INVESTMENT GUIDE

guide-simiyu

guide-simiyu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Support<br />

available<br />

Challenges/<br />

Risk and<br />

Mitigation<br />

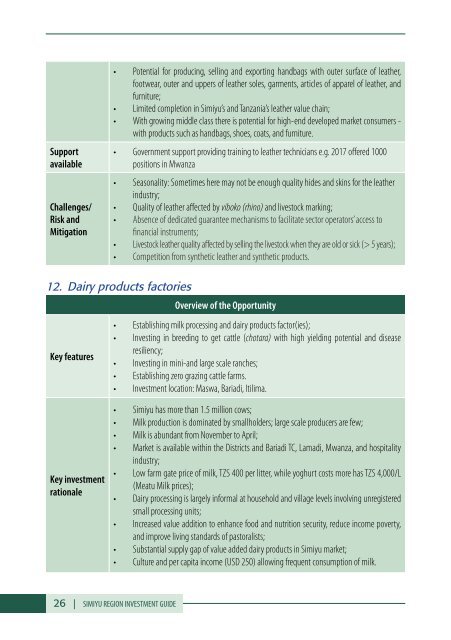

• Potential for producing, selling and exporting handbags with outer surface of leather,<br />

footwear, outer and uppers of leather soles, garments, articles of apparel of leather, and<br />

furniture;<br />

• Limited completion in Simiyu’s and Tanzania’s leather value chain;<br />

• With growing middle class there is potential for high-end developed market consumers -<br />

with products such as handbags, shoes, coats, and furniture.<br />

• Government support providing training to leather technicians e.g. 2017 offered 1000<br />

positions in Mwanza<br />

• Seasonality: Sometimes here may not be enough quality hides and skins for the leather<br />

industry;<br />

• Quality of leather affected by viboko (rhino) and livestock marking;<br />

• Absence of dedicated guarantee mechanisms to facilitate sector operators’ access to<br />

financial instruments;<br />

• Livestock leather quality affected by selling the livestock when they are old or sick (> 5 years);<br />

• Competition from synthetic leather and synthetic products.<br />

12. Dairy products factories<br />

Overview of the Opportunity<br />

Key features<br />

• Establishing milk processing and dairy products factor(ies);<br />

• Investing in breeding to get cattle (chotara) with high yielding potential and disease<br />

resiliency;<br />

• Investing in mini-and large scale ranches;<br />

• Establishing zero grazing cattle farms.<br />

• Investment location: Maswa, Bariadi, Itilima.<br />

Key investment<br />

rationale<br />

• Simiyu has more than 1.5 million cows;<br />

• Milk production is dominated by smallholders; large scale producers are few;<br />

• Milk is abundant from November to April;<br />

• Market is available within the Districts and Bariadi TC, Lamadi, Mwanza, and hospitality<br />

industry;<br />

• Low farm gate price of milk, TZS 400 per litter, while yoghurt costs more has TZS 4,000/L<br />

(Meatu Milk prices);<br />

• Dairy processing is largely informal at household and village levels involving unregistered<br />

small processing units;<br />

• Increased value addition to enhance food and nutrition security, reduce income poverty,<br />

and improve living standards of pastoralists;<br />

• Substantial supply gap of value added dairy products in Simiyu market;<br />

• Culture and per capita income (USD 250) allowing frequent consumption of milk.<br />

26 | SIMIYU REGION <strong>INVESTMENT</strong> <strong>GUIDE</strong>