Biotech financing

25WmEet 25WmEet

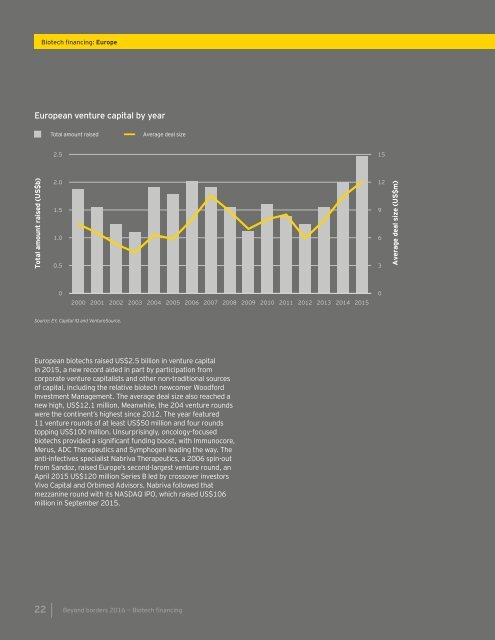

Biotech financing: Europe European venture capital by year Total amount raised Average deal size 15 12 9 6 3 0 Source: EY, Capital IQ and VentureSource. European biotechs raised US$2.5 billion in venture capital in 2015, a new record aided in part by participation from corporate venture capitalists and other non-traditional sources of capital, including the relative biotech newcomer Woodford Investment Management. The average deal size also reached a new high, US$12.1 million. Meanwhile, the 204 venture rounds were the continent’s highest since 2012. The year featured 11 venture rounds of at least US$50 million and four rounds topping US$100 million. Unsurprisingly, oncology-focused biotechs provided a significant funding boost, with Immunocore, Merus, ADC Therapeutics and Symphogen leading the way. The anti-infectives specialist Nabriva Therapeutics, a 2006 spin-out from Sandoz, raised Europe’s second-largest venture round, an April 2015 US$120 million Series B led by crossover investors Vivo Capital and Orbimed Advisors. Nabriva followed that mezzanine round with its NASDAQ IPO, which raised US$106 million in September 2015. 22 Beyond borders 2016 — Biotech financing

Top European venture financing, 2015 Company Country Lead product clinical stage Status Amount (US$m) Month Immunocore* UK Phase II Oncology 313 July Nabriva Therapeutics Austria Phase II Infectious disease 120 April Mereo BioPharma* UK Phase III Multiple 117 July CureVac Germany Phase II Oncology 111 November Merus Netherlands Phase I Oncology 81 August ADC Therapeutics Switzerland Phase I Oncology 80 September Symphogen Denmark Phase II Oncology 75 October CureVac Germany Phase II Multiple 74 March CRISPR Therapeutics Switzerland Preclinical Genetic diseases 64 April ObsEva Switzerland Phase II Women's health 60 November Kymab UK Preclinical Multiple 50 May Autolus UK Preclinical Oncology 46 January Sanifit Spain Phase II Hematology 41 September PsiOxus Therapeutics UK Phase II Oncology 38 May GenSight Biologics France Phase III Ophthalmic 36 July Source: EY, Capital IQ and VentureSource. *First venture round Beyond borders 2016 — Biotech financing 23

- Page 1 and 2: Beyond borders 2016: Biotech financ

- Page 3 and 4: Contents Financing Slowdown ahead?

- Page 5 and 6: Slowdown ahead? Since the US garner

- Page 7 and 8: Venture financing accelerates While

- Page 9 and 10: Biotechs in the US and Europe raise

- Page 11 and 12: US and European biotechnology IPOs

- Page 13 and 14: Innovation capital in the US by yea

- Page 15 and 16: Innovation capital raised by leadin

- Page 17 and 18: US biotechnology IPOs by year Capit

- Page 19 and 20: Biotech financing: Europe Europe Eu

- Page 21: Innovation capital raised by leadin

- Page 25 and 26: Top European biotech IPOs, 2015 Com

- Page 27 and 28: Italy Rome Antonio Irione antonio.i

- Page 29: Data exhibit index Page 8 9 10 10 1

- Page 32: EY | Assurance | Tax | Transactions

<strong>Biotech</strong> <strong>financing</strong>: Europe<br />

European venture capital by year<br />

Total amount raised<br />

Average deal size<br />

15<br />

12<br />

9<br />

6<br />

3<br />

0<br />

Source: EY, Capital IQ and VentureSource.<br />

European biotechs raised US$2.5 billion in venture capital<br />

in 2015, a new record aided in part by participation from<br />

corporate venture capitalists and other non-traditional sources<br />

of capital, including the relative biotech newcomer Woodford<br />

Investment Management. The average deal size also reached a<br />

new high, US$12.1 million. Meanwhile, the 204 venture rounds<br />

were the continent’s highest since 2012. The year featured<br />

11 venture rounds of at least US$50 million and four rounds<br />

topping US$100 million. Unsurprisingly, oncology-focused<br />

biotechs provided a significant funding boost, with Immunocore,<br />

Merus, ADC Therapeutics and Symphogen leading the way. The<br />

anti-infectives specialist Nabriva Therapeutics, a 2006 spin-out<br />

from Sandoz, raised Europe’s second-largest venture round, an<br />

April 2015 US$120 million Series B led by crossover investors<br />

Vivo Capital and Orbimed Advisors. Nabriva followed that<br />

mezzanine round with its NASDAQ IPO, which raised US$106<br />

million in September 2015.<br />

22 Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong>