Optimization of the company's cash flow

This book is about the company's treasuries and financial management, more specifically; it shows how a company can manage its treasury in an efficient and short way.

This book is about the company's treasuries and financial management, more specifically; it shows how a company can manage its treasury in an efficient and short way.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

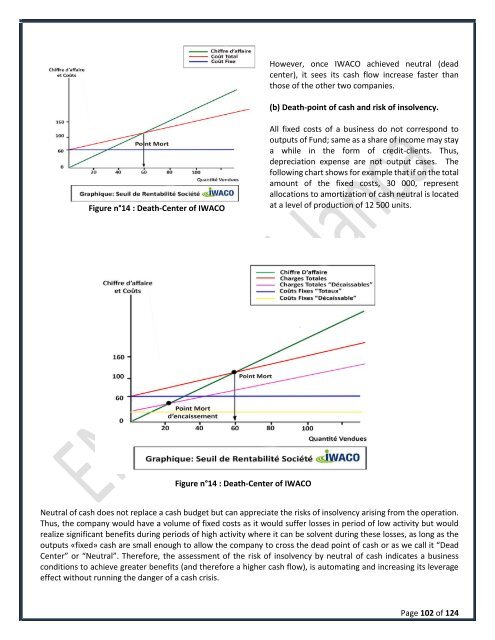

However, once IWACO achieved neutral (dead<br />

center), it sees its <strong>cash</strong> <strong>flow</strong> increase faster than<br />

those <strong>of</strong> <strong>the</strong> o<strong>the</strong>r two companies.<br />

(b) Death-point <strong>of</strong> <strong>cash</strong> and risk <strong>of</strong> insolvency.<br />

Figure n°14 : Death-Center <strong>of</strong> IWACO<br />

All fixed costs <strong>of</strong> a business do not correspond to<br />

outputs <strong>of</strong> Fund; same as a share <strong>of</strong> income may stay<br />

a while in <strong>the</strong> form <strong>of</strong> credit-clients. Thus,<br />

depreciation expense are not output cases. The<br />

following chart shows for example that if on <strong>the</strong> total<br />

amount <strong>of</strong> <strong>the</strong> fixed costs, 30 000, represent<br />

allocations to amortization <strong>of</strong> <strong>cash</strong> neutral is located<br />

at a level <strong>of</strong> production <strong>of</strong> 12 500 units.<br />

Figure n°14 : Death-Center <strong>of</strong> IWACO<br />

Neutral <strong>of</strong> <strong>cash</strong> does not replace a <strong>cash</strong> budget but can appreciate <strong>the</strong> risks <strong>of</strong> insolvency arising from <strong>the</strong> operation.<br />

Thus, <strong>the</strong> company would have a volume <strong>of</strong> fixed costs as it would suffer losses in period <strong>of</strong> low activity but would<br />

realize significant benefits during periods <strong>of</strong> high activity where it can be solvent during <strong>the</strong>se losses, as long as <strong>the</strong><br />

outputs «fixed» <strong>cash</strong> are small enough to allow <strong>the</strong> company to cross <strong>the</strong> dead point <strong>of</strong> <strong>cash</strong> or as we call it “Dead<br />

Center” or “Neutral”. Therefore, <strong>the</strong> assessment <strong>of</strong> <strong>the</strong> risk <strong>of</strong> insolvency by neutral <strong>of</strong> <strong>cash</strong> indicates a business<br />

conditions to achieve greater benefits (and <strong>the</strong>refore a higher <strong>cash</strong> <strong>flow</strong>), is automating and increasing its leverage<br />

effect without running <strong>the</strong> danger <strong>of</strong> a <strong>cash</strong> crisis.<br />

Page 102 <strong>of</strong> 124