Dividend Yield Form - Appuonline.com

Dividend Yield Form - Appuonline.com

Dividend Yield Form - Appuonline.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BLUE PINK<br />

(A 18-months close ended equity fund with an automatic<br />

conversion into an open ended scheme on expiry<br />

of 18-months from the date of allotment)<br />

Offer of units of face value of Rs. 10 each at<br />

face value<br />

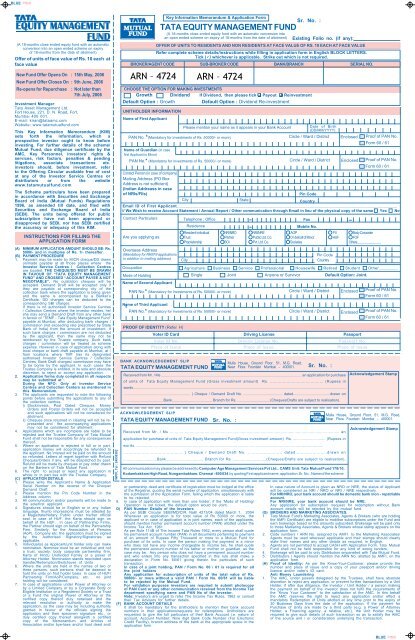

Key Information Memorandum & Application <strong>Form</strong><br />

TATA EQUITY MANAGEMENT FUND<br />

(A 18-months close ended equity fund with an automatic conversion into<br />

an open ended scheme on expiry of 18-months from the date of allotment)<br />

Sr. No. :<br />

Existing Folio no. (if any):<br />

OFFER OF UNITS TO RESIDENTS AND NON RESIDENTS AT FACE VALUE OF RS. 10 EACH AT FACE VALUE<br />

Refer <strong>com</strong>plete scheme details/instructions while filling in application form in English BLOCK LETTERS.<br />

Tick () whichever is applicable. Strike out which is not required.<br />

BROKER/AGENT CODE SUB-BROKER CODE<br />

BANK/BRANCH SERIAL NO.<br />

New Fund Offer Opens On : 15th May, 2006<br />

New Fund Offer Closes On : 9th June, 2006<br />

Re-opens for Repurchase : Not later than<br />

7th July, 2006<br />

Investment Manager:<br />

Tata Asset Management Ltd.<br />

Fort House, 221, D. N. Road, Fort,<br />

Mumbai 400 001.<br />

E-mail: kiran@tataamc.<strong>com</strong><br />

Website: www.tatamutualfund.<strong>com</strong><br />

This Key Information Memorandum (KIM)<br />

sets forth the information, which a<br />

prospective investor ought to know before<br />

investing. For further details of the scheme/<br />

Mutual Fund, due diligence certificate by the<br />

AMC, Key Personnel, investors’ rights &<br />

services, risk factors, penalties & pending<br />

litigations, associate transactions etc.<br />

investors should, before investment, refer<br />

to the Offering Circular available free of cost<br />

at any of the Investor Service Centres or<br />

distributors or from the website<br />

www.tatamutualfund.<strong>com</strong><br />

The Scheme particulars have been prepared<br />

in accordance with Securities and Exchange<br />

Board of India (Mutual Funds) Regulations<br />

1996, as amended till date, and filed with<br />

Securities and Exchange Board of India<br />

(SEBI). The units being offered for public<br />

subscription have not been approved or<br />

disapproved by SEBI, nor has SEBI certified<br />

the accuracy or adequacy of this KIM.<br />

INSTRUCTIONS FOR FILLING THE<br />

APPLICATION FORM<br />

(A) MINIMUM APPLICATION AMOUNT SHOULD BE: Rs.<br />

5000/- and in multiples of Re. 1/- thereafter.<br />

(B) PAYMENT PROCEDURE<br />

1. Payment may be made by MICR cheque/DD drawn<br />

on/made payable at all those places where the<br />

Investor Service Centres / Collection Centres<br />

are located. THE CHEQUE/DD MUST BE DRAWN<br />

IN FAVOUR OF “TATA EQUITY MANAGEMENT<br />

FUND” AND CROSSED ‘‘ACCOUNT PAYEE & NOT<br />

NEGOTIABLE’’. No outstation cheques will be<br />

accepted. Demand Draft will be accepted only if<br />

they are payable at corresponding city of the<br />

collection bank where the application is being given<br />

and the same is ac<strong>com</strong>panied by a Banker’s<br />

Certifcate. DD charges can be deducted to the<br />

corresponding SBI charges.<br />

If there is no authorised Investor Service Centres<br />

/ Collection Centres where the investor resides, he/<br />

she may send a Demand Draft from any other bank<br />

in favour of “TEMF - Tata Equity Management Fund”<br />

payable at Mumbai, after deducting bank charges /<br />

<strong>com</strong>mission (not exceeding rate prescribed by State<br />

Bank of India) from the amount of investment. If<br />

such bank charges / <strong>com</strong>mission are not deducted<br />

by the applicant, then the same may not be<br />

reimbursed by the Trustee <strong>com</strong>pany. Such bank<br />

charges / <strong>com</strong>mission will be treated as scheme<br />

expense. However in case of application along with<br />

local cheque or bank draft payable at Mumbai, at /<br />

from locations where TMF has its designated<br />

authorised Investor Service Centres / Collection<br />

Centres, Bank Draft charges/ <strong>com</strong>mission may have<br />

to be borne by the applicant. In such cases the<br />

Trustee Company is entitled, in its sole and absolute<br />

discretion, to reject or accept any application.<br />

2. Application forms duly <strong>com</strong>pleted in all respects<br />

may be submitted at :<br />

During the NFO: Only at Investor Service<br />

Centres and Collection Centers as mentioned in<br />

this Memorandum.<br />

3. The applicants are requested to note the following<br />

points before submitting the applications to any of<br />

the collection centres.<br />

i) Stockinvests, Post Dated Cheques, Money<br />

Orders and Postal Orders will not be accepted<br />

and such applications will not be considered for<br />

allotment.<br />

ii) Cheques once returned in clearing will not be represented<br />

and the ac<strong>com</strong>panying applications<br />

may not be considered for allotment.<br />

4. Applications which are in<strong>com</strong>plete are liable to be<br />

rejected and the Trustee Company of Tata Mutual<br />

Fund shall not be responsible for any consequences<br />

thereof.<br />

5. Where an application is rejected in full or in part,<br />

application money will accordingly be refunded to<br />

the applicant. No interest will be paid on the amount<br />

so refunded. Letters of regret together with Refund<br />

Cheques/Orders if any, will be despatched by post.<br />

Refund will be made by cheques or pay order drawn<br />

on the Bankers of Tata Mutual Fund.<br />

6. The right to accept or reject any application in<br />

whole or in part lies with the Trustee Company.<br />

(C) APPLICATION DETAILS<br />

1. Please write the Applicant’s Name & Application<br />

Serial Number on the reverse of the Cheque/<br />

Demand Draft.<br />

2. Please mention the Pin Code Number in the<br />

Address column.<br />

3. All <strong>com</strong>munication and/or payments will be made to<br />

the sole/first applicant.<br />

4. Signatures should be in English or in any Indian<br />

language, thumb impressions must be attested by<br />

a Magistrate/Notary Public under his/her official<br />

seal. In case of HUF, the Karta should sign on<br />

behalf of the HUF. In case of Partnership Firms,<br />

the Partner should sign on behalf of the Partnership<br />

Firm. Similarly, for the Association of Persons<br />

(AoP), Company etc. the application must be signed<br />

by the Authorised Signatory/Signatories as<br />

applicable.<br />

5. Individual(s) as Applicant/unit holder only can make<br />

nomination. Nominee must be an individual and not<br />

a trust, society, body corporate partnership firm,<br />

Karta of Hindu Undivided Family or a power of<br />

Attorney Holder. Nomination stands rescinded upon<br />

transfer/Redemption/Switchover of Units<br />

6. Where the units are held in the names of two or<br />

three persons, such persons shall be deemed to<br />

hold the units on first holder basis. In case of HUF/<br />

Partnership Firm/AoP/Company, etc. no joint<br />

holding will be considered.<br />

7. In case of applications under Power of Attorney or<br />

by a Limited Company or by a Corporate Body or<br />

Eligible Institution or a Registered Society or a Trust<br />

or a Fund the original Power of Attorney or the<br />

certified copy thereof duly notarised and the<br />

relevant resolution or authority to make the<br />

application, as the case may be including authority<br />

granted in favour of the officials signing the<br />

application and their specimen signature etc., or<br />

duly certified copy thereof alongwith a certified<br />

copy of the Memorandum and Articles of<br />

Association and/or bye-laws and/or trust deed and/<br />

WPPL Tel : 24939382<br />

CHOOSE THE OPTION FOR MAKING INVESTMENTS<br />

Growth <strong>Dividend</strong> If <strong>Dividend</strong>, then please tick Payout Reinvestment<br />

Default Option : Growth<br />

Default Option : <strong>Dividend</strong> Re-investment<br />

UNITHOLDER INFORMATION<br />

Name of First Applicant<br />

Contact Person (in case of <strong>com</strong>pany)<br />

Mailing Address (PO Box<br />

Address is not sufficient)<br />

(Indian Addreass in case<br />

of NRIs/FIIs)<br />

Pin Code<br />

City<br />

State<br />

Country<br />

Email ID of First Applicant________________________________________________________________________________________________<br />

I/ We Wish to receive Account Statement / Annual Report / Other <strong>com</strong>munication through Email in lieu of the physical copy of the same Yes No<br />

BANK ACKNOWLEDGEMENT SLIP<br />

TATA EQUITY MANAGEMENT FUND<br />

Please mention your name as it appears in your Bank Account<br />

Received from Mr. / Ms ......................................................................................................................................... an application for purchase<br />

of units of Tata Equity Management Fund (Gross investment amount) Rs. .......................................... (Rupees in<br />

words.........................................................................................................................................................................................................................<br />

................................................................. ) Cheque / Demand Draft No. ...................................... dated....................................drawn on<br />

.......................................Bank....................................... Branch for Rs. ................................(Cheques/Drafts are subject to realisation).<br />

