You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

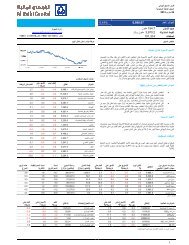

Saudi Banks Sector<br />

Banks –Finance<br />

6 April 2017<br />

Figure 50 Corporate operating income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi (13) 608 552 NM -9.2% -0.2% 8.5%<br />

Samba 812 728 636 -21.7% -12.6% 14.5% 9.8%<br />

Riyad 723 730 774 7.0% 5.9% 12.9% 11.9%<br />

BSF 734 787 749 2.1% -4.8% 13.1% 11.5%<br />

SABB 693 773 769 11.0% -0.5% 12.4% 11.9%<br />

ANB 501 506 451 -10.1% -10.9% 9.0% 6.9%<br />

Al Awwal 263 484 464 76.1% -4.2% 4.7% 7.1%<br />

SIB 172 315 302 75.2% -4.0% 3.1% 4.7%<br />

Alinma 395 369 397 0.6% 7.5% 7.1% 6.1%<br />

AlJazira 106 124 129 21.9% 3.8% 1.9% 2.0%<br />

Albilad 196 223 204 4.1% -8.5% 3.5% 3.1%<br />

NCB 1,002 1,274 1,063 6.1% -16.6% 17.9% 16.4%<br />

Total 5,584 6,920 6,489 16.2% -6.2% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

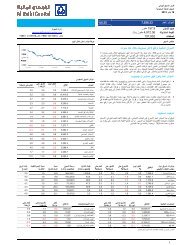

Figure 51 Corporate net operating income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi (460) 337 341 0.0% 1.2% -12.9% 7.8%<br />

Samba 684 583 449 -34.4% -23.1% 19.2% 13.5%<br />

Riyad 562 376 (74) 0.0% 0.0% 15.7% 8.7%<br />

BSF 518 611 (18) 0.0% 0.0% 14.5% 14.1%<br />

SABB 482 489 228 -52.7% -53.4% 13.5% 11.3%<br />

ANB 210 282 208 -0.9% -26.1% 5.9% 6.5%<br />

Al Awwal 327 234 (286) 0.0% 0.0% 9.1% 5.4%<br />

SIB 101 242 235 132.6% -3.0% 2.8% 5.6%<br />

Alinma 280 253 175 -37.3% -30.6% 7.8% 5.8%<br />

AlJazira (3) 33 26 -934.3% -21.0% -0.1% 0.8%<br />

Albilad 133 111 84 -36.4% -24.2% 3.7% 2.6%<br />

NCB 738 767 532 -27.9% -30.6% 20.7% 17.8%<br />

Total 3,572 4,319 1,901 -46.8% -56.0% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 52 Total corporate segment assets<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 54,520 63,778 61,797 13.3% -3.1% 6.1% 6.9%<br />

Samba 106,307 107,875 105,514 -0.7% -2.2% 12.0% 11.8%<br />

Riyad 105,783 114,016 103,814 -1.9% -8.9% 11.9% 11.6%<br />

BSF 110,466 121,578 116,505 5.5% -4.2% 12.4% 13.0%<br />

SABB 96,850 96,859 93,094 -3.9% -3.9% 10.9% 10.4%<br />

ANB 81,991 80,678 81,689 -0.4% 1.3% 9.2% 9.1%<br />

Al Awwal 59,069 56,069 51,274 -13.2% -8.6% 6.7% 5.7%<br />

SIB 38,262 38,803 36,013 -5.9% -7.2% 4.3% 4.0%<br />

Alinma 45,380 56,329 57,567 26.9% 2.2% 5.1% 6.4%<br />

AlJazira 23,028 23,359 22,682 -1.5% -2.9% 2.6% 2.5%<br />

Albilad 22,793 23,197 22,537 -1.1% -2.8% 2.6% 2.5%<br />

NCB 143,147 150,314 142,830 -0.2% -5.0% 16.1% 16.0%<br />

Total 887,596 932,856 895,315 0.9% -4.0% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 53 Corporate segment yield (operating income/assets)<br />

