OFFER DOCUMENT

Balanced Offer Document - Appuonline.com

Balanced Offer Document - Appuonline.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

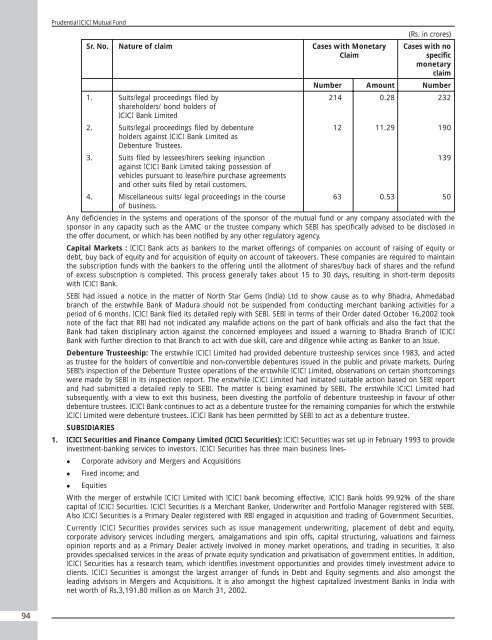

Prudential ICICI Mutual Fund<br />

(Rs. in crores)<br />

Sr. No. Nature of claim Cases with Monetary Cases with no<br />

Claim<br />

specific<br />

monetary<br />

claim<br />

Number Amount Number<br />

1. Suits/legal proceedings filed by 214 0.28 232<br />

shareholders/ bond holders of<br />

ICICI Bank Limited<br />

2. Suits/legal proceedings filed by debenture 12 11.29 190<br />

holders against ICICI Bank Limited as<br />

Debenture Trustees.<br />

3. Suits filed by lessees/hirers seeking injunction 139<br />

against ICICI Bank Limited taking possession of<br />

vehicles pursuant to lease/hire purchase agreements<br />

and other suits filed by retail customers.<br />

4. Miscellaneous suits/ legal proceedings in the course 63 0.53 50<br />

of business.<br />

Any deficiencies in the systems and operations of the sponsor of the mutual fund or any company associated with the<br />

sponsor in any capacity such as the AMC or the trustee company which SEBI has specifically advised to be disclosed in<br />

the offer document, or which has been notified by any other regulatory agency.<br />

Capital Markets : ICICI Bank acts as bankers to the market offerings of companies on account of raising of equity or<br />

debt, buy back of equity and for acquisition of equity on account of takeovers. These companies are required to maintain<br />

the subscription funds with the bankers to the offering until the allotment of shares/buy back of shares and the refund<br />

of excess subscription is completed. This process generally takes about 15 to 30 days, resulting in short-term deposits<br />

with ICICI Bank.<br />

SEBI had issued a notice in the matter of North Star Gems (India) Ltd to show cause as to why Bhadra, Ahmedabad<br />

branch of the erstwhile Bank of Madura should not be suspended from conducting merchant banking activities for a<br />

period of 6 months. ICICI Bank filed its detailed reply with SEBI. SEBI in terms of their Order dated October 16,2002 took<br />

note of the fact that RBI had not indicated any malafide actions on the part of bank officials and also the fact that the<br />

Bank had taken disciplinary action against the concerned employees and issued a warning to Bhadra Branch of ICICI<br />

Bank with further direction to that Branch to act with due skill, care and diligence while acting as Banker to an Issue.<br />

Debenture Trusteeship: The erstwhile ICICI Limited had provided debenture trusteeship services since 1983, and acted<br />

as trustee for the holders of convertible and non-convertible debentures issued in the public and private markets. During<br />

SEBI’s inspection of the Debenture Trustee operations of the erstwhile ICICI Limited, observations on certain shortcomings<br />

were made by SEBI in its inspection report. The erstwhile ICICI Limited had initiated suitable action based on SEBI report<br />

and had submitted a detailed reply to SEBI. The matter is being examined by SEBI. The erstwhile ICICI Limited had<br />

subsequently, with a view to exit this business, been divesting the portfolio of debenture trusteeship in favour of other<br />

debenture trustees. ICICI Bank continues to act as a debenture trustee for the remaining companies for which the erstwhile<br />

ICICI Limited were debenture trustees. ICICI Bank has been permitted by SEBI to act as a debenture trustee.<br />

SUBSIDIARIES<br />

1. ICICI Securities and Finance Company Limited (ICICI Securities): ICICI Securities was set up in February 1993 to provide<br />

investment-banking services to investors. ICICI Securities has three main business linesl<br />

Corporate advisory and Mergers and Acquisitions<br />

l Fixed income; and<br />

l Equities<br />

With the merger of erstwhile ICICI Limited with ICICI bank becoming effective, ICICI Bank holds 99.92% of the share<br />

capital of ICICI Securities. ICICI Securities is a Merchant Banker, Underwriter and Portfolio Manager registered with SEBI.<br />

Also ICICI Securities is a Primary Dealer registered with RBI engaged in acquisition and trading of Government Securities.<br />

Currently ICICI Securities provides services such as issue management underwriting, placement of debt and equity,<br />

corporate advisory services including mergers, amalgamations and spin offs, capital structuring, valuations and fairness<br />

opinion reports and as a Primary Dealer actively involved in money market operations, and trading in securities. It also<br />

provides specialised services in the areas of private equity syndication and privatisation of government entities. In addition,<br />

ICICI Securities has a research team, which identifies investment opportunities and provides timely investment advice to<br />

clients. ICICI Securities is amongst the largest arranger of funds in Debt and Equity segments and also amongst the<br />

leading advisors in Mergers and Acquisitions. It is also amongst the highest capitalized Investment Banks in India with<br />

net worth of Rs.3,191.80 million as on March 31, 2002.<br />

94