ACKNOWLEDGEMENT SLIP<br />

TATA EQUITY MANAGEMENT FUND<br />

Sr. No. :<br />

or partnership deed and certificate of registration must be lodged at the office<br />

of the Registrar, quoting the serial number of application simultaneously with<br />

the submission of the Application <strong>Form</strong>, failing which the application is liable<br />

to be rejected.<br />

8. In case of application with more than one holder, if the ‘Mode of Holding/<br />

Operation’ is not ticked, the default option would be Joint.<br />

D) PAN Number Details of the Investors<br />

As per SEBI Circular SEBI/MD/CIR. No6/ 4213/04 dated March 1, 2004<br />

Whenever an application is for total value of Rs 50000 or more, the<br />

applicant or in case of application is in joint names, each of the applicants,<br />

should mention his/her permanent account number (PAN) allotted under the<br />

In<strong>com</strong>e Tax Act, 1961<br />

As per Rule 114B of The In<strong>com</strong>e Tata Rules 1962, every person shall quote<br />

his permanent account number (PAN) in all documents pertaining to payment<br />

of an amount of Rupees Fifty Thousand or more to a Mutual Fund for<br />

purchase of its units. In case the person making the payment is a minor<br />

who does not have any in<strong>com</strong>e chargeable to in<strong>com</strong>e tax, he shall quote<br />

the permanent account number of his father or mother or guardian, as the<br />

case may be. Any person who does not have a permanent account number<br />

and who enters into any transaction specified in this rule shall make a<br />

declaration in <strong>Form</strong> No. 60/61 giving therein the particulars of such<br />

transaction.<br />

In case of a joint holding, PAN / <strong>Form</strong> No. 60 / 61 is required for all<br />

the joint holders<br />

Any application for subscription of units of the total value of Rs.<br />

50000/- or more without a valid PAN / <strong>Form</strong> No. 60/61 will be liable<br />

to be rejected by the Mutual Fund.<br />

For validation purposes investors are required to submit photocopy<br />

of PAN Card or any other <strong>com</strong>munication received from the In<strong>com</strong>e Tax<br />

department specifying name and PAN No of the investor.<br />

Note: Investors are urged to refer The In<strong>com</strong>e Tax Rules, 1962 or consult<br />

their Tax Advisors for further details.<br />

(F) BANK ACCOUNT DETAILS<br />

It shall be mandatory for the Unitholders to mention their bank account<br />

numbers in their applications/requests for redemptions. Unitholders are<br />

requested to give the full particulars of their Bank Account i.e. nature of<br />

account, Account Number, Nine digit Bank Code Number (For Electronic<br />

Credit Facility), branch address of the bank at the appropriate space in the<br />

application form.<br />

In case nature of Account is given as NRO or NRE, the status of Applicant<br />

will be considered as NRI / NRO or NRI / NRE respectively.<br />

For NRI/NRO, your bank account should be domestic bank /non - repatriable<br />

account.<br />

For NRI/NRE, your bank account should be NRE.<br />

Any application for subscription /request for redemption without Bank<br />

account details will be rejected by the mutual fund.<br />

(G) BROKERS AND MARKETING ASSOCIATES.<br />

1. Tata Mutual Fund’s Marketing Associates, Agents & Brokers (who are holding<br />

the AMFI Certificate) are eligible to mobilise subscriptions under the Fund and<br />

earn brokerage based on the amounts subscribed. Brokerage will be paid only<br />

to those Marketing Associates, Agents & Brokers whose stamp appears on the<br />

application form.<br />

2. Code numbers / ARN No. assigned by AMFI to the Marketing Associates/<br />

Agents must be used wherever applicable and their stamps should clearly<br />

state their names and any other details as required, in English.<br />

3. Agents are not permitted to accept CASH with Application <strong>Form</strong>. Tata Mutual<br />

Fund shall not be held responsible for any kind of wrong tenders.<br />

4. Brokerage will be paid to only Distributors empanelled with Tata Mutual Fund.<br />

5. Distributors / Agents should mention the ARN No. allotted by AMFI, on the<br />

application form.<br />

(H)<br />

Date of Birth<br />

(DD/MM/YYYY)<br />

PAN No. *(Mandatory for investments of Rs. 50000/- or more) Circle / Ward / District Enclosed Proof of PAN No.<br />

Name of Guardian (in case<br />

first Applicant is Minor)<br />

PAN No.* (Mandatory for investments of Rs. 50000/- or more) Circle / Ward / District Enclosed<br />

Contact Particulars<br />

Are you applying as<br />

Overseas Address<br />

(Mandatory for NRI/FII appilcations<br />

in addition to mailing address)<br />

Mode of Holding<br />

Name of Second Applicant<br />

PAN No.* (Mandatory for investments of Rs. 50000/- or more) Circle / Ward / District Enclosed<br />

Name of Third Applicant<br />

PROOF OF IDENTITY (Refer H)<br />

Voter ID Card<br />

Voter ID No.<br />

Place of Issue<br />

Telephone : Office<br />

PAN No.* (Mandatory for investments of Rs. 50000/- or more) Circle / Ward / District Enclosed<br />

Driving License<br />

Driving License No.<br />

Place of Issue<br />

Sr. No. :<br />

Received from Mr. / Ms .............................................................................................................................................. an<br />

application for purchase of units of Tata Equity Management Fund(Gross investment amount) Rs. .............................. (Rupees in<br />

words............................................................................................................................................................<br />

............................................. ) Cheque / Demand Draft No. .......................... dated........................drawn on<br />

..............................Bank................................ Branch for Rs. ............................(Cheques/Drafts are subject to realisation).<br />

All <strong>com</strong>munication may please be addressed to Computer Age Management Services Pvt Ltd., CAMS Unit: Tata Mutual Fund 178/10,<br />

Kodambakkam High Road, Nungambakkam, Chennai - 600 034 by quoting First applicant name, application Sr. No., Name of the scheme.<br />

<strong>Form</strong> 60 / 61<br />

Proof of PAN No.<br />

<strong>Form</strong> 60 / 61<br />

Resident Individual NRI/NRO NRI/NRE AOP FII Body Corporate<br />

Trust Partner Public Ltd. Co. On behalf of Minor HUF FOF<br />

Proprietorship BOI Pvt. Ltd. Co. Societies Others_______________<br />

City<br />

Residence<br />

Fax<br />

Mobile No.<br />

Occupation Agriculture Business Service Professional Housewife Retired Student Other_________<br />

Single Joint Anyone or Survivor<br />

Mulla House, Ground Floor, 51, M.G. Road,<br />

Near Flora Fountain Mumbai - 400001.<br />

Pin Code<br />

Country<br />

Default Option: Joint.<br />

Passport<br />

Passport No.<br />

Place of Issue<br />

Proof of PAN No.<br />

<strong>Form</strong> 60 / 61<br />

Proof of PAN No.<br />

<strong>Form</strong> 60 / 61<br />

Acknowledgement Stamp<br />

Mulla House, Ground Floor, 51, M.G. Road,<br />

Near Flora Fountain Mumbai - 400001.<br />

Acknowledgement Stamp<br />

Proof of Identity: As per the Know-Your-Customer, please provide the<br />

number and place of issue and a copy of your passport and/or driving<br />

licence and/or voter’s ID card.<br />

Anti Money Laundering<br />

1. The AMC, under powers delegated by the Trustees, shall have absolute<br />

discretion to reject any application, or prevent further transactions by a Unit<br />

Holder, if after due diligence, the investor / Unit Holder / a person making<br />

the payment on behalf of the investor does not fulfil the requirements of<br />

the “Know Your Customer” to the satisfaction of the AMC. In this behalf<br />

the AMC reserves the right to reject any application and/or effect a<br />

mandatory Redemption of Units allotted at any time prior to the expiry of<br />

30 Business Days from the date of the application. If the payment for<br />

Purchase of Units are made by a third party (e.g. a Power of Attorney<br />

Holder, a Financing agency, a relative, etc.), the Unit Holder may be<br />

required to give such details of such transaction so as to satisfy the AMC<br />

of the source and / or consideration underlying the transaction.<br />

BLUE PINK

BLUE PINK<br />

APPLICATION MONEY DETAILS (Cheque / DD to be drawn in the name of Tata Equity Management Fund)<br />

* DD charges to be borne by AMC if investor doesn’t fall within ISCs. - Refer B<br />

Gross Amount in Rs.<br />

A/c No. _____________________________ A/c Type _________________ Cheque/DD No. __________________ Dated _______/_______/<br />

_________<br />

NOMINATION<br />

Nominee Name__________________________________________________Relationship_____________________<br />

Guardian details (if nominee is a minor) Name & Address_______________________________________________<br />

______________________________________________________________________________________________________<br />

DIRECT CREDIT FACILITY FOR REDEMPTION / DIVIDEND<br />

Tata Mutual Fund directly credits the <strong>Dividend</strong>s /Redemption into the investor Bank Account in case the account is with ICICI Bank Ltd./HDFC Bank Ltd./UTI Bank /IDBI<br />

Bank/Standard Chartered Bank/Kotak Bank/HSBC Bank/Deutsche Bank.<br />

I / We understand that the instruction to the bank for Direct Credit/ ECS will be given by the Mutual Fund and such instruction will be adequate discharge of Mutual Fund<br />

towards redemption/dividend proceeds. In case of bank not crediting my/our bank account with/without assigning any reason thereof or if the transaction is delayed or not<br />

effected at all for reasons of in<strong>com</strong>plete or incorrect information, I/We would not hold Tata Mutual Fund responsible. I/We understand that in case account number<br />

furnished by me/us, if found incorrect, I/We would not hold Tata Mutual Fund responsible for the credit going to the wrong account. Further, the Mutual Fund reserves the right<br />

to issue a demand draft/payable at par cheque in case it is not possible to make payment by DC/ECS.<br />

If however you wish to receive cheque payout, please tick here<br />

DOCUMENTS TO BE SUBMITTED (Please tick () whichever is applicable)<br />

1) Memorandum & Articles of Association (Corporate) 2) Board Resolution (Corporate) 3) Authorised signatories list<br />

4) Trust Deed (in case of a trust) 5) Partnership Deed (for partnership firm) 6) Copy of the PAN card of all unitholders (for investment<br />

of Rs. 50,000/- and above)<br />

DECLARATION AND SIGNATURES<br />

The Trustee, Tata Mutual Fund<br />

Having read and understood the contents of the Offer Document of the Scheme, I/ We<br />

hereby apply for units of the scheme and agree to abide by the terms, conditions, rules<br />

and regulations governing the scheme. I/ We hereby declare that the amount invested in<br />

the scheme is through legitimate sources only and does not involve and is not designed<br />

for the purpose of the contravention of any Act, Rules, Regulations, Notifications or<br />

Directions of the provisions of the In<strong>com</strong>e Tax Act, Anti Money Laundering Laws, Anti<br />

Corruption Laws or any other applicable laws enacted by the Government of India from<br />

time to time. I/ We have understood the details of the scheme and I/ We have not received<br />

nor have been induced by any rebate or gifts, directly or indirectly in making this<br />

investment. I/ We confirm that the funds invested in the Scheme, legally belong to me /<br />

us. In the event "Know Your Customer" process is not <strong>com</strong>pleted by me / us to the<br />

satisfaction of the AMC, I/ We hereby authorise the AMC, to redeem the funds invested<br />

in the Scheme, in favour of the applicant at the applicable NAV prevailing on the date of<br />

such redemption and undertaking such other action with such funds that may be required<br />

by the Law.<br />

For NRls only: I/ We confirm that I am / we are Non Residents of Indian Nationality /<br />

Origin and that I/ we have remitted funds from abroad through approved banking channels<br />

or from funds in my / our Non-Resident External / Non-Resident Ordinary / FCNR<br />

account.<br />

I/ We confirm that details provided by me / us are true and correct.<br />

Date:<br />

DD Charges Rs. (if any)*<br />

Net Amount in Rs.<br />

Gross Investment (Rs in Words) ________________________________________________________________________________________________<br />

Drawn on Bank __________________________________________________________________________ Branch __________________________<br />

YOUR BANK ACCOUNT DETAILS (Mandatory) please refer instruction F<br />

All <strong>com</strong>munication and payments will be made to the first applicant or to the Karta in case of HUF.<br />

