Biotech financing

25WmEet

25WmEet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

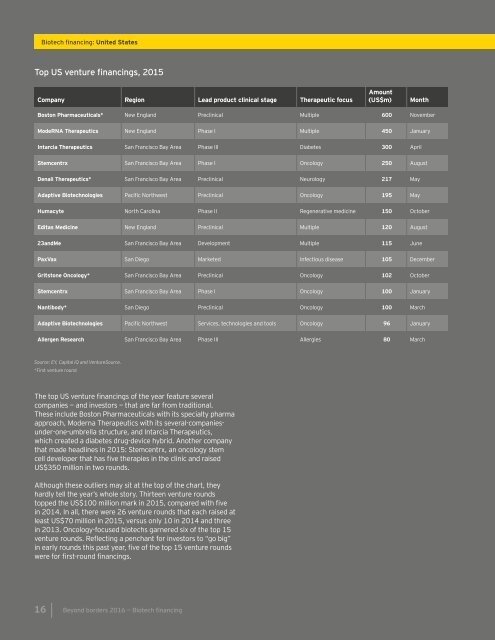

<strong>Biotech</strong> <strong>financing</strong>: United States<br />

Top US venture <strong>financing</strong>s, 2015<br />

Company Region Lead product clinical stage Therapeutic focus<br />

Amount<br />

(US$m)<br />

Month<br />

Boston Pharmaceuticals* New England Preclinical Multiple 600 November<br />

ModeRNA Therapeutics New England Phase I Multiple 450 January<br />

Intarcia Therapeutics San Francisco Bay Area Phase III Diabetes 300 April<br />

Stemcentrx San Francisco Bay Area Phase I Oncology 250 August<br />

Denali Therapeutics* San Francisco Bay Area Preclinical Neurology 217 May<br />

Adaptive <strong>Biotech</strong>nologies Pacific Northwest Preclinical Oncology 195 May<br />

Humacyte North Carolina Phase II Regenerative medicine 150 October<br />

Editas Medicine New England Preclinical Multiple 120 August<br />

23andMe San Francisco Bay Area Development Multiple 115 June<br />

PaxVax San Diego Marketed Infectious disease 105 December<br />

Gritstone Oncology* San Francisco Bay Area Preclinical Oncology 102 October<br />

Stemcentrx San Francisco Bay Area Phase I Oncology 100 January<br />

Nantibody* San Diego Preclinical Oncology 100 March<br />

Adaptive <strong>Biotech</strong>nologies Pacific Northwest Services, technologies and tools Oncology 96 January<br />

Allergen Research San Francisco Bay Area Phase III Allergies 80 March<br />

Source: EY, Capital IQ and VentureSource.<br />

*First venture round<br />

The top US venture <strong>financing</strong>s of the year feature several<br />

companies — and investors — that are far from traditional.<br />

These include Boston Pharmaceuticals with its specialty pharma<br />

approach, Moderna Therapeutics with its several-companiesunder-one-umbrella<br />

structure, and Intarcia Therapeutics,<br />

which created a diabetes drug-device hybrid. Another company<br />

that made headlines in 2015: Stemcentrx, an oncology stem<br />

cell developer that has five therapies in the clinic and raised<br />

US$350 million in two rounds.<br />

Although these outliers may sit at the top of the chart, they<br />

hardly tell the year’s whole story. Thirteen venture rounds<br />

topped the US$100 million mark in 2015, compared with five<br />

in 2014. In all, there were 26 venture rounds that each raised at<br />

least US$70 million in 2015, versus only 10 in 2014 and three<br />

in 2013. Oncology-focused biotechs garnered six of the top 15<br />

venture rounds. Reflecting a penchant for investors to “go big”<br />

in early rounds this past year, five of the top 15 venture rounds<br />

were for first-round <strong>financing</strong>s.<br />

16 Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong>