MR Microinsurance_2012_03_29.indd - International Labour ...

MR Microinsurance_2012_03_29.indd - International Labour ... MR Microinsurance_2012_03_29.indd - International Labour ...

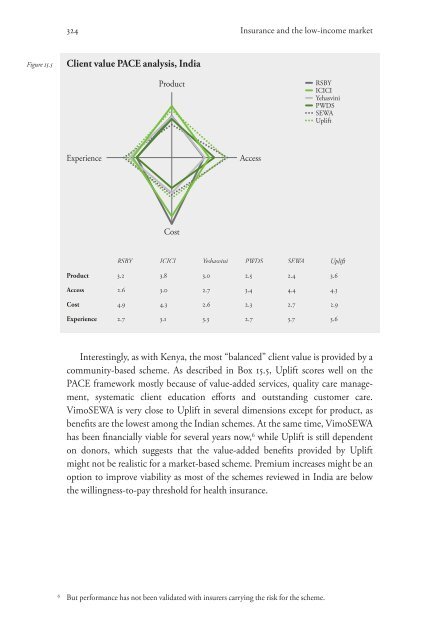

324 Insurance and the low-income market Figure 15.5 Client value PACE analysis, India Experience Product Cost Access RSBY ICICI Yeshasvini PWDS SEWA Uplift Product 3.2 3.8 3.0 2.9 2.4 3.6 Access 2.6 3.0 2.7 3.4 4.4 4.3 Cost 4.9 4.3 2.6 2.3 2.7 2.9 Experience 2.7 3.1 3.3 2.7 3.7 3.6 Interestingly, as with Kenya, the most “balanced” client value is provided by a community-based scheme. As described in Box 15.5, Uplift scores well on the PACE framework mostly because of value-added services, quality care management, systematic client education eff orts and outstanding customer care. VimoSEWA is very close to Uplift in several dimensions except for product, as benefi ts are the lowest among the Indian schemes. At the same time, VimoSEWA has been fi nancially viable for several years now, 6 while Uplift is still dependent on donors, which suggests that the value-added benefi ts provided by Uplift might not be realistic for a market-based scheme. Premium increases might be an option to improve viability as most of the schemes reviewed in India are below the willingness-to-pay threshold for health insurance. 6 But performance has not been validated with insurers carrying the risk for the scheme. RSBY ICICI Yehasvini PWDS SEWA Uplift

Improving client value Yeshasvini and PWDS products add slightly less value, but they serve their captive markets and provide decent cover at a fair price. Access seems to be an issue for Yeshasvini, while PWDS, the least mature of the Indian schemes, needs to improve claims administration and quality of service. If adverse selection and moral hazard problems are solved, there might be room for further improvement, resulting in higher client value. To summarize, the PACE analysis for India draws an interesting picture of the value delivered by different models. Each model has different strengths that can be exploited to create better health insurance products for low-income households. Private-sector players and NGOs should align their products with large public schemes (provided that service quality improves) through integration or by targeting different market segments. 15.4.3 Enhancing value from life insurance in the Philippines Just as India is one of the most mature markets for health microinsurance, the Philippines is for life microinsurance. Compulsory life covers with disability and funeral benefits were selected for the PACE analysis. The different models represented include CARD and FICCO, which are large mutual benefit associations (MBAs), CLIMBS, a regulated, cooperative insurer working in a partner-agent model with MFIs and cooperatives, and MicroEnsure, a specialized broker that develops and administers products delivered in a partner-agent model. 7 The four products are similar and the microinsurers broadly target the same market segments (Table 15.4), which makes the PACE analysis easier than in the other countries where the presence of social security schemes and the complexity of health insurance made comparison more difficult. 7 The MicroEnsure product with TSKI is taken as a reference for the PACE assessment in the Philippines. 325

