14.12 Game Theory â Final Instructions. This is an ... - DSpace@MIT

14.12 Game Theory â Final Instructions. This is an ... - DSpace@MIT

14.12 Game Theory â Final Instructions. This is an ... - DSpace@MIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

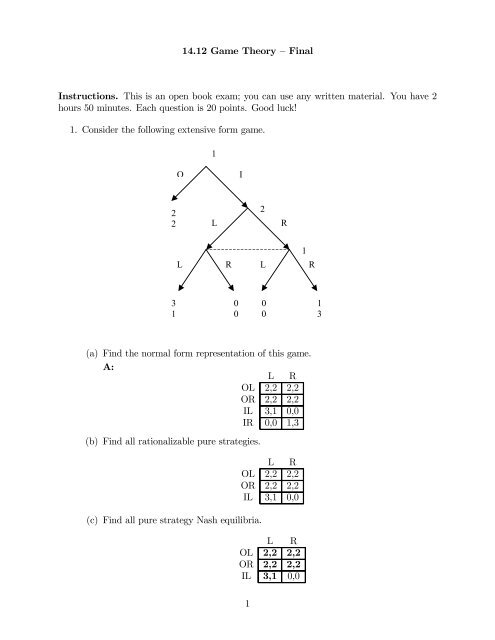

<strong>14.12</strong> <strong>Game</strong> <strong>Theory</strong> — <strong>Final</strong><br />

<strong>Instructions</strong>. <strong>Th<strong>is</strong></strong> <strong>is</strong> <strong>an</strong> open book exam; you c<strong>an</strong> use <strong>an</strong>y written material. You have 2<br />

hours 50 minutes. Each question <strong>is</strong> 20 points. Good luck!<br />

1. Consider the following extensive form game.<br />

1<br />

O<br />

I<br />

2<br />

2<br />

L<br />

2<br />

R<br />

1<br />

L<br />

R<br />

L<br />

R<br />

3 <br />

1 <br />

0<br />

0<br />

0<br />

0<br />

1<br />

3<br />

(a) Find the normal form representation of th<strong>is</strong> game.<br />

A:<br />

L R<br />

OL 2,2 2,2<br />

OR 2,2 2,2<br />

IL 3,1 0,0<br />

IR 0,0 1,3<br />

(b) Find all rationalizable pure strategies.<br />

OL<br />

OR<br />

IL<br />

L R<br />

2,2 2,2<br />

2,2 2,2<br />

3,1 0,0<br />

(c) Find all pure strategy Nash equilibria.<br />

OL<br />

OR<br />

IL<br />

L R<br />

2,2 2,2<br />

2,2 2,2<br />

3,1 0,0<br />

1

(d) Which strategies are cons<strong>is</strong>tent with all of the following assumptions?<br />

(i) 1 <strong>is</strong> rational.<br />

(ii) 2 <strong>is</strong> sequentially rational.<br />

(iii) at the node she moves, 2 knows (i).<br />

(iv) 1 knows (ii) <strong>an</strong>d (iii).<br />

ANSWER: By (i) 1 does not play IR. Hence, by (iii), at the node she moves, 2<br />

knows that 1 does not play IR, hence he knows IL. Then, by (ii), 2 must play L.<br />

Therefore, by (i) <strong>an</strong>d (iv), 1 must play IL. The <strong>an</strong>swer <strong>is</strong> (IL,L).<br />

2. <strong>Th<strong>is</strong></strong> question <strong>is</strong> about a milkm<strong>an</strong> <strong>an</strong>d a customer. At <strong>an</strong>y day, with the given order,<br />

• Milkm<strong>an</strong> puts m ∈ [0, 1] liter of milk <strong>an</strong>d 1 − m liter of water in a container <strong>an</strong>d<br />

closes the container, incurring cost cm for some c > 0;<br />

• Customer, without knowing m, decides on whether or not to buy the liquid at<br />

some price p. If she buys, her payoff <strong>is</strong> vm − p <strong>an</strong>d the milkm<strong>an</strong>’s payoff <strong>is</strong> p − cm.<br />