Name of Your Bank<br />

Your Account No.<br />

Account No. (in words)<br />

Bank Address<br />

City<br />

PIN<br />

Account Type<br />

Example for filling<br />

the Account number:<br />

Ac. No.<br />

In words<br />

0 0 9 7 4 6 1 5 2<br />

Zero Zero Nine Seven Four Six One Five Two<br />

Holder<br />

Branch<br />

Signature of Guardian<br />

Bank account details of First Unitholder<br />

is required without which the application<br />

would be rejected.<br />

Signature(s) / Thumb Impression(s)<br />

(Refer Instruction number C (4))<br />

IV, B - 9, City Center, Sector IV, Bokaro Steel City, Bokaro-827 004. Tel.: 06542-232786/87/88. Calicut: Ratheesh Vellora Vadakkeveettil, Malabar Palace, G.H Road, Calicut-673 001. Tel.: 0495-2727759. Chalakudy: Rajeev R, Police Station<br />

Road, Chalakudy-680 307. Tel.: 0480/2707754/55. Chandigarh: Hemant/Deepak, Sco 371/372, Sector 35 - B, Chandigarh.tel.: 0172-2711285/5088303. Changanacherry: Gireesh G, Cms Dept, Golden Tower, Golden Tower , M C Road,<br />

Vezhakattiuchira, Changanacherry-686 101. Tel.: 0481 2425002/2425004. Chengannur: Mathew Jacob, Govt Hospital Junction, Chengannur 689 121 Tel.: 0479-2456215. Chennai: K L Lakshman / Sridhar Ramamurthy, 751 - B Anna Salai,<br />

Mariam Centre, Chennai-600 002. Tel.: 044-28420870 / 76 : Extn : 203 / 204. Cochin: R Bhagawatheeswaran, 2nd Floor , Elmar Square, M.g Road, M.g Road, Ravipuram, Cochin-682 016. Tel.: 0484-2359436./09349133907. Coimbatore:<br />

Mohan Kumar / Somaprakash, 1635 Classic Tower, Trichy Road, Coimbatore 641 018 Tel.: 0422-2302630/46/2303300. Cuttack: Ashim, Bajrakbati Road, Cuttack-753 001. Tel.: 0671-2332744/33/22/11, Davangere: Prashanth Ubrangala,<br />

No 621, Bhm Enclave, Binny Co Road, Mandipet, Davangere. Tel.: 08192-232781. Dehradun: Rupesh Nath, 56, Rajpur Road, Uttaranchal, Dehradun 248 001 Tel.: 0135-2745295. Dhanbad: Kamal Matwala, Sri Ram Plaza , 1st Floor, Bank<br />

More Dhanbad, Jharkhand 826 001 Tel.: (0326) 2308831. Durgapur: Nirmalya Banerjee / Snehamay De, A102 & 103, City Centre, Bengal Shristi Complex , City Center, Durgapur Road, Durgapur-713 216 Tel.: 0343- 2549962- 65. Erode:<br />

R Shri Krishnan, 456 Brough Road, Erode-638 001. Tel.: (95424) - 2261287 / 2268522 - Extn 0424. Gandhidham: Tejas Mankad, Plot No 1, Sector 8, Rabindranath Tagore Road , Near Gpo, Gandhidham-370 201 Tel.: (02836) - 573251. Gaya:<br />

Navneen, Near Ganta Ghar, K.p Road, Gaya-823 001. Tel.: (0631) -2220012. Gorakhpur: Prashant Kumar, Cms Dept, Prahlad Rai Trade Centre, Ayodhya Crossing, Bank Road, Gorakhpur-273 001 Tel.: (0551) -2342612. Guntur: Gupta<br />

K.s, 87-90 , Main Road, Lakshmipuram, Guntur-52 2007 Tel.: (0863) -2265648. Guwahati: Mr. Nayanjyoti Das, House No 126 , Opp Times Of India, Bhangagarh, Guwahati-781 005 Tel.: 0361-2461082 (D), 74/80/81. Gwalior: Suresh Asolia<br />

/ Gopal Sharma, Block G1 , Plot No . 43, Anand Deep Building ,City Centre, Gwalior-474 011 Tel.: 0751 4015007. Himatnagar: Vandan Patel, G.F. Shop No 5-8 & First Floor 4 - 9, Kumar House, Durga Oil Mill Compound, Himmatnagar-383<br />

001 Tel.: 02772-571156/9898592977 Hosur: C . N. Vinay, No. 24 & 25, Maruthi Nagar, Near Dharga, Sipcot Po, Hosur, 635 126 Tel.: 04344-500554 Hubli: Madhusudhan Radhakrishnan, T B Revankar Complex, Vivekanand Hospital Road,<br />

Hubli 580 029 Tel.: 0836-2217084 Hyderabad: Umesh Krishna / Krishna Phani Sharma Ammiraju / Shivaji, 6-1-73 3rd Floor Saeed Plaza, Lakadikapaul, Hyderabad 500 004 Tel.: 040-55666821/ 55630666 / 32347423/ 32347412 Indore:<br />

Mr.K.vinod Kumar / Raghunatha Reddy, 3 Rd Floor , 9/1A , U.V.house, South Tukonj, Indore 452 001. Tel.: 0731- 5201919/5077794 / 5077793 / 5200043 Irinjalakuda: Tito P J, Ushus Complex, Main Road West Tana Po, Irinjalaguda 680 121<br />

Tel.: 0480 2829655 Jabalpur: Mr. Akhilesh Thakur, 1702, Naiper Town, Model Road, Jabalpur 482 002 Tel.: (0761) 5018773, 5063040 Or 41. Jaipur: Puneet Saxena / Ajay Rastogi, 1st Floor ,O - 10 , Ashok Marg, Ahimsa Circle, C Scheme,<br />

Jaipur 302 001 Tel.: 0141-5593966 Jalandhar: Raj Chaudhry, 911 , Near Narinder Cinema, G T Road, Jalandhar 144 001 Tel.: 0181-5071644. Jalgaon: Ashutosh Rana / Suresh Pawar, Plot No 134 / 135 , Dsp Chowk, Facing Mahal Road,<br />

Jalgaoan 4425 001 Tel.: 0257-2237642 / 2238948 / 2238958 / 223878 Extn - 104 /110. Jamnagar: Nilesh Dhruve, Plot No 6 , Park Colony, St Ann’s School, Bedi Bunder Road, Jamnagar3361 008 Tel.: 0288 - 2662035 , 0288-3112594.<br />

Jamshedpur: Sanjay Karmarkar / Babita Thakur / Arup / Arti, C/o Mithila Motors Ltd, Near Ram Mandir, Bistupur, Jamshedpur 831 001 Tel.: 0657-2756006 / 2756066. Jodhpur: Arun Verma / Anil Vyas, Plot No 57 / B, 9th Chopasani Road,<br />

Jodhpur 342 003 Tel.: 0291-5106400 / 5106100 / 5106200 / 51062300 Extn 108 / 110. Kadi: Amrish Jhala, Radhaswami Complex ,R.S. No 242, Nr. N.c. Desai Petrol Pump , Highway Char Rastha, Kadi-382 715Tel.: 02764 - 242027. Kanpur:<br />

Vasudha Khemka, Navin Market Branch, 15/46 Civil Lines, Kanpur 280 001 Tel.: 00512-3018052. Karad: Vishal Phadnis, Mr Pravin Shaligram,, Near Hotel Sangam, Pune Bangalore Highway, Karad 415 110 Tel.: 02164-229679. Karnal: Rohit<br />

Budhiraja, Sco 778-779, Opp Mahabir Dal Hospital, Kanjpura Road, Karnal Tel.: 00184-2202789. Kolhapur: Harshad Kulkarni / Amita Marathe, Jaju Arcade,TTarabai Park, Kolhapur 416 003 Tel. 0231-2651906, 2651908. Kolkata: Anish Gandhi<br />

/ Debjyoti, Abhilasha Ii ,6, 1st Floor, 6 Royd Street, Kolkata 700 016 Tel.: 0033-22273760-65,2227 3761. Quilon: Harish Sivaram,Vgp Buildings , Door No XVI / 1539 (1320a), Vadakumbhagom Ward , Irumpupalam, Kollam6691 001 Tel.: 00474<br />

2766171 / 74. Kota: Deepak Gupta, Neeraj Agarwal, Show Room No 13 - 14, Main Jhalawar Road,Kota3324 007 Tel.: 00744-2390485 (D), 9829 230 230. Kottayam: Manoj Kumar K.C, Unity Building , Opp Midc Centre, K K Road, Kottayam6686<br />

002 Tel.: 00481-2302361 Latur: Pradeep D. Walunj, Shri Prabha Arcade , Shop No 3-6, M.G. Road, Near Nagar Parishad , Opp Town Hall, Latur 413 512 Tel.: 002382 - 255116. Lucknow: Nitish Srivastav / Anirudh Ramodarai / Amit Srivatava<br />

/ Shivam Saxena, Pranay Tower,Darbari Lal Sharma Marg, Beside Pratibha Cinema, Lucknow 226 001Tel.: 0522-3019124-27 /3919811 / 3919813 /3019132/3019136 /3019140. Ludhiana: Mr Sanjeev Katare, Vishesh Sudhkaker, CMS Dept<br />

, 5th Floor,MMall Road, Ludhiana00 Tel.: 00161- 2422344 / 5021699. Madurai: Sridhar / Kannan Manikandan, 7 - A , West Veli Street, Opp Railway Station, Madurai6625 001 Tel.: 00452-2350707. Mangalore: Muralidhar Hande / Vishwanath<br />

Attar, M.N. Towers,KKadri,MMangalore5575 002 Tel.: 00824 - 2225405/2225410. Manjeri: Madhusoodanan P.V. / Shabeer, CMS Dept ,Kurikal Plaza, Bldg #20/1245 Kacheripady,Malapurram Road, Manjeri 676 121 Tel.: 0483 3094040/3091472.<br />

Mathura: Saurabh Pandya, CMS Dept, Ops Bsa College, Gaushala Raod, Mathura 281 001 Tel.: 0565-2463805 / 2463808. Meerut: Sumeet Talwar,3381 Western Kachery Road, Meerut2250 001 Tel.: 0121-2666080/2665799. Mehsana: Jigar<br />

Patel / Ketan Engineer, Prabhu Complex , Near Raj Kamal Petrol Pump,Abhu Highway, Mehsana 384 002 Tel.: 002762-243173, 02762 - 243 008. Moradabad: Manish B Saxena, Chaddha Shopping Complex,GGmd Road, Moradabad2244 001Tel.:<br />

00591- 2310508 / 09. Mumbai: Deepak Rane / Tushar Gavankar / Sunil Kolencherry, Maneckjiwadia Building, Nanik Motwani Marg, Mumbai 4400 023Tel.: 022 - 56573657 / 56573669 / 22679947 / 22679961. Muzzafarpur: Pintu Kumar Singh,<br />

