You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

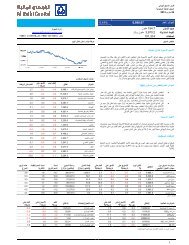

Saudi Banks Sector<br />

Banks –Finance<br />

6 April 2017<br />

Segmental breakup<br />

Figure 44 Net income breakup<br />

Bank Retail Corporate Treasury<br />

Investment<br />

services &<br />

brokerage<br />

Others<br />

Al Rajhi 52% 17% 26% 5% 0%<br />

Samba 28% 41% 28% 2% 0%<br />

Riyad 72% -25% 67% 10% -24%<br />

BSF 11% -5% 86% 8% 0%<br />

SABB 15% 38% 44% 0% 4%<br />

ANB 52% 37% -4% 4% 12%<br />

Al Awwal -15% 115% 2% -2% 0%<br />

SIB -2% 78% 35% 3% -13%<br />

Alinma 12% 45% 33% 9% 0%<br />

AlJazira 15% 17% 78% 9% -18%<br />

Albilad 10% 38% 23% 7% 22%<br />

NCB 29% 23% 41% 3% 5%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 45 Total assets breakup<br />

Bank Retail Corporate Treasury<br />

Investment<br />

services &<br />

brokerage<br />

Others<br />

Al Rajhi 52% 18% 29% 0.7% 0%<br />

Samba 16% 46% 39% 0.0% 0%<br />

Riyad 18% 48% 33% 0.0% 1.5%<br />

BSF 8% 57% 34% 0.5% 0%<br />

SABB 17% 50% 33% 0.0% 0%<br />

ANB 23% 48% 27% 1.0% 1.3%<br />

Al Awwal 20% 49% 30% 0.5% 0%<br />

SIB 30% 38% 28% 0.4% 3%<br />

Alinma 17% 55% 28% 0.4% 0%<br />

AlJazira 30% 34% 34% 1.2% 0.2%<br />

Albilad 34% 42% 21% 0.4% 2.4%<br />

NCB 24% 32% 34% 0.3% 9.2%<br />

Source: Company data, Al Rajhi Capital<br />

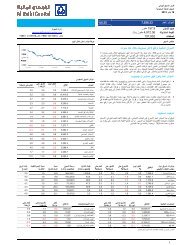

Figure 46 Retail operating income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 3,089 2,821 2,594 -16.0% -8.0% 34.1% 29.6%<br />

Samba 565 965 811 43.6% -15.9% 6.2% 9.2%<br />

Riyad 816 539 495 -39.3% -8.2% 9.0% 5.6%<br />

BSF 378 370 356 -5.8% -3.7% 4.2% 4.1%<br />

SABB 571 612 588 3.0% -4.0% 6.3% 6.7%<br />

ANB 493 497 746 51.4% 50.0% 5.4% 8.5%<br />

Al Awwal 302 371 384 27.1% 3.5% 3.3% 4.4%<br />

SIB 240 275 184 -23.5% -33.3% 2.7% 2.1%<br />

Alinma 263 297 288 9.5% -3.0% 2.9% 3.3%<br />

AlJazira 249 230 238 -4.3% 3.3% 2.7% 2.7%<br />

Albilad 321 330 324 1.1% -1.8% 3.5% 3.7%<br />

NCB 1,768 1,914 1,770 0.1% -7.5% 19.5% 20.2%<br />

Total 9,054 9,222 8,778 -3.0% -4.8% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 47 Retail net operating income<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 1906 1330 1073 -43.7% -19.3% 47.3% 38.1%<br />

