DEVELOPMENT

The pdf-version - Eesti Koostöö Kogu

The pdf-version - Eesti Koostöö Kogu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

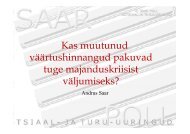

Table 4.5.4<br />

Comparison of the indices of innovation capacity and<br />

business sophistication<br />

Innovation<br />

capacity<br />

High<br />

Middle<br />

Innovation<br />

capacity<br />

better than<br />

business<br />

sophistication<br />

Finland<br />

Taiwan<br />

Israel<br />

Singapore<br />

South Korea<br />

Canada<br />

New Zealand<br />

Estonia<br />

Hungary<br />

Costa Rica<br />

Business<br />

sophistication<br />

better than<br />

innovation<br />

capacity<br />

Netherlands<br />

Austria<br />

Chile<br />

Low Uruguay Slovakia<br />

Both almost<br />

equal<br />

Switzerland<br />

Denmark<br />

Ireland<br />

Czech Republic<br />

Slovenia<br />

nies in Costa Rica are able to make use of their international<br />

competitive advantage, which is apparently their<br />

relatively inexpensive production location, which is close<br />

to the U.S. markets; the utilisation of top tech nology is<br />

also rated as being quite good. Chile stands out primarily<br />

for its good marketing skills and the existence of clusters.<br />

In all the Asian states in the sample, their positions<br />

are better in the innovation index than in the BSI,<br />

but as a rule, their business sophistication indicators<br />

are high. Singapore lags behind the others as far as the<br />

quantity of local suppliers (caused by the small size of<br />

the state) and the strong role of foreign participation in<br />

the state’s economy. South Korea has very good indicators<br />

related to the position of its companies in the value<br />

chain and control of distribution channels. However,<br />

the WEF methodology does not want to accept South<br />

Korea’s closed cooperative system of monopoly conglomerates<br />

(chaebols), and punishes it with low marks for the<br />

state’s decentralisation capability, which reduces South<br />

Korea’s general BSI rating. As a whole, the business<br />

enterprises in the selected Asian countries, except for<br />

the companies in Taiwan, have relatively strong control<br />

over the entire value chain, and they all use the world’s<br />

top technology. In this group of states, the development<br />

of clusters is especially essential in Taiwan and Singapore.<br />

It would be beneficial for Estonia to investigate this<br />

concrete business development.<br />

In Table 4.5.4, we see that the majority of the states<br />

in our sample get a better assessment in the innovation<br />

index, than in the BSI. It can be assumed that the reason<br />

for this is the singularity of our sample – the sample is<br />

dominated by small states. In large states, like the U.S.,<br />

Japan and Germany, there are definitely better opportunities<br />

for controlling the value chain and for using local<br />

suppliers. One can also assume that developing business<br />

networks takes more time than the development of innovation<br />

potential, and that government policies have less<br />

of an impact on them.<br />

In Table 4.5.4, we can see that the business sophistication<br />

index is positively impacted by a country’s geographical/logistical<br />

position. The geographical location of<br />

the Netherlands, Austria or the Czech Republic is definitely<br />

more favourable for appropriating key positions in<br />

the value chain, than are the locations of Estonia or New<br />

Zealand. But this cannot be changed. Insofar that it is<br />

clear that poor positioning in business networks limits<br />

the possibilities for making one’s economy more innovative,<br />

Estonia must look for answers for how to compensate<br />

for this shortcoming.<br />

The first possibility is to have Estonia’s companies<br />

appropriate positions in servicing and processing the<br />

goods and raw materials flows that, for rational logistical<br />

reasons, tend to cross the territory of our state – for<br />

instance the transport and processing of goods and raw<br />

materials related to Finland and Russia. However, this<br />

presupposes the establishment of appropriate transport<br />

channels (for example, Rail Baltic) and the development<br />

of a business-friendly climate in foreign policy. The<br />

second possibility would be a more purposeful national<br />

policy for cluster creation. And the third possibility, a<br />

policy for attracting foreign high tech firms to the country,<br />

which would encompass the development of collaboration<br />

networks that involve domestic companies, right<br />

from the start.<br />

4.5.4<br />

Foreign versus domestic capital<br />

The reference states can be generally divided into two<br />

groups: the ones whose economic development has<br />

occurred based primarily on domestic capital, and those<br />

that have developed with the help of foreign investments.<br />

The most conspicuous examples of countries in<br />

the first group are Austria and Switzerland; the most significant<br />

representatives of the second group are Slovakia,<br />

the Czech Republic and Hungary.<br />

Most of the countries with highly developed economies<br />

belong to the first group. The exception is Ireland,<br />

where the strong development is based on foreign investments.<br />

Canada and New Zealand comprise an interim<br />

group, since the control of their distribution channels<br />

tends to be in the hands of foreigners, to a fairly large<br />

extent. Of the CEE countries, only Slovenia belongs to the<br />

first group, all the other countries in the sample belong<br />

to the second group, some even in an extreme manner.<br />

Of the comparative group of Latin American countries,<br />

Chile belongs to the first group, while Costa Rica and<br />

Uruguay are, rather, in the second group. However, none<br />

of these classifications are of an extreme nature. Of the<br />

Asian countries in the comparative group, Singapore,<br />

quite clearly, belongs to the second group. The other<br />

Asian countries in the sample belong to first group.<br />

A weakness of the development that is based on<br />

foreign investments is the risk that foreign-owned companies<br />

tend to bring less sophisticated and cheaper functions<br />

to the destination state, while the functions at the<br />

top of the value chain, as well as the more complex and<br />

expensive production, tends to remain in the country of<br />

origin. Based on our sample, we will examine whether<br />

this risk is actually realised, by using the indicators for<br />

value chain breadth and the complexity of the production<br />

processes to find the answer. Since the correlation<br />

between these indicators is quite high, we arrive at the<br />

following three classifications:<br />

Estonian Human Development Report 2012/2013<br />

185