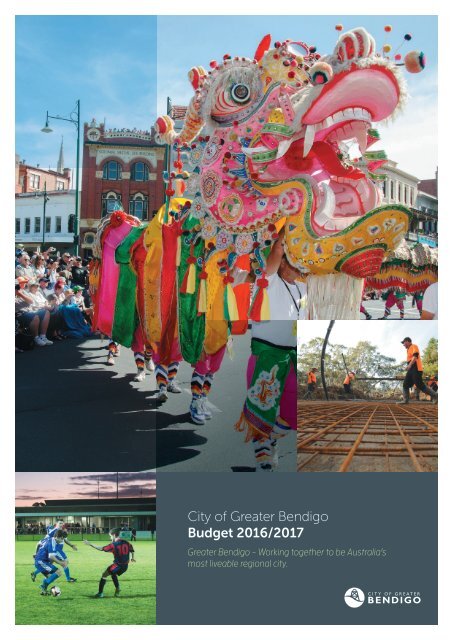

City of Greater Bendigo Budget 2016/2017

The Budget for 2016/2017 sees Council deliver on its commitments and includes a record $96.2M investment in capital expenditure for new projects and for maintaining and renewing existing infrastructure.

The Budget for 2016/2017 sees Council deliver on its commitments and includes a record $96.2M investment in capital expenditure for new projects and for maintaining and renewing existing infrastructure.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong><br />

<strong>Budget</strong> <strong>2016</strong>/<strong>2017</strong><br />

<strong>Greater</strong> <strong>Bendigo</strong> - Working together to be Australia’s<br />

most liveable regional city.

Main cover image:<br />

Sun Loong at the Hazeldene’s <strong>Bendigo</strong> Easter Festival<br />

Sub images:<br />

1. Concrete work for the bridge replacement on the Heathcote-East Baynton Road<br />

2. Soccer match at the Epsom Huntly Recreation Reserve

TABLE OF CONTENTS<br />

Page<br />

Mayor's Introduction, Cr Rod Fyffe<br />

Chief Executive Officer's Summary<br />

1<br />

2<br />

<strong>Budget</strong> Reports<br />

4<br />

1. Link to the Council Plan 5<br />

2. Services and Service Performance Indicators 9<br />

3. Financial Statements 22<br />

4. Financial Performance Indicators 29<br />

5. Other <strong>Budget</strong> Information 31<br />

6. Capital Works Program 33<br />

7. Rates and Charges 38<br />

<strong>Budget</strong> Analysis<br />

50<br />

8. Summary <strong>of</strong> Financial Position 51<br />

9. <strong>Budget</strong> Influences 56<br />

10. Analysis <strong>of</strong> Operating <strong>Budget</strong> 60<br />

11. Analysis <strong>of</strong> <strong>Budget</strong>ed Cash Position 66<br />

12. Analysis <strong>of</strong> Capital <strong>Budget</strong> 69<br />

13. Analysis <strong>of</strong> <strong>Budget</strong>ed Financial Position 74<br />

Long Term Strategies<br />

77<br />

14. Strategic Resource Plan 78<br />

15. Rating Information 80<br />

16. Summary <strong>of</strong> Other Strategies 87<br />

Appendices 90<br />

A Fees and Charges Schedule 91<br />

B <strong>Budget</strong> Processes 111<br />

C Capital Evaluation 112<br />

C1 List <strong>of</strong> Capital Works Program 115<br />

D Maps 119<br />

E Glossary <strong>of</strong> Terms 124<br />

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

<strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Mayor’s Introduction, Cr Rod Fyffe<br />

I am pleased to introduce the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>’s (COGB) <strong>2016</strong>/17 <strong>Budget</strong>. This year’s <strong>Budget</strong> includes<br />

$99.3 million in capital works including maintaining and renewing existing infrastructure. The <strong>City</strong> will also invest<br />

$170 million in service delivery through the operating <strong>Budget</strong>.<br />

The <strong>Budget</strong> advances the priorities outlined in the Council Plan 2013-<strong>2017</strong>; leadership and governance, planning<br />

for growth, presentation and vibrancy, productivity and sustainability. As this is the final year <strong>of</strong> the current Council<br />

term, the focus <strong>of</strong> this <strong>Budget</strong> is completion <strong>of</strong> our current commitments.<br />

The <strong>Budget</strong> proposes a rate increase <strong>of</strong> 2.5 per cent. This is in line with the Victorian Government’s new Fair Go<br />

Rates System which has capped rates increases by Victorian councils to the forecast movement <strong>of</strong> 2.5 per cent in<br />

the Consumer Price Index. Rates, along with fees and user charges, and State and Federal Government grants<br />

and funding will allow the <strong>City</strong> to deliver its program <strong>of</strong> projects and services.<br />

The <strong>Budget</strong> includes funding for important infrastructure projects which will have significant benefits for the whole<br />

<strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>. These projects include the <strong>Bendigo</strong> Airport Redevelopment ($9.2 million, including State and<br />

Federal contributions), the expansion <strong>of</strong> the <strong>Bendigo</strong> Stadium ($14 million, including State and <strong>Bendigo</strong> Stadium<br />

Ltd contributions), the Strathfieldsaye Early Learning Community Hub ($2.7 million), the Barrack Reserve Pavilion<br />

Redevelopment in Heathcote ($1.8 million), and the <strong>Greater</strong> <strong>Bendigo</strong> Indoor Aquatic and Wellbeing Centre ($25.7<br />

million, including State and Federal contributions).<br />

The <strong>Budget</strong> also includes funding for the next stage <strong>of</strong> the Canterbury Park Redevelopment in Eaglehawk. There<br />

is $350,000 for the construction <strong>of</strong> the social pavilion and $250,000 towards the development <strong>of</strong> the Canterbury<br />

Park Central Activity Area. The Marist Community Recreation Precinct will also receive $500,000.<br />

New initiatives in this year’s <strong>Budget</strong> include $3.3 million for the reconstruction <strong>of</strong> the Scott Street Bridge in White<br />

Hills, the construction <strong>of</strong> the <strong>Bendigo</strong> Tennis Pavilion ($1 million), the Eaglehawk Regional Play Space ($500,000)<br />

and the Garden Gully Community Pavilion Design ($200,000). The <strong>Budget</strong> also includes around $2 million for new<br />

or upgraded footpaths across the municipality.<br />

A number <strong>of</strong> parks and reserves will benefit from lighting upgrades including Lake Weeroona ($50,000), Lake<br />

Neangar ($48,000), Strathfieldsaye Junior Football Oval ($170,000) and also general street lighting ($267,500).<br />

To maintain existing infrastructure, the <strong>Budget</strong> will see $13.7 million invested in renewing sealed roads and $3.9<br />

million to renew drainage across the municipality. There is also $600,000 for the Nolan St Bridge, $90,000 to<br />

renew the College Crescent Play Space, $120,000 for Stage 2 <strong>of</strong> the Strathdale Park Play Space renewal and<br />

$100,000 for the Summit Drive Play Space.<br />

Recreation facilities are another focus with $275,000 earmarked for new nets at the <strong>Bendigo</strong> Cricket Club,<br />

$270,000 for the <strong>Bendigo</strong> Regional BMX Facility Redevelopment, $300,000 for the design and construction <strong>of</strong><br />

shade shelter at the Queen Elizabeth Oval and $400,000 for swimming pools.<br />

Heathcote will benefit from $120,000 for the Heathcote Independent Living Estate, $60,000 to upgrade heating<br />

and lighting at the Heathcote RSL and $5,500 for the Heathcote Winery Signage program.<br />

The operating <strong>Budget</strong> will continue to fund important community services including maternal and child health<br />

services, youth services, home support services, childcare, tourism and visitor services, economic development,<br />

the <strong>Bendigo</strong> Art Gallery, the Capital and Ulumbarra theatres, street cleaning, maintaining parks, gardens and<br />

recreation facilities, rubbish and recycling collection, statutory planning and strategy.<br />