If she does not buy, she gets 0, <strong>an</strong>d the milkm<strong>an</strong> gets −cm. If she buys, then she<br />

learns m.<br />

(a) Assume that th<strong>is</strong> <strong>is</strong> repeated for 100 days, <strong>an</strong>d each player tries to maximize the<br />

sum of h<strong>is</strong> or her stage payoffs. Find all subgame-perfect equilibria of th<strong>is</strong> game.<br />

ANSWER: The stage game has a unique Nash equilibrium, in which m = 0 <strong>an</strong>d<br />

the customer does not buy. Therefore, th<strong>is</strong> finitely repeated game has a unique<br />

subgame-perfect equilibrium, in which the stage equilibrium <strong>is</strong> repeated.<br />

(b) Now assume that th<strong>is</strong> <strong>is</strong> repeated infinitely m<strong>an</strong>y times <strong>an</strong>d each player tries to<br />

maximize the d<strong>is</strong>counted sum of h<strong>is</strong> or her stage payoffs, where d<strong>is</strong>count rate <strong>is</strong><br />

δ ∈ (0, 1). What <strong>is</strong> the r<strong>an</strong>ge of prices p for which there ex<strong>is</strong>ts a subgame perfect<br />

equilibrium such that, everyday, the milkm<strong>an</strong> chooses m = 1,<strong>an</strong>d the customer<br />

buys on the path of equilibrium play?<br />

ANSWER: The milkm<strong>an</strong> c<strong>an</strong> guar<strong>an</strong>tee himself 0 by always choosing m = 0.<br />

Hence, h<strong>is</strong> continuation value at <strong>an</strong>y h<strong>is</strong>tory must be at least 0. Hence, in the<br />

worst equilibrium, if he deviates customer should not buy milk forever, giving the<br />

milkm<strong>an</strong> exactly 0 as the continuation value. Hence, the SPE we are looking for<br />

<strong>is</strong> the milkm<strong>an</strong> always chooses m=1 <strong>an</strong>d the customer buys until <strong>an</strong>yone deviates,<br />

<strong>an</strong>d the milkm<strong>an</strong> chooses m=0 <strong>an</strong>d the customer does not buy thereafter. If the<br />

milkm<strong>an</strong> does not deviate, h<strong>is</strong> continuation value will be<br />

p − c<br />

V = .<br />

1 − δ<br />

The best deviation for him (at <strong>an</strong>y h<strong>is</strong>tory on the path of equilibrium play) <strong>is</strong> to<br />

choose m = 0 (<strong>an</strong>d not being able to sell thereafter). In that case, he will get<br />

V d = p + δ0 = p.<br />

In order th<strong>is</strong> to be <strong>an</strong> equilibrium, we must have V ≥ V d ; i.e.,<br />

p − c ≥ p,<br />

1 − δ<br />

2

i.e.,<br />

c<br />

p ≥ .<br />

δ<br />

In order that the customer buy on the equilibrium path, we must also have p ≤ v.<br />

Therefore,<br />

c<br />

v ≥ p ≥ .<br />

δ<br />

3. For the game in question 2.a, assume that with probability 0.001, milkm<strong>an</strong> strongly<br />

believes that there <strong>is</strong> some entity who knows what the milkm<strong>an</strong> does <strong>an</strong>d will pun<strong>is</strong>h<br />

him severely on the day 101 for each day the milkm<strong>an</strong> dilutes the milk (by choosing<br />

m< 1). Call th<strong>is</strong> type irrational. Assume that th<strong>is</strong> <strong>is</strong> common knowledge. For some<br />

v>p > c, find a perfect Bayesi<strong>an</strong> equilibrium of th<strong>is</strong> game. [If you find it easier,<br />

take the customers at different dates different, but assume that each customer knows<br />

whatever the previous customers knew.]<br />

ANSWER: [It <strong>is</strong> very difficult to give a rigorous <strong>an</strong>swer to th<strong>is</strong> question,<br />

so you would get a big partial grade for <strong>an</strong> informal <strong>an</strong>swer that shows<br />

that you underst<strong>an</strong>d the reputation from <strong>an</strong> incomplete-information point<br />

of view.] Irrational type always sets m = 1. Since he will be detected whenever he<br />

sets m < 1 <strong>an</strong>d the customer buys, the rational type will set either m = 1 or m = 0.<br />

