Biotech financing

25WmEet

25WmEet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

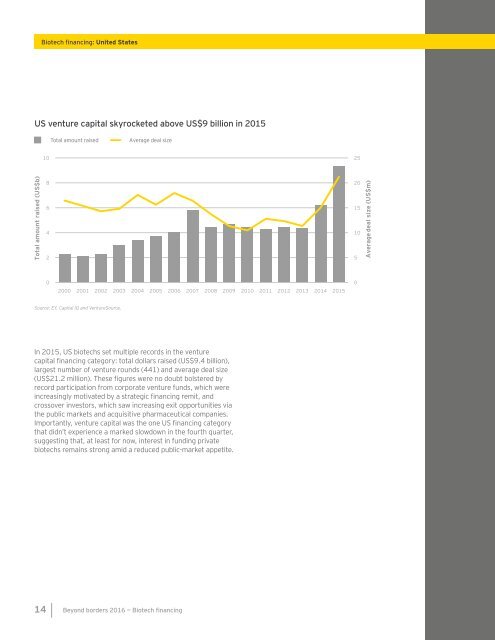

<strong>Biotech</strong> <strong>financing</strong>: United States<br />

US venture capital skyrocketed above US$9 billion in 2015<br />

Total amount raised<br />

Average deal size<br />

10<br />

25<br />

Total amount raised (US$b)<br />

8<br />

6<br />

4<br />

2<br />

20<br />

15<br />

10<br />

5<br />

Average deal size (US$m)<br />

0<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015<br />

0<br />

Source: EY, Capital IQ and VentureSource.<br />

In 2015, US biotechs set multiple records in the venture<br />

capital <strong>financing</strong> category: total dollars raised (US$9.4 billion),<br />

largest number of venture rounds (441) and average deal size<br />

(US$21.2 million). These figures were no doubt bolstered by<br />

record participation from corporate venture funds, which were<br />

increasingly motivated by a strategic <strong>financing</strong> remit, and<br />

crossover investors, which saw increasing exit opportunities via<br />

the public markets and acquisitive pharmaceutical companies.<br />

Importantly, venture capital was the one US <strong>financing</strong> category<br />

that didn’t experience a marked slowdown in the fourth quarter,<br />

suggesting that, at least for now, interest in funding private<br />

biotechs remains strong amid a reduced public-market appetite.<br />

14 Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong>