SCI Annual Report 2015

Annual Report Annual Report

SCI Electric Public Company Limited Financial Ratio Consolidation FY2015 FY2014 FY2013 Per share information** Earnings Per Share (Baht) 0.37 1.98 1.04 Weighted average number of common shares (share) 501,616,438 165,000,000 165,000,000 Remark : ** devalue the par value to Baht 1 per share and issue the new share during the year 2015 Liquidity ratio The current ratio was increased which mainly came from increased in the current asset and decreased in the current liabilities. The quick ration was increased the same as the current ratio. SOURCE OF FUNDS LIABILITIES As at 31 December 2015, the Company had total liabilities of Baht 1,048.08 million, decreased by Baht 252.52 million or 19.42% compared as at 31 December 2014, Baht 1,927.09 million. The major portion of liabilities was current liabilities of Baht 953.56 million which decreased of Baht 246.26 million or decreased 20.525 compared as at 31 December 2014, Baht 1,199.82 million. The current liabilities represented 90.985 of total liabilities. The detail of total liabilities is shown in table 5. Borrowing from financial institutions As at 31 December 2015, the borrowing was decreased of Baht 161.59 million or decreased 37.64% compare to the year 2014. The reason of decrease came from the repayment borrowing after IPO to reduce the financial costs. The detail of borrowing is shown as below Unit: Million Baht Consolidation Borrowing As 31/12/2015 As 31/12/2014 Increased (Decreased) Amount % Amount % Amount % Current liabilities Overdrafts 11.89 4.44 13.35 3.11 (1.46) (10.95) Promissory notes 88.97 33.23 221.39 51.57 (132.43) (59.82) Total short-term loans facilities from financial institutions 100.86 37.68 234.75 54.68 (133.89) (57.04) Long-term loans - Current portion 13.96 5.21 14.51 3.38 (0.55) (3.79) - Classified as current liability 103.55 38.68 116.40 27.12 (12.85) (11.04) Total long-term loans as current liability 117.51 43.90 130.91 30.50 (13.40) (10.24) Total loans as current liability 218.37 81.57 365.66 85.18 (147.29) (40.28) 250

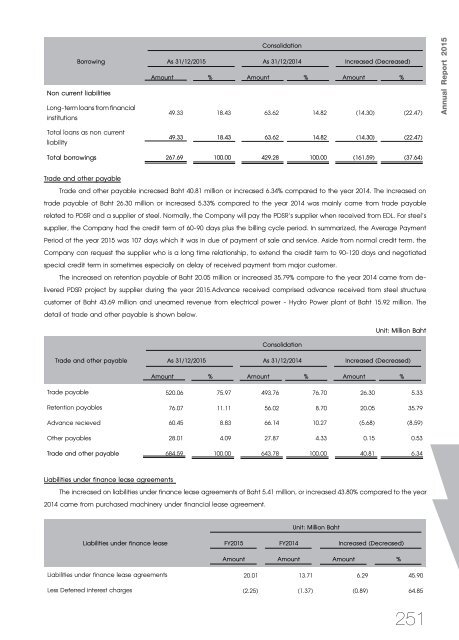

Borrowing Non current liabilities Long-term loans from financial institutions Total loans as non current liability Consolidation As 31/12/2015 As 31/12/2014 Increased (Decreased) Amount % Amount % Amount % 49.33 18.43 63.62 14.82 (14.30) (22.47) 49.33 18.43 63.62 14.82 (14.30) (22.47) Total borrowings 267.69 100.00 429.28 100.00 (161.59) (37.64) Trade and other payable Trade and other payable increased Baht 40.81 million or increased 6.34% compared to the year 2014. The increased on trade payable of Baht 26.30 million or increased 5.33% compared to the year 2014 was mainly came from trade payable related to PDSR and a supplier of steel. Normally, the Company will pay the PDSR’s supplier when received from EDL. For steel’s supplier, the Company had the credit term of 60-90 days plus the billing cycle period. In summarized, the Average Payment Period of the year 2015 was 107 days which it was in due of payment of sale and service. Aside from normal credit term, the Company can request the supplier who is a long time relationship, to extend the credit term to 90-120 days and negotiated special credit term in sometimes especially on delay of received payment from major customer. The increased on retention payable of Baht 20.05 million or increased 35.79% compare to the year 2014 came from delivered PDSR project by supplier during the year 2015.Advance received comprised advance received from steel structure customer of Baht 43.69 million and unearned revenue from electrical power - Hydro Power plant of Baht 15.92 million. The detail of trade and other payable is shown below. Unit: Million Baht Consolidation Trade and other payable As 31/12/2015 As 31/12/2014 Increased (Decreased) Amount % Amount % Amount % Trade payable 520.06 75.97 493.76 76.70 26.30 5.33 Retention payables 76.07 11.11 56.02 8.70 20.05 35.79 Advance recieved 60.45 8.83 66.14 10.27 (5.68) (8.59) Other payables 28.01 4.09 27.87 4.33 0.15 0.53 Trade and other payable 684.59 100.00 643.78 100.00 40.81 6.34 Liabilities under finance lease agreements The increased on liabilities under finance lease agreements of Baht 5.41 million, or increased 43.80% compared to the year 2014 came from purchased machinery under financial lease agreement. Unit: Million Baht Liabilities under finance lease FY2015 FY2014 Increased (Decreased) Amount Amount Amount % Liabilities under finance lease agreements 20.01 13.71 6.29 45.90 Less Deferred interest charges (2.25) (1.37) (0.89) 64.85 251 Annual Report 2015