Council is confident this <strong>Budget</strong> will help to achieve its vision <strong>of</strong> being Australia’s most liveable regional city. It<br />

includes significant funding for large scale projects which will benefit the wider <strong>Greater</strong> <strong>Bendigo</strong> community, but<br />

money has also been allocated for smaller projects, for maintaining and upgrading our key infrastructure and<br />

assets like roads and footpaths and into providing ongoing services to the community.<br />

Cr Rod Fyffe<br />

Mayor<br />

1 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Chief Executive Officer's Summary<br />

The <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council has prepared a proposed <strong>Budget</strong> for <strong>2016</strong>/17 which is aligned to the vision in the<br />

Council Plan 2013-<strong>2017</strong>. The <strong>Budget</strong> sets out the resources required to maintain and improve services and<br />

infrastructure as well as deliver projects and services that are valued by our community, and do this within the rate<br />

increase mandated by the State Government for the <strong>2016</strong>/17 year.<br />

The proposed <strong>Budget</strong> includes an unusually high operating surplus <strong>of</strong> $54 million. The higher than normal operating<br />

result includes capital revenue <strong>of</strong> $36.9 million <strong>of</strong> contributions and grants that are used to fund the Capital Works<br />

program <strong>of</strong> $99.3 million. It is worth noting that the revenue is accounted for in the operating result, however the<br />

expenditure is not.<br />

The Council had previously forecast rate increases <strong>of</strong> 5% in future years to fund the delivery <strong>of</strong> services and<br />

projects needed by the community as well as accommodating the growth that is occurring in <strong>Bendigo</strong>. We have<br />

worked hard to find substantial savings in costs and identified some efficiencies to build a budget that can fit within<br />

the 2.5% rate cap set by the State Government. Many <strong>of</strong> these efficiencies and savings are <strong>of</strong> a one-<strong>of</strong>f nature.<br />

There is no doubt that as we look forward to future <strong>Budget</strong>s the rate cap will place strain on Council’s revenue<br />

raising, which will challenge Council’s ability to deliver services and infrastructure for the community in future years.<br />

Council will need to work hard to remain financially sustainable over the medium term and has developed a<br />

program <strong>of</strong> service reviews to further complement the efficiency measures already put in place.<br />

The proposed <strong>Budget</strong> delivers on the actions that are listed in the Council Plan for the coming year, as well as<br />

delivering ongoing services to the community. There is a major Capital Works program totalling $99.3 million. This<br />

includes $51 million for new assets, $28 million for renewing existing assets, $7.4 million upgrading some <strong>of</strong> our<br />

infrastructure and buildings and $12.8 million on expansion works.<br />

This program includes the significant investment into the delivery <strong>of</strong> the <strong>Bendigo</strong> Indoor Aquatic and Wellbeing<br />

Centre, the <strong>Bendigo</strong> Airport redevelopment and the <strong>Bendigo</strong> Stadium expansion. These three projects have been<br />

priority projects for the Council for some time and we will see them all take major shape over the <strong>2016</strong>/17 year.<br />

More information on the capital works proposed can be found in section 10.<br />

Of note in the proposed <strong>Budget</strong> is the inclusion <strong>of</strong> funds for the introduction <strong>of</strong> a kerbside organics collection to<br />

begin during the year. This has been a service that has been developed as part <strong>of</strong> the Waste and Resource<br />

Management Strategy and follows a trial organics collection that took place during 2015/16.<br />

The State Government Fair Go Rate System will come into effect from the start <strong>of</strong> the <strong>2016</strong>/17 year. The rate cap is<br />

set by applying the State Government projected CPI for <strong>2016</strong>/17 <strong>of</strong> 2.5% to the General Rates <strong>of</strong> each Municipality.<br />

This has been incorporated into this budget. Council has the ability to set Waste Charges at levels that meet the<br />

costs <strong>of</strong> providing that service and these are proposed to increase by 4.2% in <strong>2016</strong>/17.<br />

As required by the Local Government Act, Council completed a revaluation <strong>of</strong> all rateable properties as at 1<br />

January <strong>2016</strong>. While the revaluation does not alter the amount <strong>of</strong> rates collected, it does redistribute rates across<br />

the municipality according to property values. Even though rate capping has been introduced this year, some<br />

people will see their rates go up by more than 2.5% and others will see them go up by less. This is because<br />

changes in property value impacts the rates to be paid.<br />

The proposed <strong>Budget</strong> is influenced by a number <strong>of</strong> external and internal factors. These include:<br />

• Managing the impact <strong>of</strong> being a growing regional city.<br />

• Introduction <strong>of</strong> the State Government rate cap.<br />

• A constrained Federal and State Government fiscal environment including the freezing <strong>of</strong> indexation <strong>of</strong> some<br />

recurrent grants.<br />

• The increased regulatory environment in which the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> operates.<br />

• Picking up the costs <strong>of</strong> some services delivered on behalf <strong>of</strong> the State and Federal Governments.<br />

• The potential future liability <strong>of</strong> the Defined Benefits Superannuation Fund.<br />

• Delivery <strong>of</strong> the Council Plan.<br />

• Adhering to the <strong>Budget</strong> Principles adopted by the Council.<br />

• Investment in developing the <strong>City</strong> <strong>of</strong> greater <strong>Bendigo</strong> workforce.<br />

• The need to replace and upgrade ageing infrastructure.<br />

• Complying with the provisions <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> Enterprise Agreement.<br />

2 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

• An ongoing focus on greater efficiency.<br />

The total revenue to be collected for <strong>2016</strong>/17 is $210.4 million, comprised <strong>of</strong> rates and charges, statutory fees and<br />

fines, user charges, fees and fines, contributions and interest on investments (Section 10). This will be used to fund<br />

operating costs and in part the capital works program. Other funding will include $17 million <strong>of</strong> new borrowings, $1.7<br />

million from asset sales and $16.9 million from cash and reserves.<br />

This is the largest budget prepared by this Council, particularly with the inclusion <strong>of</strong> the three large projects<br />

identified earlier. It has been carefully prepared to ensure that the council can continue to provided day to day<br />

services to the community, deliver capital projects that are for community use that are important to our people, and<br />

to provide a stable financial position for the following financial period.<br />

More detail on the budget is provided throughout the document.<br />

Craig Niemann<br />

Chief Executive Officer<br />

3 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

<strong>Budget</strong> Reports<br />

The following reports include all statutory disclosures <strong>of</strong> information and are supported by the analysis contained in<br />

sections 8 to 16 <strong>of</strong> this report.<br />

This section includes the following reports and statements in accordance with the Local Government Act 1989 and<br />

the Local Government Model Financial Report.<br />

1 Links to the Council Plan<br />

2 Services and Service Performance Indicators<br />

3 Financial Statements<br />

4 Financial Performance Indicators<br />

5 Other <strong>Budget</strong> Information<br />

6 Capital Works Program<br />

7 Rates and Charges<br />

4 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

1. Link to the Council Plan<br />

This section describes how the Annual <strong>Budget</strong> links to the achievement <strong>of</strong> the Council Plan within an overall<br />

planning framework. This framework guides the Council in identifying community needs and aspirations over the<br />

long term (<strong>Greater</strong> <strong>Bendigo</strong> 2036), medium term (Council Plan, Strategic Resource Plan) and short term (Annual<br />

Actions and <strong>Budget</strong>) and then holding itself accountable (Annual Report and Audited Statements).<br />

1.1 Planning and Accountability Framework<br />

The Strategic Resource Plan is part <strong>of</strong>, and prepared in conjunction with the Council Plan, and is a rolling four year<br />

plan that outlines the financial and non-financial resources that Council requires to achieve the strategic objectives<br />

described in the Council Plan. The Annual <strong>Budget</strong> is framed within the Strategic Resource Plan, taking into account<br />

the services and initiatives which contribute to achieving the strategic objectives specified in the Council Plan.<br />

The timing <strong>of</strong> each component <strong>of</strong> the planning framework is critical to the successful achievement <strong>of</strong> the planned<br />

outcomes. A new Council Plan, including the Strategic Resource Plan, is required to be completed by 30 June<br />

following a general election and is reviewed each year in advance <strong>of</strong> the Annual <strong>Budget</strong> process.<br />

