Enhancing India’s Readiness to Climate Finance

India has taken several steps to improve its national response to climate change. India’s climate finance requirements, however, are very high, and will need to be met through a combination of public, private and international climate finance. See more at: http://shaktifoundation.in/

India has taken several steps to improve its national response to climate change. India’s climate finance requirements, however, are very high, and will need to be met through a combination of public, private and international climate finance. See more at: http://shaktifoundation.in/

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

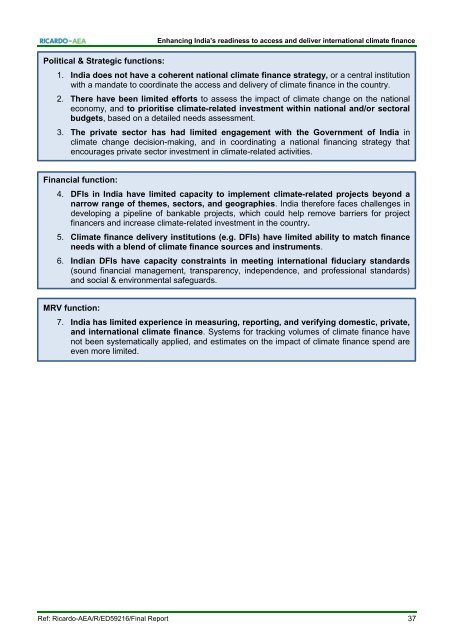

Political & Strategic functions:<br />

<strong>Enhancing</strong> <strong>India’s</strong> readiness <strong>to</strong> access and deliver international climate finance<br />

1. India does not have a coherent national climate finance strategy, or a central institution<br />

with a mandate <strong>to</strong> coordinate the access and delivery of climate finance in the country.<br />

2. There have been limited efforts <strong>to</strong> assess the impact of climate change on the national<br />

economy, and <strong>to</strong> prioritise climate-related investment within national and/or sec<strong>to</strong>ral<br />

budgets, based on a detailed needs assessment.<br />

3. The private sec<strong>to</strong>r has had limited engagement with the Government of India in<br />

climate change decision-making, and in coordinating a national financing strategy that<br />

encourages private sec<strong>to</strong>r investment in climate-related activities.<br />

Financial function:<br />

4. DFIs in India have limited capacity <strong>to</strong> implement climate-related projects beyond a<br />

narrow range of themes, sec<strong>to</strong>rs, and geographies. India therefore faces challenges in<br />

developing a pipeline of bankable projects, which could help remove barriers for project<br />

financers and increase climate-related investment in the country.<br />

5. <strong>Climate</strong> finance delivery institutions (e.g. DFIs) have limited ability <strong>to</strong> match finance<br />

needs with a blend of climate finance sources and instruments.<br />

6. Indian DFIs have capacity constraints in meeting international fiduciary standards<br />

(sound financial management, transparency, independence, and professional standards)<br />

and social & environmental safeguards.<br />

MRV function:<br />

7. India has limited experience in measuring, reporting, and verifying domestic, private,<br />

and international climate finance. Systems for tracking volumes of climate finance have<br />

not been systematically applied, and estimates on the impact of climate finance spend are<br />

even more limited.<br />

Ref: Ricardo-AEA/R/ED59216/Final Report<br />

37