TECHNOLOGY AT WORK

1Oclobi

1Oclobi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

26<br />

Citi GPS: Global Perspectives & Solutions February 2015<br />

The adoption of digital money can help 220<br />

million individuals enter the formal financial<br />

sector, moving $1 trillion from the informal to<br />

the formal sector<br />

Citi’s Digital Strategy Team in its recent report Digital Money: A Pathway to an<br />

Experience Economy estimates a 10% increase in the adoption of digital money can<br />

help an estimated 220 million individuals enter the formal financial sector. This<br />

translates to an additional $1 trillion moving from the informal economy to the formal<br />

economy. The Centre for Economic and Business Research (CEBR) estimates that<br />

the cost of cash works out to be about 2.8% of the total cash takings by retailers.<br />

Based on this forecast, Citi estimates the adoption of digital money can result in<br />

over $125 billion in cost savings from cash handling.<br />

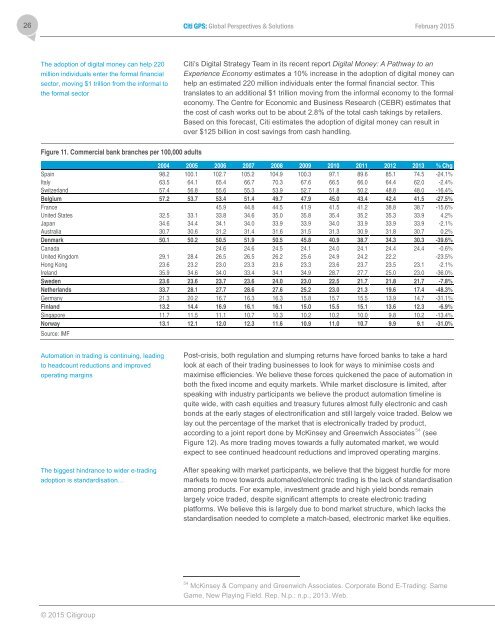

Figure 11. Commercial bank branches per 100,000 adults<br />

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 % Chg<br />

Spain 98.2 100.1 102.7 105.2 104.9 100.3 97.1 89.6 85.1 74.5 -24.1%<br />

Italy 63.5 64.1 65.4 66.7 70.3 67.6 66.5 66.0 64.4 62.0 -2.4%<br />

Switzerland 57.4 56.8 55.6 55.3 53.9 52.7 51.8 50.2 48.8 48.0 -16.4%<br />

Belgium 57.2 53.7 53.4 51.4 49.7 47.9 45.0 43.4 42.4 41.5 -27.5%<br />

France 45.9 44.8 44.5 41.9 41.5 41.2 38.8 38.7 -15.6%<br />

United States 32.5 33.1 33.8 34.6 35.0 35.8 35.4 35.2 35.3 33.9 4.2%<br />

Japan 34.6 34.4 34.1 34.0 33.9 33.9 34.0 33.9 33.9 33.9 -2.1%<br />

Australia 30.7 30.6 31.2 31.4 31.6 31.5 31.3 30.9 31.8 30.7 0.2%<br />

Denmark 50.1 50.2 50.5 51.9 50.5 45.8 40.9 38.7 34.3 30.3 -39.6%<br />

Canada 24.6 24.6 24.5 24.1 24.0 24.1 24.4 24.4 -0.6%<br />

United Kingdom 29.1 28.4 26.5 26.5 26.2 25.6 24.9 24.2 22.2 -23.5%<br />

Hong Kong 23.6 23.2 23.0 23.3 23.6 23.3 23.6 23.7 23.5 23.1 -2.1%<br />

Ireland 35.9 34.6 34.0 33.4 34.1 34.9 28.7 27.7 25.0 23.0 -36.0%<br />

Sweden 23.6 23.6 23.7 23.6 24.0 23.0 22.5 21.7 21.8 21.7 -7.8%<br />

Netherlands 33.7 28.1 27.7 28.6 27.6 25.2 23.0 21.3 19.6 17.4 -48.3%<br />

Germany 21.3 20.2 16.7 16.3 16.3 15.8 15.7 15.5 13.9 14.7 -31.1%<br />

Finland 13.2 14.4 16.9 16.1 16.1 15.0 15.5 15.1 13.6 12.3 -6.9%<br />

Singapore 11.7 11.5 11.1 10.7 10.3 10.2 10.2 10.0 9.8 10.2 -13.4%<br />

Norway 13.1 12.1 12.0 12.3 11.6 10.9 11.0 10.7 9.9 9.1 -31.0%<br />

Source: IMF<br />

Automation in trading is continuing, leading<br />

to headcount reductions and improved<br />

operating margins<br />

The biggest hindrance to wider e-trading<br />

adoption is standardisation…<br />

Post-crisis, both regulation and slumping returns have forced banks to take a hard<br />

look at each of their trading businesses to look for ways to minimise costs and<br />

maximise efficiencies. We believe these forces quickened the pace of automation in<br />

both the fixed income and equity markets. While market disclosure is limited, after<br />

speaking with industry participants we believe the product automation timeline is<br />

quite wide, with cash equities and treasury futures almost fully electronic and cash<br />

bonds at the early stages of electronification and still largely voice traded. Below we<br />

lay out the percentage of the market that is electronically traded by product,<br />

according to a joint report done by McKinsey and Greenwich Associates 54 (see<br />

Figure 12). As more trading moves towards a fully automated market, we would<br />

expect to see continued headcount reductions and improved operating margins.<br />

After speaking with market participants, we believe that the biggest hurdle for more<br />

markets to move towards automated/electronic trading is the lack of standardisation<br />

among products. For example, investment grade and high yield bonds remain<br />

largely voice traded, despite significant attempts to create electronic trading<br />

platforms. We believe this is largely due to bond market structure, which lacks the<br />

standardisation needed to complete a match-based, electronic market like equities.<br />

54 McKinsey & Company and Greenwich Associates. Corporate Bond E-Trading: Same<br />

Game, New Playing Field. Rep. N.p.: n.p., 2013. Web.<br />

© 2015 Citigroup