- Page 200 and 201: SCI Electric Public Company Limited

- Page 202 and 203: SCI Electric Public Company Limited

- Page 204 and 205: SCI Electric Public Company Limited

- Page 206 and 207: SCI Electric Public Company Limited

- Page 208 and 209: SCI Electric Public Company Limited

- Page 210 and 211: SCI Electric Public Company Limited

- Page 212 and 213: SCI Electric Public Company Limited

- Page 214 and 215: SCI Electric Public Company Limited

- Page 216 and 217: SCI Electric Public Company Limited

- Page 218 and 219: SCI Electric Public Company Limited

- Page 220 and 221: SCI Electric Public Company Limited

- Page 222 and 223: SCI ELECTRIC PUBLIC COMPANY LIMITED

- Page 224 and 225: SCI Electric Public Company Limited

- Page 226 and 227: SCI Electric Public Company Limited

- Page 228 and 229: SCI Electric Public Company Limited

- Page 230 and 231: SCI Electric Public Company Limited

- Page 232 and 233: SCI Electric Public Company Limited

- Page 234 and 235: SCI Electric Public Company Limited

- Page 236 and 237: SCI Electric Public Company Limited

- Page 238 and 239: SCI Electric Public Company Limited

- Page 240 and 241: SCI Electric Public Company Limited

- Page 242 and 243: SCI Electric Public Company Limited

- Page 244 and 245: SCI Electric Public Company Limited

- Page 246 and 247: SCI Electric Public Company Limited

- Page 248 and 249: SCI Electric Public Company Limited

- Page 252 and 253: SCI Electric Public Company Limited

Borrowing<br />

Non current liabilities<br />

Long-term loans from financial<br />

institutions<br />

Total loans as non current<br />

liability<br />

Consolidation<br />

As 31/12/<strong>2015</strong> As 31/12/2014 Increased (Decreased)<br />

Amount % Amount % Amount %<br />

49.33 18.43 63.62 14.82 (14.30) (22.47)<br />

49.33 18.43 63.62 14.82 (14.30) (22.47)<br />

Total borrowings 267.69 100.00 429.28 100.00 (161.59) (37.64)<br />

Trade and other payable<br />

Trade and other payable increased Baht 40.81 million or increased 6.34% compared to the year 2014. The increased on<br />

trade payable of Baht 26.30 million or increased 5.33% compared to the year 2014 was mainly came from trade payable<br />

related to PDSR and a supplier of steel. Normally, the Company will pay the PDSR’s supplier when received from EDL. For steel’s<br />

supplier, the Company had the credit term of 60-90 days plus the billing cycle period. In summarized, the Average Payment<br />

Period of the year <strong>2015</strong> was 107 days which it was in due of payment of sale and service. Aside from normal credit term, the<br />

Company can request the supplier who is a long time relationship, to extend the credit term to 90-120 days and negotiated<br />

special credit term in sometimes especially on delay of received payment from major customer.<br />

The increased on retention payable of Baht 20.05 million or increased 35.79% compare to the year 2014 came from delivered<br />

PDSR project by supplier during the year <strong>2015</strong>.Advance received comprised advance received from steel structure<br />

customer of Baht 43.69 million and unearned revenue from electrical power - Hydro Power plant of Baht 15.92 million. The<br />

detail of trade and other payable is shown below.<br />

Unit: Million Baht<br />

Consolidation<br />

Trade and other payable As 31/12/<strong>2015</strong> As 31/12/2014 Increased (Decreased)<br />

Amount % Amount % Amount %<br />

Trade payable 520.06 75.97 493.76 76.70 26.30 5.33<br />

Retention payables 76.07 11.11 56.02 8.70 20.05 35.79<br />

Advance recieved 60.45 8.83 66.14 10.27 (5.68) (8.59)<br />

Other payables 28.01 4.09 27.87 4.33 0.15 0.53<br />

Trade and other payable 684.59 100.00 643.78 100.00 40.81 6.34<br />

Liabilities under finance lease agreements<br />

The increased on liabilities under finance lease agreements of Baht 5.41 million, or increased 43.80% compared to the year<br />

2014 came from purchased machinery under financial lease agreement.<br />

Unit: Million Baht<br />

Liabilities under finance lease FY<strong>2015</strong> FY2014 Increased (Decreased)<br />

Amount Amount Amount %<br />

Liabilities under finance lease agreements 20.01 13.71 6.29 45.90<br />

Less Deferred interest charges (2.25) (1.37) (0.89) 64.85<br />

251<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2015</strong>