We are looking for <strong>an</strong> equilibrium in which early in the relation the rational milkm<strong>an</strong><br />

will always set m = 1 <strong>an</strong>d the customer will always buy, but near the end of the relation<br />

the rational milkm<strong>an</strong> will mix between m = 1 <strong>an</strong>d m = 0, <strong>an</strong>d the customer will mix<br />

between buy <strong>an</strong>d not buy.<br />

In th<strong>is</strong> equilibrium, if the milkm<strong>an</strong> sets m < 1 or the customer does not buy at <strong>an</strong>y<br />

t, then the rational milkm<strong>an</strong> sets m = 0 at each s >t. In that case, if in addition the<br />

costumer buys at some dates in the period {t +1,t +2,...,s − 1} <strong>an</strong>d if the milkm<strong>an</strong><br />

chooses m = 1 at each of those days, then the costumer will assign probability 1 to<br />

that the milkm<strong>an</strong> <strong>is</strong> irrational <strong>an</strong>d buy the milk at s; otherw<strong>is</strong>e, he will not buy the<br />

milk. On the path of such play, if the milkm<strong>an</strong> sets m < 1 or the customer does not<br />

buy at <strong>an</strong>y t, then the rational milkm<strong>an</strong> sets m = 0 <strong>an</strong>d the costumer does not buy at<br />

each s >t. In order th<strong>is</strong> to be <strong>an</strong> equilibrium, the probability µ t that the milkm<strong>an</strong> <strong>is</strong><br />

irrational at such h<strong>is</strong>tory must sat<strong>is</strong>fy<br />

µ t (100 − t)(v − p) − (1 − µ t ) p ≤ 0,<br />

where the first term <strong>is</strong> the expected benefit from experimenting (if the milkm<strong>an</strong> happens<br />

to be irrational) <strong>an</strong>d the second term <strong>is</strong> the cost (if he <strong>is</strong> rational). That <strong>is</strong>,<br />

p<br />

µ t ≤ .<br />

p +(100 − t)(v − p)<br />

Now we determine what happens if the milkm<strong>an</strong> has always been setting m = 1,<br />

<strong>an</strong>d the customer has been buying. In the last date, the rational type will set m = 0,<br />

<strong>an</strong>d the rational type will set m = 1; hence, the buyer will buy iff<br />

µ 100 (v − p) − (1 − µ 100 ) p ≥ 0,<br />

3

i.e.,<br />

µ 100 ≥ p .<br />

v<br />

Since we w<strong>an</strong>t him to mix, we set<br />

p<br />

µ 100 = .<br />

v<br />

We derive µ t for previous dates using the Bayes’ rule <strong>an</strong>d the indifference condition<br />

necessary for the customer’s mixing. Let’s write α t for the probability that the rational<br />

milkm<strong>an</strong> sets m = 1 at t, <strong>an</strong>d a t = µ t +(1 − µ t ) α t for the total probability that m = 1<br />

at date t. Since the customer will be indifferent between buying <strong>an</strong>d not buying at<br />

t +1, h<strong>is</strong> expected payoff at t +1 will be 0. Hence, h<strong>is</strong> expected payoff from buying at<br />

t <strong>is</strong><br />

a t (v − p)+(1 − a t )(−p) .<br />

For indifference, th<strong>is</strong> must be equal to zero, thus<br />

On the other h<strong>an</strong>d, by Bayes’ rule,<br />

p<br />

a t = .<br />

v<br />

µ t<br />

µ t+1 = .<br />

a t<br />

Therefore,<br />

That <strong>is</strong>,<br />

p<br />

µ t = a t µ t+1 = µ t+1 .<br />

v<br />

p<br />

µ 100 =<br />

v ³ ´<br />

µ 99 =<br />

v<br />

³ ´<br />

µ 98 =<br />

v<br />

p 2<br />

p 3<br />

Note that<br />

p<br />

− µ v t<br />

a t = = µ t +(1 − µ t ) α t ⇒ α t = .<br />

v<br />

1 − µ t<br />

Assume that (p/v) 100 < 0.001. Then, we will have a date t ∗ such that<br />

³ ´ ∗ ³ ´ ∗<br />

p 101−t<br />

p<br />

< 0.001 < 100−t<br />

.<br />

v<br />

v<br />

∗<br />

At each date t>t , we will have µ t =(p/v) 101−t <strong>an</strong>d the players will mix so that<br />

