FSA Annual Report 2006/07 - Better Regulation Ltd

FSA Annual Report 2006/07 - Better Regulation Ltd FSA Annual Report 2006/07 - Better Regulation Ltd

Section five – Financial statements FSA Annual Report 2006/07 79 2007 Wholesale & Retail Regulatory Corporate Total for Year ended 31 March 2007 Institutional Markets Services Services continuing Markets and Board operations £m £m £m £m £m Revenue Fees 282.1 282.1 Sundry income 7.0 1.3 17.0 0.7 26.0 Result Segmental surplus/(deficit) (69.9) (102.8) 244.3 (59.3) 12.3 Investment revenues 5.1 Other net finance (cost)/income 1.0 Surplus before tax 18.4 Income tax expense (1.5) Surplus for year 16.9 Other information Capital additions: Tangible 7.9 7.9 Intangible 10.3 10.3 Depreciation (9.1) (9.1) Amortisation (5.3) (5.3) Trade receivables impairment losses recognised (0.6) (0.6) Current and past pension service costs (2.1) (2.8) (2.9) (1.9) (9.7) 2006 (Restated) Year ended 31 March 2006 Revenue Fees 265.1 265.1 Sundry income 5.5 0.9 13.0 3.4 22.8 Result Segmental surplus/(deficit) (64.1) (96.0) 231.9 (66.6) 5.2 Investment income 4.4 Other net finance (cost)/income (0.8) Surplus before tax 8.8 Income tax expense (1.3) Surplus for year 7.5 Other information Capital additions: Tangible 6.1 6.1 Intangible 4.5 4.5 Depreciation (8.7) (8.7) Amortisation (5.3) (5.3) Trade receivables impairment losses (0.7) (0.7) Current and past pension service costs (1.8) (2.4) (2.7) (1.6) (8.5)

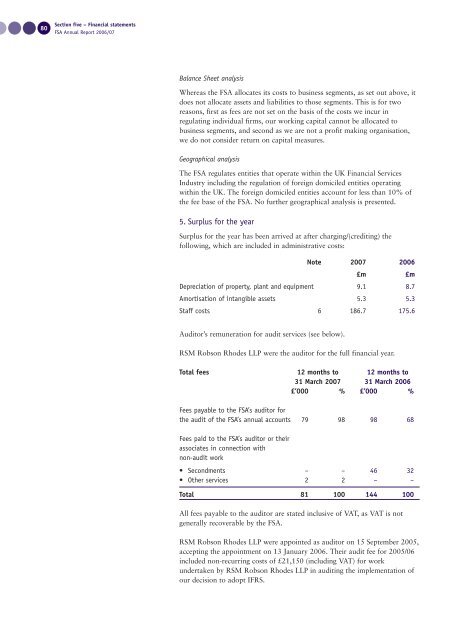

80 Section five – Financial statements FSA Annual Report 2006/07 Balance Sheet analysis Whereas the FSA allocates its costs to business segments, as set out above, it does not allocate assets and liabilities to those segments. This is for two reasons, first as fees are not set on the basis of the costs we incur in regulating individual firms, our working capital cannot be allocated to business segments, and second as we are not a profit making organisation, we do not consider return on capital measures. Geographical analysis The FSA regulates entities that operate within the UK Financial Services Industry including the regulation of foreign domiciled entities operating within the UK. The foreign domiciled entities account for less than 10% of the fee base of the FSA. No further geographical analysis is presented. 5. Surplus for the year Surplus for the year has been arrived at after charging/(crediting) the following, which are included in administrative costs: Note 2007 2006 £m £m Depreciation of property, plant and equipment 9.1 8.7 Amortisation of intangible assets 5.3 5.3 Staff costs 6 186.7 175.6 Auditor’s remuneration for audit services (see below). RSM Robson Rhodes LLP were the auditor for the full financial year. Total fees 12 months to 12 months to 31 March 2007 31 March 2006 £’000 % £’000 % Fees payable to the FSA’s auditor for the audit of the FSA’s annual accounts 79 98 98 68 Fees paid to the FSA’s auditor or their associates in connection with non-audit work • Secondments – – 46 32 • Other services 2 2 – – Total 81 100 144 100 All fees payable to the auditor are stated inclusive of VAT, as VAT is not generally recoverable by the FSA. RSM Robson Rhodes LLP were appointed as auditor on 15 September 2005, accepting the appointment on 13 January 2006. Their audit fee for 2005/06 included non-recurring costs of £21,150 (including VAT) for work undertaken by RSM Robson Rhodes LLP in auditing the implementation of our decision to adopt IFRS.