- Page 296 and 297: 274 13 The psychology of microinsur

- Page 298 and 299: 276 Insurance and the low-income ma

- Page 300 and 301: 278 Insurance and the low-income ma

- Page 302 and 303: 280 Insurance and the low-income ma

- Page 304 and 305: 282 Insurance and the low-income ma

- Page 306 and 307: 284 Insurance and the low-income ma

- Page 308 and 309: 286 14 Emerging practices in consum

- Page 310 and 311: 288 Insurance and the low-income ma

- Page 312 and 313: 290 Insurance and the low-income ma

- Page 314 and 315: 292 Insurance and the low-income ma

- Page 316 and 317: 294 Insurance and the low-income ma

- Page 318 and 319: 296 Insurance and the low-income ma

- Page 320 and 321: 298 Insurance and the low-income ma

- Page 322 and 323: 300 15 Improving client value: Insi

- Page 324 and 325: 302 Insurance and the low-income ma

- Page 326 and 327: 304 Insurance and the low-income ma

- Page 328 and 329: 306 Insurance and the low-income ma

- Page 330 and 331: 308 Insurance and the low-income ma

- Page 332 and 333: 310 Insurance and the low-income ma

- Page 334 and 335: 312 Insurance and the low-income ma

- Page 336 and 337: 314 Insurance and the low-income ma

- Page 338 and 339: 316 Insurance and the low-income ma

- Page 340 and 341: 318 Insurance and the low-income ma

- Page 342 and 343: 320 Insurance and the low-income ma

- Page 344 and 345: 322 Insurance and the low-income ma

- Page 348 and 349: 326 Insurance and the low-income ma

- Page 350 and 351: 328 Insurance and the low-income ma

- Page 352 and 353: 330 Insurance and the low-income ma

- Page 354 and 355: 332 Insurance and the low-income ma

- Page 356 and 357: 334 Insurance and the low-income ma

- Page 358 and 359: 336 Insurance and the low-income ma

- Page 360 and 361: 338 Insurance and the low-income ma

- Page 362 and 363: 340 Insurance and the low-income ma

- Page 364 and 365: 342 Insurance and the low-income ma

- Page 366 and 367: 344 Insurance and the low-income ma

- Page 368 and 369: 346 Insurance and the low-income ma

- Page 370 and 371: 16.4.4 Donors 348 Insurance and the

- Page 372 and 373: 350 Insurance and the low-income ma

- Page 374 and 375: 352 Insurance and the low-income ma

- Page 376 and 377: 354 Insurance and the low-income ma

- Page 378 and 379: 356 Insurance and the low-income ma

- Page 380 and 381: 358 Insurance and the low-income ma

- Page 382 and 383: 360 Insurance and the low-income ma

- Page 384 and 385: 362 Insurance and the low-income ma

- Page 386 and 387: 364 Insurance and the low-income ma

- Page 389 and 390: VI Insurers and microinsurance 367

- Page 391 and 392: Is microinsurance a profitable busi

- Page 393 and 394: Is microinsurance a profitable busi

- Page 395 and 396: Is microinsurance a profitable busi

324 Insurance and the low-income market<br />

Figure 15.5 Client value PACE analysis, India<br />

Experience<br />

Product<br />

Cost<br />

Access<br />

RSBY ICICI Yeshasvini PWDS SEWA Uplift<br />

Product 3.2 3.8 3.0 2.9 2.4 3.6<br />

Access 2.6 3.0 2.7 3.4 4.4 4.3<br />

Cost 4.9 4.3 2.6 2.3 2.7 2.9<br />

Experience 2.7 3.1 3.3 2.7 3.7 3.6<br />

Interestingly, as with Kenya, the most “balanced” client value is provided by a<br />

community-based scheme. As described in Box 15.5, Uplift scores well on the<br />

PACE framework mostly because of value-added services, quality care management,<br />

systematic client education eff orts and outstanding customer care.<br />

VimoSEWA is very close to Uplift in several dimensions except for product, as<br />

benefi ts are the lowest among the Indian schemes. At the same time, VimoSEWA<br />

has been fi nancially viable for several years now, 6 while Uplift is still dependent<br />

on donors, which suggests that the value-added benefi ts provided by Uplift<br />

might not be realistic for a market-based scheme. Premium increases might be an<br />

option to improve viability as most of the schemes reviewed in India are below<br />

the willingness-to-pay threshold for health insurance.<br />

6 But performance has not been validated with insurers carrying the risk for the scheme.<br />

RSBY<br />

ICICI<br />

Yehasvini<br />

PWDS<br />

SEWA<br />

Uplift