p<br />

∗<br />

a t = . At each date t

hence<br />

0.001<br />

a t ∗ = ¡ p<br />

¢ 100−t ∗ .<br />

∗<br />

Note that a t ∗ >p/v, hence the customer will certainly buy at t .<br />

v<br />

Let’s write β t for the probability that the customer will buy at day t. In the day<br />

99, if the rational milkm<strong>an</strong> sets m = 1,he will get<br />

U = β 99 (p − c)+ β 99 β 100 p +(1 − β 99 )(−c) ,<br />

where the first term <strong>is</strong> the profit from selling at day 99, the second term <strong>is</strong> the profit<br />

from day 100 (when he will set m = 0), <strong>an</strong>d the last term <strong>is</strong> the loss if the customer<br />

does not buy at day 99. If he sets m = 0,he will get β 99 p (from the sale at 99, <strong>an</strong>d<br />

will get zero thereafter). Hence, he will set m = 1 iff<br />

i.e.,<br />

β 99 (p − c)+ β 99 β 100 p +(1 − β 99 )(−c) ≥ β 99 p<br />

c<br />

β 99 β 100 ≥ .<br />

p<br />

We are looking for <strong>an</strong> indifference, hence we set<br />

c<br />

β 99 β 100 = .<br />

p<br />

Similarly, at day 98 the rational milkm<strong>an</strong> will set m = 1 iff<br />

β 98 (p − c)+ β 98 β 99 p +(1 − β 98 )(−c) ≥ β 98 p,<br />

where the second term <strong>is</strong> due to the fact that at date 99 he will be indifferent between<br />

choosing m = 0 <strong>an</strong>d m = 1.For indifference, we set<br />

c<br />

β 98 β 99 = .<br />

p<br />

We will continue on like th<strong>is</strong> as long as we need the milkm<strong>an</strong> to mix. That <strong>is</strong>, we will<br />

have<br />

β t ∗ β t ∗ +1 =<br />

β t ∗ +1β t ∗ +2 =<br />

c ,<br />

p<br />

c ,<br />

p<br />

β 98 β 99 =<br />

β 99 β 100 =<br />

. c ,<br />

p<br />

c .<br />

p<br />

5

As we noted before, β t ∗ =1. Hence, β t ∗ +1<br />

c<br />

= p<br />

. Hence, β t ∗ +2 =1, ... That <strong>is</strong>,<br />

β t ∗<br />

β t ∗ +1<br />

β t ∗ +2<br />

β t ∗ +3<br />

= 1,<br />

c<br />

= ,<br />

p<br />

= 1,<br />

c<br />

= ,<br />

p<br />

.<br />

Bonus: [10 points] D<strong>is</strong>cuss what would happen if the irrational type were known to<br />

dilute the milk by accident with some small but positive probability.<br />

4. Find a perfect Bayesi<strong>an</strong> equilibrium of the following game.<br />

-1 1<br />

1<br />

1<br />

beer<br />

quiche<br />

0<br />

0<br />

1<br />

0<br />

duel<br />

don’t<br />

duel<br />

beer<br />

quiche<br />

duel<br />

don’t<br />

duel<br />

3 2<br />

1 1<br />

don’t<br />

{.9}<br />

{.1}<br />

t w<br />

t s<br />

don’t<br />

0<br />

0<br />

3<br />

0<br />

ANSWER:<br />

6

-1 1<br />

1<br />

1<br />

beer<br />

quiche<br />

duel<br />

0<br />

{0}<br />

{.1}<br />

{1}<br />

3<br />

0 t w<br />

0<br />

1<br />

0<br />

don’t<br />

duel<br />

{1}<br />

beer<br />

quiche<br />

{0}<br />

duel<br />

don’t<br />

duel<br />

3 2<br />

1 1<br />

don’t<br />

{.9}<br />

t s<br />

don’t<br />

0<br />

0<br />

5. A r<strong>is</strong>k-neutral entrepreneur has a project that requires $100,000 as <strong>an</strong> investment, <strong>an</strong>d<br />