5 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

The diagram below depicts the strategic planning framework <strong>of</strong> Council.<br />

In addition to the above, Council has a long term plan (Vision 2036) which articulates a community vision, mission<br />

and values. The Council Plan is prepared with reference to Council's long term Community Plan.<br />

Council's Planning and Reporting framework is underpinned by Federal, State and Regional Strategic Plans,<br />

Policies and Legislation.<br />

6 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

1.2 Our Purpose<br />

Vision and Values<br />

Council Vision<br />

Working together to be Australia’s most liveable regional city.<br />

Council Values<br />

Council wants the community to continue to have reason to be proud <strong>of</strong> the city and will do this through:<br />

•<br />

Transparency - Information about Council decisions is readily available and easily understood.<br />

•<br />

•<br />

•<br />

•<br />

Efficiency and effectiveness - Council provides services based on evidence <strong>of</strong> need and demonstrates<br />

continuous improvement in the delivery <strong>of</strong> services.<br />

Inclusion and consultation - Council uses a range <strong>of</strong> engagement strategies to ensure community members<br />

can understand and take part in discussion that informs the development <strong>of</strong> new strategies and actions.<br />

Clear, decisive and consistent planning - In a rapidly growing municipality, Council undertakes to plan<br />

effectively for our long term future.<br />

Respect for community priorities and needs - Council will advocate for improved services for community<br />

members and will consider community impact and feedback regarding the decisions it makes.<br />

Staff Organisational Values<br />

Working together to be the best we can for the community:<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

We Lead<br />

We Learn<br />

We Contribute<br />

We Care<br />

We Respond<br />

We Respect<br />

1.3 Themes<br />

Council delivers activities and initiatives under 34 major service categories. Each contributes to the achievement <strong>of</strong><br />

one <strong>of</strong> the five themes as set out in the Council Plan for the 2013-17 years. The following table lists the five themes<br />

as described in the Council Plan.<br />

Themes<br />

Description<br />

1. Leadership and Good<br />

Governance<br />

• Council demonstrates leadership in its decisions to meet future needs and<br />

challenges.<br />

• Lobbying and advocacy about agreed priorities place <strong>Greater</strong> <strong>Bendigo</strong> at the<br />

forefront <strong>of</strong> policy and funding considerations.<br />

• Community members are supported to take an active part in democratic<br />

engagement.<br />

• Continuous improvement methods are used to ensure the standard <strong>of</strong> service<br />

delivery is excellent.<br />

• Long term planning and staff capacity building help to develop a resilient<br />

organisation.<br />

2. Planning for Growth • <strong>Greater</strong> <strong>Bendigo</strong> plans for the needs <strong>of</strong> our growing population through the<br />

preparation <strong>of</strong> long-term strategies and the development <strong>of</strong> major new assets<br />

and supporting infrastructure.<br />

• <strong>Greater</strong> <strong>Bendigo</strong> residents, businesses and communities are connected with<br />

accessible transport options.<br />

• Planning ensures residents have access to diverse, affordable and<br />

sustainable housing choices.<br />

• Effective telecommunication options connect business and community<br />

members.<br />

7 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

3 Presentation and Vibrancy • High quality public space infrastructure, programs and services are planned<br />

and delivered that support <strong>Greater</strong> <strong>Bendigo</strong> to be Australia’s most liveable<br />

regional city.<br />

• Diverse sporting, recreational and artistic experiences are <strong>of</strong>fered for<br />

residents and visitors.<br />

• Activities, groups and networks enable people to be connected and feel<br />

welcome.<br />

• <strong>Greater</strong> <strong>Bendigo</strong> is a child friendly city where people report improved health<br />

and wellbeing and they can feel safe.<br />

• <strong>Greater</strong> <strong>Bendigo</strong> is a drawcard for visitors.<br />

4. Productivity<br />

• <strong>Greater</strong> <strong>Bendigo</strong> has a vibrant and diverse economy that grows jobs and<br />

enables good living standards.<br />

• <strong>Bendigo</strong> is a centre for innovation and creativity that helps build economic<br />

sustainability.<br />

• Educational diversity and support for lifelong learning is fostered.<br />

5. Sustainability<br />

• The built and natural qualities that make <strong>Greater</strong> <strong>Bendigo</strong> an attractive and<br />

appealing place are valued and conserved.<br />

• Council demonstrates leadership in reducing our environmental footprint.<br />

• We help to build community resilience for managing the impacts <strong>of</strong> climate<br />

change.<br />

• Council manages its resources, assets & infrastructure for the long term.<br />

8 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

2. Services and Service Performance Indicators<br />

This section provides a description <strong>of</strong> the services and initiatives to be funded in the <strong>Budget</strong> for the <strong>2016</strong>/17 year<br />

and how these will contribute to achieving the strategic objectives outlined in the Council Plan. It also describes a<br />

number <strong>of</strong> major initiatives, initiatives and service performance outcome indicators for key areas <strong>of</strong> Council’s<br />

operations. Council is required by legislation to identify major initiatives, initiatives and service performance<br />

outcome indicators in the <strong>Budget</strong> and report against them in their Annual Report to support transparency and<br />

accountability. The relationship between these accountability requirements in the Council Plan, the <strong>Budget</strong> and the<br />

Annual Report is shown below.<br />

In order to demonstrate the full cost <strong>of</strong> Council services, the <strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> allocates the cost <strong>of</strong> a number<br />

<strong>of</strong> internal support areas to other service units <strong>of</strong> Council. These include Finance, Information Management,<br />

People and Performance and Customer Service.<br />

9 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

2.1 Theme 1: Leadership and Good Governance<br />

Council demonstrates leadership to assure the community that there is capacity and flexibility to plan for and<br />

manage emerging challenges, as well as responding to immediate needs and concerns. Good governance is<br />

evident in transparent and well-informed decision making for the long term, sound management <strong>of</strong> resources and<br />

diverse and effective engagement with community members.<br />

Services<br />

Service Unit<br />

Rating and Valuation<br />

Services<br />

Information<br />

Management<br />

Description <strong>of</strong> Services Provided<br />

Executive Services The Executive Services Unit provides strategic leadership to the<br />

organisation, timely and effective CEO, Mayor and Councillor support,<br />

timely and compliant Council meetings, responsive implementation <strong>of</strong> the<br />

Independent Review, authoritative advice on civic administration,<br />

governance and legislative compliance, comprehensive monitoring and<br />

implementation <strong>of</strong> Council resolutions. High-level internal and external<br />

communication, high quality online, verbal, printed, radio, television and<br />

web-based communication is also provided by the Unit.<br />

Organisation Support The Organisation Support Directorate advises Council on matters<br />

relating to the Directorate, contributes to the executive management <strong>of</strong><br />

COGB and contributes to the good governance <strong>of</strong> the Goldfields Library<br />

Corporation, the <strong>Bendigo</strong> Regional Archives Centre Inc. and the <strong>Bendigo</strong><br />

Stadium Finance Committee by representing COGB on these bodies.<br />

The Directorate provides funding support for the Discovery Science and<br />

Library Services<br />

People and<br />

Performance<br />

Technology Centre.<br />

The Goldfields Library Corporation, <strong>of</strong> which COGB is one <strong>of</strong> the four<br />

member municipalities, provides a public library service to four sites<br />

throughout the municipality in <strong>Bendigo</strong>, Kangaroo Flat, Eaglehawk and<br />

Heathcote, along with the mobile library, and operates the <strong>Bendigo</strong><br />