Above Maruti Showroom, Choti Saria Ganj, Muzzafarpur 842 001 Tel.: 0621-2241638 Mysore: Harsha, Nageetha Complex, Vishwamanawa Double Road, Saraswathi Puram, Mysore 570 009 Tel.: 0821-5255304. Nadiad: Rakesh Parmar, Shoot<br />

Out Building , Nadiad Ice Factory Compound, College Road,Nadiad 387 001 Tel.: 0268- 5540114. Nagpur: Chandramouli Bharadwaj/Pratima Sarangi, 303 & 304, 3rd Floor , Wardh Road,112, Milestone, Near Lokmat Square, Nagpur4440 010<br />

Tel.: 0712- 2554405 / 2551746 Extn - 119 And 111 Nasik: Binoj Parameswaran / Prashant Pisolkar, Archit Centre, 3rd Floor, Chandak Circle Link Road,Opp Sandeep Hotel , Near Mahamarg Bus Stand, Nasik 422 002 Tel.: 0253-5647594 / 97<br />

/ 98. Navsari: Nirav Gandhi, Nandini Complex, Ground Floor, Station Road , Sandh Kuva,NNavsari 396 445 Tel.: 02637 280901 / 240702 / 247896 Nellore: T N Raj Kumar,G.T. Road, Nellore 524 001 Tel.: 00861-2327181 Delhi: Rahul Sikka<br />

/ Chetan Sondhi / Bharat Chadha,, Figops , Ist Floor, Kailash Building , 26 K G Marg, New Delhi 110 001 Tel.: 011-41699406 / 41699406 Palanpur: Shauank Pandya, Parth Complex , Near Cozy Tower, Opp Joravar Palace,Palanpur3385 001<br />

Tel.: 02742-571638,9327568081 Panipat: Harish Singla/Puneet Gupta/Gurpreet Singh/Ashu Gupta, 801 / 4 , G.T. Road, Panipat1132 103Tel.: 00180 - 5015268 (D) , 2648619-20 Ext 207 Panjim: Kamlakant Bhartu / Amar,Swami Vivekanand<br />

Road, 301 , Milroc Lar Menezes,Opp Gomantak Maratha Samaz, Panjim4403 001Tel.: 0832 - 5621250 / 5621251 / 2421952 Pathanamthitta: Prajish M, CMS Dept , Aban Arcade Ward # 9/1128, Pathanathitta-kumbazha Road, Pathanathitta<br />

689 645 Tel.: 0468-2322378 Patiala: Jaswinder Singh/ Inder Pal Singh,SS.C.O. 70 - 73 , Leela Bhawan Market, Patiala1147 001Tel.: 00175 5002500 Patna: Rakesh Verma / Pintu Kumar, Rajendra Ram Plaza,Exhibition Road, Patna 800 001Tel.:<br />

00612-2206161,2224332,3116348 Perinthalmanna: Prasanth P R, Calicut Road, Perinthalmanna , Malappura Dist, Perinthalmanna Tel.: 04933-395306 Phagwara: Gurpreet Singh, Kalra Road , Opp Hanuman Garhi Mandir,GG.t Road,<br />

Phagwara 144 401Tel.: 01824-221844-45 Pondicherry: R. Kumar,TTS No 6 , 100 Feet Road, Ellaipillaichavady, Pondhicherry 605 005Tel.: 00413-2200741 Pune: Mangesh Dhole/ Nitin Mandke, 5th Floor Millennium Tower, Bhandarkar Road,<br />

Shivaji Nagar ,Pune 411 004 Tel.: 020 -25651575 Extn 121 Raipur: Sunil Nagpal / Vaibhav Agarwal, Chawla Complex, Near Vanijya Bhawan, Sai Nagar, Devendra Nagar Road, Raipur4492 009Tel.: 0771 - 252 9110 (D), 0771 - 505 8901 /02<br />

/ 03 Ext. 201 / 202 Rajahmundry: Mr. Narayana Rao / Lakshminarayana, H.No : 46-17-20,MMain Road, Danavaipet,Rajahmundry 533 103Tel.: 0883-2442928 Rajkot: Rajiv S. Sheth / Bharat Pandya,Opp Alfred High School, 2nd Floor ,<br />

Panchratna Bldg, Jawahar Road, Rajkot 360 001 Tel.: 0281-5595553 Ranchi: Sanjib Jha, Ranchi Club Shopping Complex,Apt No. 11 , Main Road,Ranchi 8834 001Tel.: 00651-2308148 Rohtak: Rajesh Gupta,,4401 -402, D Park, Model Town<br />

, Main Delhi Road, Rohtak 124 001 Tel.: 001262-210936, 01262-211064 Ext 211 & 212 Rourkela: Suvankar Pal,Bisra Road , Dwivedi Bhawan,Dwivedi Square, Rourkela 769 001Tel.: 00661- 2500666 ( D ) / 2511666 / 2522666 / 2514666<br />

Rudrapur: Ankur Jain,Plot No1&2,Nanital Road, Plot No1&2,Nanital Road, Rudrapur 263 153 Tel.:05944-241747. Saharanpur: Alok Balodi, Mission Compound,Court Road, Adjoining Top Shop, Saharanpur 247 001 Tel.: 0132 - 2726467 Salem:<br />

Mr. Shanmugham,55 / 241 - F, Rathna Arcade, Omalur Main Road,Salem36636 004lTel.: 0427-2331604, 03A, Sangli: Prashant C, 640, Venkatesh Senate, Miraj Road,NSangli4414 416l Tel.: 0233-2327836H, Shimla: Ms. Anupama Srivastava,<br />

Jankidas Building, 3, The Mall , Shimla1171 001lTel.: 0177-2658541 / 26585412 / 26585413 Siliguri: Arupendu, 3 No , Ramkrishna Samity Building, Sevoke Road, Pani Tanki More,LSiliguri 734 401 Tel.: 0353-2640726., 0353 2642566 Extn.<br />

MICR<br />

Code<br />

Savings Current NRO NRNR NRE FCNR<br />

1st/<br />

Sole<br />

Unitholder<br />

2nd<br />

Unitholder<br />

3rd<br />

Unitholder<br />

CHECKLIST<br />

Please ensure that your Application <strong>Form</strong> is <strong>com</strong>plete in all respects & signed by all applicants : • Name, Address and Contact Details are mentioned in full. • Bank Account<br />

Details are entered <strong>com</strong>pletely and correctly. • Permanent Account Number (PAN) of all Applicants is mentioned if the investment amount is Rs. 50,000/- or more along with the<br />

copy of the PAN card • Copy of proof of identity • Appropriate Option is selected. If the <strong>Dividend</strong> Option is chosen, <strong>Dividend</strong> Payout or Re-investment is indicated. • If units<br />

are applied for jointly, Mode of Operation of account is indicated • Your Investment Cheque / DD is drawn in favour of “Tata Equity Management Fund”, dated and signed.<br />

• Application Number is mentioned on the reverse of the cheque. • Documents as listed below are submitted along with the Application <strong>Form</strong> (as applicable to your specific case).<br />

Documents Companies Trusts Societies Partnership Firms Flls NRI Investments through Constituted Attorney<br />

1. Resolution/Authorisation to invest <br />

2. List of Authorised Signatories with Specimen Signature(s) <br />

3. Memorandum & Articles of Association <br />

4. Trust Deed <br />

5. Bye-Laws <br />

6. Partnership Deed <br />

7. Overseas Auditor’s Certificate <br />

8. Notarised Power of Attorney <br />

9. Foreign Inward Remitiance Certificate, in case payment <br />

is made by DD from NRE / FCNR a/c or where applicable<br />

All documents in 1 to 6 above should be originals / true copies certified by the Director / Trustee / Company Secretary / Authorised Signatory / Notary Public<br />