will yield $300,000 with probability 1/2, $0 with probability 1/2. There are two types<br />

of entrepreneurs: rich who has a wealth of $1,000,000, <strong>an</strong>d poor who has $0. For some<br />

reason, the wealthy entrepreneur c<strong>an</strong>not use h<strong>is</strong> wealth as <strong>an</strong> investment towards th<strong>is</strong><br />

project. There <strong>is</strong> also a b<strong>an</strong>k that c<strong>an</strong> lend money with interest rate π. That <strong>is</strong>, if<br />

the entrepreneur borrows $100,000 to invest, after the project <strong>is</strong> completed he will pay<br />

back $100, 000 (1 + π) – if he has that much money. If h<strong>is</strong> wealth <strong>is</strong> less th<strong>an</strong> th<strong>is</strong><br />

amount at the end of the project, he will pay all he has. The order of the events <strong>is</strong> as<br />

follows:<br />

• First, b<strong>an</strong>k posts π.<br />

• Then, entrepreneur decides whether to borrow ($100,000) <strong>an</strong>d invest.<br />

• Then, uncertainty <strong>is</strong> resolved.<br />

(a) Compute the subgame perfect equilibrium for the case when the wealth <strong>is</strong> common<br />

knowledge.<br />

ANSWER: The rich entrepreneur <strong>is</strong> always going to pay back the lo<strong>an</strong> in full<br />

amount, hence h<strong>is</strong> expected payoff from investing (as a ch<strong>an</strong>ge from not investing)<br />

<strong>is</strong><br />

(0.5)(300, 000) − 100, 000 (1 + π) .<br />

Hence, he will invest iff th<strong>is</strong> amount <strong>is</strong> non-negative, i.e.,<br />

π ≤ 1/2.<br />

Thus, the b<strong>an</strong>k will set the interest rate at<br />

7<br />

π R =1/2.

The poor entrepreneur <strong>is</strong> going to pay back the lo<strong>an</strong> only when the project succeeds.<br />

Hence, h<strong>is</strong> expected payoff from investing <strong>is</strong><br />

(0.5)(300, 000 − 100, 000 (1 + π)).<br />

He will invest iff th<strong>is</strong> amount <strong>is</strong> non-negative, i.e.,<br />

π ≤ 2.<br />

Thus, the b<strong>an</strong>k will set the interest rate at<br />

π P =2.<br />

(b) Now assume that the b<strong>an</strong>k does not know the wealth of the entrepreneur. The<br />

probability that the entrepreneur <strong>is</strong> rich <strong>is</strong> 1/4. Compute the perfect Bayesi<strong>an</strong><br />

equilibrium.<br />

ANSWER: As in part (a), the rich type will invest iff π ≤ π R = .5, <strong>an</strong>d the poor<br />

type will invest iff π ≤ π P =2.Now, if π ≤ π R , the b<strong>an</strong>k’s payoff <strong>is</strong><br />

·<br />

¸<br />

1 3 1 1<br />

U (π) = 100, 000 (1 + π)+ 100, 000 (1 + π)+ 0 − 100, 000<br />

4 4 2 2<br />

5<br />

= 100, 000 (1 + π) − 100, 000<br />

8<br />

5<br />

≤ 100, 000 (1 + π R ) − 100, 000<br />

8<br />

5 1<br />

= 100, 000 (1 + 1/2) − 100, 000 = − 100, 000 < 0.<br />

8 16<br />

If π R < π ≤ π P , the b<strong>an</strong>k’s payoff <strong>is</strong><br />

U (π) =<br />

·<br />

¸<br />

3 1 1<br />

100, 000 (1 + π)+ 0 − 100, 000<br />

4 2 2<br />

=<br />

3<br />

100, 000 (π − 1) ,<br />

8<br />

which <strong>is</strong> maximized at π P , yielding 3<br />

8 100, 000. If π > π P , U (π) =0. Hence, the<br />

b<strong>an</strong>k will choose π = π P .<br />

8