- Page 29 and 30: 28 Section two - Helping retail con

- Page 31 and 32: 30 Section two - Helping retail con

- Page 33 and 34: 32 Section two - Helping retail con

- Page 35: 34 Section two - Helping retail con

- Page 39 and 40: 38 Section three - Improving our bu

- Page 41 and 42: 40 Section three - Improving our bu

- Page 43 and 44: 42 Section three - Improving our bu

- Page 46 and 47: Section four - Financial review FSA

- Page 48 and 49: Section four - Financial review FSA

- Page 50 and 51: Section four - Financial review FSA

- Page 52: Section four - Financial review FSA

- Page 55 and 56: 54 Section five - The Board of the

- Page 57 and 58: 56 Section five - Report of the Dir

- Page 59 and 60: 58 Section five - Report of the Dir

- Page 61 and 62: 60 Section five - Corporate governa

- Page 63 and 64: 62 Section five - Corporate governa

- Page 65 and 66: 64 Section five - Corporate governa

- Page 67 and 68: 66 Section five - Corporate governa

- Page 69 and 70: 68 Section five - Report of the ind

- Page 71 and 72: 70 Section five - Financial stateme

- Page 73 and 74: 72 Section five - Financial stateme

- Page 75 and 76: 74 Section five - Financial stateme

- Page 77 and 78: 76 Section five - Financial stateme

- Page 79: 78 Section five - Financial stateme

- Page 83 and 84: 82 Section five - Financial stateme

- Page 85 and 86: 84 Section five - Financial stateme

- Page 87 and 88: 86 Section five - Financial stateme

- Page 89 and 90: 88 Section five - Financial stateme

- Page 91 and 92: 90 Section five - Financial stateme

- Page 93 and 94: 92 Section five - Financial stateme

- Page 95 and 96: 94 Section five - Financial stateme

- Page 97 and 98: 96 Section five - Statement of allo

- Page 99 and 100: 98 Section five - Statement of allo

- Page 101 and 102: 100 Appendices FSA Annual Report 20

- Page 103 and 104: 102 Section six - Appendices Append

- Page 105 and 106: Section six - Appendices Appendix 2

- Page 107 and 108: Section six - Appendices Appendix 2

- Page 109 and 110: Section six - Appendices Appendix 2

- Page 111 and 112: Section six - Appendices Appendix 2

- Page 113 and 114: Section six - Appendices Appendix 2

- Page 115 and 116: Section six - Appendices Appendix 2

- Page 117 and 118: Section six - Appendices Appendix 2

- Page 119 and 120: Section six - Appendices Appendix 2

- Page 121 and 122: Section six - Appendices Appendix 2

- Page 123 and 124: Section six - Appendices Appendix 2

- Page 125 and 126: Section six - Appendices Appendix 3

- Page 127 and 128: Section six - Appendices Appendix 3

- Page 129 and 130: Section six - Appendices Appendix 5

80<br />

Section five – Financial statements<br />

<strong>FSA</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

Balance Sheet analysis<br />

Whereas the <strong>FSA</strong> allocates its costs to business segments, as set out above, it<br />

does not allocate assets and liabilities to those segments. This is for two<br />

reasons, first as fees are not set on the basis of the costs we incur in<br />

regulating individual firms, our working capital cannot be allocated to<br />

business segments, and second as we are not a profit making organisation,<br />

we do not consider return on capital measures.<br />

Geographical analysis<br />

The <strong>FSA</strong> regulates entities that operate within the UK Financial Services<br />

Industry including the regulation of foreign domiciled entities operating<br />

within the UK. The foreign domiciled entities account for less than 10% of<br />

the fee base of the <strong>FSA</strong>. No further geographical analysis is presented.<br />

5. Surplus for the year<br />

Surplus for the year has been arrived at after charging/(crediting) the<br />

following, which are included in administrative costs:<br />

Note 20<strong>07</strong> <strong>2006</strong><br />

£m £m<br />

Depreciation of property, plant and equipment 9.1 8.7<br />

Amortisation of intangible assets 5.3 5.3<br />

Staff costs 6 186.7 175.6<br />

Auditor’s remuneration for audit services (see below).<br />

RSM Robson Rhodes LLP were the auditor for the full financial year.<br />

Total fees 12 months to 12 months to<br />

31 March 20<strong>07</strong> 31 March <strong>2006</strong><br />

£’000 % £’000 %<br />

Fees payable to the <strong>FSA</strong>’s auditor for<br />

the audit of the <strong>FSA</strong>’s annual accounts 79 98 98 68<br />

Fees paid to the <strong>FSA</strong>’s auditor or their<br />

associates in connection with<br />

non-audit work<br />

• Secondments – – 46 32<br />

• Other services 2 2 – –<br />

Total 81 100 144 100<br />

All fees payable to the auditor are stated inclusive of VAT, as VAT is not<br />

generally recoverable by the <strong>FSA</strong>.<br />

RSM Robson Rhodes LLP were appointed as auditor on 15 September 2005,<br />

accepting the appointment on 13 January <strong>2006</strong>. Their audit fee for 2005/06<br />

included non-recurring costs of £21,150 (including VAT) for work<br />

undertaken by RSM Robson Rhodes LLP in auditing the implementation of<br />

our decision to adopt IFRS.