Samba 168 307 309 83.9% 0.9% 4.2% 11.0%<br />

Riyad 373 226 213 -43.0% -6.1% 9.3% 7.5%<br />

BSF 125 73 43 -66.1% -41.8% 3.1% 1.5%<br />

SABB 184 226 88 -52.3% -61.0% 4.6% 3.1%<br />

ANB 126 24 295 133.2% 1124.3% 3.1% 10.5%<br />

Al Awwal 109 110 37 -65.8% -66.0% 2.7% 1.3%<br />

SIB 104 99 -7 -106.3% -106.6% 2.6% -0.2%<br />

Alinma 68 69 48 -28.5% -29.9% 1.7% 1.7%<br />

AlJazira 32 20 22 -31.0% 13.4% 0.8% 0.8%<br />

Albilad 40 35 23 -42.7% -35.5% 1.0% 0.8%<br />

NCB 792 601 670 -15.3% 11.5% 19.7% 23.8%<br />

Total 4,028 3,120 2,815 -30.1% -9.8% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 48 Total retail segment assets<br />

Market share<br />

Bank Q4 2015 Q3 2016 Q4 2016 y-o-y q-o-q Q4 2015 Q4 2016<br />

Al Rajhi 169,972 178,424 177,178 4.2% -0.7% 32.0% 32.2%<br />

Samba 38,886 38,410 35,982 -7.5% -6.3% 7.3% 6.5%<br />

Riyad 39,686 39,102 39,437 -0.6% 0.9% 7.5% 7.2%<br />

BSF 15,978 17,040 16,500 3.3% -3.2% 3.0% 3.0%<br />

SABB 33,000 33,456 31,751 -3.8% -5.1% 6.2% 5.8%<br />

ANB 39,173 40,324 38,646 -1.3% -4.2% 7.4% 7.0%<br />

Al Awwal 17,343 21,195 21,469 23.8% 1.3% 3.3% 3.9%<br />

SIB 26,218 26,789 28,418 8.4% 6.1% 4.9% 5.2%<br />

Alinma 15,466 17,699 17,590 13.7% -0.6% 2.9% 3.2%<br />

AlJazira 19,624 20,201 20,167 2.8% -0.2% 3.7% 3.7%<br />

Albilad 15,818 18,078 18,343 16.0% 1.5% 3.0% 3.3%<br />

NCB 99,916 107,786 104,491 4.6% -3.1% 18.8% 19.0%<br />

Total 531,081 558,504 549,974 3.6% -1.5% 100.0% 100.0%<br />

Source: Company data, Al Rajhi Capital<br />

Figure 49 Retail segment yield (operating income/assets)<br />

Change bps<br />

Bank Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 y-o-y q-o-q<br />

Al Rajhi 7.3% 6.3% 6.6% 6.4% 5.8% (142.0) (51.5)<br />

Samba 5.8% 6.1% 4.3% 10.0% 8.7% 296.0 (125.8)<br />

Riyad 8.1% 6.4% 6.4% 5.5% 5.0% (303.4) (47.9)<br />

BSF 9.3% 9.6% 9.0% 8.6% 8.5% (84.9) (14.9)<br />

SABB 6.7% 6.8% 7.0% 7.2% 7.2% 54.3 (1.1)<br />

ANB 5.0% 5.4% 5.3% 4.9% 7.6% 251.0 269.2<br />

Al Awwal 7.2% 7.4% 7.2% 7.0% 7.2% (0.4) 15.9<br />

SIB 3.8% 3.5% 4.4% 4.0% 2.7% (114.7) (131.8)<br />

Alinma 6.8% 6.8% 6.5% 6.6% 6.5% (25.0) (10.0)<br />

AlJazira 5.1% 5.0% 4.7% 4.5% 4.7% (37.3) 20.1<br />

Albilad 8.7% 7.9% 7.4% 7.3% 7.1% (152.7) (21.1)<br />

NCB 7.1% 7.6% 7.3% 7.1% 6.7% (46.2) (41.1)<br />

Total 6.8% 6.5% 6.4% 6.6% 6.3% (49.3) (24.6)<br />

Source: Company data, Al Rajhi Capital<br />

Disclosures Please refer to the important disclosures at the back of this report. 12