Regional Archive Centre.<br />

The Rating and Valuation Services Unit provides statutory valuations for<br />

rating purposes, provides asset and insurance valuations and maintains<br />

the integrity and updates the land information database. The Unit also<br />

annually levies and collects rates and charges, maintains the corporate<br />

property database, maintains the central name register <strong>of</strong> ratepayers and<br />

prepares voters rolls.<br />

The People and Performance Unit supports COGB to ensure it has the<br />

right people delivering the right outcomes. The Unit achieves its purpose<br />

through building a productive, high performance culture, providing<br />

advice, support and assurance on risk, opportunities and performance<br />

and developing a continuously improving and change resilient<br />

organisation.<br />

The Information Management Unit is responsible for providing,<br />

developing and maintaining corporate Information and Communications<br />

Technology systems and continually improving business processes. The<br />

Unit also manages records and the record archive, Ombudsman<br />

requests and privacy matters.<br />

Contract and Project The Contract and Project Coordination Unit provides best practice<br />

Coordination<br />

tendering and contracting services and provides a Project Management<br />

<strong>of</strong>fice with sound governance processes and continual development <strong>of</strong><br />

project managers and project management tools.<br />

Customer Support The Customer Support Unit provides an effective and efficient Call<br />

Centre as the first point <strong>of</strong> contact for our customers. The Unit also<br />

manages events and activities in the CBD on behalf <strong>of</strong> COGB and<br />

delivers information and cashiering services at service centres at<br />

Lyttleton Terrace, <strong>Bendigo</strong> and High Street, Heathcote.<br />

*Cost allocated across other units<br />

Expenditure<br />

(Revenue)<br />

Net Cost<br />

$'000<br />

3,769<br />

(144)<br />

3,625<br />

473<br />

(10)<br />

463<br />

3,083<br />

0<br />

3,083<br />

2,886<br />

(1,105)<br />

1,781<br />

3,582<br />

(1,805) *<br />

1,777<br />

(115)<br />

1,662<br />

3,812<br />

(3,531) *<br />

281<br />

762<br />

(13)<br />

749<br />

1,957<br />

(912) *<br />

1,045<br />

(14)<br />

1,031<br />

10 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Major Initiatives<br />

1<br />

Citizens' Jury, provision for an independent jury process to inform development <strong>of</strong> the <strong>2017</strong>-2021 Council<br />

Plan (Net cost $58,000).<br />

Initiatives<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

Better response to Customer needs over periods <strong>of</strong> planned and unplanned leave, increase 0.7 full time<br />

equivalent (FTE) casual support staff hours (Net cost $53,890).<br />

Employ a Graphic Designer 1 FTE to increase the capacity <strong>of</strong> the Communications Team to provide this<br />

service to the organisation rather than using an external Graphic Designer (Net cost $0).<br />

My Community Connect, marketing partnership between COGB and Southern Cross Austereo to enable free<br />

promotion <strong>of</strong> not for pr<strong>of</strong>it community events and community engagement activities. This gives a greater<br />

exposure to the COGB brand supporting the community and not for pr<strong>of</strong>it (Net cost $15,000).<br />

Employ a Community Engagement Adviser 1 FTE to better coordinate community engagement activities and<br />

provision <strong>of</strong> expert advice and assistance to staff across the organisation (Net cost $87,217).<br />

Internet Service upgrades to enable a higher internet speed and meet increased demand on the service as<br />

more remote sites use the internet (Net cost $60,000).<br />

Completion <strong>of</strong> the biannual organisation culture survey (Net cost $30,000).<br />

Making the temporary Valuer position ongoing at 0.8 FTE to improve the timelines for the processing <strong>of</strong><br />

supplementary valuations, the additional income will <strong>of</strong>fset the cost <strong>of</strong> the position (Net cost $0).<br />

Improve financial analysis <strong>of</strong> the business and provide information to senior levels <strong>of</strong> management and<br />

Councillors through the appointment <strong>of</strong> an Accountant 1 FTE (Net cost $73,909).<br />

Deliver the Apprentice scheme in the Works unit employ 1 FTE which provides a career path for the young<br />

people in the community and encourages a culture <strong>of</strong> learning (Net cost $47,708).<br />

Social Media Monitoring S<strong>of</strong>tware which will enable the <strong>City</strong> to stay better informed about issues in the<br />

community and allow for them to be addressed in real time (Net cost $12,500).<br />

Water for grading unsealed road repairs to provide safer rural roads (Net cost $200,000).<br />

Human Resource Advisor increase to 1 FTE and make an ongoing role to assist the organisation in<br />

maintaining required HR levels (Net cost $54,334).<br />

Project support for Service Reviews employ 1 FTE and a 0.65 FTE to successfully implement the<br />

independent Review recommendation <strong>of</strong> service reviews (Net cost $126,981).<br />

Service Performance Outcome Indicators<br />

The following indicators outline how we intend to measure achievement <strong>of</strong> service objectives.<br />

Service<br />

Governance<br />

Indicator<br />

Satisfaction<br />

Performance Measure<br />

Satisfaction with Council<br />

Computation<br />

Community satisfaction rating out<br />

decisions<br />

<strong>of</strong> 100 with how Council has<br />

performed in making decisions in<br />

the interests <strong>of</strong> the community<br />

Libraries Participation Active library members [Number <strong>of</strong> active library members/<br />

municipal population] x100<br />

11 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

2.2 Theme 2: Planning for Growth<br />

During this term Council has made a strong commitment to complete significant planning work to develop detailed<br />

and long term plans around integrated transport and future residential needs. This encompasses projects that<br />

contribute to achieving the vision <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong> becoming the most liveable regional city in Australia, and<br />

covers development <strong>of</strong> infrastructure that differentiates the municipality as an affordable, comfortable, connected<br />

and safe place to live and provides for modern and future lifestyle and cultural choices.<br />

It is essential that <strong>Greater</strong> <strong>Bendigo</strong> plans for the future and presents compelling arguments to the State and Federal<br />

Governments for funding to deliver on the plans, especially major infrastructure items.<br />

There are competing demands in community priorities and internal funding decisions in the desires to plan for<br />

growth, maintain the existing infrastructure to safe and acceptable standards and meet increasing demand for<br />

social services and new infrastructure.<br />

These strategies ensure <strong>Greater</strong> <strong>Bendigo</strong> adapts to the needs <strong>of</strong> a growing and increasingly diverse population<br />

smoothly and positively.<br />

Services<br />

Expenditure<br />

Service Unit Description <strong>of</strong> Services Provided (Revenue)<br />

Net Cost<br />

Planning and<br />

Development<br />

The Planning and Development Directorate advises Council on matters<br />

relating to the Directorate and contributes to the executive management<br />

<strong>of</strong> COGB.<br />

Statutory Planning The Statutory Planning Unit facilitates planning and delivery <strong>of</strong> timely and<br />

quality planning decisions, provides a heritage advisory and heritage<br />

architecture service and implements Planning Scheme Amendments,<br />

including the <strong>Bendigo</strong> Flood Study. Many <strong>of</strong> the services delivered by<br />

the Statutory Planning Unit are in accordance with State Government<br />

legislation and local strategies and policies adopted by Council following<br />

intensive community consultation.<br />

Strategy<br />

The Strategy Unit facilitates, coordinates and develops strategies, plans<br />

and advice that provide direction and guidance for Council to make<br />

decisions and implement projects, planning scheme provisions, land use<br />

change, social and community development, health and wellbeing,<br />

integrated transport and the heritage management for the municipality.<br />

Major Projects The Major Projects Unit focusses on major projects that involve<br />

significant funding from external sources, significant stakeholder<br />

engagement and require detailed planning, design and delivery. The<br />

Unit contributes to the economic, cultural and social prosperity <strong>of</strong> our<br />

region by effectively delivering identified major projects, successfully<br />

cooperating and proactively developing the <strong>Greater</strong> <strong>Bendigo</strong> Indoor<br />

Aquatic and Wellbeing Centre, the <strong>Bendigo</strong> Airport and the <strong>Bendigo</strong><br />

Stadium expansion and, in doing so, continues to raise the municipality’s<br />

pr<strong>of</strong>ile as an exceptional place in which to live, work, invest and visit.<br />

$'000<br />

478<br />

(6)<br />

472<br />

3,513<br />

(809)<br />

2,704<br />

1,993<br />

(6)<br />

1,987<br />

897<br />

(128)<br />

769<br />

12 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Major Initiatives<br />

15<br />

16<br />

17<br />

18<br />

19<br />

Construction <strong>of</strong> the Social Pavilion at Canterbury Park, Eaglehawk (Net cost $350,000).<br />

