Biotech financing

25WmEet

25WmEet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

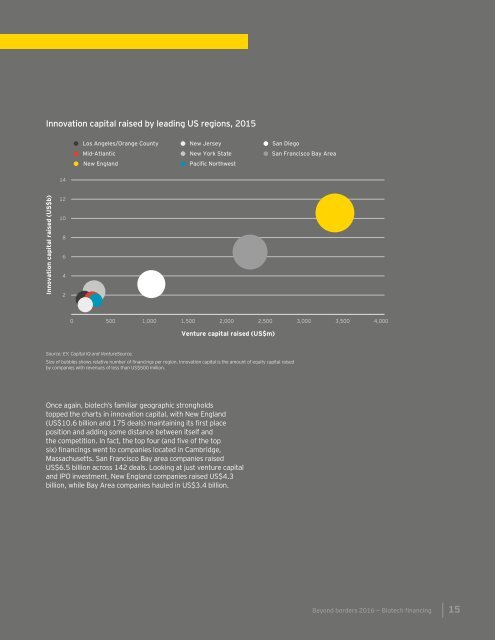

Innovation capital raised by leading US regions, 2015<br />

Los Angeles/Orange County<br />

Mid-Atlantic<br />

New England<br />

New Jersey<br />

New York State<br />

San Diego<br />

San Francisco Bay Area<br />

14<br />

Innovation capital raised (US$b)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

Venture capital raised (US$m)<br />

Source: EY, Capital IQ and VentureSource.<br />

Size of bubbles shows relative number of <strong>financing</strong>s per region. Innovation capital is the amount of equity capital raised<br />

by companies with revenues of less than US$500 million.<br />

Once again, biotech’s familiar geographic strongholds<br />

topped the charts in innovation capital, with New England<br />

(US$10.6 billion and 175 deals) maintaining its first place<br />

position and adding some distance between itself and<br />

the competition. In fact, the top four (and five of the top<br />

six) <strong>financing</strong>s went to companies located in Cambridge,<br />

Massachusetts. San Francisco Bay area companies raised<br />

US$6.5 billion across 142 deals. Looking at just venture capital<br />

and IPO investment, New England companies raised US$4.3<br />

billion, while Bay Area companies hauled in US$3.4 billion.<br />

Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong><br />

15