Biotech financing

25WmEet 25WmEet

Biotech financing: United States Top US venture financings, 2015 Company Region Lead product clinical stage Therapeutic focus Amount (US$m) Month Boston Pharmaceuticals* New England Preclinical Multiple 600 November ModeRNA Therapeutics New England Phase I Multiple 450 January Intarcia Therapeutics San Francisco Bay Area Phase III Diabetes 300 April Stemcentrx San Francisco Bay Area Phase I Oncology 250 August Denali Therapeutics* San Francisco Bay Area Preclinical Neurology 217 May Adaptive Biotechnologies Pacific Northwest Preclinical Oncology 195 May Humacyte North Carolina Phase II Regenerative medicine 150 October Editas Medicine New England Preclinical Multiple 120 August 23andMe San Francisco Bay Area Development Multiple 115 June PaxVax San Diego Marketed Infectious disease 105 December Gritstone Oncology* San Francisco Bay Area Preclinical Oncology 102 October Stemcentrx San Francisco Bay Area Phase I Oncology 100 January Nantibody* San Diego Preclinical Oncology 100 March Adaptive Biotechnologies Pacific Northwest Services, technologies and tools Oncology 96 January Allergen Research San Francisco Bay Area Phase III Allergies 80 March Source: EY, Capital IQ and VentureSource. *First venture round The top US venture financings of the year feature several companies — and investors — that are far from traditional. These include Boston Pharmaceuticals with its specialty pharma approach, Moderna Therapeutics with its several-companiesunder-one-umbrella structure, and Intarcia Therapeutics, which created a diabetes drug-device hybrid. Another company that made headlines in 2015: Stemcentrx, an oncology stem cell developer that has five therapies in the clinic and raised US$350 million in two rounds. Although these outliers may sit at the top of the chart, they hardly tell the year’s whole story. Thirteen venture rounds topped the US$100 million mark in 2015, compared with five in 2014. In all, there were 26 venture rounds that each raised at least US$70 million in 2015, versus only 10 in 2014 and three in 2013. Oncology-focused biotechs garnered six of the top 15 venture rounds. Reflecting a penchant for investors to “go big” in early rounds this past year, five of the top 15 venture rounds were for first-round financings. 16 Beyond borders 2016 — Biotech financing

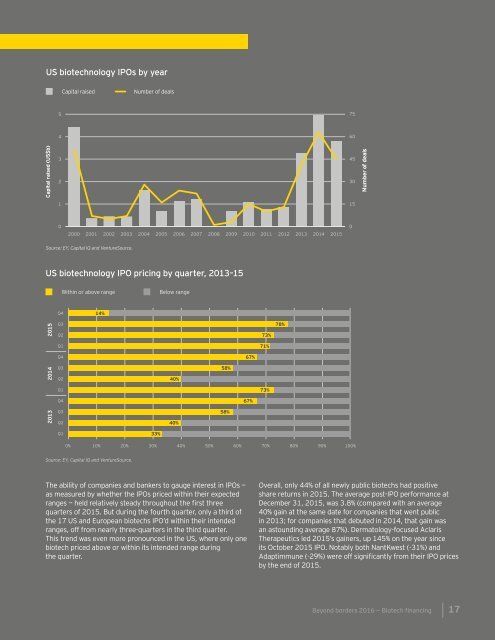

US biotechnology IPOs by year Capital raised Number of deals 5 75 4 60 3 2 45 30 Number of deals 1 15 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 0 Source: EY, Capital IQ and VentureSource. US biotechnology IPO pricing by quarter, 2013–15 Within or above range Below range Q4 14% 2013 2014 2015 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 40% 40% 58% 58% 67% 67% 73% 71% 73% 78% Q1 33% Source: EY, Capital IQ and VentureSource. The ability of companies and bankers to gauge interest in IPOs — as measured by whether the IPOs priced within their expected ranges — held relatively steady throughout the first three quarters of 2015. But during the fourth quarter, only a third of the 17 US and European biotechs IPO’d within their intended ranges, off from nearly three-quarters in the third quarter. This trend was even more pronounced in the US, where only one biotech priced above or within its intended range during the quarter. Overall, only 44% of all newly public biotechs had positive share returns in 2015. The average post-IPO performance at December 31, 2015, was 3.8% (compared with an average 40% gain at the same date for companies that went public in 2013; for companies that debuted in 2014, that gain was an astounding average 87%). Dermatology-focused Aclaris Therapeutics led 2015’s gainers, up 145% on the year since its October 2015 IPO. Notably both NantKwest (-31%) and Adaptimmune (-29%) were off significantly from their IPO prices by the end of 2015. Beyond borders 2016 — Biotech financing 17

- Page 1 and 2: Beyond borders 2016: Biotech financ

- Page 3 and 4: Contents Financing Slowdown ahead?

- Page 5 and 6: Slowdown ahead? Since the US garner

- Page 7 and 8: Venture financing accelerates While

- Page 9 and 10: Biotechs in the US and Europe raise

- Page 11 and 12: US and European biotechnology IPOs

- Page 13 and 14: Innovation capital in the US by yea

- Page 15: Innovation capital raised by leadin

- Page 19 and 20: Biotech financing: Europe Europe Eu

- Page 21 and 22: Innovation capital raised by leadin

- Page 23 and 24: Top European venture financing, 201

- Page 25 and 26: Top European biotech IPOs, 2015 Com

- Page 27 and 28: Italy Rome Antonio Irione antonio.i

- Page 29: Data exhibit index Page 8 9 10 10 1

- Page 32: EY | Assurance | Tax | Transactions

US biotechnology IPOs by year<br />

Capital raised<br />

Number of deals<br />

5<br />

75<br />

4<br />

60<br />

3<br />

2<br />

45<br />

30<br />

Number of deals<br />

1<br />

15<br />

0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

0<br />

Source: EY, Capital IQ and VentureSource.<br />

US biotechnology IPO pricing by quarter, 2013–15<br />

Within or above range<br />

Below range<br />

Q4<br />

14%<br />

2013 2014 2015<br />

Q3<br />

Q2<br />

Q1<br />

Q4<br />

Q3<br />

Q2<br />

Q1<br />

Q4<br />

Q3<br />

Q2<br />

40%<br />

40%<br />

58%<br />

58%<br />

67%<br />

67%<br />

73%<br />

71%<br />

73%<br />

78%<br />

Q1<br />

33%<br />

Source: EY, Capital IQ and VentureSource.<br />

The ability of companies and bankers to gauge interest in IPOs —<br />

as measured by whether the IPOs priced within their expected<br />

ranges — held relatively steady throughout the first three<br />

quarters of 2015. But during the fourth quarter, only a third of<br />

the 17 US and European biotechs IPO’d within their intended<br />

ranges, off from nearly three-quarters in the third quarter.<br />

This trend was even more pronounced in the US, where only one<br />

biotech priced above or within its intended range during<br />

the quarter.<br />

Overall, only 44% of all newly public biotechs had positive<br />

share returns in 2015. The average post-IPO performance at<br />

December 31, 2015, was 3.8% (compared with an average<br />

40% gain at the same date for companies that went public<br />

in 2013; for companies that debuted in 2014, that gain was<br />

an astounding average 87%). Dermatology-focused Aclaris<br />

Therapeutics led 2015’s gainers, up 145% on the year since<br />

its October 2015 IPO. Notably both NantKwest (-31%) and<br />

Adaptimmune (-29%) were off significantly from their IPO prices<br />

by the end of 2015.<br />

Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong><br />

17