Commence construction <strong>of</strong> the <strong>Greater</strong> <strong>Bendigo</strong> Indoor Aquatic and Wellbeing Centre, Kangaroo Flat (Net<br />

cost $10,325,000).<br />

Commence construction <strong>of</strong> the Garden for the Future at <strong>Bendigo</strong> Botanic Gardens, White Hills (Net cost<br />

$2,365,000).<br />

Construction <strong>of</strong> the <strong>Bendigo</strong> Airport Runway (Net cost $3,707,000).<br />

Construction <strong>of</strong> the Barrack Reserve Pavilion, Heathcote (Net cost $1,630,000).<br />

Initiatives<br />

20<br />

21<br />

22<br />

Additional planning legal costs to accommodate ongoing legal fees associated with fulfilling legislative<br />

requirements (Net cost $23,000).<br />

Progress the Marong Structure Plan and Developers Contribution Plan as Marong has been identified as a<br />

township to accommodate substantial growth (Net cost $65,000).<br />

Planning Strategies - Implementation through planning scheme amendments which require expert advice and<br />

incur planning panel costs (Net cost $115,000).<br />

23<br />

<strong>Bendigo</strong> Airport certification, this is the transition from a registered to a certified aerodrome.<br />

required change with the construction <strong>of</strong> the new runway (Net cost $0).<br />

This is a<br />

24<br />

25<br />

26<br />

27<br />

Employ an Integrated Transport and Land Use Strategy (ITLUS) Community Engagement Implementation<br />

Officer at 1 FTE. This would ensure that COGB is able to work with the various stakeholders and key<br />

Government agencies to progressively implement ITLUS (Net cost $93,165).<br />

Prepare Marong Business Park business case, which will be used as the strategic framework for the business<br />

park into the future to assist in attracting investment and business (Net cost $90,000).<br />

Conduct the <strong>Bendigo</strong> Creek Linear Trail, Pall Mall underpass feasibility study to undertake due diligence to<br />

determine the feasibility <strong>of</strong> this use and develop a conceptual plan for implementation (Net cost $30,000).<br />

Conduct the Ironbark Creek Trail feasibility study and concept design for a trail linking Garden Gully<br />

Recreation Reserve to <strong>Bendigo</strong> Creek Linear Trail (Net cost $30,000).<br />

Service Performance Outcome Indicators<br />

The following indicator outlines how we intend to measure achievement <strong>of</strong> service objectives.<br />

Service Indicator Performance Measure Computation<br />

Statutory Planning Decision Making Council planning decisions upheld [Number <strong>of</strong> VCAT decisions that<br />

by VCAT<br />

did not set aside Council’s decision<br />

in relation to a planning application/<br />

Number <strong>of</strong> VCAT decisions in<br />

relation to planning applications]<br />

x100<br />

13 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

2.3 Theme 3: Presentation and Vibrancy<br />

When people in <strong>Greater</strong> <strong>Bendigo</strong> describe it as being very liveable, they use phrases such as it ‘looks good’, is<br />

easy to get around, it is safe, it is affordable, and there is good access to health, education and services for people,<br />

including those who need help. There are choices in activities, education, housing, entertainment, sporting facilities<br />

and open spaces are well maintained.<br />

These are important features <strong>of</strong> the community to strengthen as <strong>Greater</strong> <strong>Bendigo</strong> grows and changes. New<br />

initiatives will be developed on the basis <strong>of</strong> equity to meet gaps in existing services or provide better access to<br />

existing services for members <strong>of</strong> the public. Outcomes that specifically encourage physical activity and those that<br />

promote mental and physical wellbeing are valued. At the same time preservation and/or promotion <strong>of</strong> the<br />

municipality's physical and cultural heritage remain important criteria.<br />

Services<br />

Expenditure<br />

Service Unit Description <strong>of</strong> Services Provided (Revenue)<br />

Net Cost<br />

Capital Venues and<br />

Events<br />

<strong>Bendigo</strong> Art Gallery<br />

Community Wellbeing<br />

Active and Healthy<br />

Communities<br />

The Capital Venues and Events Unit provides quality performing arts<br />

programming and activities to the central Victorian region and provides<br />

facilities and opportunities for participation in the arts.<br />

The <strong>Bendigo</strong> Art Gallery develops and delivers exhibitions, public<br />

programs and associated events that are appealing to a range <strong>of</strong><br />

audiences. The Gallery also encourages philanthropy and supports the<br />

<strong>Bendigo</strong> Art Gallery Foundation. Marketing opportunities are developed<br />

for the Gallery that are linked specifically to the exhibition program and<br />

continue to consolidate the Gallery as a national leader within the cultural<br />

sector.<br />

The Community Wellbeing Directorate advises Council on matters<br />

relating to the Directorate and contributes to the executive management<br />

<strong>of</strong> COGB.<br />

The Active and Healthy Communities Unit plans, develops and manages<br />

public places for participation, encouraging and promoting a broad range<br />

<strong>of</strong> sport and leisure opportunities available to the residents <strong>of</strong> and visitors<br />

to the <strong>Greater</strong> <strong>Bendigo</strong> municipality. The Unit improves the health and<br />

wellbeing <strong>of</strong> residents by collaboratively planning across organisations<br />

influencing health through strategies such as the Municipal Public Health<br />

and Wellbeing Plan.<br />

Community Services The Community Services Unit delivers a broad range <strong>of</strong> services for the<br />

early childhood target group and their families including health<br />

promotion, prevention, care, education and advocacy. It provides<br />

support to frail older people, people with disabilities and their carers,<br />

whose capacity for independent living is at risk, or who are at risk <strong>of</strong><br />

premature admission to long term residential care.<br />

Community Partnerships The Community Partnerships Unit encourages a collaborative approach<br />

with all community partners to work towards an agreed vision and<br />

common outcomes for children, young people and their families across<br />

the municipality. The Unit undertakes planning to promote diversity,<br />

community participation and acceptance <strong>of</strong> all cultural groups, people<br />

living with disabilities and older people and develops strategies to<br />

support this planning. The Unit also facilitates greater community<br />

participation in decision making, greater accountability to the community<br />

and encourages effective and efficient responses to community<br />

concerns.<br />

$'000<br />

5,426<br />

(3,223)<br />

2,203<br />

4,486<br />

(2,184)<br />

2,302<br />

514<br />

(5)<br />

509<br />

4,563<br />

(205)<br />

4,358<br />

14,273<br />

(11,762)<br />

2,511<br />

4,145<br />

(572)<br />

3,573<br />

14 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Environmental Health<br />

and Local Laws<br />

Engineering and Public<br />

Space<br />

Parks and Natural<br />

Reserves<br />

Works<br />

<strong>Bendigo</strong> Livestock<br />

Exchange<br />

Major Initiatives<br />

The Environmental Health and Local Laws Unit supports the aim <strong>of</strong> a<br />

community free <strong>of</strong> communicable disease, that tobacco is not sold to<br />

minors and that registered premises, including food and health premises,<br />

have safe business practices. The Unit works collaboratively with<br />

partners to improve safety and security in public places, regulates<br />

activities to ensure a healthy and safe environment and manages fire<br />

prevention information, preparation and activities.<br />

The Engineering and Public Space Unit provides a network <strong>of</strong> road and<br />

footpath infrastructure to service the mobility requirements <strong>of</strong> the<br />

municipality. The Unit designs and delivers quality passive open spaces<br />

as well as all levels <strong>of</strong> play spaces. Detailed designs are developed by<br />

the Unit for the delivery <strong>of</strong> Open Space Masterplans. The Unit is<br />

responsible for the implementation <strong>of</strong> the <strong>Bendigo</strong> Botanic Gardens<br />

