You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Saudi Banks Sector<br />

Banks –Finance<br />

6 April 2017<br />

demand deposits and 4% of time deposits. Thus, even if the Saudi government issues<br />

domestic bonds, the banking system would have the ability to absorb it without squeezing<br />

liquidity.<br />

c) Moreover, Banks have sufficient liquid assets (in the form of investments) over and above<br />

the required 20% of deposits they are required to maintain.<br />

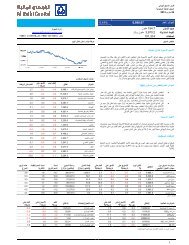

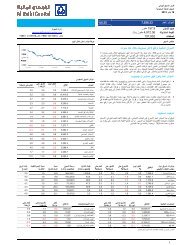

Valuation and risks: After moving up sharply in Q4 2016 on news of Govt payment of dues,<br />

the banking <strong>sector</strong> has thereafter declined in Q1 2017, (down 4.1% sequentially). In terms of<br />

valuations, the <strong>sector</strong> is currently trading at 1.2x FY2016 book value. However, if the<br />

government starts to pay its outstanding dues to companies, it could lead to repayment to<br />

banks, which may result in reversal of provisions and act as a catalyst for the banking <strong>sector</strong><br />

stocks.<br />

Figure 3 Performance of Bank <strong>sector</strong> vs. TASI<br />

Figure 4 ROE (avg. last 4 quarters) vs. P/B (12m forward)<br />

110.0<br />

105.0<br />

100.0<br />

95.0<br />

18.0%<br />

16.0%<br />

Title:<br />

Source:<br />

NCB<br />

Al Rajhi<br />

Please fill in the values above to have them entered in your report<br />

90.0<br />

85.0<br />

80.0<br />

75.0<br />

14.0%<br />

12.0%<br />

SABB<br />

ANB BSF Samba<br />

Aljazira<br />

Albilad<br />

70.0<br />

65.0<br />

60.0<br />

10.0%<br />

8.0%<br />

SIB<br />

Riyad<br />

Alawwal<br />

Alinma<br />

Banks TASI<br />

6.0%<br />

0.4 0.6 0.8 1 1.2 1.4 1.6 1.8 2<br />

Source: Bloomberg, Al Rajhi Capital<br />

Source: Bloomberg, Company data, Al Rajhi Capital<br />

Disclosures Please refer to the important disclosures at the back of this report. 3