Optimization of the company's cash flow

This book is about the company's treasuries and financial management, more specifically; it shows how a company can manage its treasury in an efficient and short way.

This book is about the company's treasuries and financial management, more specifically; it shows how a company can manage its treasury in an efficient and short way.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DATE OF<br />

OPERATION<br />

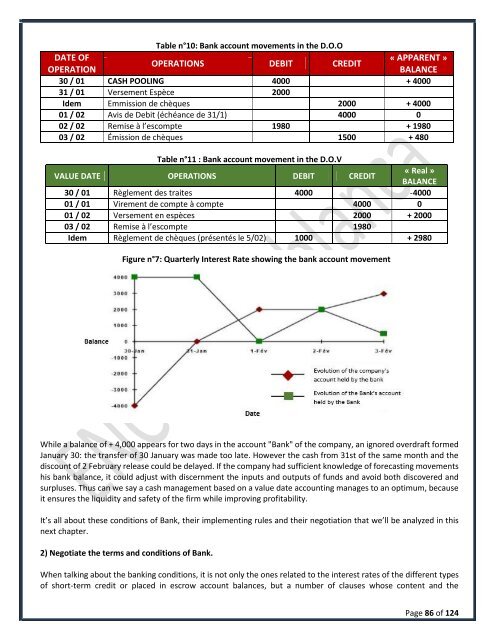

Table n°10: Bank account movements in <strong>the</strong> D.O.O<br />

OPERATIONS DEBIT CREDIT<br />

« APPARENT »<br />

BALANCE<br />

30 / 01 CASH POOLING 4000 + 4000<br />

31 / 01 Versement Espèce 2000<br />

Idem Emmission de chèques 2000 + 4000<br />

01 / 02 Avis de Debit (échéance de 31/1) 4000 0<br />

02 / 02 Remise à l’escompte 1980 + 1980<br />

03 / 02 Émission de chèques 1500 + 480<br />

Table n°11 : Bank account movement in <strong>the</strong> D.O.V<br />

VALUE DATE OPERATIONS DEBIT CREDIT<br />

« Real »<br />

BALANCE<br />

30 / 01 Règlement des traites 4000 - 4000<br />

01 / 01 Virement de compte à compte 4000 0<br />

01 / 02 Versement en espèces 2000 + 2000<br />

03 / 02 Remise à l’escompte 1980<br />

Idem Règlement de chèques (présentés le 5/02) 1000 + 2980<br />

Figure n°7: Quarterly Interest Rate showing <strong>the</strong> bank account movement<br />

While a balance <strong>of</strong> + 4,000 appears for two days in <strong>the</strong> account "Bank" <strong>of</strong> <strong>the</strong> company, an ignored overdraft formed<br />

January 30: <strong>the</strong> transfer <strong>of</strong> 30 January was made too late. However <strong>the</strong> <strong>cash</strong> from 31st <strong>of</strong> <strong>the</strong> same month and <strong>the</strong><br />

discount <strong>of</strong> 2 February release could be delayed. If <strong>the</strong> company had sufficient knowledge <strong>of</strong> forecasting movements<br />

his bank balance, it could adjust with discernment <strong>the</strong> inputs and outputs <strong>of</strong> funds and avoid both discovered and<br />

surpluses. Thus can we say a <strong>cash</strong> management based on a value date accounting manages to an optimum, because<br />

it ensures <strong>the</strong> liquidity and safety <strong>of</strong> <strong>the</strong> firm while improving pr<strong>of</strong>itability.<br />

It’s all about <strong>the</strong>se conditions <strong>of</strong> Bank, <strong>the</strong>ir implementing rules and <strong>the</strong>ir negotiation that we’ll be analyzed in this<br />

next chapter.<br />

2) Negotiate <strong>the</strong> terms and conditions <strong>of</strong> Bank.<br />

When talking about <strong>the</strong> banking conditions, it is not only <strong>the</strong> ones related to <strong>the</strong> interest rates <strong>of</strong> <strong>the</strong> different types<br />

<strong>of</strong> short-term credit or placed in escrow account balances, but a number <strong>of</strong> clauses whose content and <strong>the</strong><br />

Page 86 <strong>of</strong> 124