Masterplan and Integrated Transport and Land Use Strategy actions and<br />

maintains and updates Asset Management and GIS systems to provide<br />

information for use across COGB and by the public.<br />

The Parks and Natural Reserves Unit provides a safe network <strong>of</strong> open<br />

space that meets the needs <strong>of</strong> users to participate in a variety <strong>of</strong><br />

recreational activities, including sports fields. The Unit also protects and<br />

enhances the natural environment through the implementation <strong>of</strong><br />

management strategies and practices.<br />

The Works Unit maintains and delivers civil infrastructure projects such<br />

as sealed and unsealed roads, footpaths, bike paths, bridges, kerb and<br />

channel, drains and carparks. The Unit also provides vehicle and<br />

pedestrian management for major events and responses to emergencies<br />

and natural disasters.<br />

The <strong>Bendigo</strong> Livestock Exchange provides for the sale <strong>of</strong> livestock.<br />

2,398<br />

(1,061)<br />

1,337<br />

6,472<br />

(3,857)<br />

2,615<br />

12,087<br />

(885)<br />

11,202<br />

12,671<br />

(598)<br />

12,073<br />

1,289<br />

(1,144)<br />

145<br />

28<br />

Proactive tree maintenance program to ensure Council meets risk management requirements as well as<br />

extending the life expectancy <strong>of</strong> individual trees (Net cost $280,000).<br />

Initiatives<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

Facilities Coordinator - convert the role from temporary to ongoing to maximise the use <strong>of</strong> COGB's facilities<br />

(Net cost $79,067).<br />

Conduct pool audits at <strong>Bendigo</strong> East, Raywood and White Hills Pools to determine long term renewal<br />

requirements (Net cost $15,000).<br />

Increase the Early Years Planner role from 0.6 FTE to 1 FTE. This position plans, leads and advocates the<br />

early years priorities through the <strong>Greater</strong> <strong>Bendigo</strong> Municipal Early Years Plan (Net cost $38,932).<br />

Progress the Redesdale Community Hub development and the Agnew Mudford Reserve to respond to<br />

identified community gaps and opportunities (Net cost $25,000).<br />

Cluster Emergency Management Plan: establish a sustainable partnership which enables the member<br />

councils to co-operate in the planning and delivery <strong>of</strong> Local Government emergency management<br />

responsibilities across the municipalities <strong>of</strong> Campaspe, <strong>Greater</strong> <strong>Bendigo</strong>, Loddon and Mount Alexander (Net<br />

cost $30,000).<br />

Conduct Intermediate Dam Inspections to outline the dam conditions and required works to ensure ongoing<br />

safety <strong>of</strong> the structures (Net cost $45,000).<br />

Employ a Senior Landscape Architect 1 FTE to improve the ability to deliver masterplans using in-house<br />

resources (Net cost $86,789).<br />

15 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

47<br />

48<br />

49<br />

Strengthen the Canterbury Park maintenance program to enable the servicing <strong>of</strong> the additional 1.2 hectares<br />

<strong>of</strong> landscaped areas and associated infrastructure that has been completed as part <strong>of</strong> the project (Net cost<br />

$20,000).<br />

Employ an Intensive Horticulture team member 1 FTE to enable servicing <strong>of</strong> the Ulumbarra Theatre and<br />

Rosalind Park precinct (Net cost $46,773).<br />

Improve sports ground maintenance funding to enable servicing <strong>of</strong> Malone Park, Marong, a second sports<br />

field at Marist College and the Kennington Primary School oval which are new facilities to the Parks and<br />

Natural Reserves program (Net cost $80,000).<br />

Conduct the Axedale sports and leisure needs analysis to determine current and future needs <strong>of</strong> this area<br />

(Net cost $15,000).<br />

Deliver the Community Giving Day pilot in partnership with the Community Foundation for Central Victoria to<br />

build local not for pr<strong>of</strong>it capacity to fundraise and build their resilience and sustainability (Net cost $25,000).<br />

Computerised database inventory <strong>of</strong> trees to incorporate a detailed proactive tree inspection program to<br />

enable COGB to manage its tree population according to risk management objectives (Net cost $25,000).<br />

Deliver the Regional Food Hub detailed design as a place to learn about food, exchange food and showcase<br />

local food (Net cost $25,000).<br />

Complete the <strong>Bendigo</strong> Mountain Bike park masterplan for a 30km purpose built trail network in the <strong>Greater</strong><br />

<strong>Bendigo</strong> heritage National Park (Net cost $89,409).<br />

Provide interest free loans to local business to assist in infrastructure upgrade costs associated with outdoor<br />

dining to facilitate activation and vibrancy <strong>of</strong> COGB streetscapes (Net cost $50,000).<br />

Deliver ANZAC day events and commemoration at the <strong>Bendigo</strong> Memorial Hall (Net cost $0).<br />

Deliver Australia Day events funding including the Rotary event held at Lake Weeroona (Net cost $0).<br />

Improve <strong>Bendigo</strong> Easter festival logistics planning to ensure that the safety and wellbeing <strong>of</strong> all festival<br />

attendees is upheld (Net cost $0).<br />

Marketing <strong>of</strong> the <strong>Bendigo</strong> international collections exhibition funding to match the State Government support<br />

for a major exhibition at the <strong>Bendigo</strong> Art Gallery in <strong>2017</strong> (Net cost $50,000).<br />

<strong>Bendigo</strong> Spirit sponsorship to extend their financial viability (Net cost $30,000).<br />

16 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Service Performance Outcome Indicators<br />

The following indicators outline how we intend to measure achievement <strong>of</strong> service objectives.<br />

Service<br />

Home and Community<br />

Indicator<br />

Participation<br />

Performance Measure<br />

Participation in Home and<br />

Computation<br />

[Number <strong>of</strong> people that received a<br />

Care<br />

Community Care service Home and Community Care<br />

service/ Municipal target population<br />

for Home and Community Care<br />

Home and Community<br />

Care<br />

Maternal and Child<br />

Health<br />

Maternal and Child<br />

Health<br />

Participation<br />

Participation<br />

Participation<br />

Participation in Home and<br />

Community Care service by<br />

Culturally and Linguistically<br />

Diverse (CALD) people<br />

Participation in the Maternal and<br />

Child Health (MCH) service<br />

Participation in Maternal and<br />

Child Health (MCH) service by<br />

Aboriginal children<br />

services] x100<br />

[Number <strong>of</strong> CALD people who<br />

receive a Home and Community<br />

Care service / Municipal target<br />

population in relation to CALD<br />

people for Home and Community<br />

Care services] x100<br />

[Number <strong>of</strong> children who attend the<br />

MCH service at least once (in the<br />

year) / Number <strong>of</strong> children enrolled<br />

in the MCH service] x100<br />

[Number <strong>of</strong> Aboriginal children who<br />

attend the MCH service at least<br />

once (in the year) / Number <strong>of</strong><br />

Aboriginal children enrolled in the<br />

MCH service] x100<br />

Aquatic Facilities Utilisation Utilisation <strong>of</strong> aquatic facilities Number <strong>of</strong> visits to aquatic<br />

facilities/ Municipal population<br />

Roads<br />

Satisfaction Satisfaction with sealed local Community satisfaction rating out<br />

roads<br />

<strong>of</strong> 100 with how Council has<br />

performed on the condition <strong>of</strong><br />

sealed local roads.<br />

Food Safety<br />

Health and Safety Critical and major non-compliance [Number <strong>of</strong> critical non-compliance<br />

notifications<br />

notifications and major noncompliance<br />

notifications about a<br />

food premises followed up/ Number<br />

<strong>of</strong> critical non-compliance<br />

notifications and major noncompliance<br />

notifications about a<br />

food premises] x100<br />

Animal Management Health and Safety Animal management prosecutions Number <strong>of</strong> successful animal<br />

management prosecutions<br />

17 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

2.4 Theme 4: Productivity<br />

Productivity is about encouraging innovation and diversity in education, commerce and industry. It is about<br />

responding to new economic opportunities, including making sure our local workforce is appropriately skilled.<br />

Council’s role involves supporting infrastructure projects that promote and enable investment, business opportunity<br />

and business security within the municipality.<br />

Further, its involves establishing the environment for investment and making sure the infrastructure is in place to<br />

support economic activity. It involves creating the opportunity for all people to be actively employed. The focus is<br />

on the potential additional economic activity generated in the community, not a direct return on investment to the<br />

