azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NEWHORIZON Shawwal–Dhu Al Hijjah 1429<br />

INNOVATION SPOTLIGHT<br />

Islamic wealth management industry over<br />

the next several years.<br />

These strategies should be transparent <strong>and</strong><br />

made available in the form of capitalprotected<br />

certificates which, in the event of<br />

a collapse of the issuer or a malfunction of<br />

the strategy, have the ability to offer 100<br />

per cent redemption by adopting a strict<br />

segregation of the Islamic principal via an<br />

Islamic trust, which in turn invests in<br />

Shari’ah-compliant assets only. This<br />

certificate must be offered at competitive<br />

levels in an attempt to rival their<br />

conventional counterparts <strong>and</strong> be made<br />

available in the secondary <strong>market</strong> at<br />

reasonable bid/offer spreads. Target<br />

investors should include retail, private <strong>and</strong><br />

institutional clients.<br />

One such Islamic dynamic strategy is the<br />

‘Islamic Navigator’, which invests in four<br />

Shari’ah-compliant assets based on an<br />

algorithm that identifies medium-term<br />

trends in these assets. The trend is identified<br />

by comparing the prevailing spot price of<br />

the asset to its recent moving average. The<br />

length of the moving average may vary for<br />

each asset <strong>and</strong> can be optimised based on<br />

historical simulations. Should the algorithm<br />

detect a positive trend (i.e. when spot price<br />

is above the moving average) for an asset,<br />

a fixed allocation is provided to that asset.<br />

In the event of a negative trend being<br />

detected, the allocation for the asset is<br />

directed to a commodity-based reserve asset.<br />

The shift in these weightings is conducted<br />

on a monthly basis. The initial result is a<br />

dynamic index linked to a number of<br />

underlying assets.<br />

The strategy is then controlled through a<br />

volatility stabilisation mechanism, which<br />

employs a ‘dynamic participation’ level<br />

based on the volatility of the initial index.<br />

Should the index observe high short-term<br />

volatility, the mechanism reduces exposure<br />

to the index, <strong>and</strong> vice versa. In effect, the<br />

strategy targets a certain st<strong>and</strong>ard deviation<br />

from the average daily returns by decreasing<br />

or increasing the exposure to the index.<br />

Hence, the volatility is ex ante defined <strong>and</strong><br />

is measurable at the outset, which is unusual<br />

for Islamic strategies.<br />

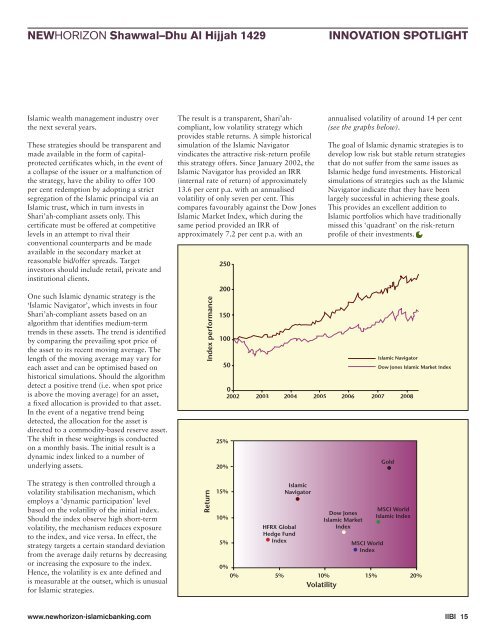

The result is a transparent, Shari’ahcompliant,<br />

low volatility strategy which<br />

provides stable returns. A simple historical<br />

simulation of the Islamic Navigator<br />

vindicates the attractive risk-return profile<br />

this strategy offers. Since January 2002, the<br />

Islamic Navigator has provided an IRR<br />

(internal rate of return) of approximately<br />

13.6 per cent p.a. with an annualised<br />

volatility of only seven per cent. This<br />

compares favourably against the Dow Jones<br />

Islamic Market Index, which during the<br />

same period provided an IRR of<br />

approximately 7.2 per cent p.a. with an<br />

annualised volatility of around 14 per cent<br />

(see the graphs below).<br />

The goal of Islamic dynamic strategies is to<br />

develop low risk but stable return strategies<br />

that do not suffer from the same issues as<br />

Islamic hedge fund investments. Historical<br />

simulations of strategies such as the Islamic<br />

Navigator indicate that they have been<br />

largely successful in achieving these goals.<br />

This provides an excellent addition to<br />

Islamic portfolios which have traditionally<br />

missed this ‘quadrant’ on the risk-return<br />

profile of their investments.<br />

www.newhorizon-<strong>islamic</strong><strong>banking</strong>.com IIBI 15