Albilad 371 419 460 24.2% 9.8% 3.8% 3.7%<br />

NCB 2,317 2,763 2,314 -0.1% -16.3% 23.9% 18.8%<br />

Total 9,714 10,933 12,277 26.4% 12.3% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 28 NIM (as a % of interest earning assets)<br />

Change (bps)<br />

Bank Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 y-o-y q-o-q<br />

Al Rajhi 3.6% 3.7% 3.9% 4.1% 4.2% 59.5 0.9<br />

Samba 2.3% 2.4% 2.6% 2.9% 2.8% 50.7 (14.4)<br />

Riyad 2.7% 2.5% 2.6% 2.6% 2.8% 0.8 17.5<br />

BSF 2.5% 2.5% 2.4% 2.5% 2.3% (20.8) (26.4)<br />

SABB 2.4% 2.6% 2.7% 2.9% 3.1% 61.3 17.1<br />

ANB 2.4% 2.6% 2.9% 2.9% 2.8% 40.4 (6.1)<br />

Al Awwal 2.5% 2.4% 2.4% 2.7% 2.6% 17.3 (4.0)<br />

SIB 2.1% 1.9% 1.9% 2.1% 1.8% (27.0) (34.8)<br />

Alinma 3.0% 2.9% 2.8% 2.9% 3.0% 6.0 7.7<br />

AlJazira 2.7% 2.5% 2.5% 2.6% 2.7% 1.9 4.0<br />

Albilad 2.8% 2.8% 2.8% 3.0% 3.1% 29.0 1.0<br />

NCB 3.2% 3.3% 3.3% 3.5% 3.5% 31.2 (1.9)<br />

Total: 2.8% 2.8% 2.9% 3.1% 3.1% 27.4 (2.3)<br />

Source: Company data, Al Rajhi Capital<br />

Figure 29 Brokerage net income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 1,333 2,070 2,233 67.5% 7.9% 13.9% 23.4%<br />

Samba 174 107 90 -48.5% -16.2% 1.8% 0.9%<br />

Riyad 98 86 82 -15.8% -3.8% 1.0% 0.9%<br />

BSF 1,587 1,172 1,077 -32.1% -8.1% 16.6% 11.3%<br />

SABB 693 616 642 -7.3% 4.3% 7.2% 6.7%<br />

ANB 1,704 1,729 1,720 1.0% -0.5% 17.8% 18.0%<br />

Al Awwal 543 548 554 2.1% 1.2% 5.7% 5.8%<br />

SIB 397 394 341 -14.2% -13.6% 4.1% 3.6%<br />

Alinma 324 418 449 38.5% 7.2% 3.4% 4.7%<br />

AlJazira 441 496 815 84.9% 64.2% 4.6% 8.5%<br />

Albilad 431 241 227 -47.2% -5.6% 4.5% 2.4%<br />

NCB 1,858 1,568 1,314 -29.3% -16.2% 19.4% 13.8%<br />

Total 9,582 9,444 9,544 -0.4% 1.1% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Disclosures Please refer to the important disclosures at the back of this report. 8