<strong>City</strong> <strong>of</strong> <strong>Greater</strong> <strong>Bendigo</strong>.<br />

Services<br />

Service Unit<br />

Description <strong>of</strong> Services Provided<br />

<strong>City</strong> Futures<br />

The <strong>City</strong> Futures Directorate advises Council on matters relating to the<br />

Directorate, contributes to the executive management <strong>of</strong> COGB and<br />

represents COGB on a number <strong>of</strong> key organisational and industry<br />

boards. The Directorate manages government advocacy relationships<br />

and provides funding support to <strong>Bendigo</strong> Heritage Attractions.<br />

Tourism<br />

The Tourism Unit continues to develop <strong>Greater</strong> <strong>Bendigo</strong> as a major<br />

regional visitor destination by building economic benefits from tourism<br />

through a year round event and activity calendar. The Unit delivers<br />

quality visitor experiences through a team <strong>of</strong> staff and volunteers and<br />

develops and markets <strong>Bendigo</strong> Tourism’s experiences digitally across a<br />

number <strong>of</strong> platforms. The Unit delivers a range and depth <strong>of</strong> market<br />

ready experiences and develops greater capacity across the tourism<br />

business landscape to deliver enriched tourism experiences.<br />

Major Events<br />

The Major Events Unit attracts and retains major events that deliver a<br />

positive economic impact, promote the liveability <strong>of</strong> the city, that provide<br />

local, national and international media exposure and help support and<br />

foster good relations with State and Federal Government. The Unit also<br />

attracts new and nurtures existing events in Sport and Leisure, Arts and<br />

Culture, Conferences, Shows and Expos, Food and Wine, Agricultural<br />

Shows, Business Events and Car Clubs to continue to drive positive<br />

economic impact for <strong>Bendigo</strong> and the region. The Unit organises,<br />

manages and presents the annual <strong>Bendigo</strong> Easter Festival and delivers<br />

civic events, including Citizenship Ceremonies.<br />

Economic Development The Economic Development Unit supports business, economic,<br />

commercial and industry development. Local businesses are supported<br />

to capitalise on the roll out <strong>of</strong> the National Broadband Network and the<br />

Unit coordinates the <strong>Bendigo</strong> Pr<strong>of</strong>essional Services Group to assist the<br />

industry in growing throughout the region. The Unit also coordinates the<br />

<strong>Bendigo</strong> Manufacturing Group to help local manufacturers adapt to<br />

changing business conditions.<br />

Expenditure<br />

(Revenue)<br />

Net Cost<br />

$'000<br />

1,288<br />

0<br />

1,288<br />

3,339<br />

(1,089)<br />

2,250<br />

2,326<br />

(236)<br />

2,090<br />

1,622<br />

(250)<br />

1,372<br />

Major Initiatives<br />

50<br />

Develop the Career Horizons online work experience program, to connect students <strong>of</strong> all ages with employers<br />

(Net cost $20,000).<br />

18 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Service Performance Outcome Indicators<br />

The following indicator outlines how we intend to measure achievement <strong>of</strong> service objectives.<br />

Service Indicator Performance Measure Computation<br />

Economic Development Economic Activity Changes in number <strong>of</strong> businesses [Number <strong>of</strong> businesses with an<br />

ABN in the municipality at the end<br />

<strong>of</strong> the financial year less the<br />

number <strong>of</strong> businesses at the start<br />

<strong>of</strong> the financial year / Number <strong>of</strong><br />

businesses with an ABN in the<br />

municipality at the start <strong>of</strong> the<br />

financial year] x100<br />

2.5 Theme 5: Sustainability<br />

Sustainability means making good use <strong>of</strong> all our resources, so that the decisions made today do not limit the<br />

choices <strong>of</strong> future generations. Developing the environmental sustainability <strong>of</strong> the municipality is supported,<br />

including carbon and waste management. In the context <strong>of</strong> the Council Plan, built and natural assets and finances<br />

must also be managed in a way that is viable into the future.<br />

Services<br />

Expenditure<br />

Service Unit Description <strong>of</strong> Services Provided (Revenue)<br />

Net Cost<br />

Parking and Animal<br />

Control<br />

promote public safety and residential amenity.<br />

Building and Property The Building and Property Unit develops, upgrades and maintains<br />

community assets to meet current needs, standards and uses. The Unit<br />

also plans and delivers new projects to address the growing future needs<br />

<strong>of</strong> COGB. The Unit ensures COGB owned and other facilities comply<br />

with relevant building codes and standards. The Unit provides an<br />

effective and responsive building advice and support service.<br />

Presentation and Assets The Presentation and Assets Directorate advises Council on matters<br />

relating to the Directorate and contributes to the executive management<br />

<strong>of</strong> COGB. The Directorate maintains relationships with and lobbies State<br />

and Federal governments and their departments.<br />

Waste Services The Waste Services Unit collects garbage from domestic and<br />

commercial properties, collects and sorts kerbside recycling, will provide<br />

the new organics collection service, operates landfills and transfer<br />

stations and provides street cleaning. The Unit also provides servicing<br />

to the entire Depot based fleet and for COGB’s car fleet.<br />

Sustainable<br />

Environment<br />

The Parking and Animal Control Unit manages the <strong>City</strong>'s parking control,<br />

animal management, school crossing supervision, aerodrome safety,<br />

maintenance and compliance and CCTV surveillance in the CBD to<br />

The Sustainable Environment Unit provides a coordinated approach to<br />

the development <strong>of</strong> environmental policies, strategies, programs and<br />

processes including climate change mitigation and adaptation and<br />

carbon management. The Unit provides advice on native vegetation and<br />

biodiversity matters, provides technical advice and recommendations<br />

relating to vegetation assessments and engages and supports the<br />

community to value and protect native landscapes. The Unit also<br />

coordinates energy efficient installations in COGB buildings.<br />

Finance The Finance Unit ensures financial accountability and integrity <strong>of</strong><br />

financial data and assists COGB in demonstrating probity, accountability,<br />

compliance with legislative frameworks and transparency to key<br />

stakeholders. The Unit also oversees the borrowing and investing <strong>of</strong><br />

COGB funds and ensures financial accountability over the payment <strong>of</strong><br />

Developer Levies.<br />

*Cost allocated across other units<br />

$'000<br />

4,358<br />

(6,734)<br />

(2,376)<br />

8,181<br />

(2,801)<br />

5,380<br />

23,933<br />

0<br />

23,933<br />

26,087<br />

(13,504)<br />

12,583<br />

980<br />

(66)<br />

914<br />

1,955<br />

(1,306) *<br />

649<br />

(65)<br />

584<br />

19 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

Major Initiatives<br />

51<br />

Organics fortnightly waste collection (Net cost $0).<br />

Initiatives<br />

52<br />

53<br />

54<br />

55<br />

56<br />

57<br />

58<br />

Funding to support growth in the Building and Property Unit to enable the maintenance <strong>of</strong> current buildings<br />

and assets to a safe and acceptable standard (Net cost $100,000).<br />

Employ a Project Administration Officer in Building and Property 0.6 FTE to carry out the project and contract<br />

administration duties (Net cost $37,315).<br />

Asset Management Planning in Building and Property to better understand the scope and needs <strong>of</strong> the<br />

community and users engaged and consulted in a timely manner (Net cost $49,000).<br />

Deliver decontamination and loading <strong>of</strong> kerbside organics, by the employment <strong>of</strong> 2 FTE to decontaminate<br />

prior to transport to avoid penalties at the processing facility (Net cost $0).<br />

Management <strong>of</strong> Heathcote Landfill rather than continuing to outsource, to comply with EPA requirements. 0.5<br />

FTE to manage the tipping face and application <strong>of</strong> the cover (Net cost $0).<br />

New garbage truck and driver to cater for urban growth in COGB to maintain existing service levels.<br />