ICICI BANK NFO COLLECTION CENTRES<br />

Ahmedabad: Chirag Patel, JMC House, Opp. Parimal Gardens,<br />

Ambawadi, Ahmedabad-380006, Tel: (079) 55523700, Fax:<br />

(079) 55523720, BM Tel.: (079) 55523716, Mobile No. 9879114830.<br />

Bangalore: Kalyana Chakravarthy, ICICI Bank Towers, 1,<br />

Commissariat Road, Ground Floor, Bangalore-560025. Tel: 080<br />

- 51296007, Fax: 080 - 51124607, BM Tel.: 080 - 51296008.<br />

Cochin: Gibi George, Emgee Square, M.G.Road, Ernakulam,<br />

Kochi. Cochin-682035. Te.: 0484 - 2382026 / 27 /28, Fax: 0484<br />

- 2372739, BM Tel.: 0484 - 2290163, Mobile No. 9349779825.<br />

Coimbatore: Senthil Kumar R, Cheran Plaza, 1090, Trichy<br />

Road, Coimbatore-641018. Te.: 0422-4292102 - 4292115, Fax:<br />

0422 - 2300172, BM Tel.: 0422-4292101, Mobile No. 9994345670.<br />

Hyderabad: Rahul Godse, 6-2-1012, TGV Mansions, Opp. Institution<br />

of Engineers, Khairatabad, Hyderabad-500004. Tel:<br />

040 - 23301534;55662345;23376844;55626660, Fax: 040 -<br />

23321181, BM Tel.: 040 - 23394077, Mobile No. 98855 66088.<br />

Jamshedpur: Arnab Sensarma, Natraj Mansion, Main Road,<br />

Bistupur, Jamshedpur-831001. Tel.: 0657 - 2422509 / 10 /<br />

2425907 / 12, Fax: 0657 - 2425865, BM Tel.: 0657 - 2425924,<br />

Mobile No. 09334042602, Kanpur: Barindra, J.S Towers ; 16/<br />

106 - The Mall. Kanpur-208001. Tel.:0512 - 2331041,42,43,44,45,<br />

Fax: 0512 - 2331042, BM Tel.: 0512 - 2331042, Mobile No.<br />

9839600345, 9839086665. Kolkata: Manoj Kumar Jaiswal, 22,<br />

R N Mukherjee Road, Kolkata-700001. Tel.:033 - 22428537 /<br />

22100995. Fax: 033 - 22426696, BM Tel.: 033-22137601, Mobile<br />

No. 9830088088. Lucknow: Saurab Pathak, 11, MG Road,<br />

Hazarat Gunj, Lucknow-226001. Tel.:0522 - 2214246 /2214247<br />

/ 2214254 Fax: 0522 - 2225232, BM Tel.: 0522 - 2201055,<br />

Mobile No. 9838513469. Mumbai: Capital Market Division, 30,<br />

Mumbai Samachar marg, Fort, Mumbai 400 001 Nasik: Sandeep<br />

Gore, U-1, Crown Commercial Complex, Opp. Rajiv Gandhi<br />

Bhavan (NMC), Utility Centre, Sharanpur Road, Nashik-422002.<br />

Tel.:0253 - 5605600/ 5606032/ 5606033, Fax: 0253 - 2313475,<br />

BM Tel.: 0253 - 5605191 Mobile No. 9823330060. New Delhi:<br />

Rahul Krishnatrey, 9A, Phelps Building, Inner Circle,Connaught<br />

Place, New Delhi-110001. Tel.:011 -51517954-58, Fax: 011 -<br />

23351092, BM Tel.: 011 - 51516142, Mobile No. +919811203153.<br />

Panji: Anant Narayan Samant, 65, Sindur Business Centre,<br />

Swami Vivekanand Road, Panji-403001. Tel.:0832 - 2232180 /<br />

2424217/ 2424225/ 2423444, Fax: 0832 - 2232390, BM Tel.:<br />

0832 - 2421639. Mobile No. 9823144162. Patna: Amit<br />

Bhattacharjee, Shahi Bhawan Ground Floor Exihibition Road<br />

Patna-800001. Tel.:0612 -2205398, 2205400, 2205400, Fax:<br />

0612 - 2202968, BM Tel.: 0612 -2 202966, Mobile No. 9835030917.<br />

Pune: Yatin Gupta, A-Wing, Shangrila Gardens, Bund Garden<br />

Road, Pune-411001. Tel.:020 - 26128248 , 26054345, Fax: 020<br />

- 26128594, BM Tel.: 020 - 26111690, Mobile No. 9823330074.<br />

Vadodara: Hemant Gulabchand Baid, Landmark Building, Race<br />

Course Circle, Alkapuri, Vadodara-390007. Tel.:0265 - 2339923<br />

/ 2339924 / 2339925 / 2339927 / 2339928, Fax: 0265 - 2339926,<br />

BM Tel.: 0265 - 2325318, Mobile No. 9825047840<br />

NRI Centres : Mumbai, Kolkata, Bangalore, Cochin,<br />

Ahmedabad and Vadodra<br />

HDFC BANK NFO COLLECTION CENTRES<br />

Agra: Manoj Minocha/ Puneet Prakash, SHOP NO - 11, Block<br />

No-17/2/4, Friends Plaza, Sanjay Place, Agra-282 002. Tel.:<br />

(0562) 2524089. Ahmedabad: Kunal Kak/Mahyar Chhindiawala,<br />

HDFC Bank House, Near Mithakali Six Roads, Navrangpura-<br />

380 009 Tel.: 079 -55217163 / 55217184. Ahmednagar: Anand<br />

Lele, Amber Plaza,Station Road, Opp ADCC Bank Sahakar<br />

Gruh, Ahmednagar-414 001. Tel.: 95241-2451962-63 / 2451194.<br />

Ajmer: Manish Vashistha, AMC NO - 13/10 & 14/10, Near<br />

Suchma Kendra, Adajcent to Swami Complex, Ajmer-305 001.<br />

Tel.: 0145-5100123. Akola: Sachin Raje/Shrinivas Dhankar/<br />

Anand Karajgikar/Shukla, Sethi Heights, Opp To Collector Office,<br />

Z P ROAD, Akola-444 001. Tel.: 0724-2432204 (D), 2441128 &<br />

2431446 (Ext 110). Allahabad: Abhishek Pathak, 54/1 S.P.<br />

Marg Civil Lines, Allahabad-211 003. Tel.: 0532- 2260049. Alwar:<br />

C. P. Jangir, Bhagat Singh Circle, Road No 2, Alwar-301 001.<br />

Tel.: 0144-5100880. Ambala: Balwinder Singh Sondhi, Shingar<br />

Palace Complex, Nicholson Road, Ambala Cantt 133 001 Tel.:<br />

0171-2600044 (D), 0171-2600045. Amravati: Suryakant Sisodiya<br />

/ Yatin Deshpande, C/o. Rasik Plaza, Jaistambh Chowk, Morshi<br />

Road, Amravati-444 601. Tel.: 0721- 2568432,05,06 Amritsar:<br />

Deepak Gohlan/Anoop Grover/Guneet Pal Singh/Rajpal Singh,<br />

39, The Mall Amritsar, Tel.: 0183-2564616. Anand: Ankit Shah,<br />

1St Floor , Sanket Towers, Opp Anand Arts College , Grid Road,<br />

Anand-388 001. Tel.: 02692- 573195. Ankleshwar: Mr. Tarak<br />

Gandhi,Mr Ritesh Shah, S A Motors Building, S A Motors Building,<br />

Ankleshwar395 002. Tel.: (02646) 227704/227705. Asansol:<br />

Amitabha, CMS Dept, P C Chatterjee Market, G.t Road,<br />

Rambhandu Tala, Asansol-713 303. Tel.: 0341-2214848.<br />

Aurangabad: Mr. Amol Bhale / Mr. Azeemuddine Shaikha / Mr<br />

Nitin Sawant / Madhu, Shivani Chambers, Manjeet Nagar ,<br />

Jalna Road , Opp Akashwani, Aurangabad-431 001. Tel.: (0240)<br />

2362042/47. Balasore: Subrat Mohanty, C/o Bharat Motors,<br />

F.M Circle, Balasore-756 001. Tel.: 06782 - 263335. Bangalore:<br />

P Sugunan/ KT Bhanushree / Joseph Marian, NO 8 / 24 Salco<br />

Centre, Richmond Road, Bangalore-560 025. Tel.: 080-<br />

41266865. Bardoli: Mr Jaideep SHekhawat (Manager) Daxesh<br />

SHukla (TBG), Shree Ambika Niketan Temple, Shree Ambika<br />

Niketan Temple, Bardoli-394 601. Tel.: 02622 223627, (02622)<br />

223879. Barielly: Vinod Mishra, 154 , KRISHNA PALACE,<br />

CIVIL LINES, BAREILLY-243 001. Tel.: (0581) - 3099631.<br />

Belgaum: Mr Vinay Balwally / Mr Ravi Kiran Ganti/ Girish ,<br />

4830 / 28 A Opp District Hospital, Dr Ambedkar Road, Belgaum-<br />

590 002. Tel.: 2404411/15. Bharuch: Anuradha Gupta/Surya<br />

Prakash Patel, Near Octroi Naka Link Road, Near Octroi Naka<br />

, Link Road, Bharuch-392 001. Tel.: Direct No.222031 (02642),<br />

Board line -220108,222032 extn.23. Bhatinda: Sunil Seth, 3027<br />

- B Guru Kanshi Marg, Bhatinda-151 001. Tel.: 0164-<br />

2240832,2240993-996. Bhavnagar: Manish Malkan, Gopi<br />

Arcade, Opp Takhteshwar Post Office, Bhavnagar. Tel.: (0278)<br />

5540340. Bhilwara: Rahul Atal / Tushar Mathur, 2-3-4, S.K<br />

PLAZA COMPLEX, PUR ROAD, BHILWARA. Tel.: 01482-<br />

512686. Bhopal: Tavinder Pal Singh, Sumeet Kapoor, Monu<br />

Mehra, E - 1/57 , Arera Colony, Bhopal-462 016. Tel.: 0755-<br />

2461145 (Direct), Board-5281616,5276007,5276008.<br />

Bhubaneshwar: Subir Roy / Subrat Mohanty, Junction of<br />

Janpath & Gandhi Marg, Hotal Jajati Complex , Kharvelanagar,<br />

Unit - III , Master Canteen Square, Bhubaneshwar-751 001.<br />

Tel.: 0674-2400986/95. Bhuj: Parth, 101 & 102 Sunrise Tower,<br />

11 - Vijaynagar Society , Hospital Road, Bhuj -370 001.Tel.:<br />

02832-571466. Bokaro: Shamim Ahmed, B-9 City Centre, Sector<br />

BLUE PINK

BLUE PINK<br />

112/114U. Surat: Devang Desai / Tejas Mehta, 7th Floor, Kashi Plaza, Next To Dr Bipin Desai Children Hospital , Majura<br />

Gate, Surat5 002 Tel.: 0261 - 5563650. Thalassery: Biju M R, Avk Nair Road, Thalassery 670 001 Tel.: 0490 - 2325104.<br />

Thiruvalla: Prasanth P R, Illampallil Buildings, 26/149(1&2), Mc Road, Tiruvalla 689 101 Tel.: 0469 2741378. Trichur:<br />

Ramachandran Naganathan, Kalliyath Royal Square, Palace Road, Trichur-680 020 Tel.: 0487-2330980/2330981,<br />

Trichy: S. Madhankumar, A - 10 , Lakshmi Arcade, 11th Cross Main Road , Thillainagar, Trichy 620 018. Tel.: 0431 -<br />

2742204. Trivandrum: Akilandeswari / Harikrishnan, Kenton Towers, Vazhuthacaud, Trivandrum 695 014 Tel.: 0471<br />

2337615. Udaipur: Hitesh Babel, 358 Post Office Road, Chetak Circle , Adjacent To Chetak Cinema, Udaipur-313 001<br />

Tel.: 0294- 5103355. Unjha: Manish, Suvidhi Complex, 1 St Floor, Nr. Radha Krishna Temple, Station Road, Unjha 382<br />

170 Tel.: 02767-240623 Ext 107, 02767-240624 Direct. Baroda: Rakesh Sharma / Dheeraj Patange, 5th Floor , Midway<br />

Heights, Next To Panchmukhi Hanuman Temple , Lokmanya Tilak Road ,Kirti Mandir ,Near Kala Ghoda , Raopura Baroda<br />

- 390 001 Baroda 390 001 Tel.: 0265-5585516, 09327585780-Rakesh Sharma, Valsad: Sudeep Shah / Nitesh Gajjar, 1st<br />

Floor ,Ekta Appt , Near R J J High School, Thithal Road, Valsad 396 001 Tel.: 02632-572201. Vapi: Hitesh, Snehal<br />

Prajapati, Komal Bhatt, Nilesh Unalkat, Lower Ground , Emperor Arcade, Chala Road, Vapi 396 191 Tel.: 0260 - 5548104<br />

R93275 68120. Varanasi: Mukesh Kumar Verma/ Pragya, D 58 / 2 Kuber Complex, Rathyatra Crossing, Varanasi 221<br />

010 Tel.: 0542-2226203. Vishakapatnam: Mr K Srinivasa Raju / N Ratna Kumar. 1st Floor , Potluri Castle, Above<br />

Rayomond Showroom Dwarka Nagar, Vishakapatnam Tel.: 0891-5571123<br />

NRI Centres : Mumbai, New Delhi, Bangalore, Chennai and Surat<br />

IDBI BANK LIMITED NFO COLLECTION CENTRES<br />

Ahmedabad: N.G.S. Ramesh, CG Road, IDBI Complex, Lal Bungalows, Off CG Road, Ahmedabad, Gujarat-380006 Tel.:<br />

+91 (79) 6431296. Bangalore: Venugopal N, Mission Road, IDBI House, 58 Mission Road, Bangalore, Karnataka-560027 Tel.:<br />

+91 (80) 2279576 Bhavnagar: Madhu Sudan Nandyala, Bhavnagar, G-10, Ground Floor, Radhe Shyam Complex, Waghawadi<br />

Road, Bhavnagar, Gujarat-364001 Tel.: +91 (278) 517-000. Bhilai: Rabi Narayan Mishra, Bhilai, New Era, 19, Priyadarshni<br />

Parisar, Nehru Nagar Square, Bhilai, Madhya Pradesh 490020 Tel.: +91 (788) 292-156 Bikaner: Amit Modani, Bikaner,<br />

Vyapar Udyog Bhavan, Near DRM Office, Modern Market, Bikaner Rajasthan 334001 Tel.: 0151-2200166,167. Chennai:<br />

