BRITISH COLUMBIA HYDRO AND POWER AUTHORITY

financial-information-act-return-march-31-2016 financial-information-act-return-march-31-2016

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED MARCH 31, 2016 AND 2015 British Columbia Hydro and Power Authority liabilities and expenses incurred jointly with third parties and any revenue from the sale or use of its share of the output in relation to the assets. (t) New Standards and Interpretations Not Yet Adopted A number of new standards, and amendments to standards and interpretations, are not yet effective for the year ended March 31, 2016, and have not been applied in preparing these consolidated financial statements. In particular, the following new and amended standards become effective for the Company’s annual periods beginning on or after the dates noted below: Amendments to IFRS 10, Consolidated Financial Statements (April 1, 2016) Amendments to IFRS 11, Joint Arrangements (April 1, 2016) Amendments to IFRS 12, Disclosure of Interests in Other Entities (April 1, 2016) Amendments to IAS 1, Presentation of Financial Statements (April 1, 2016) Amendments to IAS 16, Property, Plant and Equipment (April 1, 2016) Amendments to IAS 38, Intangible Assets (April 1, 2016) Amendments to IAS 7, Statement of Cash Flows (April 1, 2017) IFRS 9, Financial Instruments (April 1, 2018) IFRS 15, Revenue From Contracts With Customers (April 1, 2018) IFRS 16, Leases (April 1, 2019) The Company does not have any plans to early adopt any of the new or amended standards. It is expected that the standards effective for the Company’s 2017 fiscal year will not have a material effect on the consolidated financial statements. The Company continues to assess the impact of adopting standards that become effective for the Company’s fiscal years commencing April 1, 2017 and later. IFRS 14, Regulatory Deferral Accounts, effective for fiscal years beginning on or after January 1, 2016, has been issued; however, the Company currently does not intend to adopt IFRS 14 as it applies the Prescribed Standards, not IFRS, and accounts for its regulatory accounts in accordance with ASC 980.

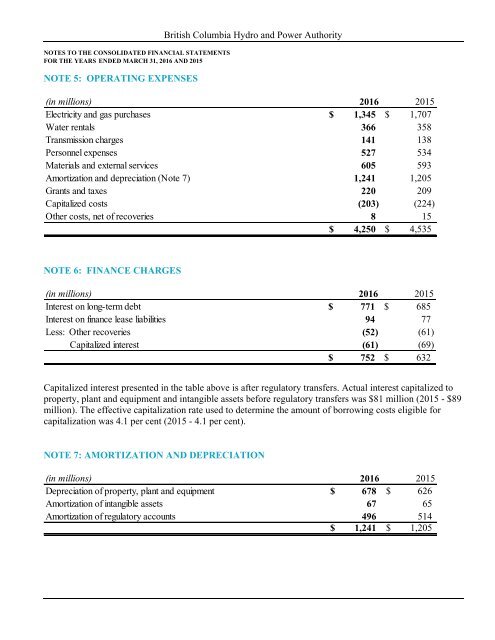

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED MARCH 31, 2016 AND 2015 NOTE 5: OPERATING EXPENSES British Columbia Hydro and Power Authority (in millions) 2016 2015 Electricity and gas purchases $ 1,345 $ 1,707 Water rentals 366 358 Transmission charges 141 138 Personnel expenses 527 534 Materials and external services 605 593 Amortization and depreciation (Note 7) 1,241 1,205 Grants and taxes 220 209 Capitalized costs (203) (224) Other costs, net of recoveries 8 15 $ 4,250 $ 4,535 NOTE 6: FINANCE CHARGES (in millions) 2016 2015 Interest on long-term debt $ 771 $ 685 Interest on finance lease liabilities 94 77 Less: Other recoveries (52) (61) Capitalized interest (61) (69) $ 752 $ 632 Capitalized interest presented in the table above is after regulatory transfers. Actual interest capitalized to property, plant and equipment and intangible assets before regulatory transfers was $81 million (2015 - $89 million). The effective capitalization rate used to determine the amount of borrowing costs eligible for capitalization was 4.1 per cent (2015 - 4.1 per cent). NOTE 7: AMORTIZATION AND DEPRECIATION (in millions) 2016 2015 Depreciation of property, plant and equipment $ 678 $ 626 Amortization of intangible assets 67 65 Amortization of regulatory accounts 496 514 $ 1,241 $ 1,205

- Page 1 and 2: BRITISH COLUMBIA HYDRO AND POWER AU

- Page 3 and 4: British Columbia Hydro and Power Au

- Page 5 and 6: British Columbia Hydro and Power Au

- Page 7 and 8: British Columbia Hydro and Power Au

- Page 9 and 10: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 11 and 12: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 13 and 14: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 15 and 16: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 17 and 18: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 19 and 20: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 21: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 25 and 26: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 27 and 28: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 29 and 30: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 31 and 32: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 33 and 34: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 35 and 36: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 37 and 38: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 39 and 40: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 41 and 42: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 43 and 44: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 45 and 46: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 47 and 48: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 49 and 50: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 51 and 52: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 53 and 54: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 55 and 56: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 57 and 58: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 59 and 60: NAME POSITION MEETINGS ATTENDED 1 R

- Page 61 and 62: BRITISH COLUMBIA HYDRO AND POWER AU

- Page 63 and 64: BRITISH COLUMBIA HYDRO AND POWER AU

- Page 65 and 66: BRITISH COLUMBIA HYDRO AND POWER AU

- Page 67 and 68: BRITISH COLUMBIA HYDRO AND POWER AU

- Page 69 and 70: BRITISH COLUMBIA HYDRO AND POWER AU

- Page 71 and 72: BRITISH COLUMBIA HYDRO AND POWER AU

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEARS ENDED MARCH 31, 2016 <strong>AND</strong> 2015<br />

NOTE 5: OPERATING EXPENSES<br />

British Columbia Hydro and Power Authority<br />

(in millions) 2016 2015<br />

Electricity and gas purchases $ 1,345 $ 1,707<br />

Water rentals 366 358<br />

Transmission charges 141 138<br />

Personnel expenses 527 534<br />

Materials and external services 605 593<br />

Amortization and depreciation (Note 7) 1,241 1,205<br />

Grants and taxes 220 209<br />

Capitalized costs (203) (224)<br />

Other costs, net of recoveries 8 15<br />

$ 4,250 $ 4,535<br />

NOTE 6: FINANCE CHARGES<br />

(in millions) 2016 2015<br />

Interest on long-term debt $ 771 $ 685<br />

Interest on finance lease liabilities 94 77<br />

Less: Other recoveries (52) (61)<br />

Capitalized interest (61) (69)<br />

$ 752 $ 632<br />

Capitalized interest presented in the table above is after regulatory transfers. Actual interest capitalized to<br />

property, plant and equipment and intangible assets before regulatory transfers was $81 million (2015 - $89<br />

million). The effective capitalization rate used to determine the amount of borrowing costs eligible for<br />

capitalization was 4.1 per cent (2015 - 4.1 per cent).<br />

NOTE 7: AMORTIZATION <strong>AND</strong> DEPRECIATION<br />

(in millions) 2016 2015<br />

Depreciation of property, plant and equipment $ 678 $ 626<br />

Amortization of intangible assets 67 65<br />

Amortization of regulatory accounts 496 514<br />

$ 1,241 $ 1,205