You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Q1 2012<br />

Q2 2012<br />

Q3 2012<br />

Q4 2012<br />

Q1 2013<br />

Q2 2013<br />

Q3 2013<br />

Q4 2013<br />

Q1 2014<br />

Q2 2014<br />

Q3 2014<br />

Q4 2014<br />

Q1 2015<br />

Q2 2015<br />

Q3 2015<br />

Q4 2015<br />

Q1 2016<br />

Q2 2016<br />

Q3 2016<br />

Q4 2016<br />

Saudi Banks Sector<br />

Banks –Finance<br />

6 April 2017<br />

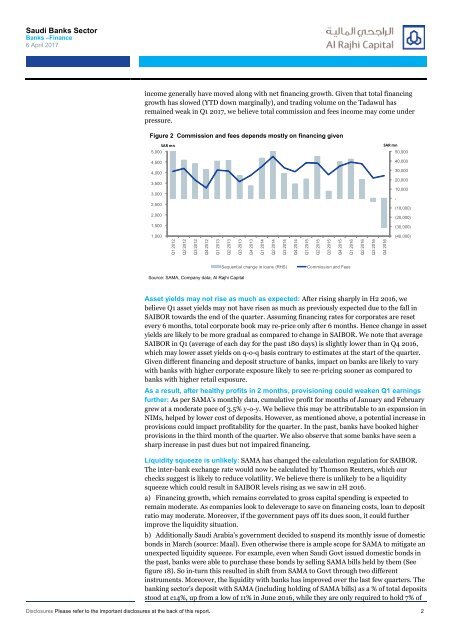

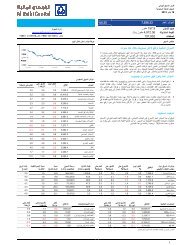

income generally have moved along with net financing growth. Given that total financing<br />

growth has slowed (YTD down marginally), and trading volume on the Tadawul has<br />

remained weak in Q1 2017, we believe total commission and fees income may come under<br />

pressure.<br />

Figure 2 Commission and fees depends mostly on financing given<br />

SAR mn<br />

5,000<br />

4,500<br />

4,000<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

SAR mn<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

-<br />

(10,000)<br />

(20,000)<br />

(30,000)<br />

(40,000)<br />

Sequential change in loans (RHS)<br />

Commission and Fees<br />

Source: SAMA, Company data, Al Rajhi Capital<br />

Asset yields may not rise as much as expected: After rising sharply in H2 2016, we<br />

believe Q1 asset yields may not have risen as much as previously expected due to the fall in<br />

SAIBOR towards the end of the quarter. Assuming financing rates for corporates are reset<br />

every 6 months, total corporate book may re-price only after 6 months. Hence change in asset<br />

yields are likely to be more gradual as compared to change in SAIBOR. We note that average<br />

SAIBOR in Q1 (average of each day for the past 180 days) is slightly lower than in Q4 2016,<br />

which may lower asset yields on q-o-q basis contrary to estimates at the start of the quarter.<br />

Given different financing and deposit structure of banks, impact on banks are likely to vary<br />

with banks with higher corporate exposure likely to see re-pricing sooner as compared to<br />

banks with higher retail exposure.<br />

As a result, after healthy profits in 2 months, provisioning could weaken Q1 earnings<br />

further: As per SAMA’s monthly data, cumulative profit for months of January and February<br />

grew at a moderate pace of 3.5% y-o-y. We believe this may be attributable to an expansion in<br />

NIMs, helped by lower cost of deposits. However, as mentioned above, a potential increase in<br />

provisions could impact profitability for the quarter. In the past, banks have booked higher<br />

provisions in the third month of the quarter. We also observe that some banks have seen a<br />

sharp increase in past dues but not impaired financing.<br />

Liquidity squeeze is unlikely: SAMA has changed the calculation regulation for SAIBOR.<br />

The inter-bank exchange rate would now be calculated by Thomson Reuters, which our<br />

checks suggest is likely to reduce volatility. We believe there is unlikely to be a liquidity<br />

squeeze which could result in SAIBOR levels rising as we saw in 2H 2016.<br />

a) Financing growth, which remains correlated to gross capital spending is expected to<br />

remain moderate. As companies look to deleverage to save on financing costs, loan to deposit<br />

ratio may moderate. Moreover, if the government pays off its dues soon, it could further<br />

improve the liquidity situation.<br />

b) Additionally Saudi Arabia's government decided to suspend its monthly issue of domestic<br />

bonds in March (source: Maal). Even otherwise there is ample scope for SAMA to mitigate an<br />

unexpected liquidity squeeze. For example, even when Saudi Govt issued domestic bonds in<br />

the past, banks were able to purchase these bonds by selling SAMA bills held by them (See<br />

figure 18). So in-turn this resulted in shift from SAMA to Govt through two different<br />

instruments. Moreover, the liquidity with banks has improved over the last few quarters. The<br />

banking <strong>sector</strong>’s deposit with SAMA (including holding of SAMA bills) as a % of total deposits<br />

stood at c14%, up from a low of 11% in June 2016, while they are only required to hold 7% of<br />

Disclosures Please refer to the important disclosures at the back of this report. 2