Krishnadas C.H., Greams Road, PM Towers, 37, Greams Road, Chennai, Tamil Nadu 600006 Tel.: +91 (44) 28292375.<br />

Chittorgarh: Anjali Chawat, Chittorgarh, B-1 Meera Market, Chittorgarh, Chittorgarh, Rajasthan 312001 Tel.: 01472 -<br />

246424/ 4151. Cochin: Jorty M. Chacko, Kochi, Dhanwantari Building, Near Padma Theater, MG Road, Kochi, Kerala-<br />

682035 Tel.: +91 (484) 382519. Coimbatore: Narasimhan Venkatesh, Coimbatore, Ground Floor, Viscose Towers, 1078,<br />

Avinashi Road, Coimbatore Tamil Nadu 641018 Tel.: +91 (422) 210-158. Hyderabad: Vasudevan Govindarajulu, Basheerbagh,<br />

Mahavir House, Basheerbagh Square, Hyderabad Andhra Pradesh 500029 Tel.: +91 (40) 3224822. Kakinada: Jagadish<br />

Gullapally, Kakinada, R K Electrical Works, Door No 43-1-28, Main Road, Kakinada Andhra Pradesh 533001 Tel.: 0884-<br />

2345602. Kolkata: Sourav Kar, Park Street, Siddha Point, Ground Floor, 101, Park Street, Kolkata, West Bengal 700016<br />

Tel.: +91 (33) 2175040. Lucknow: Mamta Rohit, Lucknow, Dhan Complex, 15, Ashoka Marg, Lucknow, Uttar Pradesh<br />

226001 Tel.: +91 (522) 2287102. Madgaon: Yogesh Hanuman Shinde, Margao, Jyoti Plaza, Isidorio Baptista Road, Margaon<br />

Goa 403601. Mumbai: Vasumati Jokelkar, Nariman Point, Mittal Tower, C Wing, Grnd floor, Nariman Point, Mumbai-400021<br />

Maharashtra Tel.: +91 (22) 22024831. Nagpur: Rupesh N. Nagar, Nagpur, Gupta House, Plot no 1, Ravindra Nath Tagore<br />

Marg, Civil Lines, Nagpur-440001, Maharashtra Tel.: +91 (712) 2549797. New Delhi: Sunil Sehgal, KG Marg, Surya Kiran<br />

Building, Ground Floor, 19 K G Marg, New Delhi110001 Delhi (UT - NCT) Tel.: +91 (11) 23358290 . Pune: Dhananjay Lele,<br />

FC Road, Dynaneshwar Paduka Chowk, Fergusson College Road, Pune-411004 Maharashtra Tel.: +91 (20) 5672191<br />

Rajkot: Ashvin Panchal, Rajkot, Shiv Darshan, Jagnath plot corner, Dr. Radhakrishna Road, Opp. Rajkumar College, Near<br />

trikon bagh, Off Yagnik Road, Rajkot-360001 Gujarat Tel.: 281- 2467000/ 01/ 02. Renukoot: Mukul Kumar, Renukoot, Birla<br />

Market, Renukoot, Sonbhadra District, Renukoot, Uttar Pradesh 231217 Tel.: +91 (5446) 54500 Ujjain: Krishnaraj C.P.,<br />

Ujjain, Hotel Ashray, 77, Devas Road, Ujjain Madhya Pradesh 456010 Tel.: +91 (734) 2526133 Vadodara: Mahendra<br />

Ramabhai Patel, Baroda, Concorde, RC Dutt Road, Alkapuri , Vadodara-390007 Gujarat Tel.: +91 (265) 2333200 Vallabh<br />

Vidhyanagar: Niral Chokshi, Vallabh Vidyanagar, Nana Bazar, Vallabh Vidyanagar-388120 Gujarat Tel.: +91 (2692) 238-<br />

201 Vijayawada: Venkateshwarlu Mallineni, Vijayawada, BSR Plaza, Near Maris Stella College, Ring Road, Vijayawada-<br />

520008 Andhra Pradesh Tel.: +91 (866) 2496912<br />

STANDARD CHARTERED BANK LTD. NFO COLLECTION CENTRES<br />

Bhubaneshwar: Plot No 3, Bapuji Nagar, Janpath; Bhubaneshwar 751 009. Guwahati: G N Bardoli Road,Ambari,<br />

Guwahati-781001. Kolkata: 19 Netaji Subhas Road, Kolkata 700001. Patna: Bhagwati Dwaraka Arcade, Plot No: 830<br />

P, Exhibition Road, Patna -800 001. Chandigarh: SCO, 137-138,Sector – 9C, Madhya Marg,Chandigarh. Jaipur: H8,<br />

Showroom No.1, Bhagwat Bhawan, MI Road, Jaipur. Kanpur: 16/105, M.G. Marg, Kanpur – 208 001. Ludhiana: SCO<br />

16-17, Feroze Gandhi Market,Ludhiana,Punjab- 141001. Lucknow: 4 Shahnajaf Road ,Lucknow , UP-226001. New<br />

Delhi: H2, Connaught Circle New Delhi 110001. Bangalore: 6 TH Floor , West Wing Raheja Tower, 26th M .G Road<br />

Banglore –560001. Chennai: 19, RAJAJI SALAI ,CHENNAI 600001. Cochin: XXIV/ 1633, KPK Menon Road ,Willingdon<br />

Island, Cochin- 682003. Coimbatore: 509, D. B. Road,R.S.Puram,Coimbatore- 641 002. Hyderabad: 6-3 1090 Raj<br />

Bhavan Road Somajiguda , Hyderabad 500082. Ahmedabad: Abhijeet Ii, Ground Florr Meetakali, 6th Road Ahmedabad<br />

–380006. Bhopal: Ground Floor, Northern Wing, Alankar Complex,Plot No.10,Zone II, MP Nagar, ,Bhopal-462011.<br />

Indore: DM Towers; 21 / 1 Race Course Road,Indore, MP 452 001. Mumbai: 270 D.N.Road, Fort Mumbai 400001.<br />

Pune: Shrirang House, 364-365,Junglee Maharaj Road,Shivaji Nagar, Pune – 411 005. Surat: Manav Mandir,UG4 & FF,<br />

Parle Point,Surat 395007. Vadodara: Gokulesh, R C Dutt Road, Vadodara – 390 009 .<br />

KOTAK MAHINDRA BANK LTD. NFO COLLECTION CENTRES<br />

Kolkata: Apeejay House 15, Park Street Kolkatta -700 016. Lucknow: 17 Ground Floor Speed Building 3rd Shahjanaf<br />

Road,Opposite Narayan,Lucknow-226001. New Delhi: Ground Floor, Ambadeep, 14, K.G. Marg, New Delhi-110001.<br />

Bangalore: 10/7, Umiya Land mark, Next to Chancery Hotel, Lavelle Road, Bangalore 560 001. Chennai: Capitale’<br />

Ground Floor, 555, Anna Salai, Chennai - 600 018. Ahmedabad: 213/214, Sakar II, Ellis Bridge Corner, Ashram Road,<br />

Ahmedabad, Gujarat-380006 Ahmedabad, Kadi: Kunal Complex Opp. J.K. petrol pump, Highway Cross roads, Kadi.<br />

Dist Mehsana Mumbai: 5 C/ II, Mittal Court, 224, Nariman Point, Mumbai - 400 021. Pune: M-4, Virwani Plaza,11, East<br />

Street, Pune. Surat: Megh Mayur Plaza, Parle Point, Surat Dumas Road, Athwa Lines, Surat - 395 007. Unjha: 2nd<br />

Floor, Old APMC Building, Above Bhojnalaya, Ganj Bazar, Unjha - 384 170 Gujarat. Vadodara: Panorama Building,<br />

Ground Floor, R.C.Dutta Road, Alkapuri, Vadodara-390 005.<br />

INDIAN OVERSEAS BANK COLLECTION CENTRES<br />

Mumbai: 2/10, Elphinstone Building, Veernariman Road, Horniman Circle, Fort, Mumbai - 400 023. Tel.: 22817899 /<br />

22045761 / 22047341 New Delhi: F47, Malhotra Buildings, Janpath, Queensway, New Delhi - 110 001. Tel.: 23350036<br />

/ 23731508 / 23310560 Kolkata: P35 Indian Exchange Place, Kolkata - 700 001. Tel.: 22218690 / 22254674 /<br />

22254055 Chennai: 762, IOB Building, Anna Salai, Chennai - 600 002. Tel.: 28514695 / 28548089 / 28523833<br />

Bangalore: 7, Srisailam, I Main Road, Gandhi Nagar, Bangalore - 560 009. Tel.: 22950228 / 22950224 / 22950225<br />

Hyderabad: 104 / 1 Abids to Koti Road, Sultan Bazar, Hyderabad - 500 095. Tel.: 24755324 / 24756655 / 24756656<br />

INVESTOR SERV ICE CENTRES - AMC OFFICES<br />

CALL FREE : 1-800-22-0101<br />

West Zone:- Ahmedabad: Hitesh Pujara, Tata Asset Management Ltd, 702, "Abhijeet - 1", Mithakhali Circle, Navarangpura,<br />

Ahmedabad - 380 009 Tel.: (079) 55418989, 26466080, Bhopal: Mr. Swadesh Dubey, Tata Asset Management Ltd. MF<br />

- 12, Block - A, Mansarovar Complex, Near Habibganj Railway Station, Bhopal - 462 016 Tel.: (0755) 4229379, Goa:<br />

Mr. Kaushal Shah, Tata Asset Management Ltd, Flat No.7 - Cristina Apartment, Behind Ashwin Garage, Alto - Porvorim,<br />

Goa - 403 521 Tel.: 9850368867, Indore: Mr. Atul Bhagtya, Tata Asset Management Ltd, G - 25, City Centre, 570, M.<br />

G. Road, Indore 452 001. Tel.: (0731) 4201806 / 7, Jabalpur: Nimish Bhangre, Tata Asset Management Ltd, C/o Mr.<br />

V. S. Rajput, 1133, Besides Subhakamana Apartment, Hathital Colony, Jabalpur - 482001, Tel.: 9826339115. Mumbai:<br />

Kiran, Mulla House, Ground Floor, 51, M.G. Road, Near Flora Fountain Mumbai - 400001. Tel.: 56315191 / 2 / 3,<br />

Nagpur: Mr. Veerendra Kothekar, Tata Asset Management Ltd., Near RSS Building, Garud Khamb Road Mahal Area,<br />

Nagpur - 440 002. Tel.: 9373127111, Nashik: Mr. Santosh Trivedi, Tata Asset Management Ltd., Samruddhi Residency,<br />

Opp hotel City pride, Tilak wadi, Nashik - 422 007. Tel.: (0253) 5605138 / 2573689, Pune: Mr. Rahul Khandekar, Office<br />

No.14, Karnik Heritage, 2nd Floor, 1225 D Shivaji Nagar, Off F. C. Rd, Near Hotel Roopali, Opp Venus Traders, Pune<br />

411 004. Tel.: (020) 56052827 / 8 / 9, Rajkot: Mr. Amit Desai, Tata Asset Management Ltd., Arihant Plaza, 201, 2nd<br />