Change (bps)<br />

Bank Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 y-o-y q-o-q<br />

Al Rajhi -0.1% 2.8% 2.7% 3.8% 3.5% 360.6 (27.7)<br />

Samba 3.1% 2.6% 2.7% 2.7% 2.4% (70.7) (31.4)<br />

Riyad 2.8% 2.9% 2.7% 2.5% 2.8% (0.3) 29.7<br />

BSF 2.7% 2.8% 2.7% 2.6% 2.5% (14.3) (12.6)<br />

SABB 2.8% 3.3% 3.2% 3.1% 3.2% 40.1 12.2<br />

ANB 2.5% 2.5% 2.7% 2.5% 2.2% (24.9) (26.5)<br />

Al Awwal 1.8% 3.9% 3.4% 3.4% 3.5% 164.6 2.8<br />

SIB 1.8% 1.6% 3.1% 3.3% 3.2% 142.1 (7.5)<br />

Alinma 3.6% 2.7% 2.8% 2.7% 2.8% (84.1) 10.7<br />

AlJazira 1.8% 2.1% 1.9% 2.1% 2.2% 41.4 15.4<br />

Albilad 3.8% 3.4% 2.8% 3.8% 3.6% (24.3) (26.5)<br />

NCB 2.8% 3.0% 3.0% 3.4% 2.9% 5.2 (47.3)<br />

Total 2.5% 2.8% 2.8% 3.0% 2.8% 29.5 (12.3)<br />

Source: Company data, Al Rajhi Capital<br />

Figure 54 Treasury operating income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 324 322 552 NM NM 10.5% 15.6%<br />

Samba 353 171 342 -3.0% 99.7% 11.4% 9.7%<br />

Riyad 179 294 209 16.7% -29.1% 5.8% 5.9%<br />

BSF 363 402 380 4.7% -5.4% 11.7% 10.7%<br />

SABB 285 302 307 7.8% 1.9% 9.2% 8.7%<br />

ANB 200 387 1 -99.5% -99.8% 6.5% 0.0%<br />

Al Awwal (46) 45 45 -199.9% 0.1% -1.5% 1.3%<br />

SIB 260 141 130 -49.9% -7.3% 8.4% 3.7%<br />

Alinma 87 134 199 128.6% 48.8% 2.8% 5.6%<br />

AlJazira 192 203 196 2.4% -3.3% 6.2% 5.6%<br />

Albilad 38 62 67 78.5% 8.1% 1.2% 1.9%<br />

NCB 857 820 1,107 29.2% 35.0% 27.7% 31.3%<br />

Total 3,092 3,283 3,537 14.4% 7.7% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 55 Treasury net operating income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 360 260 540 49.9% 107.4% 15.4% 18.3%<br />

Samba 321 340 308 -4.0% -9.4% 13.7% 10.4%<br />

Riyad 161 233 196 22.2% -15.5% 6.9% 6.7%<br />

BSF 295 308 321 9.0% 4.1% 12.6% 10.9%<br />

SABB 247 264 264 6.8% 0.1% 10.6% 9.0%<br />

ANB 178 335 (25) -114.1% -107.5% 7.6% -0.9%<br />

Al Awwal 13 (81) (5) NM NM 0.5% -0.2%<br />

SIB 100 (48) 106 NM NM 4.3% 3.6%<br />

Alinma 22 (33) 130 NM NM 0.9% 4.4%<br />

AlJazira 142 131 118 -16.7% -9.7% 6.1% 4.0%<br />

Albilad 25 49 52 109.6% 4.9% 1.1% 1.8%<br />

NCB 476 535 944 98.5% 76.4% 20.3% 32.0%<br />

Total 2,340 2,293 2,950 26.1% 28.6% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Disclosures Please refer to the important disclosures at the back of this report. 13