Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Q1 2012<br />

Q2 2012<br />

Q3 2012<br />

Q4 2012<br />

Q1 2013<br />

Q2 2013<br />

Q3 2013<br />

Q4 2013<br />

Q1 2014<br />

Q2 2014<br />

Q3 2014<br />

Q4 2014<br />

Q1 2015<br />

Q2 2015<br />

Q3 2015<br />

Q4 2015<br />

Q1 2016<br />

Q2 2016<br />

Q3 2016<br />

Q4 2016<br />

Q1 2012<br />

Q2 2012<br />

Q3 2012<br />

Q4 2012<br />

Q1 2013<br />

Q2 2013<br />

Q3 2013<br />

Q4 2013<br />

Q1 2014<br />

Q2 2014<br />

Q3 2014<br />

Q4 2014<br />

Q1 2015<br />

Q2 2015<br />

Q3 2015<br />

Q4 2015<br />

Q1 2016<br />

Q2 2016<br />

Q3 2016<br />

Q4 2016<br />

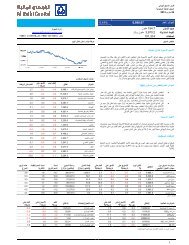

Saudi Banks Sector<br />

Banks –Finance<br />

6 April 2017<br />

Figure 5 Movement of asset yield, cost of deposit, net interest margin and interest rates<br />

5.0%<br />

4.5%<br />

4.0%<br />

3.5%<br />

3.0%<br />

2.5%<br />

2.0%<br />

1.5%<br />

1.0%<br />

4.0% 4.3%<br />

3.6% 3.5% 3.6% 3.6% 3.5% 3.4% 3.4%3.5% 3.4% 3.3% 3.3% 3.2% 3.3% 3.5% 3.7% 3.2% 3.2% 3.2%<br />

3.1%<br />

3.2% 3.1% 3.1% 3.1% 3.0% 3.0%<br />

3.1%<br />

2.9%<br />

2.9% 2.9% 2.8% 2.9% 2.8% 2.8% 2.8% 2.8% 2.8% 2.9% 3.1%<br />

1.7% 2.1% 2.3% 2.2%<br />

0.8% 0.9% 1.0% 1.0% 1.0% 1.0% 1.0% 0.9% 1.0% 1.0% 1.1%<br />

0.9% 0.9% 0.8% 0.8% 0.8%<br />

0.5%<br />

0.0%<br />

Q1<br />

2012<br />

Q2<br />

2012<br />

Q3<br />

2012<br />

Q4<br />

2012<br />

Q1<br />

2013<br />

Q2<br />

2013<br />

Q3<br />

2013<br />

Q4<br />

2013<br />

Q1<br />

2014<br />

Q2<br />

2014<br />

Q3<br />

2014<br />

Q4<br />

2014<br />

Q1<br />

2015<br />

Q2<br />

2015<br />

Q3<br />

2015<br />

Q4<br />

2015<br />

Q1<br />

2016<br />

Q2<br />

2016<br />

Q3<br />

2016<br />

Q4<br />

2016<br />

Asset yield Cost of deposits NIM 3m SAIBOR 3m LIBOR<br />

Source: Company data, Al Rajhi Capital (* NIM is calculated as Non-interest income divided by interest earning assets)<br />

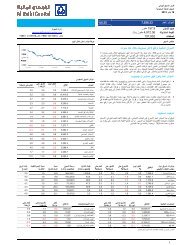

Figure 6 Non-performing loan ratio vs. coverage ratio<br />

190%<br />

180%<br />

170%<br />

160%<br />

150%<br />

140%<br />

130%<br />

120%<br />

2.4%<br />

2.2%<br />

2.0%<br />

1.8%<br />

1.6%<br />

1.4%<br />

1.2%<br />

1.0%<br />

Figure 7 Net interest income for the <strong>sector</strong><br />

SAR mn<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

Title:<br />

Source:<br />

16%<br />

14%<br />

12%<br />

Please fill in the values above to have them entered in your report<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

-6%<br />

coverage ratio<br />

Source: Company data, Al Rajhi Capital<br />

Non-performing loan to gross loans (RHS)<br />

Source: Company data, Al Rajhi Capital<br />

Net interest income y-o-y (RHS) q-o-q (RHS)<br />

Disclosures Please refer to the important disclosures at the back of this report. 4