Floor, Subhash Road, Near Moti Taki, Rajkot - 360 001.Tel.: (0281) 5524848, 5544949, Surat: Harnish Rathod, Tata<br />

Asset Management Ltd, 421, Jolly Plaza, Nr Collectors Office, Next to G. P. College, Athwa Gate, Surat - 395 001. Tel.:<br />

(0261) 5554418 /19, Vadodara: Nutan Gupta, 9824557567, Vijay Pandya, 9824312354, 6/55, Marutidham Society,<br />

G.I.D.C., Makarpura, Vadodara - 390 010. 9824312354. East Zone:- Bhubaneshwar: Mr. Gopabandu Mohanty, Tata<br />

Asset Management Ltd,Narayan Market Complex, 2nd Floor, Janapath, 48 - Ashok Nagar,Bhubaneswar - 751 009.Tel.:<br />

(0674) 2533818. Dhanbad: Neeraj Anand, C/o UTI Securities Ltd, Shriram Plaza, 4th Floor, Bank More, Dhanbad,<br />

Jharkhand - 826 001. Tel.: 9934174385, Durgapur: Mrinmoy Ukil, Tata Asset Management Ltd., 255, Aurobindo Bldg.<br />

Tally, Burdwan - 713101, Tel.: 9932241935. Guwahati: Bineet Singh, Tata Asset Management Ltd. 109, 1st Floor, Orion<br />

Tower, Christian Basti, G. S. Road, Guwahati - 781 005. Assam, 9864176896, Jamshedpur: Anu Verma, Tata Asset<br />

Management Ltd, C/o Mithila Motors Ltd. 1st Floor, Main Road, Bistupur,Jamshedpur - 831 004, Tel.: 0657-2756021/22/<br />

23, Kolkata: Nikhat Budharaja, Tata Asset Management Ltd, Tata Centre, 1st Floor, 43, Jawaharlal Nehru Rd, Kolkata<br />

700 071. Tel.: (033) 22881534 / 22883413 / 22883415. Patna: Ravi Shanker Prasad, Tata Asset Management Ltd. 3-A,<br />

3rd Floor, Anand Tower, Exhibition Road, Patna - 800 001. Tel.: (0612) 2322214, Raipur: Ravi Mullick, Tata Asset<br />

Management Ltd. 331 & 332, 3rd Floor, Lalganga, Shopping Mall, G.E.Road, Raipur - 492 001, Tel.: (0771) 5537340,<br />

Ranchi: Amit Sinha, Tata Asset Management Ltd. C/o Mr. Alok Sinha (Works Manager), M/s J J Industries Corporation,<br />

Workshop under overbridge, Nivaranpur, Main Road, Ranchi - 834 001, Chhatrisgarh, Tel.: (0651) 2330704 / 2330226.<br />

North Zone:- Agra: Dilip Kumar, C/o Rahul Gupta, 10, Subhash Nagar, Karan Yogi Enclave Road, Kamla Nagar, Agra<br />

5, Tel.:9335092813, Allahabad: Amit Jadoun, C/o R. K. Singh, 306, Madhavpur, Baihrana, Opp. New Nanny Bridge,<br />

Behind Bangar Dharmashala, Allahabad 211 003, Tel.:9839600696, Chandigarh: Manmohan, Tata Asset Management<br />

Ltd, Cabin No. - 3-4-5 1st Floor, S.C.O. - 487 - 488, Sector - 35C, Chandigarh - 160 022, Tel.: (0172) 2605320,<br />

Dehradun: Sunil Ahuja, 379/1, Street No. 4, Lane No. 4, Rajinder Nagar, Dehradun - 248 001, 9719127277, Delhi:<br />

Rinki, Tata Asset Management Ltd, 710 - 712, 7th Floor, Prakashdeep Building, 7, Tolstoy Marg, New Delhi - 110 001,<br />

Tel.: (011) 55303252 / 53, Jaipur: Sandeep Mathur, Tata Asset Management Ltd, 233, Ganpati Plaza, 2nd Floor, M I<br />

Road, Jaipur - 302 001. Tel.: (0141) 5105177/78, Jodhpur: Himanshu Acharya, 95, Shanti Priya Nagar, Behind Kamla<br />

Nagar hospital, Jodhpur, 9829652615, Kanpur: Nirmal, Tata Asset Management Ltd, Survey No.419/1, Agarwal<br />

Building, Grnd Floor, Adjoining Oriental Bank of Commerce, Cantts-The Mall, Kanpur - 208 004, Tel.: (0512) 2306066,<br />

Lucknow: Devendra Mani, Tata Asset Management Ltd, Office No - 4, 1st Floor, Centre Court Building, Adjacent<br />

Saran Chamber 1, 3 C, 5 - Park Road, Lucknow 226 001, Tel.: (0522) 4001731, Ludhiana: Sumit Mahajan, Tata Asset<br />

Management Ltd, Cabin No- 301, 3rd Floor, SCO 18, Opp Ludhiana Stock Exchange, Feroze Gandhi Market, Ludhiana<br />

- 141 001, Tel.: (0161) 5089667, Moradabad: Deepanshu Kumar, C/o Shri Krishna Kumar, 15 / B, Neel Kanth Colony,<br />

Civil Lines, Moradabad, Tel.: 9837054178. Udaipur: Umesh Daila, 2nd Flr, Office No. 4, Madhav Comp, Opp. GPO,<br />

Chetak Circle, Udaipur, 313 001, Tel.:9829455338, Varanasi: Rakesh Kumar, Rashmi Nagar Colony, D - 31 / 82, K -<br />

6 Lanka, Varanasi, Tel.: (0542) 55446555, Jalandhar: Varun Gupta, 91, New Johar Nagar, Jalandar - 144 001 Tel.:<br />

9876601508. South Zone:- Bangalore: Tata Asset Management Ltd, No. 1/4, 1st Floor, Batra Chambers, Cunningham<br />

Crescent Road, Bangalore - 560 052. Tel.: (080) 57561313, 55335986, 55335987, Calicut: Kishore Krishna, 17/1865,<br />

S-Malabar Palace, Manuel Sons Junction, G. H. Road, Calicut, Tel.: 9895072920, Chennai: Tata Asset Management<br />

Ltd. Flat-C, 1st Floor, Ashika Chambers, Opp. Cars India Showroom, Next to Satyam Building, 22, Chamiers Road,<br />

Teynampet, Chennai - 600 018, Tel.: (044) 24320032, 55510243, 24320033, Cochin: (0484) 2377580 / 520, Coimbatore:<br />

Tata Asset Management Ltd, 208, Gowtham Arcade, 3rd Floor, T.V. Samy Rd (E), Near Post Office, R. S. Puram.<br />

Coimbatore - 641 002, Tel.: (0422) 5365635, Hyderabad: Tata Asset Management Ltd, R.R.Estates, Block - B, 3rd<br />

Floor, G. S. Mall, Somajiguda, Hyderabad - 500 082, Tel.: (040) 55961237/38, 55548290, Madurai: Gopal Subramanyam,<br />

Tata Asset Management Ltd, D2 3rd Floor, Ar. Plaza, 16/17. North Veli Street, Madurai - 625001,Tel.: 9894905546.<br />

Mangalore: Basavaraj, (Res.)44/41-B, Trinetra, 2nd Main, 2nd Cross, Land Links Township, Mangalore-08, Tel.:<br />

9886972305, Mysore: Ganapathy- 9980523994, Vijaywada: Sudhir Simhadri, 24-7-12 Rama Nagar, Gokul Building,<br />

Jonnavithulavari Veedhi, Vijaywada - 520 003, 9849999468, Vishakapatnam: Prakash, Tata Asset Management Ltd.<br />

D.No:48-9-1, 1st floor,Office No: 10&11, Srimukha Complex, Dwarakanagar, Visakhapatnam - 16. Tel.: 9885555900.<br />

Trichur: Harsha Mohan, 2nd Flr, Ajay Vihar, M. G. Road, Cochin 682 016, Tel.: 9895090489, Kottayam: Boby Paul, 2nd<br />

Flr, Ajay Vihar, M. G. Road, Cochin 682 016, Tel.: 9447781954, Hubli: Pawan Kumar, 15/16, Eureka Junction,<br />

Travellers Bunglow Road, Hubli 29, Tel.: 9880044750, Salem: Anand Raj, (Res.) Neelmegha Resi., 2/3, Voc Street,<br />

Subramania Nagar, Salem 4, Tel.: 9843798654, Trichy: Senthil Kumar, Tata Asset Management Ltd, 1/8,<br />

Middlestreet,Mullikkarumbur, Kumaravalayur - Post, Perumal Temple, Trichy - 620102, Tel.: 9842995983, Trivandrum:<br />

Dhanish Kumar, Tata Asset Management Ltd., 2nd Floor, Akshaya Towers, Sasthamangalam, Trivandrum - 695 010.<br />

Tel.: 9249886732.<br />

INVESTMENT OBJECTIVE<br />

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term<br />

growth opportunities by investing in a portfolio constituted of equity & equity related instruments and the secondary<br />

objective is to generate consistent returns by investing in debt and money market securities.<br />

Asset Allocation Pattern<br />

Proportion** (% of Funds Available /Net Assets)<br />

Instrument Minimum Maximum Risk<br />

Equity / Equity related instruments 65 100 High<br />

Debt, Money Market and Securitized Debt Instruments* 0 35 Low to Medium<br />

* Investment by the scheme in securitised debt, will not normally exceed 20% of the net assets of the scheme.<br />

** At the time of investment<br />

The above asset allocation pattern is only indicative. The investment manager in line with the investment objective may<br />

alter the above pattern for short term and on defensive consideration. The allocation between debt and equity will be<br />

decided based upon prevailing market conditions, macro economic environment and the performance of corporate<br />

sector, the equity market and other considerations.<br />

The fund will also use the derivatives route to hedge the equity portfolio & the extent to which the portfolio will be hedged<br />

will be linked to the P/E of the Index. The extent of hedging would involve <strong>com</strong>plete portfolio hedging by way of short<br />

position in Index Futures / Options as well as hedging of individual stocks depending upon the fund managers’ perception<br />

of the markets. Hedging would also include but not only limited to selling of stocks that are not owned by the Fund but<br />

are available under derivative (Futures & Options) segment in the market for trading from time to time as permitted by<br />

the Regulations/ guidelines. The Derivative will be used mainly for the purpose of hedging. However the Fund manager<br />

may if the opportunity exist, use derivative to earn profit. Exposure to derivative instruments will not exceed 100% of<br />

the portfolio value.<br />

No investments will be made in foreign securitized debt.<br />

Stock Lending - Maximum upto 25% of the net assets with a ceiling of 5% per intermediary.<br />

RISK PROFILE OF THE SCHEME<br />

Mutual Fund investments are subject to market risks. Please read the offer document carefully for details on risk factors<br />

before investment.<br />

PLANS AND OPTIONS<br />

The Scheme offers two investment options; viz. <strong>Dividend</strong> Option (Payout or Re-investment) and Growth Option.<br />