(Net cost $0).<br />

Planning Scheme Amendments to manage the planning and development <strong>of</strong> the funding for <strong>Greater</strong> <strong>Bendigo</strong><br />

through the preparation <strong>of</strong> major Strategies and effective amendments to the planning scheme (Net cost<br />

$238,280).<br />

Service Performance Outcome Indicators<br />

The following indicator outlines how we intend to measure achievement <strong>of</strong> service objectives.<br />

Service<br />

Waste Collection<br />

Indicator<br />

Waste diversion<br />

Performance Measure<br />

Kerbside collection waste diverted<br />

from landfill<br />

(Percentage <strong>of</strong> garbage,<br />

recyclables and green organics<br />

collected from kerbside bins that<br />

is diverted from landfill)<br />

Computation<br />

[Weight <strong>of</strong> recyclables and green<br />

organics collected from kerbside<br />

bins / Weight <strong>of</strong> garbage,<br />

recyclables and green organics<br />

collected from kerbside bins] x100<br />

2.7 Performance Statement<br />

The service performance indicators detailed in the preceding pages will be reported on in the Performance<br />

Statement which is prepared at the end <strong>of</strong> the year as required by Section 132 <strong>of</strong> the Act and included in the<br />

<strong>2016</strong>/17 Annual Report. The Performance Statement will also include reporting on prescribed indicators <strong>of</strong> financial<br />

performance (outlined in Section 8) and sustainable capacity, which are not included in this budget report. The<br />

prescribed performance indicators contained in the Performance Statement are audited each year by the Victorian<br />

Auditor General who issues an audit opinion on the Performance Statement. The major initiatives detailed in the<br />

preceding pages will be reported in the Annual Report in the form <strong>of</strong> a statement <strong>of</strong> progress in the Report <strong>of</strong><br />

Operations.<br />

20 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

2.8 Reconciliation with budgeted operating result<br />

Leadership and Good Governance<br />

Planning for Growth<br />

Presentation and Vibrancy<br />

Productivity<br />

Sustainability<br />

Total services and initiatives<br />

Other non-attributable<br />

Deficit before funding sources<br />

Funding sources:<br />

Rates and charges<br />

Capital grants<br />

Contribution to capital works<br />

Total funding sources<br />

Surplus for the year<br />

Net Cost /<br />

Revenue Expenditure Revenue<br />

$’000 $’000 $’000<br />

12,675 20,324 7,649<br />

5,932 6,881 949<br />

42,828 68,324 25,496<br />

7,000 8,575 1,575<br />

41,018 65,494 24,476<br />

109,453 169,598 60,145<br />

20,606<br />

88,847<br />

106,616<br />

26,367<br />

9,876<br />

142,859<br />

54,012<br />

21 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

3. Financial Statements<br />

This section presents information in regard to the Financial Statements.<br />

<strong>2017</strong>/18 to 2019/20 has been extracted from the Strategic Resource Plan.<br />

The budget information for the years<br />

This section includes the following financial statements in accordance with the Local Government Act 1989 and the<br />

Local Government Model Financial Report.<br />

3.1 Comprehensive Income Statement<br />

3.2 Balance Sheet<br />

3.3 Statement <strong>of</strong> Changes in Equity<br />

3.4 Statement <strong>of</strong> Cash Flows<br />

3.5 Statement <strong>of</strong> Capital Works<br />

3.6 Statement <strong>of</strong> Human Resources<br />

22 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

3.1 Comprehensive Income Statement<br />

For the four years ending 30 June 2020<br />

Forecast<br />

Actual<br />

<strong>Budget</strong><br />

Strategic Resource Plan<br />

Projections<br />

2015/16 <strong>2016</strong>/17 <strong>2017</strong>/18 2018/19 2019/20<br />

$’000 $’000 $’000 $’000 $’000<br />

Income<br />

Rates and charges 99,760 106,616 109,668 112,815 116,062<br />

Statutory fees and fines 3,972 4,103 4,266 4,437 4,614<br />

User charges, fees and fines 23,216 24,223 25,192 26,198 27,246<br />

Grants - operating 21,563 24,207 24,484 25,192 25,621<br />

Grants - capital 21,639 26,367 6,968 5,812 5,911<br />

Contributions - monetary 12,580 11,613 4,065 4,227 4,397<br />

Contributions - non-monetary 11,391 11,846 11,620 11,736 11,500<br />

Interest on investments 1,496 1,471 1,600 1,619 1,642<br />

Total income 195,617 210,446 187,863 192,036 196,993<br />

Expenses<br />

Employee costs 57,727 60,805 64,088 67,037 70,120<br />

Contracts payments, materials and<br />

69,039 59,689 61,668 63,413 65,206<br />

services<br />

Bad and doubtful debts 131 130 126 130 134<br />

Depreciation and amortisation 29,408 30,919 32,465 34,088 35,793<br />

Borrowing costs 1,715 1,891 2,374 2,318 2,257<br />

Net loss on disposal <strong>of</strong> property,<br />

3,000 3,000 3,000 3,000 3,000<br />

infrastructure, plant and equipment<br />

Total expenses 161,020 156,434 163,721 169,986 176,510<br />

Surplus/(deficit) for the year 34,597 54,012 24,142 22,050 20,483<br />

Other comprehensive income<br />

Items that will not be reclassified to<br />

surplus or deficit in future periods:<br />

Net asset revaluation 51,908 27,992 52,439 29,204 56,612<br />

Share <strong>of</strong> other comprehensive income<br />

6 (184) 12 73 47<br />

<strong>of</strong> associates<br />

Total comprehensive result 86,511 81,820 76,593 51,327 77,142<br />

23 <strong>Greater</strong> <strong>Bendigo</strong> <strong>City</strong> Council <strong>Budget</strong> - <strong>2016</strong>/17

3.2 Balance Sheet<br />

For the four years ending 30 June 2020<br />

Forecast<br />

Actual<br />

<strong>Budget</strong><br />

Strategic Resource Plan<br />

Projections<br />

2015/16 <strong>2016</strong>/17 <strong>2017</strong>/18 2018/19 2019/20<br />

$’000 $’000 $’000 $’000 $’000<br />

Assets<br />

Current assets<br />

Cash and cash equivalents 55,854 41,389 44,194 46,136 47,189<br />

Trade and other receivables 9,676 9,900 10,244 10,483 10,767<br />

Inventories 179 185 188 190 195<br />

Other assets 1,500 1,520 1,542 1,558 1,570<br />

Total current assets 67,209 52,994 56,168 58,367 59,721<br />

Non-current assets<br />

Trade and other receivables 50 80 100 110 115<br />

Investments in associates 4,036 3,852 3,864 3,937 3,984<br />

Property, infrastructure, plant and 1,394,910 1,507,712 1,581,518 1,630,580 1,706,312<br />

equipment<br />

Forestry Plantations 56 56 80 80 80<br />

Intangible Assets 173 173 229 241 246<br />

Total non-current assets 1,399,225 1,511,873 1,585,791 1,634,948 1,710,737<br />

Total assets 1,466,434 1,564,867 1,641,959 1,693,315 1,770,458<br />

Liabilities<br />

Current liabilities<br />

Trade and other payables 13,500 13,532 14,093 14,624 15,172<br />

Trust funds and deposits 2,848 2,936 3,024 3,115 3,208<br />

Provisions 14,857 15,466 15,492 15,520 15,548<br />

Interest-bearing loans and borrowings 2,164 3,366 3,751 3,832 4,266<br />

Total current liabilities 33,369 35,300 36,360 37,091 38,194<br />

Non-current liabilities<br />

Provisions 8,968 9,739 9,977 10,221 10,473<br />

Interest-bearing loans and borrowings 33,284 47,011 46,224 45,351 44,044<br />

Total non-current liabilities 42,252 56,750 56,201 55,572 54,517<br />

Total liabilities 75,621 92,050 92,561 92,663 92,711<br />

Net assets 1,390,813 1,472,817 1,549,398 1,600,652 1,677,747<br />

Equity<br />

Accumulated surplus 609,864 669,954 694,382 719,982 738,965<br />