Default Option: Please note that if no option is mentioned / indicated in the application form, the units will, by default,<br />

be allotted under the Growth Option. Similarly, under the <strong>Dividend</strong> Option, if no choice (payout or reinvestment) is<br />

indicated, the applicant will be deemed to have applied for the <strong>Dividend</strong> Re-investment Option under the <strong>Dividend</strong> Option.<br />

APPLICABLE NAV<br />

The scheme will not accept any subscription during close ended period. The repurchase (including switch out) facility<br />

will be available at a weekly interval during close ended period. Applications for repurchase can be submitted upto 3<br />

p.m. on any Wednesday (or immediate next business day if such Wednesday is a holiday) of the week after scheme<br />

opens for repurchase. The relevant NAV for repurchase shall be the NAV calculated on close of such Wednesday.<br />

For the convenience of investors, the Fund will accept repurchase request on any business day of the week.<br />

Application received during the day other than the Wednesday will be processed at the NAV calculated at close of<br />

immediate next Wednesday (or immediate next business day if such Wednesday is a holiday).<br />

Minimum Repurchase Requirement : 100 units and in multiple of 1 unit thereafter.<br />

Maximum Repurchase : Single Investor – No Limit<br />

Aggregate - 15% of the units outstanding at the beginning of repurchase day.<br />

In case of receipt of the repurchase requests (including repurchase requests carried forward in accordance with this<br />

clause) in excess of 15% of the outstanding units at the beginning of any repurchase day, the AMC reserves the right<br />

to carry forward excess units, on a pro-rata basis, to the next repurchase day and such excess units shall be<br />

processed at the applicable NAV of next repurchase day.<br />

After Conversion into an open ended scheme<br />

The relevant NAV for Repurchase, Switch, Resale will be the closing NAV of the business day of receipt of the<br />

Repurchase/Switch/Sale request provided. The date of receipt of a request for fresh Sale, Repurchase, Switch will<br />

be the actual business day of the Mail receipt at any of the Authorised Investor Service Centers stated in this offering<br />

circular and / of in-person request if received upto 3.00pm on any business day.<br />

Outstation cheques/demand drafts will not be accepted at centers other than at Mumbai.<br />

Relevant NAV for subscription application received along with and outstation cheque/demand draft will be NAV of the<br />

closing of the day on which cheque/demand draft is credited to account.<br />

MINIMUM APPLICATION AMOUNT/ NUMBER OF UNITS<br />

Purchase : Rs. 5000/- and in multiples of Re. 1/- thereafter.<br />

Additional Purchase facility will be available only after the scheme converts to an open ended scheme.<br />

DESPATCH OF REPURCHASE (REDEMPTION) PROCEEDS<br />

Within 10 working days of the receipt of the redemption request at the authorized centre of the Tata Mutual Fund.<br />

BENCHMARK INDEX<br />

S & P CNX NIFTY<br />

KEY INFORMATION MEMORANDUM<br />

DIVIDEND POLICY<br />

In case of Growth Option the in<strong>com</strong>e / profits received / earned would be accumulated by the Fund as capital accretion,<br />

aimed at achieving medium to long term and also short term capital growth as reflected in the NAV. In case of <strong>Dividend</strong><br />

Option the profits received / earned and so retained and reinvested may be distributed as In<strong>com</strong>e at appropriate rates<br />

(after providing for all relevant ongoing expenses, etc.) and at appropriate intervals as may be decided by the AMC and/<br />

or Trustee Company and will be distributed to the unitholders who hold the units on the record date of declaration of the<br />

In<strong>com</strong>e. The In<strong>com</strong>e distribution warrants shall be despatched within 30 days of the declaration of the In<strong>com</strong>e. Guided<br />

by the philosophy of value-oriented returns, the Trustee Company may periodically capitalise net earnings of the Scheme<br />

(including interest in<strong>com</strong>e and realised gains on the Securities) by way of allotment/credit of bonus Units to the<br />

Unitholders Accounts in either option. The Fund reserves a right modify the periodicity and manner of payout of such<br />

dividend as they deem fit without giving any further notice to unitholders.<br />

The Fund does not assure any targeted annual return / in<strong>com</strong>e nor any capitalisation ratio. Accumulation of earnings and<br />

/ or capitalisation of bonus units and the consequent determination of NAV, may be suspended temporarily or indefinitely<br />

under any of the circumstances as stated in the clause “Suspension of Ongoing Sale, repurchase or switch of units.”<br />

<strong>Dividend</strong> Reinvestment Option :<br />

Unitholders under this Option also have the facility of reinvestment of the in<strong>com</strong>e so declared, if so desired. In<strong>com</strong>e<br />

Distribution Warrants will not be despatched to such Unitholders. The in<strong>com</strong>e declared would be reinvested in the<br />

Scheme on the immediately following ex-dividend date.<br />

M. Venugopal<br />

Tata Trustee Co. Pvt. Ltd.<br />

Tata Tax Saving Fund<br />

(An open ended equity ELSS Scheme)<br />

Period Scheme Benchmark<br />

Return (%) Return (%)<br />

Last 1 year 80.38 95.67<br />

Last 3 years 80.74 59.58<br />

Last 5 years 44.31 27.88<br />

Since Inception 30.51 13.47<br />

Past Performance may or may not be sustained in<br />

future. <strong>Dividend</strong>s are assumed to be reinvested.<br />

While calculating returns dividend distribution tax<br />

is excluded. Benchmark - BSE SENSEX<br />

Tata Select Equity Fund<br />

(An open ended equity Scheme)<br />

Period Scheme Benchmark<br />

Return (%) Return (%)<br />

Last 1 year 95.97 95.67<br />

Last 3 years 83.57 59.58<br />

Last 5 years 43.95 27.88<br />

Since Inception 23.65 12.58<br />

Past Performance may or may not be sustained in<br />

future. <strong>Dividend</strong>s are assumed to be reinvested.<br />

While calculating returns dividend distribution tax<br />

is excluded. Benchmark - BSE SENSEX<br />

NAME OF THE FUND MANAGER<br />

NAME OF THE TRUSTEE COMPANY<br />

PERFORMANCE (CAGR) AS ON 30/04/2006 OF SIMILAR SCHEMES LAUNCHED IN THE PAST<br />

Tata Pure Equity Fund<br />

(An open ended equity Scheme)<br />

Period Scheme Benchmark<br />

Return (%) Return (%)<br />

Last 1 year 94.00 95.67<br />

Last 3 years 85.49 59.58<br />

Last 5 years 41.90 27.88<br />

Since Inception 37.67 14.55<br />

Past Performance may or may not be sustained in<br />

future. <strong>Dividend</strong>s are assumed to be reinvested.<br />

While calculating returns dividend distribution tax<br />

is excluded. Benchmark - BSE SENSEX<br />

BLUE PINK

BLUE PINK<br />

Tata Equity Opportunities Fund<br />

(An open ended equity Scheme)<br />

Period Scheme Benchmark<br />

Return (%) Return (%)<br />

Last 1 year 103.79 95.67<br />

Last 3 years 94.28 59.58<br />

Last 5 years 44.86 27.88<br />

Since Inception 14.13 11.70<br />

Past Performance may or may not be sustained in<br />

future. <strong>Dividend</strong>s are assumed to be reinvested.<br />

While calculating returns dividend distribution tax<br />

is excluded. Benchmark - BSE SENSEX<br />

Tata Growth Fund<br />

(An open ended equity Scheme)<br />

Period Scheme Benchmark<br />

Return (%) Return (%)<br />

Last 1 year 72.51 95.67<br />

Last 3 years 71.30 59.58<br />

Last 5 years 41.20 27.88<br />

Since Inception 11.48 9.49<br />

Past Performance may or may not be sustained in<br />

future. <strong>Dividend</strong>s are assumed to be reinvested.<br />

While calculating returns dividend distribution tax<br />

is excluded. Benchmark - BSE SENSEX<br />

EXPENSES OF THE SCHEME<br />

NEW FUND OFFER EXPENSES<br />

The NFO expenses of the TATA EQUITY MANAGEMENT FUND, to the extent of 6% of amount mobilised will be borne<br />

by the scheme and the new fund offer expenditure in excess of the above limits shall be borne by TAML / TTCPL. NFO<br />

expenses will be borne by the scheme and amortized over a period of 18 months from the date of initial allotment.<br />

Applicable Load Structure – In respect of applications received during NFO Period<br />

Entry Load - Nil Exit Load - Nil*<br />

*An early exit charge equivalent to the unamortized new fund offer expenses will be recovered from the investor<br />

in case of redemption before expiry of 18 months from the date of allotment.<br />

Applicable Load Structure – In respect of applications received after conversion into an open ended scheme<br />

Entry Load: 1) On amount invested other than by way of a Systematic Investment Plan<br />

Entry Load: 2.25% for each investment amount less than Rs. 2 crores. Nil for each investment amount equal to or more<br />

than Rs. 2 crores.<br />

Exit Load : Nil<br />

2) On amount invested by way of a Systematic Investment Plan #<br />

Entry Load : 1% Exit Load : 1.25% if redeemed on or before expiry of 24 months from the date of allotment.<br />

If redeemed after 24 months - Nil.<br />

#<br />

Maximum SIP installment should not exceed Rs 10 lakhs during ongoing sales.<br />

No exit load shall be charged on the units subscribed by any Fund of Funds Scheme.<br />

The trustee may at their discretion change the load structure of the scheme.<br />

Recurring expenses: Limits as per Regulation 52 (6) of the SEBI (Mutual Funds) Regulations, 1996 on Annual<br />

Scheme Recurring expenses: • On the first Rs.100 Crores of the average daily net assets: 2.50% • On the next<br />

Rs.300 Crores of the average daily net assets: 2.25% • On the next Rs.300 Crores of the average daily net assets:<br />

2.00% • On the balance of the assets: 1.75%<br />

TAX TREATMENT OF INVESTMENTS IN MUTUAL FUNDS<br />

TAX TREATMENT OF INVESTMENTS IN MUTUAL FUNDS<br />

Certain tax benefits as described below are available, under present taxation laws to the Unitholders holding the Units<br />

as an investment. The information set out below is included for general information purposes only and does not<br />

constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to<br />

consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the<br />

Scheme. In<strong>com</strong>e Tax benefits to the mutual fund and to the unitholder is in accordance with the prevailing tax laws<br />

as certified by the mutual funds tax consultant.<br />

i. TAX BENEFITS TO THE MUTUAL FUND<br />

Tata Mutual Fund is a Mutual Fund registered with the Securities and Exchange Board of India and hence the entire<br />

in<strong>com</strong>e of the Fund will be exempt from in<strong>com</strong>e-tax in accordance with the provisions of Section 10(23D) of the<br />

In<strong>com</strong>e-tax Act, 1961 (the Act).<br />

The Fund is entitled to receive all in<strong>com</strong>e without any deduction of tax at source under the provisions of Section<br />

196(iv), of the Act.<br />

However, as per the taxation laws in force, read with Chapter VII of the Finance (No. 2) Act, 2004 pertaining to<br />

<strong>Dividend</strong> Distribution Tax, it is provided that on in<strong>com</strong>e distribution, if any, made by the Fund, on or after 1 April, 2004,<br />

to its Unitholders, being Individuals and Hindu Undivided Family, in<strong>com</strong>e-tax will be payable under Section 115R of<br />